Michigan Mc 49 PDF Form

In the event that an individual in Michigan finds themselves facing garnishment of their wages or bank accounts, the Michigan MC 49 form serves as a critical tool for asserting one's rights within the judicial system. This document, formally referred to as the "Objections to Garnishment and Notice of Hearing," allows debtors to challenge the garnishment action taken against them. It outlines several grounds on which the garnishment can be contested, including claims that the funds are exempt by law, pending bankruptcy proceedings, existence of an installment payment order, garnishment exceeding legal limits due to other court orders, full payment of the judgment, or procedural errors in the issuance of the writ of garnishment. Upon filing an objection using the MC 49 form with the court that issued the garnishment, the debtor earns the right to a court hearing where both the plaintiff (judgment creditor) and the defendant (judgment debtor) are required to appear, potentially adjusting the course of action with regard to the garnishment in question. The process for completing and serving the objection form is meticulously laid out, encompassing instructions for filling out necessary details, making copies, filing with the court, and informing involved parties. This procedural framework not only empowers individuals to stand up against wage or property garnishment but also ensures that any objection raised is heard and adjudicated fairly, reflecting the system's commitment to due process and individual rights.

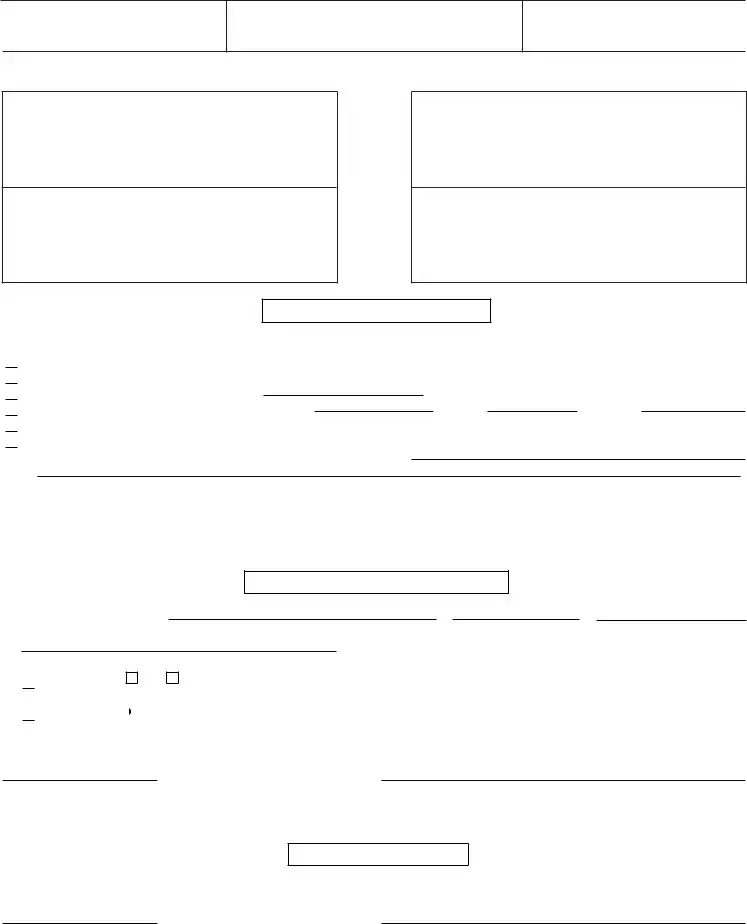

Preview - Michigan Mc 49 Form

|

Original - Court |

|

|

1st copy - Plaintiff |

|

Approved, SCAO |

2nd copy - Defendant |

|

3rd copy - Garnishee |

||

|

STATE OF MICHIGAN JUDICIAL DISTRICT JUDICIAL CIRCUIT

OBJECTIONS TO GARNISHMENT

AND NOTICE OF HEARING

CASE NO.

Court address |

Court telephone no. |

Plaintiff's name, address, and telephone no. (judgment creditor)

Defendant's name, address, and telephone no. (judgment debtor)

v

Plaintiff's attorney, bar no., address, and telephone no.

Garnishee's name and address

OBJECTIONS TO GARNISHMENT

I object to the writ of garnishment issued on |

|

and request a hearing because |

|

Date

a. the funds or property are exempt (protected) from garnishment by law.

a. the funds or property are exempt (protected) from garnishment by law.

b. of bankruptcy proceedings. Case No:

b. of bankruptcy proceedings. Case No:

c. I have an installment payment order, issued on. Court:Case No:

c. I have an installment payment order, issued on. Court:Case No:

d. the maximum amount permitted by law is already being withheld by another court order.

d. the maximum amount permitted by law is already being withheld by another court order.

e. the judgment has been paid.

e. the judgment has been paid.

f. the writ was not properly issued or is otherwise invalid because

f. the writ was not properly issued or is otherwise invalid because

.

I was served with a copy of a writ of garnishment on |

|

. |

||

|

|

Date |

||

|

|

|

|

|

Date |

|

Signature of defendant |

||

To be completed by the court.

1. A hearing will be held on

Date

NOTICE OF HEARING ON OBJECTIONS

atat

TimeLocation

before Hon. |

|

. |

|

2. |

The defendant and plaintiff are required to appear. |

||

3. |

The garnishee |

is |

is not required to appear. |

4. a. Objections were filed within 14 days of the defendant being served with the writ of garnishment. The garnishee shall continue to withhold funds but shall not release withheld funds until further order of the court.

a. Objections were filed within 14 days of the defendant being served with the writ of garnishment. The garnishee shall continue to withhold funds but shall not release withheld funds until further order of the court.

b. Objections were filed 14 days or more after the defendant was served with the writ of garnishment. The garnishee shall continue to withhold and release funds unless otherwise ordered by the court.

b. Objections were filed 14 days or more after the defendant was served with the writ of garnishment. The garnishee shall continue to withhold and release funds unless otherwise ordered by the court.

Date |

Deputy court clerk |

If you require special accommodations to use the court because of a disability or if you require a foreign language interpreter to help you fully participate in court proceedings, please contact the court immediately to make arrangements.

CERTIFICATE OF MAILING

I certify that on this date I served a copy of this objection and notice on the parties or their attorneys by

Date |

Defendant's signature/District court clerk |

|

MC 49 (8/12) |

OBJECTIONS TO GARNISHMENT AND NOTICE OF HEARING |

15 USC 1672, 15 USC 1673, MCR 3.101(K)(3) |

Instructions for Filing and Serving an Objection to Garnishment (Form MC 49)

If you received a writ of garnishment (form MC 12, MC 13, or MC 52), you can object to that garnishment only if:

•your money is exempt (protected) from garnishment by law (see the list of exempt funds on the back of your writ of garnishment form),

•you filed for bankruptcy and those proceedings are pending or the debt has been discharged,

•you have an installment payment order signed by a judge (form MC 15a),

•the maximum amount of money that can be garnished by law is already being withheld by another court order,

•you already paid the judgment in full,

•the garnishment was not properly issued (for example, it was issued on false information) or the garnishment

is invalid (for example, the interest, costs, or judgment amount are inaccurate).

You cannot use this form to challenge the judgment or because you are unable to pay the judgment.

1.How do I file an Objection?

You file an objection by completing the form and filing it with the same court that signed the writ of garnishment. There is no cost.

2.Fill out the Objection form.

Write in the court number, case number, the court address and telephone number, and the names, addresses, and telephone numbers of the plaintiff and the defendant exactly as they are on the writ of garnishment.

Write in the date the garnishment was issued (see the lower

Write in the date you complete the form and sign your name.

3.Make four copies of the completed objection form.

4.File the Objection with the court.

File all four copies of your objection with the court in person or by

5.Serve the Objection.

If your case is in the district court, the court will serve the objection and will return one copy to you.

If your case is in the circuit court, when you get the three remaining copies of the objection with the Notice of Hearing completed, serve a copy on the plaintiff and a copy on the garnishee by

For information on preparing for a hearing generally, see the Michigan Court’s

Form Characteristics

| Fact Number | Description |

|---|---|

| 1 | The form used to object to a writ of garnishment in Michigan is titled "Objections to Garnishment and Notice of Hearing" (Form MC 49). |

| 2 | This form is approved by the State Court Administrative Office (SCAO) for use in the Michigan Judicial District and Circuit Courts. |

| 3 | The MC 49 form serves multiple purposes, including the filing of objections to garnishment and providing notice of the hearing date. |

| 4 | Governing laws for garnishment procedures on this form include 15 USC 1672, 15 USC 1673, and MCR 3.101(K)(3). |

| 5 | The form requires detailed information such as court and case numbers, plaintiff and defendant details, and reasons for the objection. |

| 6 | Reasons for objecting to a writ of garnishment may include exempt funds, bankruptcy proceedings, an installment payment order, maximum allowed garnishment reached, judgment paid, or improper issuance. |

| 7 | To file an objection, the defendant must complete the form and submit it to the issuing court without any cost. |

| 8 | Upon objection, a hearing will be scheduled, and both the plaintiff and defendant are required to attend. The garnishee's attendance depends on the court's order. |

| 9 | The form includes a certificate of mailing section to document the service of the objection notice on the plaintiff, defendant, or their attorneys. |

| 10 | Instructions for filling out and serving the Objection to Garnishment form (MC 49) are detailed on the form itself, guiding individuals through the process. |

Guidelines on Utilizing Michigan Mc 49

When you receive a writ of garnishment and believe you have valid reasons to object to it, the State of Michigan provides a process for filing your objections through the MC 49 form, known as "Objections to Garnishment and Notice of Hearing." Filing this document is a critical step in protecting your rights and assets. Below, you will find guidance on how to fill out and file this form correctly. Following these steps ensures that your objections are heard by the court.

- Identify the court number, case number, the court's address, and telephone number from the writ of garnishment. Enter these details in the corresponding fields on the MC 49 form.

- Fill in the plaintiff's and defendant's names, addresses, and telephone numbers as they appear on the writ of garnishment.

- Look at the lower left-hand corner of your writ of garnishment to find the date it was issued. Write this date on the MC 49 form.

- Select the box(es) that describe the reason(s) for your objection to the garnishment. Options include exemptions by law, bankruptcy proceedings, installment payment orders, the maximum withholding already being met, the judgment being paid, or the writ being improperly issued or invalid.

- Enter the date you received the writ of garnishment under "I was served with a copy of a writ of garnishment on."

- After completing the form, sign and date it at the bottom where it says "Date Signature of defendant."

- Make four copies of the completed MC 49 form.

- File the original and the copies with the court that signed the writ of garnishment. You can do this either in person or by first-class mail. If mailing, include a postage-paid, self-addressed envelope for the court to return three copies to you with the Notice of Hearing section completed.

- After receiving the returned copies, serve one copy on the plaintiff or their attorney and another on the garnishee by first-class mail, unless the district court is serving the objection for you.

- Complete the Certificate of Mailing at the bottom of your copy of the MC 49 form. Make a copy of this completed section and file it with the court. Keep the original for your records.

Once the objection has been filed and served, it is important to prepare for the hearing. This involves gathering all documents and evidence that support your objection. Remember, the hearing is your opportunity to present your case and argue why the garnishment should not proceed as issued. For further preparation assistance, you might consider visiting the Michigan Court’s Self-Help Center online.

Crucial Points on This Form

What is the Michigan MC 49 form?

The Michigan MC 49 form, known as the Objections to Garnishment and Notice of Hearing, is a legal document used in the state of Michigan. It allows individuals (judgment debtors) to officially object to a writ of garnishment against them. The form facilitates requesting a court hearing to present reasons why the garnishment should not proceed, highlighting objections like exemptions protected by law, bankruptcy proceedings, installment payment orders, excessive withholding beyond legal limits, settlement of the judgment, or improperly issued writs.

How do I file an Objection to Garnishment using the MC 49 form?

To file an objection, complete the MC 49 form carefully, providing all required information such as court and case number, participant details, and the specific grounds for objection. There is no fee for filing this objection. Once the form is filled out:

- Make four copies of the completed form.

- File all copies with the issuing court, either in person or by first-class mail. If mailing, include a self-addressed, postage-paid envelope for the return of three copies with the Notice of Hearing.

- Serve the objection as directed based on the court's jurisdiction. District courts typically handle service, whereas circuit court filings require the filer to serve notice to the plaintiff and garnishee.

- Complete and file the Certificate of Mailing section on the objection form.

What reasons can I use to object to a garnishment on the MC 49 form?

Valid reasons for objecting to a garnishment through the MC 49 form include:

- Funds or property are legally exempt from garnishment.

- Ongoing bankruptcy proceedings.

- Existence of a court-approved installment payment order.

- Another garnishment order is already withholding the maximum amount allowed by law.

- The judgment the garnishment is based on has been paid in full.

- The garnishment was not properly issued or contains inaccuracies.

What happens after I file my objection to a garnishment?

After filing your objection with the court:

- A hearing date will be set, during which you must appear and present your case.

- The court will notify all involved parties of the hearing date and requirements.

- Depending on the timing of your objection, the garnishee may be instructed to continue withholding funds without releasing them or to proceed with withholding and releasing funds per usual practices until a court order says otherwise.

Is there a deadline for filing an objection with the MC 49 form?

Yes. Objections should be filed within 14 days of being served with the writ of garnishment to ensure specific protective measures are applied, such as preventing the release of withheld funds until a court decision is made. Filing after this period may affect the handling of withheld funds by the garnishee.

Do I need to hire a lawyer to object to garnishment using the MC 49 form?

While it's not required to hire a lawyer to object to a garnishment, obtaining legal advice can be beneficial. A lawyer can provide guidance on the process, help ensure that all legal criteria are met and properly represent your interests at the hearing.

What should I bring to the garnishment objection hearing?

Bring all documents and evidence supporting your objection to the garnishment. This includes financial records, proof of exempt funds, bankruptcy documentation, payment receipts or agreements, or any other relevant evidence that substantiates the reasons marked on your objection form.

Can I object to a garnishment if I just can't afford to pay?

No, the inability to pay is not a valid reason to object to a garnishment using the MC 49 form. This form is strictly for asserting legal defenses against the garnishment process itself, such as exemptions and inaccuracies, not for disputing the underlying debt or financial hardship.

Common mistakes

One common mistake people make when filling out the Michigan MC 49 form is not providing complete or accurate information about the court, case number, and the parties involved. It's crucial to enter the court number, case number, the court address, and telephone number, as well as the names, addresses, and telephone numbers of both the plaintiff (judgment creditor) and the defendant (judgment debtor) exactly as they appear on the writ of garnishment. Any discrepancies can lead to confusion or delays in processing the objection.

Another error occurs when individuals do not correctly identify the reason for their objection to the garnishment on the form. The MC 49 form lists several reasons an individual can object to a garnishment, such as exemptions by law, bankruptcy proceedings, an existing installment payment order, or the judgment being fully paid. Often, people overlook checking all boxes that apply or fail to provide specific details related to their objections, such as relevant dates and court case numbers.

Failing to make sufficient copies of the completed MC 49 form is also a significant oversight. After filling out the form, one must make four copies: one to file with the court, and additional copies for the plaintiff, the garnishee, and for personal records. Submitting the objection without the appropriate number of copies can impede the process, as each party needs a copy for their records and to ensure proper procedure is followed.

Improper service of the MC 49 form and the accompanying documents on the parties involved is yet another mistake. After filing the objection with the court, individuals must serve a copy on both the plaintiff and the garnishee, or the plaintiff's attorney if one is involved, by first-class mail. The Certificate of Mailing section at the bottom of the form must be completed accurately to certify that the copies were mailed to the correct addresses. Neglecting this step or incorrectly addressing the mail may invalidate the objection process.

Last, people often forget to bring supporting documents to the hearing as indicated in the instructions for filing an objection to garnishment. It's not enough to check a reason for objection on the form; documentary proof must be presented at the hearing to support the claims made in the objection. This could include bank statements, payment records, bankruptcy filing documents, or other relevant legal documents. Omitting these crucial pieces of evidence can weaken one’s position and potentially lead to an unfavorable outcome at the hearing.

Documents used along the form

When dealing with the complexities of wage garnishment in Michigan, particularly when objecting to a garnishment through the MC 49 form, individuals often find themselves amidst a myriad of legal documents and forms. Each of these documents plays a vital role in effectively navigating the legal process, providing necessary information, evidence, or procedural requests to the court or involved parties. While the MC 49 form is pivotal for raising objections against garnishment, comprehensively understanding and preparing other associated documents ensures a well-rounded defense and adherence to legal protocols.

- MC 12/13/52 Writ of Garnishment: These forms initiate the garnishment process and are essential for understanding the basis of any objection. The specifics of the garnishment, including the amount and parties involved, are outlined here.

- MC 15a Installment Payment Order: If a court has issued an order allowing a defendant to pay a judgment in installments, this document is crucial for objecting to a garnishment on those grounds.

- Proof of Payment: Demonstrating that a judgment has been satisfied or that payment arrangements are current can be grounds for objecting to garnishment. Bank statements or receipts often serve as proof.

- Bankruptcy Petition: For individuals who have filed for bankruptcy, providing documentation of the bankruptcy petition is necessary to prove that assets are protected from garnishment under federal law.

- Exemption Claim Form: This form allows individuals to declare certain funds as exempt from Garnishment under Michigan law, such as social security, unemployment benefits, etc.

- Judgment of Divorce: In matters where marital property is involved, a judgment of divorce may delineate assets protected from garnishment.

- Notice of Hearing: After filing an objection, the court issues a notice of hearing. It informs all parties involved of the date, time, and location of the hearing regarding the objection.

- Certificate of Mailing: This document verifies that all relevant parties were properly notified of the objection and the hearing, adhering to legal notification requirements.

- Financial Statement: For objections based on financial hardship or to request an installment payment plan, a detailed statement of one's financial situation may be required.

- Court's Order on Objection to Garnishment: After a hearing on the objection, the court will issue an order outlining its decision regarding the garnishment objection, which could include adjustments to or the cessation of garnishment activities.

Navigating the process of objecting to a garnishment in Michigan can be challenging. However, understanding and properly utilizing these associated forms and documents can provide a pathway through legal procedures while ensuring one's rights and financial resources are protected to the fullest extent. It is often advisable to seek legal assistance or consult various resources, such as the Michigan Court's Self-Help Center, to aid in the preparation and understanding of these processes.

Similar forms

Request for Hearing Regarding Earnings Garnishment (Form CV-406) – This document, used in Wisconsin, is comparable to the Michigan MC 49 form in that both are mechanisms for disputing a garnishment. They allow individuals to request a hearing if they believe the garnishment of their wages or property is unjust due to various reasons, such as exemption claims or errors in the issuance process.

Claim of Exemptions Form – Commonly utilized in multiple states, this form parallels the Michigan MC 49 by providing a method for individuals to claim that their earnings or assets are exempt from garnishment. Individuals can list specific legal exemptions that protect their property from being seized or garnished.

Notice of Garnishment and Exemption Claim Form – Similar to MC 49, this document notifies the debtor of the garnishment and provides a format to claim exemptions. It typically includes information about the garnishment process and the debtor’s rights, along with a section for stating reasons why certain assets should not be garnished.

Request to Stop or Modify the Garnishment Deduction (Form) – This form is used to request the cessation or alteration of a garnishment order. It is akin to the MC 49 form as it allows debtors to contest the garnishment based on specific grounds, such as payment in full or a change in financial circumstances.

Writ of Garnishment Exemption Notice and Claim Form – This document is issued alongside a writ of garnishment and provides debtors with a straightforward way to claim exemptions. It shares similarities with the Michigan MC 49 form in that it prompts individuals to identify legal grounds under which their property or earnings could be considered exempt from garnishment.

Garnishee Answer Form – Although primarily for the garnishee’s use to respond to the garnishment notice, this form is related to the MC 49 as part of the broader garnishment procedure. It allows garnishees (e.g., employers or banks) to report whether the debtor has assets subject to garnishment within their control.

Debtors’ Petition for Installment Payment Plan – This form enables a debtor to request a court-approved payment plan to satisfy a judgment in installments, which can lead to the adjustment or halting of garnishment actions. Like the MC 49 form, it is used when a debtor seeks relief or a modification due to financial hardship or other qualifying circumstances.

Dos and Don'ts

When dealing with the Michigan MC 49 Form, also known as the Objections to Garnishment and Notice of Hearing form, it’s essential to approach the process meticulously to ensure your objection is considered valid and properly addressed. To help with this, here are five dos and don'ts to keep in mind:

Do:

Fill out the form accurately: Ensure you include the correct court number, case number, court address, and phone number, as well as the names, addresses, and telephone numbers for both the plaintiff and the defendant exactly as they are listed on the writ of garnishment.

Clearly state your reason(s) for objection: Check the box next to the reason you are objecting to the garnishment. If multiple reasons apply, make sure to check all that are relevant.

Include the correct dates: Specifically, the date the garnishment was issued and the date you were served with a copy of the writ of garnishment. Accuracy here is crucial.

Sign the form: Do not forget to sign the MC 49 form once you have completed it. A signature is necessary to validate the objection.

Make and file copies appropriately: After filling out the form, make four copies. File the original and copies with the court, and serve them as instructed within the guidelines provided in the form.

Don't:

Delay filing your objection: Filing your objection promptly is critical. Keep in mind that objections should be made as soon as possible once the writ of garnishment is received to avoid any complications.

Skip any sections of the form: Each section of the MC 49 form is important. Omitting information may lead to your objection being considered incomplete or invalid.

Ignore the need for supporting documents: Be prepared to bring all documents that support your objections to the hearing. Failing to provide evidence can weaken your case.

Use the form to challenge the judgment itself: The MC 49 form is specifically for objecting to the garnishment, not for disputing the underlying judgment.

Forget the Certificate of Mailing: Completing the Certificate of Mailing section and making an additional copy for the court records is a must for a proper process.

Following these recommendations meticulously will aid in ensuring your objection is duly considered by the court. It’s essential to provide a clear, well-documented objection to the garnishment to protect your rights and interests effectively.

Misconceptions

Understanding the Michigan MC 49 form, officially known as the Objections to Garnishment and Notice of Hearing, is crucial for people dealing with garnishment issues. However, misconceptions about this form can lead to confusion and mistakes. Here are six common misconceptions explained.

Any type of debt can be disputed using the MC 49 form. This form is specifically for objecting to a garnishment order, not for disputing the underlying debt itself. It should be used only if you believe the garnishment is wrong due to reasons like exemptions by law, bankruptcy, or if the debt has already been paid.

Filing the MC 49 form immediately stops the garnishment. Filing an objection does not automatically stop the garnishment process. The garnishment continues until the court reviews the objection and decides in your favor.

There is a fee to file an objection. There is no cost to file an Objection to Garnishment using the MC 49 form. This encourages individuals to contest garnishments without the barrier of additional fees.

The form is complicated and requires legal assistance to fill out. While legal terms can be intimidating, the MC 49 form is designed to be filled out by individuals without requiring a lawyer. Clear instructions are provided with the form, helping to navigate the process.

The MC 49 form can only be filed in the district court. The objection to garnishment can be filed in the same court that issued the writ of garnishment, whether it's a district court or a circuit court. The form's purpose is to challenge the validity of the garnishment process itself, irrespective of the court.

Once the form is filed, there's nothing else to do but wait. After filing the objection, it's essential to prepare for the hearing by gathering all supporting documents related to the objections checked on the form. Active participation and preparedness can significantly impact the outcome.

Correcting these misunderstandings ensures that individuals facing garnishments are better informed and can take appropriate action to protect their rights and finances. When in doubt, seeking advice from a legal professional or utilizing resources provided by the Michigan Court's Self-Help Center can provide additional clarity and guidance.

Key takeaways

Filling out and using the Michigan MC 49 form, which pertains to objections to garnishment and notices of hearing, entails several essential steps and considerations for individuals looking to navigate this legal process effectively. Here are five key takeaways:

- Familiarize yourself with the purpose of the form. The MC 49 form is designed for individuals (judgment debtors) who wish to object to a writ of garnishment on their assets. This could be because their funds are exempt, they're undergoing bankruptcy, they've already met payment obligations through another order, or other valid reasons.

- Proper completion is crucial. When filling out the form, make sure to accurately enter the court number, case number, court address, and telephone number, along with the names, addresses, and telephone numbers of all parties involved, as they appear on the writ of garnishment. Incorrect information can delay the process or affect the outcome of your objection.

- Timeliness cannot be overstated. Objections must be filed within 14 days of receiving the writ of garnishment to ensure that the garnishee continues to withhold but does not release funds until after the court's decision. If filed later, the garnishee may continue to withhold and release funds as per the original garnishment order unless otherwise directed by the court.

- Serving the objection properly is essential. Depending on whether your case is in district or circuit court, the method by which you serve the objection to the plaintiff (and garnishee, if applicable) varies. This step is vital for ensuring all parties are duly notified and for maintaining the legal integrity of your objection.

- Preparation for the hearing is the final step. After filing and serving the objection, appearing at the scheduled hearing with all relevant documents and evidence to support your objection is necessary. This preparation is key to effectively presenting your case and achieving a favorable outcome.

By understanding these critical aspects of the Michigan MC 49 form, individuals can better navigate the process of objecting to garnishments, ensuring their rights are protected throughout the proceedings.

Popular PDF Templates

How Many Times Can a Judgement Be Renewed in Michigan - Provides peace of mind to involved parties by formally declaring a judgment satisfied.

Unconditional Release - An official clearance form averting potential liens by acknowledging complete contractor compensation.