Michigan L 4258 PDF Form

In the realm of Michigan real estate transactions, the L-4258 form plays a pivotal role, mandated by the Michigan Department of Treasury under the authority of P.A. 134 of 1966 and 330 of 1993, as amended. This Real Estate Transfer Tax Valuation Affidavit becomes essential when the parties involved in the transaction decide against disclosing the sale price on the deed itself. Its completion is a requirement not met by simply entering the transaction amount on the deed but demands detailed information about the transaction, including both the seller and purchaser's names and addresses, the type and date of the document, and a comprehensive breakdown of the financial aspects. These details encompass cash payments, the amount of mortgage or land contract, county and state taxes, total consideration, and the total revenue stamps, alongside a certification of the market value if the consideration is under this value. All this data culminates in a legal declaration of the transaction specifics as understood by the seller or an authorized agent, underscoring its truth and completeness under oath, verified through notarization. This form not only facilitates transparency in real estate transfers but also serves as a tool for accurate tax computation, ensuring compliance with state laws governing property transactions.

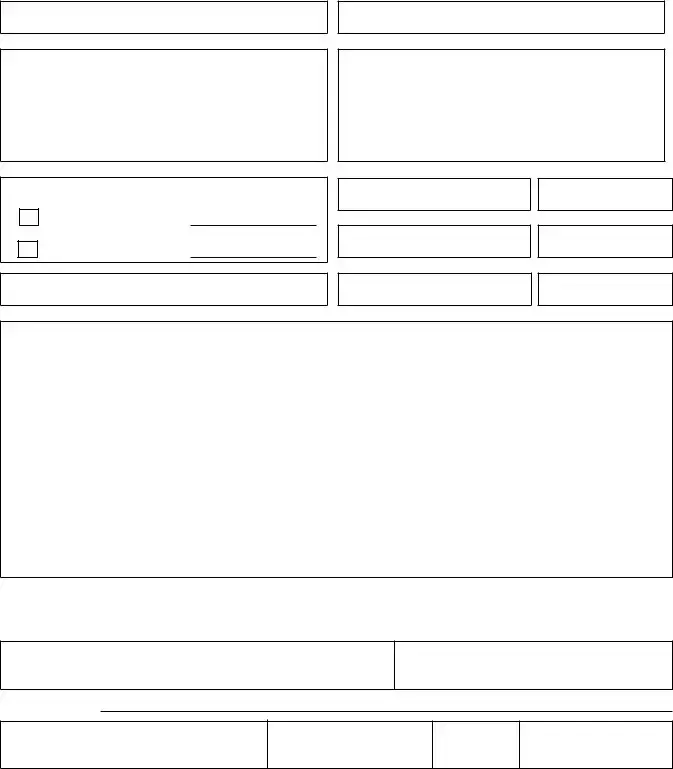

Preview - Michigan L 4258 Form

Michigan Department of Treasury

REAL ESTATE TRANSFER TAX VALUATION AFFIDAVIT

This form is issued under authority of P.A. 134 of 1966 and 330 of 1993 as amended.

This form must be filed when you choose not to enter the amount paid for real estate on the deed. It is not necessary when the amount paid is entered on the deed. This form must be completed and signed by either the seller or his/her authorized agent.

1. County of Property

3. Seller's Name and Mailing Address

2. City or Township of Property

4. Purchaser's Name and Mailing Address

5. Type and Date of Document

Land Contract |

Date: |

DeedDate:

10. If consideration is less than market value, state market value.

6. Cash Payment

$

8. Amount of Mortgage/Land Contract

$

11. Total Consideration (Add lines 6&8)

7.Amount of County Tax

9.Amount of State Tax

12. Total Revenue Stamps

13. Legal Description of Real Estate Transferred

I certify that the information above is true and complete to the best of my knowledge.

Seller's Signature

If signer is other than the seller, print name and title.

NOTARIZATION

Subscribed and sworn to me:

Notary Public

State of Michigan; County of:

on this date

My commission expires on:

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Form Identifier | Michigan Department of Treasury L-4258 |

| Revision Date | March 1995 |

| Governing Law | Public Act 134 of 1966 and 330 of 1993 as amended |

| Primary Purpose | Valuation affidavit for real estate transfer tax |

| When to File | Required when the purchase price is not stated on the deed |

| Who Must Sign | Seller or the seller's authorized agent |

| Document Types | Can include land contract or deed documentation |

| Consideration Evaluation | If the consideration is less than market value, the market value must be stated |

| Additional Requirements | Must be notarized by a Notary Public in Michigan |

Guidelines on Utilizing Michigan L 4258

When you're engaging in a real estate transaction in Michigan and choose not to disclose the sale price on the deed, the Michigan Department of Treasury requires the filing of form L-4258, Real Estate Transfer Tax Valuation Affidavit. This form helps in assessing the real estate transfer tax and must be completed by the seller or an authorized agent. In compliance with the Public Acts 134 of 1966 and 330 of 1993, here is a step-by-step guide for correctly filling out this document.

- Start by entering the County of Property to identify the location where the real estate is situated.

- Fill in the City or Township of Property to provide further location details about where the property is located.

- Enter the Seller's Name and Mailing Address in the provided space, ensuring it’s the full legal name and current address.

- Provide the Purchaser's Name and Mailing Address, again ensuring accuracy in the full legal name and address.

- Under Type and Date of Document, choose whether the transaction is under a Land Contract or Deed, and specify the date of the agreement.

- In the section for Cash Payment, indicate the amount of cash that will be paid by the purchaser.

- Input the Amount of Mortgage/Land Contract if there is a mortgage taken out on the property or if the property is being purchased through a land contract. Place this amount in the specified field.

- Calculate and enter the Amount of County Tax relevant to the property's location.

- Similarly, fill in the Amount of State Tax to be paid on this transaction.

- If the consideration is less than the market value, you are required to provide the State Market Value.

- Add the values entered in steps 6 and 8 to determine the Total Consideration, which is the transaction’s worth.

- Record the Total Revenue Stamps that relate to the total amount of taxes paid on the document.

- Provide a detailed Legal Description of Real Estate Transferred to clearly identify the property in question.

- The seller or authorized agent must then sign the document to certify that all information provided is accurate and truthful to the best of their knowledge.

- If the form is signed by an authorized agent, their name and title must be printed clearly.

- Lastly, the form requires notarization. This involves a Notary Public, who will fill out their section, including the state and county, the date, and when their commission expires. Ensure all this information is complete and accurate.

Filling out the L-4258 form correctly is crucial to the compliance and smooth processing of your real estate transfer. Ensure all information is accurately reflected and verified before submission. By following these steps, you'll be equipped to navigate this requirement with confidence, contributing to a transparent and legal property transaction.

Crucial Points on This Form

What is the Michigan L 4258 form?

The Michigan L 4258 form, also known as the Real Estate Transfer Tax Valuation Affidavit, is a document required by the Michigan Department of Treasury. It is used when the monetary amount paid for a real estate transaction is not entered directly on the deed. The form provides a structured way to declare the value of the real estate being transferred and ensure the accurate calculation of taxes owed. It was established under the authority of P.A. 134 of 1966 and P.A. 330 of 1993, as amended.

When do I need to file an L 4258 form?

You need to file the L 4258 form when you choose not to disclose the sale price of the property directly on the deed during a real estate transaction in Michigan. This affidavit allows you to report the necessary information to calculate state and county transfer taxes properly without publicly revealing the sale price on the recorded deed.

Who is required to sign the L 4258 form?

The seller of the property or their authorized agent is required to complete and sign the L 4258 form. The form must be filled out truthfully and to the best of the signer's knowledge, as it includes a certification of the accuracy of the information provided. If someone other than the seller signs the form, they must print their name and title to indicate their authority to act on behalf of the seller.

What information do I need to complete the L 4258 form?

- County of Property

- City or Township of Property

- Seller's Name and Mailing Address

- Purchaser's Name and Mailing Address

- Type and Date of Document (e.g., Land Contract, Deed)

- Cash Payment amount

- Amount of Mortgage/Land Contract

- Amount of County Tax

- Amount of State Tax

- Total Consideration (sum of Cash Payment and Amount of Mortgage/Land Contract)

- If consideration is less than market value, state market value.

- Total Revenue Stamps

- Legal Description of Real Estate Transferred

How does the L 4258 form affect taxes?

The information provided on the L 4258 form is used to calculate the amount of real estate transfer taxes that the seller owes to the county and state government. These taxes are based on the sale price of the property or its market value if the sale price is considered less than the market value. By accurately completing this form, sellers ensure they are paying the correct amount of transfer taxes.

Where should I file the completed L 4258 form?

Once completed and signed, the L 4258 form should be filed with the appropriate county register of deeds office in Michigan. This is usually the same office where the property deed will be recorded. It's essential to check with the local office for any specific filing requirements or additional documentation needed.

Is notarization required for the L 4258 form?

Yes, the L 4258 form requires notarization. The seller or their authorized agent's signature must be notarized to verify the authenticity of the signer. The form includes a section at the bottom for a notary public to fill out, including the date, the notary's signature, and the expiration of their commission.

Can the L 4258 form be filed electronically?

The ability to file the L 4258 form electronically depends on the policies of the specific county register of deeds office in Michigan where the form is being filed. Some counties may offer electronic filing options, while others may require the form to be submitted in person or by mail. It's recommended to contact the local office directly to inquire about their filing options.

Common mistakes

Filling out the Michigan Department of Treasury L-4258 form, also known as the Real Estate Transfer Tax Valuation Affidavit, can be a complex task that requires attention to detail. Unfortunately, many people fall into common pitfalls that could be easily avoided. Recognizing and steering clear of these mistakes is crucial to ensuring a smooth real estate transaction.

One common mistake is not accurately completing the section on the county and city or township of the property. This seems straightforward, but it is often overlooked or filled out incorrectly. The accuracy of this information is critical as it directly affects which local tax rates apply to the transaction.

Another error involves the seller's and purchaser's names and mailing addresses. Sometimes, people provide incomplete addresses or misspell names. This might seem minor, but inaccuracies can lead to significant problems down the line, such as delays in document processing or challenges in establishing legal ownership.

Forgetting to specify the type and date of the document is another common oversight. This section is essential because it denotes the nature of the transaction and the effective date, which are vital pieces of information for tax purposes.

Incorrectly stating the amount in the cash payment and mortgage/land contract sections is yet another frequent error. These figures should reflect the actual amounts exchanged and not rough estimates. Inaccuracies here can affect the calculation of the total consideration, potentially leading to underpayment or overpayment of taxes.

A critical mistake often made is neglecting to state the market value when the consideration is less than market value. This information is crucial for tax authorities to assess the proper taxes. Omitting this can cause delays and possible penalties.

Incorrectly calculating the total consideration, by not accurately adding the cash payment and the amount of mortgage/land contract, can lead to incorrect tax assessments. This not only affects the transaction but can also have legal implications.

Failing to calculate the correct amount of county and state taxes, or providing inaccurate revenue stamps total, can lead to shortfalls in tax payments. These shortfalls can result in penalties, interest charges, and administrative headaches.

Omitting the legal description of the real estate transferred is a severe error. This description is necessary for the deed to be properly recorded and for the local government to assess the property. An incomplete or inaccurate description can invalidate the document.

Lastly, many individuals mistakenly assume that notarization is optional. However, the seller’s signature must be notarized to validate the form. Skipping this step can render the entire document unofficial and lead to its rejection by the Michigan Department of Treasury.

Avoiding these common mistakes requires a careful and thorough approach to filling out the Michigan L-4258 form. Ensuring accuracy in every section not only helps in avoiding unnecessary delays but also prevents potential legal and financial issues. It's always advisable to review all entries meticulously and consult with a professional if there are any uncertainties.

Documents used along the form

When managing property transactions in Michigan, particularly when utilizing the Michigan Department of Treasury L-4258 form, it's important to be aware of and understand additional documents that often accompany or are required in the real estate transfer process. These documents play key roles in ensuring the transaction's legality, accurately recording it, and fulfilling all necessary tax obligations. Below is a list of documents frequently used alongside the L-4258 form.

- Warranty Deed: This document is used to legally transfer property from the seller (grantor) to the buyer (grantee). It guarantees that the title is clear, meaning the property is free of liens or claims.

- Quit Claim Deed: Unlike the Warranty Deed, this deed transfers the ownership of the property without any warranty on the clearness of title, often used between family members or to clear up title issues.

- Property Disclosure Statement: This form requires the seller to disclose the condition of the property, including any known defects or problems that could affect the property's value or desirability.

- Title Insurance Policy: Offers protection to the buyer (and lender, if applicable) against loss arising from disputes over ownership of a property or from problems related to the property title that were not found during the initial title search.

- Land Contract: Utilized when the buyer agrees to pay the seller for the property in installments. Upon final payment, the seller transfers the title to the buyer. Important details such as payment schedule, interest, and consequences of non-payment should be clearly outlined in this agreement.

- Mortgage Documents: If the purchase involves obtaining a mortgage, these documents outline the terms of the loan, including the loan amount, interest rate, repayment schedule, and other conditions of the mortgage agreement.

Navigating the paperwork required for a real estate transaction can be daunting. However, with a thorough understanding of each document's purpose and requirements, sellers and buyers can ensure a smoother, more transparent process. Each of these documents plays a critical role in safeguarding the interests of all parties involved and ensuring compliance with legal standards and regulations.

Similar forms

The Michigan L-4258 form, or the Real Estate Transfer Tax Valuation Affidavit, is specific to documenting details related to real estate transactions in Michigan where the transfer price isn't disclosed on the deed. While unique in its function, several other documents share similarities in terms of their relevance to real estate transactions, tax matters, or legal affidavits. Here is a list of ten documents similar to the Michigan L-4258 form:

- Grant Deed: This document is used to transfer property ownership rights from one party to another. It is similar to the L-4258 form as it deals with the conveyance of real estate, but it specifically involves the direct entry of the sale price on the deed itself.

- Quitclaim Deed: Like the Grant Deed, a Quitclaim Deed is used in real estate transactions, particularly for transferring interest in a property without the guarantees typically involved in a sale. It parallels the L-4258 form in handling property rights but lacks the valuation aspect.

- HUD-1 Settlement Statement: Required for all real estate transactions involving a mortgage, the HUD-1 form outlines the final transaction costs to both buyer and seller. It is akin to the L-4258 in its role in real estate transactions, focusing on financial details.

- Warranty Deed: This document guarantees that the property seller holds clear title to a piece of real estate and has the right to sell it. Similar to the L-4258, it involves the transfer of real estate, with a strong emphasis on the legal status of the property.

- Mortgage Agreement: A legal document outlining the terms of a mortgage loan, allowing individuals to obtain title to property while paying back the loan. It's related to the L-4258 form through its association with real estate financing.

- Property Tax Bill: Issued by local municipalities, it delineates the property tax owed by the owner. Although it's a bill rather than a transfer document, it shares the L-4258's focus on real estate valuation and taxation.

- Affidavit of Property Value: Similar to the L-4258, this affidavit is used in some jurisdictions to disclose the sale price of real estate for tax purposes when not stated directly on the deed.

- Certificate of Title: A statement provided by a title company confirming the legal ownership of property and outlining any liens or encumbrances. It is connected to the L-4258 through its role in verifying property ownership and valuation.

- Land Contract: An agreement between buyer and seller where the buyer pays in installments and the title is transferred upon final payment. It parallels the L-4258 in its involvement with real estate transactions not finalized at the point of agreement.

- Transfer Tax Declaration: A document required in some locales that details the property being sold, the parties involved, and the price paid, used to calculate transfer taxes. It is closely related to the L-4258 as both deal with the tax implications of transferring property.

Each of these documents plays a unique role in the broader scope of real estate transactions, legal declarations, and tax documentation, offering a spectrum of purposes and requirements parallel to those fulfilled by the Michigan L-4258 form.

Dos and Don'ts

When filling out the Michigan Department of Treasury L-4258 form, there are several dos and don'ts that one should keep in mind. This brief guide is designed to help individuals navigate the process of filling out this real estate transfer tax valuation affidavit more efficiently and accurately.

Do:

- Read the instructions carefully before starting to fill out the form. It contains specific guidance that can aid in accurately completing the form.

- Gather all necessary information regarding the transaction and property beforehand, including the county and city or township of the property, along with the legal description of the real estate transferred.

- Enter accurate values for the cash payment, amount of mortgage/land contract, and county and state tax amounts. Estimations or inaccuracies could lead to complications or delays.

- State the market value if the consideration is less than the market value. This is crucial for an accurate valuation.

- Total the consideration correctly by adding the lines for cash payment and amount of mortgage/land contract accurately. This total consideration is vital for proper tax assessment.

- Sign the form as the seller or an authorized agent. Unsigned forms are not valid and will not be processed.

- Get the form notarized, ensuring that the notarization section is completed by a Notary Public of the State of Michigan, including the notary's commission expiration date.

Don't:

- Skip entering the seller and purchaser's name and mailing address. This information is vital for record-keeping and correspondence.

- Forget to specify the type and date of the document, whether it's a land contract or a deed. This detail is crucial for legal purposes.

- Leave any fields blank unless instructions explicitly say it's optional. Incomplete forms may result in rejection or the need for resubmission.

- Estimate the total revenue stamps without calculating them according to the total consideration and applicable rates. Incorrect revenue stamps can lead to financial discrepancies.

- Understate the market value if consideration is less than market value. This could be seen as an attempt to evade taxes and could result in penalties.

- Omit the legal description of the real estate transferred. This description is vital for a clear understanding of what property is subject to the transfer tax.

- Sign in the wrong place or in a non-legible manner. Make sure the signature is clear and in the designated section for the seller or the seller's authorized agent.

Being diligent and attentive to these points can significantly ease the process of completing the Michigan L-4258 form and ensure compliance with legal requirements.

Misconceptions

Understanding the Michigan Department of Treasury L-4258 form, also known as the Real Estate Transfer Tax Valuation Affidavit, presents unique challenges and misconceptions. The following list addresses seven common misunderstandings related to this form:

- Misconception 1: The L-4258 form is optional and not necessary for real estate transactions.

This form is necessary when the sale price of the property is not disclosed on the deed. Its completion is required under specific legislation, making it a critical step in some real estate transactions.

- Misconception 2: Any party involved in the transaction can fill out the form.

The form must be completed and signed by either the seller or the seller’s authorized agent. This requirement ensures that the information provided is accurate and legally binding.

- Misconception 3: The form is only for reporting the sale price.

While the form does require information regarding the sale price (or consideration), it also asks for details such as the type of transfer document, cash payments, mortgages, market value if less than the sale price, and various taxes and fees associated. Its scope extends beyond merely reporting the sale price.

- Misconception 4: Filling out this form eliminates the need for a notary.

The seller’s signature on the form must be notarized. This step verifies the identity of the signatory and confirms the information is provided willingly and under oath.

- Misconception 5: The form is applicable only for cash sales.

While the form requests information about cash payments, it also covers transfers involving mortgages or land contracts. This makes it applicable to a broad range of real estate transactions, not just those conducted in cash.

- Misconception 6: Real Estate Transfer Tax Valuation Affidavit is the same across all states.

Each state has its own regulations and forms for real estate transactions. The Michigan L-4258 form is specific to Michigan and reflects the state’s requirements for reporting and tax purposes in real estate transfers.

- Misconception 7: Digital submission of this form is universally accepted.

The acceptance of digital forms varies by jurisdiction. It is essential to consult local guidelines to understand whether a digital submission meets legal requirements or if a hard copy is necessary.

Addressing these misconceptions ensures a smoother real estate transaction process in Michigan, aiding both buyers and sellers in complying with state laws and regulations.

Key takeaways

Completing the Michigan L-4258 form, also known as the Real Estate Transfer Tax Valuation Affidavit, is a crucial step during real estate transactions when the sale price is not disclosed on the deed. Here are seven key takeaways to consider:

- The form is mandated by the Michigan Department of Treasury under the authority of P.A. 134 of 1966 and 330 of 1993, as amended. Its completion is necessary when the transaction price is not entered on the property's deed.

- Either the seller or an authorized agent can fill out the form; this flexibility is vital for ensuring that real estate transactions remain compliant with state requirements even if the seller cannot complete the form personally.

- It requires detailed information about the transaction, including the county and city or township of the property, the seller's and purchaser's names and mailing addresses, and the type and date of the document.

- Financial details are essential: the form asks for the cash payment, the amount of mortgage or land contract, any county and state tax amounts, total consideration (which is the sum of the cash payment and the mortgage/land contract amount), and the total revenue stamps. If the consideration is less than the market value, the form requires stating the market value.

- The legal description of the real estate being transferred must be provided, emphasizing the specificity required in documenting the property involved in the transaction.

- Accuracy and honesty are paramount; the seller, or their agent, certifies that the information provided on the form is true and complete to the best of their knowledge. Incorrect or fraudulent information can lead to legal repercussions.

- Notarization is required to validate the affidavit, underscoring the legal importance and formal nature of the document. The notary public must indicate the date of notarization and when their commission expires, ensuring that the document is properly executed within the legal timeframe.

Understanding these key elements of the Michigan L-4258 form helps parties in a real estate transaction navigate the legal obligations and ensures compliance with state tax laws. Properly completing and using this document is integral to the transparency and legality of real estate transfers in Michigan.

Popular PDF Templates

Blank Motion Form Michigan - Facilitates an official pathway for alternative service, reducing potential delays in legal proceedings.

1099 Form Michigan - An EEO survey section collects voluntary information for Federal Highway Administration compliance, not affecting employment status.