Michigan Exemption PDF Form

In the state of Michigan, small business owners have an opportunity to claim a property tax exemption that can significantly lighten their fiscal responsibilities. The Michigan Department of Treasury Form 5076, officially known as the Small Business Property Tax Exemption Claim under MCL 211.9o, is a crucial document for business entities seeking relief from personal property tax on certain assets. This exemption specifically targets commercial and industrial personal properties with a combined true cash value of less than $80,000 as of December 31, 2021. The form is not submitted to the Department of Treasury or State Tax Commission but rather, it must be filed with the local unit—city or township—where the respective personal property is located. The deadline for submission is notably strict, with February 22, 2022, serving as the cutoff (albeit postmarks on this date are accepted), yet options for late filing exist through the local unit’s March Board of Review, with personal presence or authorized representation required. It is imperative for the form to be completed thoroughly as any omissions or inaccuracies can be grounds for exemption denial. Additionally, this form liberates the taxpayer from the need to file a Personal Property Statement for the year the exemption is claimed. Maintaining eligibility requires ongoing qualification under the specified criteria; failing which, a rescission form and a new personal property statement will be mandatory. Designed to ease the tax burdens on small businesses, accurate completion, and timely submission of this form can provide essential financial relief, making awareness and understanding of its requirements vital for eligible business owners.

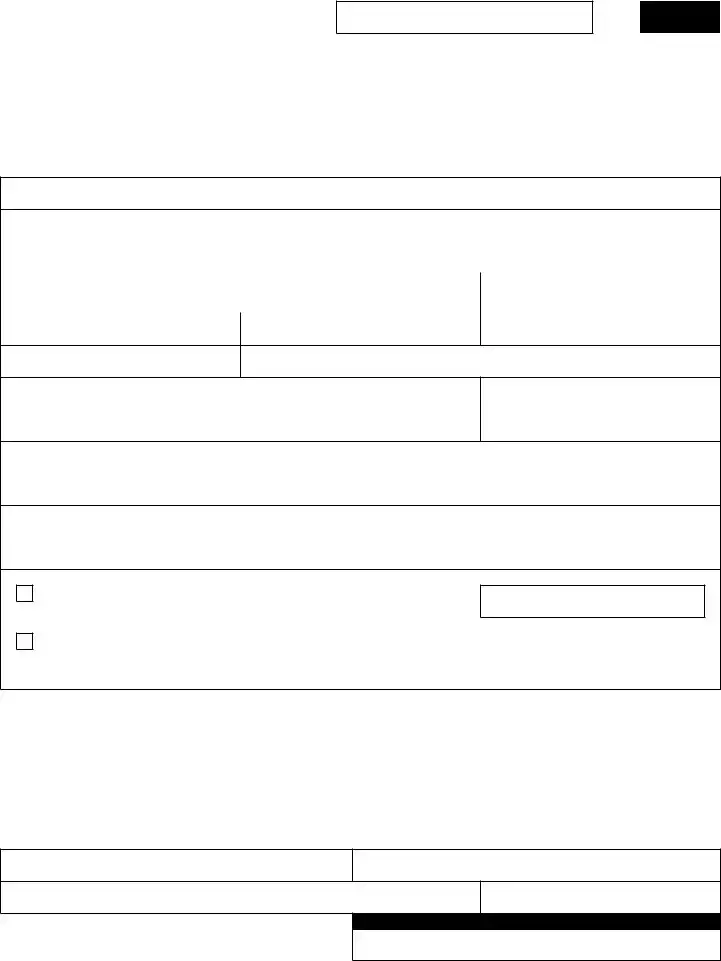

Preview - Michigan Exemption Form

Michigan Department of Treasury 5076 (Rev.

Parcel Number

2023

Small Business Property Tax Exemption Claim Under MCL 211.9o

This form is to be filed with the local unit (City or Township) where the personal property is located. Please contact the local unit where the personal property is located for their mailing address. This form IS NOT to be mailed to the Michigan Department of Treasury or

Michigan State Tax Commission. This form must be filed no later than February 21, 2023 (postmark is acceptable). Late filed forms may be filed directly with the 2023 March Board of Review prior to the closure of the March Board.

This form must be filled out in it’s entirety. Failure to fill out the form completely can be cause for denial of the exemption. Taxpayers should pay particular attention to including contact information, including phone number and email address.

General Information

Business Name

Name and Mailing Address of Owner(s) or Partners (if sole proprietorship or partnership) - attach a separate sheet if necessary

Name of Local Unit of Government |

|

County Where the Property is Located |

City:______________________ Township:______________________ Village:______________________ |

|

|

|

|

|

Parcel Number |

Assumed Name(s) Used by Legal Entity (if any) |

Owner Telephone Number |

Date Business Began in Local Tax Collecting Unit

Description of Owner’s Business Activity

Name, Telephone Number and Email Address of the Person in Charge of Personal Property Records

Address Where Personal Property Records are Kept

Names of all other businesses having personal property, including any leasehold improvements assessed as personal property at the location(s) included in this form. (Attach additional sheets as necessary.)

List all addresses where any personal property owned by, leased to, or in the possession of the owner listed above or a related entity is located within the local tax collecting unit. (Attach additional sheets as necessary.)

Value of Personal Property

The True Cash Value of all Personal Property, as defined by MCL 211.9o, located within the local tax collecting unit indicated above, that is owned by, leased to, or in the possession of the owner or related entity, was less than $80,000 on December 31, 2022. (Enter value at right.)

Value of Personal Property

The True Cash Value of all Personal Property, as defined by MCL 211.9o, located within the local tax |

Value of Personal Property |

collecting unit indicated above, that is owned by, leased to, or in the possession of the owner or related |

|

entity, was equal to or greater than $80,000 and less than $180,000 on December 31, 2022. (If checked, |

|

|

|

attach a copy of Form 632, “2023 Personal Property Statement,” to this form. Enter value at right.) |

|

The undersigned certifies that:

1.I am the owner of the commercial personal property and/or industrial personal property being claimed as exempt or I am the duly authorized agent.

2.The following procedures were used to determine that the True Cash Value of the Eligible Personal Property on December 31, 2022:

a)The determination of True Cash Value was based on the State Tax Commission’s recommended valuation procedures as set forth on Form 632

b)The determination of True Cash Value includes all assessable personal property, located within the city or township listed on this form that is owned by, leased to, or in the possession of the owner or related entity. This shall include all trade fixtures and may include leasehold improvements not assessed as real property. Attach an explanation if not all personal property is included.

3.I understand that according to MCL 211.9o, I am required to maintain and provide access to books and records for audit purposes as provided in section 22.

4.All of the information contained within Form 5076 is true and accurate and to the best of my knowledge and belief, and I acknowledge a fraudulent claim for exemption under MCL 211.9o is subject to the penalties as provided for in section 21(2).

Printed Name

Title

Signature

Date

LOCAL UNIT USE

Date Received

5076, Page 2

Instructions for Small Business Property Tax Exemption Claim Under

MCL 211.9o (Form 5076)

MCL 211.9o provides for a personal property tax exemption for “eligible personal property.” This is commonly referred to as the

Small Business Taxpayer Exemption. MCL 211.9o defines “eligible personal property” as meeting all of the following criteria:

•The personal property must be classified as industrial personal property or commercial personal property as defined in MCL 211.34c or would be classified as industrial personal property or commercial personal property if not exempt and

•The combined true cash value of all industrial personal property and commercial personal property owned by, leased by or in the possession of the owner or a related entity claiming the exemption is less than $180,000 in the local tax collecting unit and

•The property is not leased to or used by a person that previously owned the property or a person that, directly or indirectly controls, is controlled by, or under common control with the person that previously owned the property.

Personal Property Valued Less than $80,000

In order to claim an exemption for personal property valued less than $80,000, this form must be filed with the local unit (City or Township) where the personal property is located no later than February 21, 2023 (postmark is acceptable). This form IS NOT to be mailed to the Michigan Department of Treasury or the Michigan State Tax Commission. Please contact the local unit where the personal property is located for their mailing address. Late filed forms may be filed directly with the local unit March Board of Review prior to the closure of the March Board of Review. Taxpayers must contact the local unit directly to determine the March Board of Review dates.

Taxpayers must appear in person or have a representative appear on their behalf in order to late file with the March Board of Review.

Once the exemption is granted for personal property valued at less than $80,000, the taxpayer will continue to receive the exemption until they no longer qualify for the exemption. Once they no longer qualify, the taxpayer is required to file a rescission form and a personal property statement no later than February 20th of the year that the property is no longer eligible. Failure to file the rescission form will result in significant penalty and interest as prescribed in MCL 211.9o.

This form will exempt property owned only by the entity filing the form. If personal property is leased to or used by an entity other than the property’s owner, the owner of that personal property must file the form for that property, not the lessee or the user. The owner may file the form and claim the exemption only if the True Cash Value of all of the commercial or industrial personal property located within the local tax collecting unit that is owned by, leased to, or in the possession of the owner or a related entity was less than $80,000 on December 31, 2022.

This form must be filled out in it’s entirety. Failure to fill out the form completely can be cause for denial of the exemption. Taxpayers should pay particular attention to including contact information, including phone number and email address.

Once an exemption is granted for personal property valued at less than $80,000, taxpayers are not required to file a “Personal Property Statement” (Form 632) in the year they are claiming the exemption.

Personal Property Valued Greater than or Equal to $80,000 but Less than $180,000

In order to claim an exemption for personal property valued at $80,000 or more but less than $180,000, this form along Form 632 Personal Property Statement must be filed ANNUALLY with the local unit (City or Township) where the personal property is located no later than February 20 of each year (postmark is acceptable). If February 20 is a Saturday, Sunday, or legal holiday, this form and accompanying personal property statement must be filed the next day that is not a Saturday, Sunday, or legal holiday of that year. This form IS NOT to be mailed to the Michigan Department of Treasury or the Michigan State Tax Commission. Please contact the local unit where the personal property is located for their mailing address. Late filed forms may be filed directly with the local unit March Board of Review prior to the closure of the March Board of Review. Taxpayers must contact the local unit directly to determine the March Board of Review dates.

NOTICE: Questions regarding this form should be directed to the assessor of the city or township where the personal property is located. This form is issued under the authority of Public Act 206 of 1893. Additional detailed information on the Small Business Taxpayer Personal Property Exemption can be found on the State Tax Commission website at www.michigan.gov/ statetaxcommission.

Form Characteristics

| # | Fact |

|---|---|

| 1 | The form number for the Small Business Property Tax Exemption Claim in Michigan is 5076. |

| 2 | The applicable law for the exemption is MCL 211.9o. |

| 3 | The form should be filed with the local unit (City or Township) where the personal property is located, not with the Michigan Department of Treasury or the Michigan State Tax Commission. |

| 4 | Filing deadline was February 22, 2022, with the allowance that a postmark by this date is acceptable. |

| 5 | Late filed forms can be submitted directly to the March Board of Review prior to the closure of the March Board of Review session. |

| 6 | To qualify for exemption, the True Cash Value of eligible personal property must be less than $80,000 on December 31, 2021. |

| 7 | Eligible personal property is defined as industrial or commercial personal property under MCL 211.34c. |

| 8 | The exemption, once granted, will continue until the taxpayer no longer qualifies. At that point, a rescission form and a personal property statement must be filed by February 20th of the year of ineligibility. |

| 9 | Failure to file a rescission form for ineligible property results in significant penalties, including repayment of taxes with interest and penalties. |

| 10 | Information and questions about the form should be directed to the assessor of the city or township where the property is located. The form is part of the provisions under Public Act 206 of 1893. |

Guidelines on Utilizing Michigan Exemption

Filing the Michigan Exemption Form 5076 is an important process for small businesses seeking to claim the Small Business Property Tax Exemption under MCL 211.9o. This step not only aids in managing your business taxes but also ensures compliance with Michigan state tax laws. Understanding and following the procedural steps correctly can make the process smoother and prevent any unnecessary delays or issues. Remember, the form should be filed with the local unit (City or Township) where your personal property is located, not mailed to the Michigan Department of Treasury or the Michigan State Tax Commission. Keep an eye on the calendar too; the form is due no later than February 22, 2022, to avoid any late filings which have their specific process.

- Start by gathering all necessary documentation regarding your business' commercial or industrial personal property. This includes records of all personal property owned, leased, or in possession that is situated within the local tax collecting unit.

- On the form's designated field, clearly write the business name.

- Provide the name and mailing address of the owner(s) or partners. If the space provided is insufficient, attach additional sheets as necessary.

- Fill out the name of the local unit of government, specifying the county, city, township, or village where the property is located.

- Enter the parcel number associated with the property in question.

- If applicable, list any assumed names used by the legal entity.

- Include the owner's telephone number and the date the business began within the local tax collecting unit.

- Describe the owner’s business activity in the space provided.

- Provide the name, telephone number, and email address of the person in charge of personal property records, along with the address where these records are kept.

- List names of all other businesses having personal property, including any leasehold improvements assessed as personal property, at the location(s) included in this form. Attach additional sheets if necessary.

- Detail all addresses where any personal property owned by, leased to, or in the possession of the owner listed above or a related entity is located within the local tax collecting unit. If more space is needed, attach additional sheets.

- Certify the form by including the printed name and title of the owner or duly authorized agent, sign and date the form.

- Double-check that all information provided is complete and accurate to best of your knowledge. Incomplete forms may be grounds for denial of the exemption.

- Upon completion, submit the form to the local unit (City or Township) where the personal property is located. Remember, do not mail this form to the Michigan Department of Treasury or the Michigan State Tax Commission.

- Keep a copy of the filled form for your records and wait for any further instructions or confirmation from your local tax unit.

Following these steps diligently ensures that your small business property tax exemption claim is properly filed. This not only helps in potentially lowering your business costs but also aligns with Michigan's tax compliance requirements. For any questions or clarification, it's recommended to directly contact the assessor of the city or township where the personal property is located. They can provide specific guidance and support throughout the filing process.

Crucial Points on This Form

What is the Michigan Exemption Form 5076?

Michigan Exemption Form 5076, also known as the Small Business Property Tax Exemption Claim under MCL 211.9o, is a document used by small business owners in Michigan to claim an exemption from personal property tax. This form is applicable for businesses whose true cash value of owned, leased, or possessed commercial and industrial personal property is less than $80,000 within a local tax collecting unit.

Who needs to file Form 5076?

Any small business owner who has commercial or industrial personal property, including leased property or property in their possession within a specific Michigan local tax collecting unit, and whose total true cash value is under $80,000, needs to file this form. This includes sole proprietorships, partnerships, and other legal entities.

When is the deadline to file Form 5076?

The filing deadline for Form 5076 is February 22nd of the year in which the exemption is claimed. If this date is missed, the form may still be submitted directly to the local March Board of Review before it concludes. However, it's critical to act before the board closes.

Where should Form 5076 be filed?

Form 5076 should be filed with the local unit (City or Township) where the personal property is located, not with the Michigan Department of Treasury or the Michigan State Tax Commission. You should contact the local unit for their specific mailing address and any further instructions.

What information is required on Form 5076?

The form requires detailed information about the business and its owner(s), including business name, owner's name and address, local unit of government, parcel number, contact information, a detailed description of the business's activities, personal property record details, and a certification of the true cash value of eligible personal property. It's crucial to fill out the form completely to avoid denial of the tax exemption claim.

What happens if I fail to file or incorrectly file Form 5076?

Failing to file Form 5076 entirely or filing it with incomplete or inaccurate information can lead to denial of the exemption. Further, if a business no longer qualifies for the exemption and fails to file a rescission form, it may be subject to repayment of additional taxes with interest and penalties, as prescribed by P.A. 132 of 2018.

Do I have to file Form 5076 every year?

No, once the exemption is granted, you do not need to refile annually unless there is a change in qualification status. If your business no longer qualifies for the exemption, you must file a rescission form and a personal property statement by February 20th of the year in which the property is no longer eligible. This ensures that your business is compliant with Michigan tax laws.

Common mistakes

Filling out the Michigan Exemption Form 5076 correctly is crucial for small business owners seeking relief under the personal property tax exemption. A common mistake is not filing the form with the appropriate local unit. The form must be submitted directly to the city or township where the personal property is located, not mailed to the Michigan Department of Treasury or the Michigan State Tax Commission. Overlooking this detail can lead to the denial of the exemption as the local authorities handle the initial processing and approvals.

Another pitfall is neglecting the deadline. The form must be filed no later than February 22, 2022. Late submissions are permitted under certain conditions with the local unit's March Board of Review but knowing the specifics of these conditions is crucial. Late filers must contact the local unit directly to inquire about the March Board of Review dates and the process for late filing. Missing these deadlines can not only delay the exemption but also limit the opportunities to correct errors or omissions on a submitted form.

A significant error seen with the Michigan Exemption Form 5076 involves incomplete information. The form mandates that all fields must be filled out in their entirety. This includes detailed contact information, a comprehensive list of personal property locations within the local tax collecting unit, and accurate valuation of all assessable personal property. Leaving sections blank or providing insufficient information can lead to a denial of the claim. For the exemption to be granted, the assessing bodies require full transparency and detailed data about the business personal property.

Finally, failing to maintain and provide access to books and records for audit purposes, as stipulated under MCL 211.9o, section 22, is a critical misstep. Accurate record-keeping and readiness for potential audits are mandatory conditions for maintaining the exemption. Taxpayers must understand the continuing obligations that come with the exemption approval. An underestimation of this responsibility can result in the recapture of exempted taxes, coupled with penalties and interest, should ineligible exemptions be discovered later.

Documents used along the form

When navigating the complexities of the Michigan Exemption form, it's essential to understand the broader context of documentation that may be required or beneficial in this process. The Michigan Department of Treasury 5076 form, dedicated to claiming the Small Business Property Tax Exemption, represents just a slice of the paperwork landscape that businesses might navigate. This form allows small businesses to claim an exemption from personal property tax under specific conditions, making it a crucial document for eligible enterprises. However, to ensure compliance and maximum benefit, several other forms and documents are often used in conjunction with Form 5076.

- Personal Property Statement (Form 632): Although not required for those filing Form 5076, this form provides a detailed account of a business's personal property for tax assessment purposes. It's useful for record-keeping and may be needed if a business no longer qualifies for the exemption or for audit purposes.

- Rescission Form 5077: If a business that previously qualified for the small business property tax exemption no longer meets the criteria, this form serves to rescind the exemption. Timely filing avoids penalties and interest charges.

- Request for Board of Review Action (Form 618): This form is crucial for businesses that wish to contest or appeal their property tax assessment, including concerns arising from exemption disputes.

- Claim for Refund of Tax Paid on Personal Property (Form 556): If a business believes it has overpaid personal property taxes, possibly due to an erroneously denied exemption, this form can help claim a refund.

- Leasehold Improvements Affidavit: For businesses that make improvements to leased property, this document helps clarify the valuation and tax implications of those improvements, potentially impacting exemption qualification.

- Business Registration Certificate: While not directly related to the exemption process, maintaining a current business registration with the state or local government is crucial for tax compliance and may be required for verification purposes.

- Financial Statements: Comprehensive financial records, including balance sheets and income statements, can provide necessary context and evidence for the true cash value of personal property, supporting the exemption claim.

- Contact Information Update Form: To ensure smooth communication regarding tax matters, it's important for businesses to keep their contact information up to date with the local taxation unit.

- Authorization of Agent (Form 151): If a business hires a representative, such as an accountant or attorney, to handle their tax exemption claims and other property tax matters, this form grants that agent the authority to act on the business’s behalf.

While the Michigan Exemption form (Form 5076) is a critical document for eligible small businesses seeking to reduce their tax liabilities, it's part of a broader ecosystem of documentation. Understanding and preparing these additional forms and documents can ensure that a business not only secures the exemptions to which it's entitled but also remains compliant with taxation regulations. Failing to maintain proper documentation or to file necessary supplemental forms can lead to financial penalties and lost tax savings. Hence, navigating this complex landscape with care and diligence is paramount for any business aiming to leverage the Small Business Property Tax Exemption in Michigan.

Similar forms

Personal Property Statement (Form 632): Just like the Michigan Exemption Form, the Personal Property Statement requires businesses to declare the value of all assessable personal property. Both forms are crucial for determining tax obligations related to personal property and require detailed information about the assets owned or leased by the business.

Rescission Form: This document is necessary when a business no longer qualifies for the exemption provided by the Michigan Exemption Form. It serves a similar purpose in reversing an exemption status, highlighting the connectivity between obtaining and losing qualification for tax exemptions based on the value of personal property.

Business Registration Forms: Like the Michigan Exemption Form, these are required when starting or officially registering a business or a specific aspect of its operations. Both sets of documents often need detailed business information, including ownership, business activity description, and contact information.

Annual Reports for Corporations: These documents, required by many states, share similarities with the Michigan Exemption Form as they keep government authorities updated on a business's status and activities. Both require accurate, up-to-date information about the business's operations and sometimes financial status.

Commercial Lease Agreements: Similar to how the Michigan Exemption Form requires information regarding leased personal property, commercial lease agreements detail the terms under which business property is rented or leased. Both documents are vital for understanding rights and responsibilities concerning business property.

Audit Documentation: The Michigan Exemption Form emphasizes the need for maintaining and providing access to records for audit purposes, paralleling the requirement in many financial audits for businesses to present thorough documentation of their assets, liabilities, and transactions, including details about personal property.

Dos and Don'ts

When you're filling out the Michigan Exemption form, specifically the 2022 Small Business Property Tax Exemption Claim under MCL 211.9o, it's important to approach this task with care and attention to detail. To help you navigate this process smoothly, here are five things you should do and five things you shouldn't do.

What You Should Do:

- Read instructions carefully: Before you start, take time to read through the form and its instructions thoroughly to ensure you understand what’s required.

- Provide complete information: Fill out the form in its entirety. Incomplete forms can lead to a denial of the exemption.

- Include contact details: Make sure to include a current phone number and email address. This ensures that the local unit can reach you if there are any questions or further information is needed.

- Contact the local unit: If you’re unsure where to send the completed form, contact the local unit (City or Township) where the personal property is located for their mailing address.

- File on time: Ensure your form is submitted no later than February 22, 2022. If you miss this date, you may still file directly with the local unit March Board of Review prior to its closure.

What You Shouldn’t Do:

- Do not mail to the wrong place: Remember, this form should not be sent to the Michigan Department of Treasury or the Michigan State Tax Commission.

- Avoid guessing: Don’t estimate or guess when providing information about the True Cash Value of your property. Use the recommended valuation procedures for accuracy.

- Don’t forget additional documents: If you have more information than what fits on the form (e.g., additional business locations or personal property details), make sure you attach separate sheets as necessary.

- Skip representation: If you’re unable to appear in person for a late filing with the March Board of Review, don’t skip the process. Instead, have a representative appear on your behalf.

- Ignore future changes: Should your eligibility for the exemption change, don’t ignore the requirement to file a rescission form and a personal property statement by February 20th of the year you no longer qualify.

By following these do's and don'ts, you’ll increase your chances of successfully claiming the exemption and avoid potential pitfalls in the process.

Misconceptions

There are several misconceptions about the Michigan Small Business Property Tax Exemption, also known as Form 5076. It is critical to understand the facts to ensure compliance and to make the most of this exemption opportunity for eligible businesses.

- Misconception 1: The form can be filed with the Michigan Department of Treasury or the State Tax Commission.

Fact: This form should be filed with the local unit (city or township) where the personal property is located, not with the Michigan Department of Treasury or the State Tax Commission. Failure to file with the correct office can result in the denial of the exemption.

- Misconception 2: There's no strict deadline for filing.

Fact: The form must be filed no later than February 22, 2022. Late filings are possible but need to be done directly with the local unit’s March Board of Review before its closure. Adhering to the deadline is crucial for the exemption to be considered.

- Misconception 3: Filing this form is optional for small businesses.

Fact: While filing is at the discretion of the business if it meets the eligibility criteria (True Cash Value of eligible personal property less than $80,000), to benefit from the exemption, filing the form is necessary. Not filing means missing out on potential tax savings.

- Misconception 4: All businesses are eligible for the exemption.

Fact: Only businesses with commercial or industrial personal property that has a combined True Cash Value of less than $80,000 in the local tax collecting unit are eligible. Additionally, the property must not be leased from or used by a person or entity with certain prior ownership or control relations.

- Misconception 5: Once granted, the exemption is permanent.

Fact: Once granted, the exemption continues only as long as the business qualifies for it. If a business no longer qualifies, a rescission form, along with a new personal property tax statement, must be filed by February 20th of the year of ineligibility. Failure to do so can result in penalties.

- Misconception 6: A Personal Property Statement is still required if the exemption is filed.

Fact: Taxpayers who successfully file Form 5076 are not required to file a Personal Property Statement (Form 632) for the year they claim the exemption. This simplifies the tax process for eligible small businesses.

- Misconception 7: The form allows for a blanket exemption of all business personal property.

Fact: The exemption applies specifically to the commercial and industrial personal property described in the form and meeting the established criteria. Other types of property or property exceeding the True Cash Value threshold are not covered.

- Misconception 8: The exemption automatically applies to leased personal property.

Fact: If personal property is leased to or used by an entity other than its owner, the owner of the personal property must file the form to claim the exemption for that property. The lessee or user cannot claim this exemption on the owner's behalf.

- Misconception 9: Incomplete forms are still processed and considered.

Fact: Failure to fill out the form in its entirety can be cause for denial of the exemption. It is crucial to provide all requested information, including contact details to ensure the application is processed.

Key takeaways

Filling out and using the Michigan Exemption Form 5076 correctly is crucial for small business owners to benefit from the Small Business Property Tax Exemption. Here are key takeaways to ensure compliance and maximize benefits:

- File On Time: The form must be submitted to the local unit (City or Township) where the personal property is located by February 22. A postmark by this date is considered acceptable, but late submissions have a different process, requiring direct filing with the March Board of Review before it closes.

- Do Not Mail to the State: This form should not be sent to the Michigan Department of Treasury or the Michigan State Tax Commission. It is essential to contact the local unit for the appropriate mailing address and submit the form there.

- Complete the Form Fully: Incomplete forms may be denied. Every section of the form, including contact information (phone number and email), needs to be filled out carefully. Providing accurate and comprehensive information helps avoid unnecessary delays or denial of the exemption.

- Eligibility Criteria: To qualify for the exemption, the True Cash Value of all commercial or industrial personal property owned, leased to, or in possession of the owner or a related entity must be less than $80,000 as of December 31 of the prior year. Additionally, the property must not be leased to or used by a person who previously owned the property or has control over the previous owner.

- Maintain and Provide Access to Records: Claimants are required to keep and provide access to books and records for audit purposes as stipulated in MCL 211.9o, section 22. This is a critical aspect, as failure to comply could lead to revocation of the exemption and additional penalties.

It's also worth noting that once the exemption is granted, it continues annually until the business no longer qualifies. At that point, a rescission form along with a personal property statement must be filed no later than February 20th of the year the property becomes ineligible. This step is essential to avoid penalties and back taxes. The Michigan Department of Treasury strictly enforces these rules to ensure fairness and compliance with the state's tax laws.

Remember, the intention behind Form 5076 and the Small Business Taxpayer Exemption is to support small businesses by alleviating some of the burdens of personal property tax. Properly navigating this process can offer significant savings and is an advantage worth pursuing for eligible businesses.

Popular PDF Templates

Michigan Land Contract Form - Aids in the clear communication of property sales details, fostering transparency in real estate transactions.

Michigan Ri 012 - Michigan's RI-012 guide helps applicants understand the legal obligations and requirements for carrying a concealed pistol.

Tax Clearance Certificate Michigan - Urges businesses to provide their final federal return information, crucial for the Michigan tax clearance process.