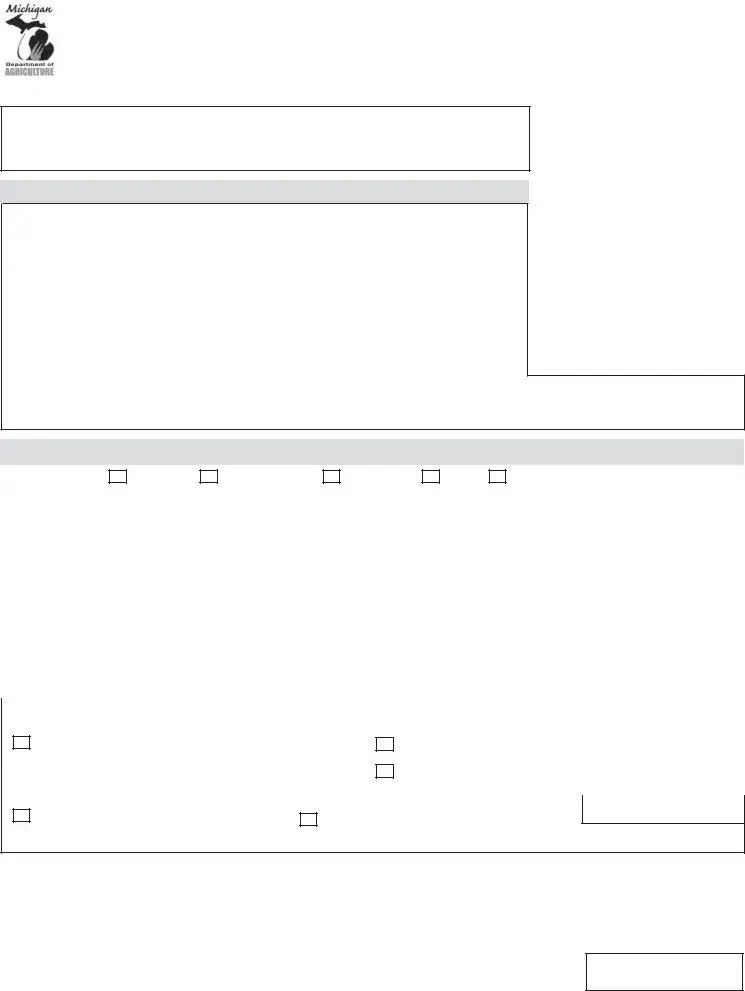

Pi 017S Michigan PDF Form

In Michigan, the Department of Agriculture oversees the regulation and licensing of nursery stock dealers and growers through a specific instrument known as the PI 017S form. This document, codified under the 1931 Public Act 189 and subject to subsequent amendments, serves a vital role in structuring the operational framework for businesses within this industry. The form addresses a wide array of essential components, ranging from basic identification details like business name and address to more intricate aspects such as ownership type and license fees. It is meticulously designed to capture comprehensive business information, including multiple contact avenues and, if applicable, differing mailing addresses. Furthermore, it delineates the types of ownership—whether a corporation, sole ownership, partnership, LLC, or other forms—together with the necessary corporate or owner information. The distinction between new applications, renewals, and notices of cessation is crucial, accommodating the dynamic nature of businesses. Additionally, license fees are clearly outlined, differentiating between various classifications of growers and dealers, reflecting the department's tailored approach to the wide spectrum of operations within the nursery stock trade. Recognized payment methods and the requirement for a non-refundable fee underscore the formalities of state transactions. This form not only facilitates the regulatory process but also reflects the state's commitment to maintaining a structured and efficient oversight of the nursery stock industry, ensuring compliance and fostering a conducive environment for these businesses to thrive.

Preview - Pi 017S Michigan Form

Michigan Department of Agriculture

P.O. Box 30746, Lansing, MI

In accordance with 1931 Public Act 189, as amended.

Nursery Stock Dealer & Grower License Application

License Year Ending: _______Status: |

|

New |

|

Renewal |

|

No Longer Needed |

If Renewal, License No. of Establisment _______________________________________

Business Information

Business Name:__________________________________________________________

Business Address:________________________________________________________

City:________________________________________________ State: _______________

County:______________________________________________ Zip:_______________

Business Phone: (_____)_____________ Business Fax:(_____)____________________

Business Email:__________________________________________________________

Mailing address if different from above: Street or P.O. Box:___________________________

__________________________________________________________________________

______________________________

Corporate/Owner Information

|

Ownership Type: |

Corporation |

Sole Ownership |

Partnership |

L.L.C. |

Other: Specify_____________________ |

|||||||

|

Corporation Name: _______________________________________________________________________________________ |

||||||||||||

|

Owner/President (CEO) Name:______________________________________________________________________________ |

||||||||||||

|

Street Address of Corporation or Owner:_______________________________________________________________________ |

||||||||||||

|

City:______________________________________________________________________ State: _______ Zip:_____________ |

||||||||||||

|

Phone: (_____)_____________ Fax:(_____)_______________ Email:_______________________________________________ |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Cell Phone: (_____)_____________ DBA Expiration Date: ____________________________ |

Federal/Tax ID # |

|

||||||||||

|

|

|

|

||||||||||

|

|

|

|

|

|

|

(Submit copy of DBA w/ application.) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License Fees |

|

|

|

|

|

|

|

|

|

|||

|

Grower License |

|

AOBJ: 0185 |

Dealer License |

|

|

AOBJ: 0342 |

||||||

|

|

|

|

|

|

|

|

||||||

|

General Nursery Stock Grower $100 |

|

Nursery Stock Dealer $100 |

||||||||||

|

( |

Inspection Required |

) |

|

|

|

Nursery Stock Dealer Market $100 |

||||||

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Small Scale Grower* $40 |

Small Scale Grower Market* $40 |

|

|

*eligibility determined by MDA |

|

Both $40 fees: AOBJ: 0341

Payment Method: Check/Money Order No. _________________________________________ Amount enclosed: _______________

Please make check/money order payable to the State of Michigan and submit to the address at the top of the page.

Signature:__________________________________________________ Date:___________________

Please print your name here:___________________________________________________________

Title:______________________________________________________________________________

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Issuing Authority | Michigan Department of Agriculture |

| Form Number | PI-017s |

| Revision Date | May 2009 |

| Contact Information | P.O. Box 30746, Lansing, MI 48909-8246, 517-241-6666 |

| Governing Law | 1931 Public Act 189, as amended |

| Application Types | New, Renewal, No Longer Needed |

| License Categories | Grower License, Dealer License, including subcategories for General Nursery Stock Grower, Nursery Stock Dealer, Nursery Stock Dealer Market, Small Scale Grower, Small Scale Grower Market |

| Fee Structure | Grower License $100, Dealer License $100, Dealer Market $100, Small Scale Grower $40, Small Scale Grower Market $40 |

| Payment Method | Check/Money Order payable to the State of Michigan |

| Signature Requirement | Applicant must sign and print name and title |

| Website for More Information | www.michigan.gov/mda-licensing |

Guidelines on Utilizing Pi 017S Michigan

Filling out the PI 017S form for the Michigan Department of Agriculture is a crucial step in either applying for or renewing a Nursery Stock Dealer & Grower License. This form serves as an application and provides the necessary details for the department to process your request. The process involves providing specific business and ownership information and deciding on the type of license and payment. Whether you are starting a new application, renewing an existing license, or marking your business as no longer needing a license, accuracy and attention to detail are paramount. The following instructions are intended to guide you through each step of completing the PI 017S form with clarity.

- License Year and Status: Start by entering the license year for which you are applying. Then, select your status: 'New' for a first-time application, 'Renewal' for updating an existing license, or 'No Longer Needed' if you are closing your business or ceasing operations.

- Business Information: Provide the full name of your business as it appears on official documents. Fill in the physical address of your business, including city, state, county, and zip code. Include your business phone and fax numbers, as well as an email address for correspondence.

- If your mailing address is different from your business address, specify this in the provided space, including the street or P.O. Box number.

- Corporate/Owner Information: Specify the type of ownership under which your business operates (e.g., Corporation, Sole Ownership, Partnership, L.L.C., or Other). If you selected Other, be sure to specify the nature of the ownership.

- Record the corporation's name, or if a sole proprietorship, the owner's full name. Include the primary owner or president's name and the corporation or owner's address, phone number, fax number, and email. If available, provide the cell phone number.

- Indicate the DBA (Doing Business As) expiration date and provide your Federal/Tax ID number. Attach a copy of your DBA with the application if applicable.

- License Fees: Choose the appropriate license type and fee. Grower licenses and Dealer licenses have different categories and fees, so ensure you select the one that applies to your operation. Indicate if an inspection is required for your license type.

- Determine your payment method and fill in the details, including the check or money order number and the amount enclosed. Make sure your payment is made to the State of Michigan.

- Conclude the application by signing and dating the form. Print your name clearly beneath your signature and specify your title within the company.

Once the PI 017S form is completed, review all the information for accuracy and completeness. Missing or inaccurate details can delay the processing of your application. After ensuring everything is in order, submit the form and your payment to the address provided at the top of the form. By following these steps carefully, you will have successfully navigated the application process for a Nursery Stock Dealer & Grower License in Michigan.

Crucial Points on This Form

What is the purpose of the PI-017S Michigan form?

The PI-017S form is used for the application of a Nursery Stock Dealer & Grower License in Michigan. It's required by the Michigan Department of Agriculture in accordance with the 1931 Public Act 189, as amended. Its purpose is to register businesses involved in the sale or growing of nursery stock so that they can legally operate within the state.

Who needs to fill out this form?

Any business entity that intends to operate as a nursery stock dealer or grower in Michigan must fill out this form. This includes corporations, partnerships, LLCs, sole ownerships, and any other types of ownerships specified in the form. It's applicable for both new applications and renewals of existing licenses.

What are the license fees associated with this form?

The license fees vary based on the type of license being applied for:

- General Nursery Stock Grower License: $100

- Nursery Stock Dealer License: $100

- Nursery Stock Dealer Market License: $100

- Small Scale Grower License: $40 (eligibility determined by MDA)

- Small Scale Grower Market License: $40 (eligibility determined by MDA)

What payment methods are accepted for the license fees?

The PI-017S form specifies that payment can be made through check or money order. These should be made payable to the State of Michigan and submitted to the Michigan Department of Agriculture's address provided at the top of the form.

Is an inspection required for all types of nursery licenses?

Yes, the form indicates that an inspection is required for the General Nursery Stock Grower license and both Nursery Stock Dealer licenses. No mention is made of inspections for the Small Scale Grower or Market licenses, but it is best to assume that some form of review or compliance check could be necessary.

What documentation is needed alongside the PI-017S form?

In addition to completing the PI-017S form, applicants are required to submit a copy of their DBA (Doing Business As) with the application if applicable. Federal/Tax ID number should also be provided, ensuring that all business and owner information is accurately and fully documented.

What information about the business and ownership must be provided?

The form requests comprehensive information including:

- Business name and address, including city, state, county, and zip code.

- Contact details such as business phone, fax, and email.

- Mailing address if different from the business address.

- Type of ownership and details of the corporation or owner.

- Corporate or owner's address, contact information, and email.

How to renew an existing license with this form?

For license renewals, businesses need to indicate their current License Number of Establishment and mark the status as "Renewal" on the form. The process involves updating any information that has changed since the last application and submitting the form along with the required renewal fees.

Where can more information about licensing be found?

For additional information or clarification on the nursery stock dealer and grower licensing process in Michigan, businesses can refer to the Michigan government's official website provided at the bottom of the PI-017S form (www.michigan.gov/mda-licensing) or contact the Michigan Department of Agriculture directly through the phone number provided: 517-241-6666.

Common mistakes

Filling out forms can sometimes be confusing, leading to mistakes that can lead to delays or even the rejection of applications. In the case of the PI 017S Michigan form, used for Nursery Stock Dealer & Grower License Applications, several common errors are frequently encountered. Understanding these can help applicants ensure their submissions are accurate and complete, enhancing the likelihood of a smooth process.

One common error involves incorrectly entering the business information. Details such as the Business Name, Address, Phone, and Email must be meticulously provided. Misspellings, incorrect addresses, or outdated contact information can hinder the communication process, potentially delaying the license issuance. It is important to double-check these sections for accuracy and completeness.

Failing to differentiate between the business and mailing addresses when they are not the same is another mistake. Some businesses operate from one location but receive mail at a different one. This form accommodates such scenarios, yet applicants often overlook this detail, inputting the same address for both. This oversight can cause important correspondence to be missed or delayed.

Selection of the correct Ownership Type (Corporation, Sole Ownership, Partnership, L.L.C., or Other) is often glossed over. This decision impacts not just how a business is perceived but also certain legal aspects. Inaccuracies here can lead to complications in the application's verification process. Each option requires specific documentation, hence, accurately indicating the ownership type is crucial.

No providing the Federal/Tax ID number and a copy of the Doing Business As (DBA) document, when applicable, is a critical omission. These documents are essential for verifying the legitimacy and legal status of the business. Failure to submit these can cause significant delays in the application process.

A misunderstanding about the license fees can also occur. There are different fees for Grower Licenses and Dealer Licenses, with additional variations depending on the scale of the operation. Applicants must ensure they understand which category their business falls under and submit the correct fee. Incorrect fees can cause processing delays.

Selecting an inappropriate payment method or not making the check/money order payable to the State of Michigan is another common blunder. This form clearly specifies the accepted methods of payment, emphasizing checks or money orders. However, not following these instructions precisely can lead to payment rejections.

Finally, forgetting to sign and date the application or not printing the applicant's name and title are simple yet significant oversights. Without these, the application cannot be processed as it lacks verification of authenticity and approval by the responsible party. Ensuring these fields are completed is the final step in confirming the application's readiness for submission.

Attention to detail when filling out the PI 017S Michigan form is paramount. Taking the time to review each section, provide accurate information, and follow the outlined instructions can significantly affect the outcome of the application process. By avoiding these common mistakes, applicants can expect a smoother, more efficient path to obtaining their Nursery Stock Dealer & Grower License.

Documents used along the form

When applying for a Nursery Stock Dealer & Grower License in Michigan using the PI-017S form, several supplementary forms and documents might be required to successfully complete your application process. These additional documents are crucial for ensuring that all necessary details and credentials are thoroughly validated, facilitating a smoother licensing procedure.

- DBA (Doing Business As) Registration Proof: Essential for businesses operating under a trade name different from their legal name. This document validates the legal registration of your business alias within the state.

- Federal Tax ID Verification: This includes a copy of your EIN (Employer Identification Number) confirmation letter from the IRS. It's critical for tax identification purposes and to verify the business's legitimacy.

- Certificate of Insurance: Provides evidence of the business’s liability insurance coverage. This documentation is vital for protecting the business against potential claims and often required by state regulations.

- Inspection Reports: Recent inspection reports may be requested to ensure compliance with state nursery stock health standards. These reports demonstrate adherence to industry best practices and state health regulations.

- Property Lease Agreement or Deed: For businesses not owning their premises, a current lease agreement is necessary. Conversely, property deeds are required for owners, proving the business's operational location legitimacy.

- Partnership Agreement or Corporation Registration: Depending on the structure of your business, a partnership agreement (for partnerships) or proof of corporation registration might be needed. These documents establish the legal structure and ownership of the business.

Together with the PI-017S form, these documents ensure a comprehensive review process, addressing both the operational and legal aspects necessary for licensing. Submitting a complete and accurate application not only aligns with regulatory compliance but also significantly expedites the licensing approval process, facilitating a smoother entry or continuity in the nursery stock business sector within Michigan.

Similar forms

California Nursery Stock Certificate Application: This document serves critical purposes similar to the Pi 017S Michigan form, including registration and regulatory compliance for entities dealing in nursery and plant stock. Both documents require business and ownership information, along with details about the licensing fees, and they both play a role in the agricultural regulation of their respective states ensuring that businesses comply with specific agricultural standards and practices.

New York Nursery and Greenhouse License Application: Similar to the Michigan form, this application is used by businesses in New York that intend to sell or distribute nursery stock. It collects detailed information about the business, owner, and operation type, just as the Pi 017S form does. Both forms initiate a regulatory process that includes inspections and adherence to state agricultural laws, reinforcing the standards for healthy plant and nursery stock trade.

Texas Nursery/Floral License Application: This form, much like Michigan’s Pi 017S form, is designed for businesses involved in the growing and selling of nursery stock and plants. They share the requirement for detailed information regarding the business, its ownership, and operation specifics. Each state uses these forms to regulate the industry, ensuring safe and disease-free trade of nursery goods within their jurisdictions.

Florida Certificate of Nursery Registration: While focusing on the registration of nurseries, this Florida document aligns closely with Michigan's Pi 017S in its aim to collect comprehensive business information. Both documents are fundamental in establishing a legal baseline for agricultural trade within their states, with specific emphasis on the nursery industry. Handling and prevention of plant diseases, along with the promotion of agricultural integrity, are primary objectives shared between them.

Oregon Nursery Stock License Application: Oregon's version of nursery and plant stock regulation also parallels Michigan's Pi 017S Michigan form by requiring detailed business and ownership details, alongside specific licensing fees based on the scale of operations. Both documents are instrumental in the state-level control and oversight of nursery stock businesses, ensuring compliance with each state's agricultural standards and protecting the local ecosystem from potentially harmful plant diseases and pests.

Dos and Don'ts

When filling out the PI 017S Michigan form, it's important to follow specific guidelines to ensure your application is processed smoothly. Here are some dos and don'ts to consider:

Do:- Read the instructions carefully before you start filling out the form. This will help you avoid common mistakes and ensure that you understand what information is required.

- Provide accurate business information. This includes your business name, address, phone number, and email. Accurate information is crucial for your application to be processed efficiently.

- Specify your business status, whether it is new, a renewal, or no longer needed. This helps in categorizing your application appropriately.

- Include the license number if you are renewing your license. This aids in quicker processing by referencing your previous records.

- Choose the correct ownership type and provide the requested details for the corporation or owner, including the name, address, and contact information.

- Ensure payment details are correct, including the check or money order number and the amount enclosed. Incorrect payment details can delay your application.

- Sign and print your name at the bottom of the form. An unsigned application may not be processed.

- Leave mandatory fields blank. Incomplete applications can lead to delays. Fill out all required sections of the form for timely processing.

- Guess on details like your Federal/Tax ID number or DBA expiration date. Incorrect information can complicate the verification process.

- Use pencil or non-permanent ink to fill out the form. This can lead to your application becoming illegible if the form is smudged or erased accidentally.

- Ignore the size of your operation when selecting your license type. Misclassification can affect the applicable fee and necessary inspections.

- Send your form without double-checking the information for mistakes. A quick review can catch errors that may delay your application.

- Forget to include a copy of your DBA with the application if required. Not adhering to documentation requirements can halt the processing of your application.

- Postpone the submission close to the deadline. Late applications may not be processed in time, affecting your business operations.

By following these guidelines, you can enhance the likelihood of your PI 017S Michigan form being processed smoothly and efficiently.

Misconceptions

When applying for or renewing a Nursery Stock Dealer & Grower License in Michigan using the PI-017S form, several misconceptions often arise. By clarifying these misunderstandings, applicants can navigate the process more effectively.

Only large-scale operations need to apply: It's a common belief that the Michigan Nursery Stock Dealer & Grower License is only for large-scale commercial operations. However, individuals and small-scale growers who sell or distribute nursery stock are also required to obtain this license, with provisions such as a reduced fee for small-scale growers.

Renewals don’t require a new application: A significant misconception is that renewing your license doesn’t require completing a new application form. Whether you're applying for the first time or renewing, a completed PI-017S form for the current license year is necessary.

Email and fax are unnecessary: While some applicants may consider providing an email address or fax number optional, including this information ensures that you can receive communications and updates regarding your application or license promptly.

Payment methods are flexible: There’s a belief that the Michigan Department of Agriculture accepts multiple forms of payment for the license fees. However, the PI-017S form clearly specifies that payment must be made via check or money order, highlighting the importance of following the stated payment instructions precisely.

Inspection is always required: Another misconception revolves around the need for inspection. While nursery stock dealers and certain types of growers do require an inspection, the form provides clarity on who must undergo this process, particularly noting exceptions such as small-scale growers.

One license covers all types of nursery stock: Some applicants mistakenly believe that a single license covers all varieties of nursery stock that a dealer or grower might sell. In reality, the Michigan Department of Agriculture delineates between general nursery stock, small-scale growers, and dealer markets, each with its applicable fee structure, to ensure proper licensing according to the type of operation.

Amid these misconceptions, the importance of reading the PI-017S form instructions thoroughly and contacting the Michigan Department of Agriculture for any clarifications cannot be understated. Properly understanding and adhering to the specified requirements will facilitate a smoother application or renewal process for your Nursery Stock Dealer & Grower License.

Key takeaways

Filing out the Pi 017S form accurately is crucial for nurseries and nursery stock dealers in Michigan to get their license from the Michigan Department of Agriculture (MDA). Here are some key takeaways for those who need to navigate through this process.

- Identify Your Status: Be clear about whether you are applying for a new license, renewing an existing license, or if the license is no longer needed. This is vital to streamline the application process.

- Provide Complete Business Information: Fill out all the business details such as name, address, phone, fax, and email correctly to prevent delays. If the mailing address differs from the business address, make sure to mention it.

- Select the Correct License Type: Understand whether you need a Grower License or a Dealer License, including the specific category that suits your business size and needs.

- Payment of License Fees: Be aware that license fees are non-refundable. Check the fee schedule carefully to know the exact amount you need to pay depending on the license type.

- Submit Required Documents: Along with your application, you must submit a copy of your Federal/Tax ID and DBA (Doing Business As), if applicable. This documentation is crucial for processing your application.

- Know Your Eligibility: For small-scale growers and dealers, knowing the eligibility criteria for the reduced fee structure is important. Ensure you meet the requirements before opting for this category.

- Payment Method: The form specifies that payment should be made via check or money order payable to the State of Michigan. It's important to follow these instructions for successful processing of your application.

- Check the Application for Completeness: Before sending, verify that all sections are filled out and that you've signed and dated the form. Incomplete applications could lead to delays.

By understanding these key points, applicants can ensure a smoother process for obtaining or renewing their nursery stock dealer or grower license in Michigan. Always refer to the latest form and guidelines from the Michigan Department of Agriculture to stay updated on any changes.

Popular PDF Templates

Request and Order to Seize Property Michigan - The endorsement section for law enforcement certifies receipt and action on the court's order.

Mi Courts - Instructions for declaring affirmative defenses, an essential step in presenting a complete defense against a complaint in Michigan courts.