Michigan Property Transfer Affidavit 2766 PDF Form

When a property changes hands in Michigan, the new owner must navigate several key steps to ensure the transfer is legally recognized. Among these is the completion and submission of the Michigan Property Transfer Affidavit Form 2766. This essential document serves a critical role in updating ownership information with the local municipality. It aids in the accurate calculation of property taxes, ensuring that they reflect the property's current market value and new ownership. The form requires detailed information about the sale or transfer, including the parties involved, the property's identification, and the transaction's specifics. Timely filing, within 45 days of the transfer, is crucial to avoid penalties. The process, while straightforward, underscores the importance of accuracy and completeness in maintaining the property's legal standing and the owner's compliance with Michigan's real estate transfer regulations.

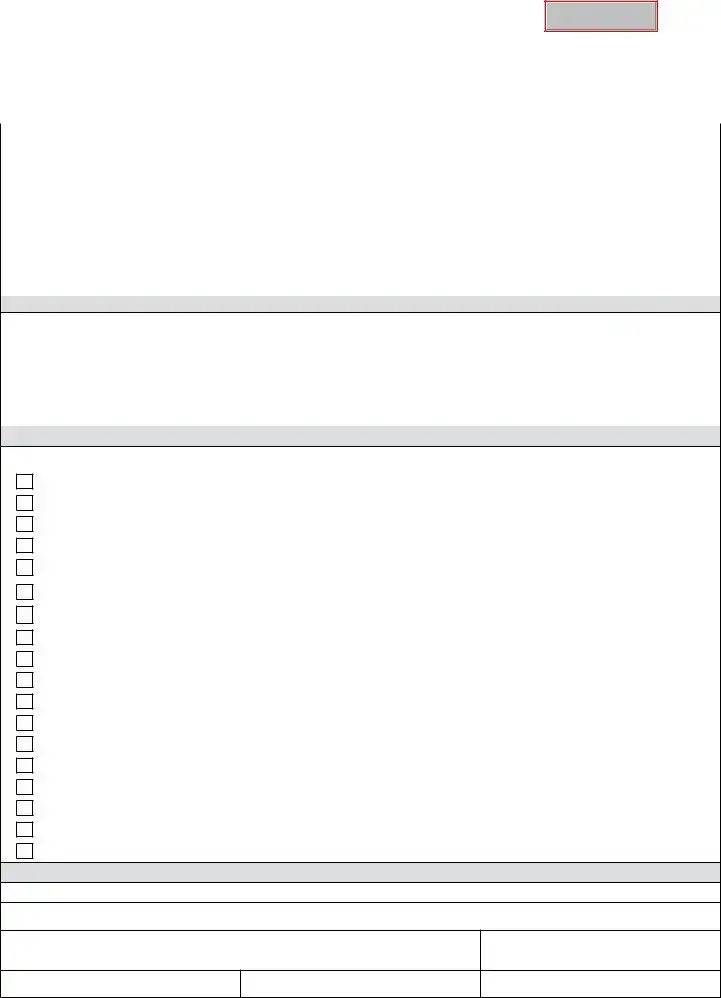

Preview - Michigan Property Transfer Affidavit 2766 Form

Reset Form

This form is issued under authority of P.A. 415 of 1994. Filing is mandatory.

This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). The completed

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

1. |

Street Address of Property |

|

|

|

|

2. County |

|

|

3. Date of Transfer (or land contract signed) |

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Location of Real Estate (Check appropriate field and enter name in the space |

below.) |

5. |

Purchase Price of |

Real Estate |

|||||

|

|

City |

|

Township |

|

Village |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

6. |

Seller’s (Transferor) Name |

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Property Identification Number (PIN). If you don’t have a PIN, attach legal description. |

8. |

Buyer’s (Transferee) Name and Mailing Address |

|||||||

PIN. This number ranges from 10 to 25 digits. It usually includes hyphens and sometimes includes |

|

|

|

|||||||

letters. It is on the property tax bill and on the assessment notice. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Buyer’s (Transferee) Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

Items 10 - 15 are optional. However, by completing them you may avoid further correspondence.

10.Type of Transfer. Transfers include, but are not limited to, deeds, land contracts, transfers involving trusts or wills, certain

|

|

Land Contract |

|

|

|

Lease |

|

|

|

|

Deed |

|

Other (specify) _______________________ |

|||

|

|

|

|

|

||||||||||||

11. Was property purchased from a financial institution? |

12. Is the transfer between related persons? |

|

13. Amount of Down Payment |

|||||||||||||

|

|

Yes |

|

No |

|

|

Yes |

|

|

|

|

No |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||||||

14. If you financed the purchase, did you pay market rate |

of interest? |

|

|

15. Amount Financed (Borrowed) |

||||||||||||

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXEMPTIONS

Certain types of transfers are exempt from uncapping. If you believe this transfer is exempt, indicate below the type of exemption you are claiming. If you claim an exemption, your assessor may request more information to support your claim.

Transfer from one spouse to the other spouse

Change in ownership solely to exclude or include a spouse

Transfer between certain family members *(see page 2)

Transfer of that portion of a property subject to a life lease or life estate (until the life lease or life estate expires)

Transfer between certain family members of that portion of a property after the expiration or termination of a life estate or life lease retained by transferor ** (see page 2)

Transfer to effect the foreclosure or forfeiture of real property

Transfer by redemption from a tax sale

Transfer into a trust where the settlor or the settlor’s spouse conveys property to the trust and is also the sole beneficiary of the trust Transfer resulting from a court order unless the order specifies a monetary payment

Transfer creating or ending a joint tenancy if at least one person is an original owner of the property (or his/her spouse)

Transfer to establish or release a security interest (collateral)

Transfer of real estate through normal public trading of stock

Transfer between entities under common control or among members of an affiliated group

Transfer resulting from transactions that qualify as a

Transfer of land with qualified conservation easement (land only - not improvements)

Other, specify: __________________________________________________________________________________________________

CErTIfICaTION

I certify that the information above is true and complete to the best of my knowledge.

Printed Name

Signature

Date

Name and title, if signer is other than the owner

Daytime Phone Number

2766, Page 2

Instructions:

This form must be filed when there is a transfer of real property or one of the following types of personal property:

•Buildings on leased land.

•Leasehold improvements, as defined in MCL Section 211.8(h).

•Leasehold estates, as defined in MCL Section 211.8(i) and (j).

Transfer of ownership means the conveyance of title to or a present interest in property, including the beneficial use of the property. For complete descriptions of qualifying transfers, please refer to MCL Section

Excerpts from Michigan Compiled Laws (MCL), Chapter 211

**Section 211.27a(7)(d): Beginning December 31, 2014, a transfer of that portion of residential real property that had been subject to a life estate or life lease retained by the transferor resulting from expiration or termination of that life estate or life lease, if the transferee is the transferor’s or transferor’s spouse’s mother, father, brother, sister, son, daughter, adopted son, adopted daughter, grandson, or granddaughter and the residential real property is not used for any commercial purpose following the transfer. Upon request by the department of treasury or the assessor, the transferee shall furnish proof within 30 days that the transferee meets the requirements of this subdivision. If a transferee fails to comply with a request by the department of treasury or assessor under this subdivision, that transferee is subject to a fine of $200.00.

*Section 211.27a(7)(u): Beginning December 31, 2014, a transfer of residential real property if the transferee is the transferor’s or the transferor’s spouse’s mother, father, brother, sister, son, daughter, adopted son, adopted daughter, grandson, or granddaughter and the residential real property is not used for any commercial purpose following the conveyance. Upon request by the department of treasury or the assessor, the transferee shall furnish proof within 30 days that the transferee meets the requirements of this subparagraph. If a transferee fails to comply with a request by the department of treasury or assessor under this subparagraph, that transferee is subject to a fine of $200.00.

Section 211.27a(10): “... the buyer, grantee, or other transferee of the property shall notify the appropriate assessing office in the local unit of government in which the property is located of the transfer of ownership of the property within 45 days of the transfer of ownership, on a form prescribed by the state tax commission that states the parties to the transfer, the date of the transfer, the actual consideration for the transfer, and the property’s parcel identification number or legal description.”

Section 211.27(5): “Except as otherwise provided in subsection (6), the purchase price paid in a transfer of property is not the presumptive true cash value of the property transferred. In determining the true cash value of transferred property, an assessing officer shall assess that property using the same valuation method used to value all other property of that same classification in the assessing jurisdiction.”

Penalties:

Section 211.27b(1): “If the buyer, grantee, or other transferee in the immediately preceding transfer of ownership of property does not notify the appropriate assessing office as required by section 27a(10), the property’s taxable value shall be adjusted under section 27a(3) and all of the following shall be levied:

(a)Any additional taxes that would have been levied if the transfer of ownership had been recorded as required under this act from the date of transfer.

(b)Interest and penalty from the date the tax would have been originally levied.

(c)For property classified under section 34c as either industrial real property or commercial real property, a penalty in the following amount:

(i)Except as otherwise provided in subparagraph (ii), if the sale price of the property transferred is $100,000,000.00 or less, $20.00 per day for each separate failure beginning after the 45 days have elapsed, up to a maximum of $1,000.00.

(ii)If the sale price of the property transferred is more than $100,000,000.00, $20,000.00 after the 45 days have elapsed.

(d)For real property other than real property classified under section 34c as industrial real property or commercial real property, a penalty of $5.00 per day for each separate failure beginning after the 45 days have elapsed, up to a maximum of $200.00.

Form Characteristics

| Fact | Description |

|---|---|

| Form Name | Michigan Property Transfer Affidavit Form 2766 |

| Purpose | Used to notify the local assessing officer of a transfer of property in Michigan. |

| Governing Law | Michigan Compiled Laws (MCL) 211.27a, which mandates reporting of property transfers. |

| Who Must File | Both the grantor (seller) and the grantee (buyer) of real property in Michigan are required to submit the form. |

| Filing Deadline | Must be filed within 45 days of the property transfer. |

| Penalty for Late Filing | A penalty may be imposed for failure to file or late filing, including a fine up to $200. |

| Where to File | Filed with the local assessor's office in the jurisdiction where the property is located. |

Guidelines on Utilizing Michigan Property Transfer Affidavit 2766

Completing the Michigan Property Transfer Affidavit form 2766 is a key step in the process of transferring property within the state. This affidavit must be filed with the local assessor for the area where the property is located, within 45 days of the transfer, to ensure that the property tax records are updated accordingly. Handling this document accurately is crucial for both the seller and the buyer, as it affects the taxation of the property. The following steps are designed to guide individuals through the process of filling out this form correctly.

- Begin by entering the date of the property transfer at the top of the form.

- In the section marked "Transferor/Seller Information," fill in the full name, address, and contact information of the person or entity selling the property.

- Under "Transferee/Buyer Information," provide the full name, address, and contact details of the individual or entity acquiring the property.

- Describe the transferred property in detail in the "Property Information" section. This should include the property's address, tax identification number(s), and legal description as recorded in deed or land contract.

- Indicate the type of transfer by selecting the appropriate box that best describes the nature of the transfer (sale, gift, exchange, etc.).

- In the case of a sale, fill in the actual sale price in the space provided. If the transfer is not a sale or the sale price does not reflect the market value, explain the reason in the space allotted.

- Specify any terms of payment if the property was sold. This includes down payment, land contract terms, or other financing details.

- Check the box indicating whether the transferee is related to the transferor and specify the relationship, if applicable.

- If any portion of the property will not be used as the principal residence of the buyer, indicate so by checking the appropriate box and providing a brief explanation.

- Sign and date the affidavit at the bottom. The form needs to be signed by either the buyer, seller, or a legally authorized agent.

- Submit the completed form to the local assessor's office. Remember, this needs to be done within 45 days of the property transfer to avoid penalties.

Once the Property Transfer Affidavit form is successfully submitted, it will prompt the assessor to update the property's record, reflecting the new ownership and potentially adjusting the property's tax assessment. This is crucial for the new owner to ensure they are correctly billed for property taxes. If there are questions or concerns at any point during this process, consulting with a real estate professional or the local assessor's office can provide clarity and guidance.

Crucial Points on This Form

What is the Michigan Property Transfer Affidavit 2766 form?

The Michigan Property Transfer Affidavit 2766 form is a document required by the state of Michigan whenever real estate property changes ownership. The form serves to notify the local assessor's office of the transfer and ensures that property tax records are updated accordingly. It must be filed by the new owner within 45 days of the transfer to avoid penalties.

Who needs to file the Michigan Property Transfer Affidavit 2766 form?

All new property owners in Michigan are required to file this affidavit following the acquisition of a property, whether through purchase, inheritance, or as a gift. This includes individuals, corporations, trusts, and partnerships. Failure to file the form within the designated timeframe can lead to penalties, including additional fees.

Where can I get the Michigan Property Transfer Affidavit 2766 form and how do I file it?

The form can be obtained from the local assessor's office in the jurisdiction where the property is located or from the Michigan Department of Treasury's website. Once completed, it should be filed with the local assessor's office. Filing can typically be done in person, by mail, or electronically, depending on the office's capabilities and requirements. It's recommended to keep a copy of the filed form for personal records.

What information is needed to complete the form?

Completing the Michigan Property Transfer Affidavit 2766 form requires several pieces of information, including:

- The property identification number (PID) or legal description.

- The date of the transfer.

- The full name and address of the new owner.

- The type of transfer (e.g., sale, inheritance, gift).

- The sale price of the property, if applicable.

- Signatures of both the grantor (seller) and grantee (buyer), when applicable.

This information helps the local assessor update the property tax rolls accurately and ensures that tax bills are sent to the correct owner.

Common mistakes

When transferring property in Michigan, the Property Transfer Affidavit Form 2766 plays a pivotal role in ensuring the smooth adjustment of property taxes. Yet, frequently, individuals encounter challenges due to common errors during its completion. One prevalent mistake is overlooking the requirement to file the form within 45 days following a property transfer. This oversight can lead to potential penalties, emphasizing the necessity of timely submission to avoid any financial consequences.

Another common error involves inaccurately reporting the property's sale price or value. This discrepancy can result in improper assessment of property taxes, potentially leading to higher tax bills or legal complications. It's crucial for individuals to double-check the figures entered on the form against official sale documents or valuation reports to ensure accuracy.

Inappropriate classification of property type is also a frequent mistake that can affect tax obligations. Michigan law distinguishes between various property types, such as residential, agricultural, or commercial, each subject to different tax rates. Mistakenly misclassifying the type of property in the Affidavit can lead to incorrect tax calculations. Individuals should carefully review the property's classification before submitting the form to ensure it accurately reflects the property's primary use.

Lastly, submitting the form without the requisite signatures or documentation is a common error that can delay the processing of the Affidavit. The form requires a signature from the buyer or the seller (or both, depending on local regulations) to validate the transfer. Additionally, some jurisdictions might request accompanying documents, such as proof of sale or transfer deeds. Failing to provide all necessary materials when submitting the form can lead to its rejection, necessitating a resubmission and potentially delaying the adjustment of property taxes.

Documents used along the form

In Michigan, when a property changes hands, a suite of documents often accompanies the Michigan Property Transfer Affidavit Form 2766 to ensure the transaction complies with state laws and local regulations. These documents, each serving a specific purpose, help to create a transparent, legal, and comprehensive record of the property's transfer. Below is a brief overview of additional forms and documents frequently used alongside the Michigan Property Transfer Affidavit 2766 form.

- Warranty Deed - This legal document guarantees that the seller holds clear title to a piece of real estate and has the right to sell it to the buyer. It is often used in property sales to protect the buyer's interests.

- Quit Claim Deed - Unlike a warranty deed, a quit claim deed does not guarantee that the property title is clear of liens or claims. It simply transfers whatever interest the seller has in the property without making any promises about the extent of that interest.

- Title Insurance Policy - This policy protects the buyer against loss arising from disputes over ownership of the property. It ensures that the buyer’s title is free from defects that were not known at the time of sale.

- Seller’s Disclosure Statement - In Michigan, sellers are required to provide this statement disclosing the condition of the property, including any known defects or problems.

- Real Estate Transfer Tax Declarations - These documents are necessary to calculate and pay the required state and county transfer taxes on the property sale.

- Proof of Identity - A government-issued photo ID (such as a driver's license or passport) is typically required to verify the identities of the parties involved in the transfer.

- Property Tax Bills - Recent property tax bills are usually required to account for prorations and ensure that all taxes on the property are up-to-date at the time of sale.

- Uniform Residential Loan Application - If the purchase involves a mortgage, this federally recognized application form is used by the borrower to apply for a loan.

Each of these documents plays a crucial role in the property transfer process, providing protection and assurance to both the buyer and seller. By understanding the purpose and requirement of each form, individuals can navigate the complexities of real estate transactions with greater confidence and assurance.

Similar forms

Real Estate Transfer Declaration - Like the Michigan Property Transfer Affidavit 2766, this form is used to report any transfer of real property. It focuses on ensuring that the details of a property transfer are fully disclosed, including the sale price and property description, critical for tax assessment purposes.

Quit Claim Deed - This document is similar because it is used in the transfer of property ownership, though it does not guarantee the title like a warranty deed. The Quit Claim Deed is important for the process of transferring ownership without seller guarantees, similarly necessitating proper filing and disclosure.

Warranty Deed - Similarly utilized in real estate transactions, a Warranty Deed guarantees that the seller holds clear title to a property and has the right to sell it, offering more protection than a quit claim deed. Like the Michigan Property Transfer Affidavit, it plays a vital role in the transfer process, ensuring the buyer is aware of the property's legal status.

Grant Deed - This document, like the Michigan Property Transfer Affidavit, is used in property transactions to transfer ownership with certain guarantees. It bears similarities in that it also requires the accurate representation of the property and ensures that the property has not been sold to another party.

Mortgage Satisfaction Document - After a mortgage is paid off, this document is filed to indicate that the debt on the property has been fully satisfied. It relates to the transfer affidavit by playing a crucial role in the property's legal documentation and in affecting property tax assessments.

Deed of Trust - This document involves the transfer of property to a trustee as security for a loan. Similar to the property transfer affidavit, it's a critical part of property transactions that affects ownership and rights, and must be accurately reported and filed.

Homeowner Association (HOA) Estoppel Certificate - This certificate is required in transactions involving properties in an HOA. It confirms the property's compliance with HOA rules and any dues outstanding, echoing the affidavit's role in ensuring clear and transparent property transactions.

Title Insurance Policy - While not a transfer document per se, title insurance protects the buyer from losses due to defects in the title not discovered during the sale process. It complements the transfer affidavit's function by providing a safety net against unforeseen legal issues.

Dos and Don'ts

When the time comes to deal with the Michigan Property Transfer Affidavit 2766 form, it's crucial to handle it with care and attention. This document is integral in the process of property transfer, and filling it out correctly can save a lot of time and prevent potential legal issues. Below, find a compilation of do's and don'ts to guide you through the process efficiently.

- Do read through the entire form before beginning to fill it out. This step ensures you understand all the requirements and gather all necessary information beforehand.

- Do double-check the property identification number (PIN) to make sure it's correct. Mistakes here can lead to significant complications in the property transfer process.

- Do provide all requested information in their respective fields accurately. Incomplete forms can delay the transfer or result in rejection by the county.

- Do sign and date the form in the designated areas. These signatures legally bind the information provided, confirming its accuracy.

- Do keep a copy of the filled-out form for your records. Having this document handy can be invaluable if any questions or issues arise later.

- Don't estimate or guess answers to the questions on the form. If you're unsure about a detail, it's better to verify the correct information than to make assumptions.

- Don't overlook the need to submit the form in a timely manner. Late submissions can lead to fines or additional assessments.

Handling the Michigan Property Transfer Affidavit 2766 form with diligence and accuracy ensures the smooth progression of property transfer. Avoiding common pitfalls can significantly enhance the efficiency of this legal process. Always consult with a professional if you encounter uncertainties during this procedure.

Misconceptions

When navigating the complexities of property transfer in Michigan, understanding the Michigan Property Transfer Affidavit 2766 form is crucial. However, misconceptions abound, leading to confusion and potential errors. Let's clarify some common misunderstandings:

It's only needed for the sale of a property: A major misconception is that the Property Transfer Affidavit is only necessary when a property is sold. In reality, this form is required for any transfer of property, whether it's sold, gifted, or transferred through a will.

The buyer is responsible for submitting it: Contrary to popular belief, the responsibility to submit the Property Transfer Affidavit falls on the seller or the person transferring the property, not the buyer. It’s important for the seller to complete this process to ensure a proper record of the transfer.

There's no deadline to submit the form: There’s a common misconception that you can submit the Property Transfer Affidavit at any time. However, Michigan law requires that this form be filed with the local assessor’s office within 45 days of the property transfer. Failure to do so can result in penalties.

It's a complicated process: While legal paperwork can seem daunting, the process of completing and submitting the Property Transfer Affidavit is straightforward. The form requires basic information about the property and the transaction. Assistance from a legal professional can simplify the process even further.

It doesn't affect property taxes immediately: Some believe filing the Property Transfer Affidavit won't have an immediate impact on their property taxes. This is incorrect; filing this affidavit can trigger a reassessment of the property’s taxable value, potentially changing the amount of property tax due.

No cost associated with filing: While the act of filing the Property Transfer Affidavit itself does not incur a fee, neglecting to file or filing late can lead to penalties. It's important to be aware of these potential costs and file the affidavit on time.

Understanding the Michigan Property Transfer Affidavit 2766 form and its requirements can smooth the process of transferring property, ensuring compliance with the law and avoiding unnecessary complications or fees.

Key takeaways

Completing and utilizing the Michigan Property Transfer Affidavit 2766 form is a crucial step in the process of transferring property within the state. This document plays a key role in ensuring that local property tax assessments are accurate and reflect current ownership. Here are five important takeaways regarding the use and completion of this form:

- The Property Transfer Affidavit must be filed whenever real estate or certain types of personal property are transferred, even if the transfer is not a sale. This includes transfers such as adding or removing a name from the title, inheritance, or transferring into a trust.

- It is required by the Michigan Department of Treasury and must be filed with the local assessor for the municipality where the property is located within 45 days of the transfer. Failure to file within the stipulated time can result in significant penalties, including fines.

- Accuracy is crucial when filling out the form. It requires detailed information about the property, including the property identification number, transaction details, and the parties involved in the transfer. Inaccurate or incomplete forms can lead to delays or incorrect property tax assessments.

- The form is used to notify the local assessing office of the change in ownership and to ensure the property tax records are updated. This update is important for calculating property taxes accurately according to the state’s property tax laws.

- The affidavit is a public record, contributing to the transparency of property ownership in Michigan. Once filed, it becomes part of the public record, accessible for reference by future property owners and to establish a clear chain of ownership over time.

Popular PDF Templates

Michigan Annual Report Pdf - Got questions on your business's tax status in Michigan? The 511 form is your starting point for answers.

Michigan Sales and Use Tax Login - The 1353 form assists Michigan in ensuring businesses meet their tax obligations based on their operational footprint within the state.