Michigan Probate PDF Form

In Michigan, the journey through the probate process is often navigated with the assistance of a specialized legal document known as the Michigan Probate Form. This integral piece of paperwork serves as the backbone for managing the estate of a deceased individual, ensuring that assets are appropriately distributed according to the wishes of the deceased, or, in the absence of a will, in line with state laws. The form encompasses various aspects of the estate settlement process, from appointing an executor or personal representative to handle the estate, to itemizing the assets, and ultimately facilitating the transfer of property to rightful heirs or beneficiaries. Given the complexity of probate laws and the potential for significant emotional and financial impact on the parties involved, the Michigan Probate Form plays a crucial role in providing a structured, legally sound framework for the resolution of a deceased person's affairs. Understanding its content, the procedures involved in its submission, and the implications of its use are essential steps for those navigating the probate landscape in Michigan, highlighting the importance of this document in the broader context of estate planning and administration.

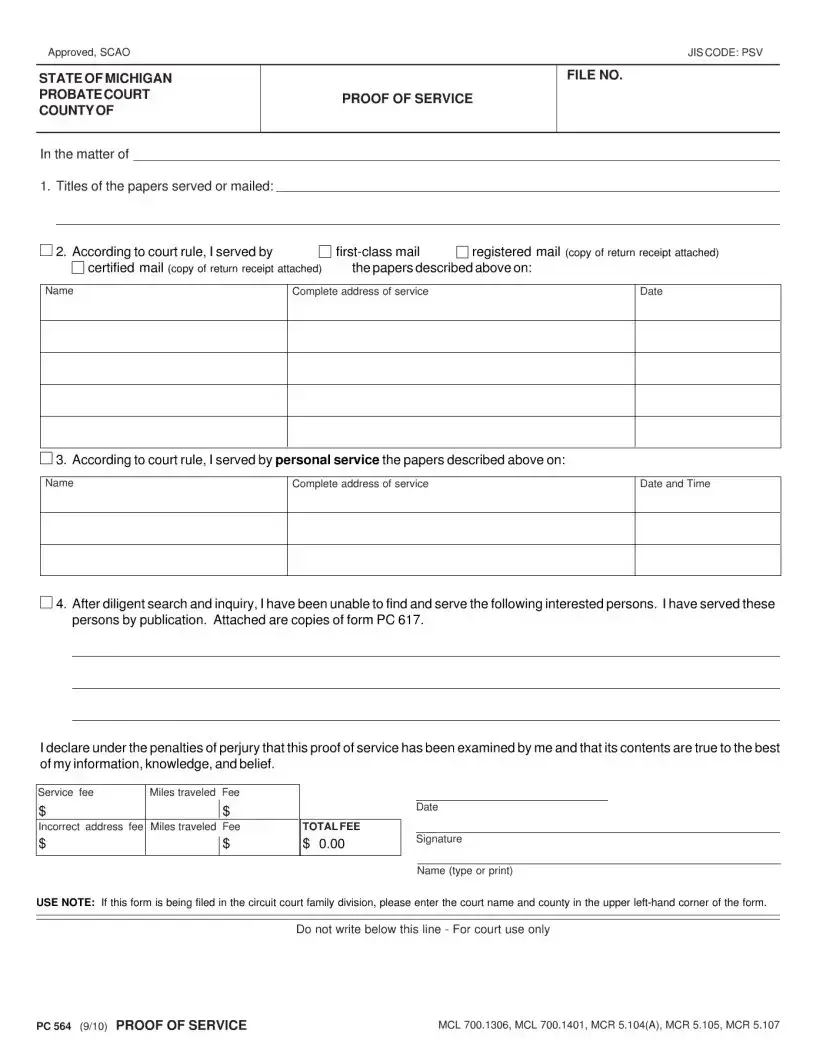

Preview - Michigan Probate Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Michigan Probate form is governed by the laws of the State of Michigan, specifically the Michigan Estates and Protected Individuals Code (EPIC). |

| Purpose | It is used to manage the distribution of a deceased person's estate to heirs and beneficiaries, ensuring that debts and taxes are paid. |

| Types of Forms | Michigan has various probate forms for different purposes, including Petition for Probate, Application for Informal Probate, and Order for Assignment. |

| Usage | These forms are used by executors, administrators, or personal representatives to carry out the process of probate in Michigan. |

| Required Information | Information needed typically includes the deceased's personal details, a list of heirs and beneficiaries, an inventory of the estate, and details of debts and taxes. |

| Filing Location | Probate forms must be filed with the probate court in the county where the deceased lived at the time of their death. |

| Filing Fees | Filing fees vary by county and type of probate process, but they are required to process the forms. |

| Online Availability | Some Michigan probate forms may be available online through court websites, but others must be obtained in person or by mail. |

| Key Deadlines | Deadlines for filing probate forms depend on the type of probate procedure and specific court rules, but it is crucial to file as soon as possible after the death. |

Guidelines on Utilizing Michigan Probate

Filling out the Michigan Probate form is a crucial step in managing the estate of someone who has passed away. This process ensures that the deceased's assets are appropriately distributed to their heirs or beneficiaries according to the law. It's a procedure that requires attention to detail and thoroughness to avoid any potential legal issues. The following steps are designed to guide you through completing the form correctly.

- Begin by gathering all necessary documents related to the deceased's assets. This includes bank statements, property deeds, and stock certificates. Having these documents on hand will make the process smoother.

- Locate the latest version of the Michigan Probate form. Ensure you have the correct form by verifying it on the Michigan Courts' official website.

- Read through the entire form before writing anything. This step will give you a clear understanding of the information required and how to provide it.

- Fill in the petitioner's name and contact information. The petitioner is the individual initiating the probate process.

- Enter the legal name of the deceased, often referred to as the decedent, and their date of death in the designated sections.

- Identify the type of probate proceeding you are filing for, such as formal, informal, supervised, or unsupervised administration, and mark the appropriate box.

- List all known heirs and devisees, including their relationship to the decedent, their ages, and their current addresses. If any are minors, indicate this clearly.

- Provide a complete inventory of the decedent's assets along with their estimated values. Include everything from real estate to personal effects.

- Sign and date the form. If you are representing yourself, you must sign the form; if an attorney represents you, they must also sign the form.

- File the completed form with the probate court in the county where the decedent lived at the time of their death. Make sure to include any filing fees required by the court.

After submitting the form, the probate court will review your application. The process ahead may involve a hearing, especially if the case is complex or if there are disputes among potential heirs. The court's role is to ensure the estate is distributed fairly according to the deceased's wishes or, in the absence of a will, in line with state laws. It's important to stay informed and possibly seek legal advice if you encounter any challenges during this process.

Crucial Points on This Form

What is the purpose of the Michigan Probate Form?

The Michigan Probate Form, officially utilized within the state of Michigan, serves as a legal document that initiates the probate process following an individual's death. This form is instrumental in facilitating the legal transfer of the deceased’s assets to their rightful heirs or beneficiaries according to the deceased’s will or, in the absence of a will, in accordance with Michigan state laws. It ensures that the distribution of assets is conducted in a organized and lawful manner, addressing debts and taxes, and ultimately transferring ownership of property to the intended recipients.

Who needs to file the Michigan Probate Form?

Generally, the individual named as the executor or personal representative in the deceased's will is responsible for filing the Michigan Probate Form. In cases where no will exists, a close relative or interested person can apply to the court to be appointed as the administrator. It’s important for this individual to file the form in the probate court located in the county where the deceased lived at the time of their death. This step is crucial for legally managing and settling the deceased’s estate.

When should the Michigan Probate Form be filed?

The timing for filing the Michigan Probate Form can vary based on the specific circumstances surrounding the estate. However, it is generally recommended to file this form as soon as possible following the individual's death. This prompt action facilitates a smoother administration process. According to Michigan law, there might be specific time frames to adhere to, especially concerning creditor notifications and estate distributions, making early filing advantageous.

What documents are required to accompany the Michigan Probate Form?

To complete the filing process effectively, several documents should accompany the Michigan Probate Form, including:

- The original will and any codicils, if applicable.

- An official death certificate of the deceased.

- An inventory of the deceased’s assets and liabilities.

- Documentation asserting the estimated value of the estate.

- Any other documents that the probate court might specifically require based on the unique aspects of the estate.

What are the steps involved in filing the Michigan Probate Form?

Filing the Michigan Probate Form involves several steps, structured to ensure a systematic approach to handling the deceased's estate. These steps generally include:

- Collecting the necessary documents, including the death certificate and the original will, if one exists.

- Completing the Probate Form accurately, ensuring all information reflects the state of the estate correctly.

- Submitting the form and accompanying documents to the probate court in the appropriate Michigan county.

- Paying any required filing fees associated with the submission of the form.

- Attending any court hearings as required and complying with court orders for estate administration.

How long does the probate process take in Michigan?

The duration of the probate process in Michigan can vary significantly, influenced by the size and complexity of the estate, the clarity of the deceased's will (if present), and any disputes among heirs or beneficiaries. Typically, a straightforward estate may be settled within six to twelve months. However, more complicated situations or disputes can prolong the process, sometimes extending it for several years. Engaging with a knowledgeable attorney can help navigate the probate process more efficiently.

Can the probate process in Michigan be avoided?

Yes, there are several methods by which the probate process can be bypassed in Michigan, aimed at easing the transfer of assets to beneficiaries without formal court involvement. These strategies include:

- Establishing a living trust, wherein property and assets are transferred to the trust to be distributed directly to beneficiaries upon death.

- Designation of beneficiaries on accounts such as life insurance policies, retirement accounts, and bank accounts, enabling the direct transfer of assets outside of probate.

- The usage of joint ownership or survivorship features on property and accounts, which allows assets to pass directly to the co-owner upon death.

Common mistakes

When individuals approach the task of filling out a Michigan Probate form, several common errors can occur, often resulting from misunderstandings about the process or the information required. These mistakes can complicate what is already a challenging time for families dealing with the loss of a loved one. Recognizing and avoiding these errors can streamline the probate process, ensuring it proceeds as smoothly as possible.

One frequent error is not providing the complete legal name of the deceased. This seems straightforward, but variations or nicknames can lead to confusion and delays. It’s essential to use the full legal name exactly as it appears on official documents like the death certificate and the assets in question.

Another common issue is failing to list all assets correctly. Sometimes, people omit assets because they are unfamiliar with what counts as an asset or they undervalue them. It’s crucial to include everything the deceased owned or had an interest in, including property, vehicles, bank accounts, and personal belongings of value.

Many also struggle with accurately identifying and notifying all potential heirs and beneficiaries. This step is critical because it affects who has a right to receive information about the estate and to challenge decisions. Missing out a potential heir can lead to disputes and further legal complications.

A significant error is incorrectly handling claims against the estate. Individuals often misunderstand the procedure for notifying creditors and which debts are legitimate obligations of the estate. This misunderstanding can result in unpaid debts that can later become a liability for the estate or its executors.

Some individuals fail to request the correct type of probate proceeding. Michigan law provides for different types of probate, depending on factors like the estate's value and whether there's a will. Choosing the wrong type can delay the process and increase costs.

Not providing a valid will, when one exists, is another area where mistakes happen. Sometimes, this is due to losing the will or not knowing it needs to be filed with the probate court. The will’s instructions are crucial for guiding the distribution of assets according to the deceased’s wishes.

Submitting inaccurate information about the value of the estate’s assets is yet another error. This mistake can affect how the estate is processed and might have tax implications. Valuing the estate correctly from the start is fundamental.

Many individuals underestimate the complexity of the probate process and attempt to go through it without seeking legal advice. This can lead to errors in the form and misunderstandings about legal requirements, potentially resulting in significant delays or financial losses.

A common technical mistake is improperly signing or notarizing the form. Some parts of the probate form require notarization to be legally valid, and failing to comply with these requirements can invalidate sections of the submission.

Lastly, a frequent oversight is failing to file in the correct county. Probate forms must be filed in the county where the deceased lived at the time of death. Filing in the wrong county can result in the refusal of the form and the need to refile, leading to delays.

Understanding and avoiding these mistakes when filling out a Michigan Probate form can significantly affect the efficiency and smooth progression of the probate process. It’s often beneficial to seek legal assistance to navigate these complex requirements.

Documents used along the form

When navigating through the Michigan probate process, various documents and forms beyond the initial probate form are often required. These additional forms play critical roles in administering an estate, ensuring that the legal obligations are met, and facilitating the distribution of assets according to the decedent's wishes or state law. Below is a description of up to four other forms and documents frequently used alongside the Michigan Probate form.

- Last Will and Testament: This document is arguably the most crucial, as it outlines the decedent's wishes regarding the distribution of their assets upon death. It also nominates an executor, the person responsible for administering the estate.

- Application for Informal Probate and/or Appointment of Personal Representative: If the decedent had a will, this application is used to begin the process of formally appointing the executor named in the will. For cases without a will, this form requests the appointment of an administrator for the estate.

- Inventory: This form lists all of the decedent’s assets at the time of death, including real estate, personal property, and bank accounts, which provides the court and beneficiaries a clear understanding of the estate's value.

- Notice of Continued Administration: This document is used when the estate cannot be settled within the initial 12 months. It informs the court and interested parties that the estate administration will continue beyond the standard period.

Completing and submitting these documents accurately and timely is essential for a smooth probate process. Each form contributes to the legal and orderly transfer of the decedent's assets while ensuring compliance with Michigan laws. Individuals going through probate should consider consulting a legal professional to navigate this complex process more effectively.

Similar forms

The California Probate Form shares similarities with the Michigan Probate Form, particularly in how both require comprehensive details about the decedent (the deceased person), including their full legal name, date of death, and a complete listing of their assets. This information is crucial in both states for beginning the process of distributing the decedent's estate according to their will or state law, if no will exists.

Similar to the Michigan Probate Form, the New York Surrogate's Court Form is used in the probate process but goes a step further by asking for specific information about potential heirs and any existing debts of the decedent. This parallel ensures that the estate is properly managed and distributed among rightful heirs while settling any outstanding debts.

The Florida Petition for Administration is another document with similarities to Michigan's form, particularly in its requirement for a detailed inventory of the decedent's assets. However, Florida's form uniquely emphasizes the need for appointing a personal representative (executor) if one has not been previously designated, showcasing a common goal of managing estate affairs efficiently but with a slight procedural divergence.

The Texas Application for Probate and the Michigan Probate Form both serve the fundamental purpose of initiating the probate process. They collect essential information about the estate and involve notifying interested parties. Yet, Texas' application is distinctly elaborate in requiring additional details about the nature and value of estate assets, highlighting a shared emphasis on transparency and thoroughness in the probate procedure, albeit through slightly different informational demands.

Dos and Don'ts

Filling out the Michigan Probate Form requires careful attention to detail and adherence to specific guidelines to ensure the process goes smoothly. Here's a compilation of important dos and don'ts to keep in mind:

Do:- Read all instructions provided with the form carefully to understand each section's requirements fully.

- Use black ink when filling out the form to ensure that all information is legible and photocopies clearly.

- Provide accurate and complete information for every question to avoid unnecessary delays or rejections.

- Double-check all entries for spelling, especially names and addresses, to ensure they match official documents.

- If required, attach additional sheets for explanations or lists, making sure each page is clearly labeled and referenced in the main form.

- Sign and date the form in the designated area, as an unsigned form may be considered invalid.

- Keep a copy of the completed form and any attachments for your records.

- Submit the form before any deadlines to avoid penalties or delays in the probate process.

- Consult with a legal professional if you have any questions or uncertainties about how to fill out the form accurately.

- Use the official form provided by the Michigan court system to ensure acceptance.

- Don't guess on any answers. If you're unsure, seek clarification before submitting the form.

- Don't use correction fluid or tape; if you make a mistake, it's better to start with a new form to maintain clarity.

- Don't leave any fields blank if they are applicable; if a question does not apply, write "N/A" (not applicable).

- Don't submit the form without reviewing it for completeness and accuracy.

- Don't overlook the requirement for witness or notary signatures if the form specifies their necessity.

- Don't use pencil, as entries made in pencil may not be considered legal or permanent.

- Don't include unofficial or informal documents unless specifically requested.

- Don't ignore instructions about attaching required documents, such as death certificates or property deeds.

- Don't submit the form to the wrong office or department; verify the correct submission location.

- Don't rush through the form, as mistakes can cause delays and potentially impact the probate outcome.

Misconceptions

When navigating the complexities of the Michigan Probate form, it's common to encounter a few misunderstandings along the way. Here's a clear breakdown of some misconceptions to help guide individuals through the process.

Only for the Wealthy: Many people think that probate is only necessary for those with large estates. However, Michigan's probate process applies to estates of various sizes, not just the affluent. It primarily depends on the type and value of the assets, not the overall wealth of the individual.

Will Avoids Probate: It's a common belief that having a will exempts an estate from going through probate. In reality, a will often needs to be validated through the probate process. Probate ensures that the will's instructions are followed properly.

Lengthy and Expensive: The fear that probate is invariably a long and costly ordeal is another misconception. With straightforward estates or when proper planning is in place, Michigan’s probate process can be relatively quick and not as expensive as anticipated.

Probate Publicizes Personal Information: While probate is a public process, the extent of personal information made available can vary. Sensitive details, like the specifics of assets and their distribution, are generally not exposed to the public.

Immediate Asset Distribution: There's a misperception that probate allows for the immediate distribution of assets. In practice, the probate process involves several steps, including validating the will, appraising the estate, and paying debts and taxes before assets can be distributed to beneficiaries.

All Assets Go Through Probate: Not all assets are subject to probate. Certain types of property, like those held in joint tenancy, retirement accounts with a named beneficiary, and life insurance payouts, can bypass the probate process entirely.

Understanding these common misconceptions about the Michigan Probate form can make navigating the process a bit easier and more straightforward. It's always recommended to work with a professional who can help guide through the specifics of Michigan's probate laws and ensure that the estate is handled correctly.

Key takeaways

When dealing with the Michigan Probate Form, it's important to approach the process with attention to detail and thoroughness. This document plays a crucial role in the administration of an estate within the probate court. By understanding the following key takeaways, individuals can ensure a smoother experience during what often is a challenging time.

- Accuracy is paramount: Every piece of information entered into the form must be accurate and truthful. The probate court relies on this data to make informed decisions about the estate. Providing false information, intentionally or accidentally, can lead to delays or legal complications.

- Understand the sections before filling them out: The form contains various sections that request specific information about the deceased's assets, debts, and beneficiaries. Before starting, one should review the entire form to understand the type of information required. This preparation can help in gathering the necessary documents and information beforehand.

- Seek legal advice when necessary: The probate process can be complex, and the form itself may contain terms or require information that is not immediately understandable to those without a legal background. It's advisable to consult with a legal professional or a probate court official if there are any questions or uncertainties. This can prevent mistakes that might delay the probate process.

- File the form timely: There are deadlines for submitting the Michigan Probate Form to the probate court. These deadlines can vary, depending on the specific circumstances of the estate. Missing a deadline can complicate the estate process, including potentially incurring additional fees. It’s crucial to be aware of and adhere to these timelines.

By keeping these key points in mind, individuals can navigate the Michigan Probate Form with greater confidence and efficiency. This attention to detail and proactive approach can help facilitate a more streamlined probate process, ultimately aiding in the resolution of the estate in accordance with the wishes of the deceased as well as applicable laws.

Popular PDF Templates

What Are Excess Wages - Correctly updating employer information through the UIA 1025 form helps in the accurate calculation and allocation of unemployment insurance taxes.

Michigan 4568 - Form 4568 incorporates a line-item approach for documenting credits from compensation, investment, research and development, among others.

Mi-1040 Form 2023 - Includes a non-waiver clause that protects the lender's rights, stating the acceptance of partial payments does not waive the lender's right to full payment adherence.