Michigan Cts 02 PDF Form

In the realm of philanthropy and nonprofit operations within Michigan, the Michigan CTS 02 form emerges as a pivotal document, guiding charitable organizations through the process of renewing their solicitation registration. Under the authority of MCL 400.271 et seq., and with possible civil and criminal penalties for non-compliance, the form serves as a comprehensive tool for organizations seeking to renew their registration with the State of Michigan Department of Attorney General under the Charitable Organizations and Solicitations Act (COSA). Specifically designed for entities whose prior registrations have lapsed or are due for renewal, the form necessitates full disclosure of any alterations to organizing documents, bylaws, IRS status, or charitable purposes since their last submission. Notably, the form delineates clear guidelines on who should file, including those needing to renew and those whose registrations have expired, while explicitly exempting new filers and organizations qualifying for registration exemption. Detailed instructions accompany the form, outlining timelines for registration renewal, associated fees — or the current lack thereof — and preferred submission methods for expedited processing. Additionally, the form emphasizes the need for accuracy in representing the organization's legal name and charitable purposes, stipulates the requirements for naming a Michigan resident agent, and elucidates the reporting obligations concerning professional fundraisers. Importantly, it makes clear the necessity for organizations to verify their compliance with IRS documentation standards and provides for the submission of financial statements, potentially requiring audited or reviewed financial documentation depending on the organization's scale of operations and financial intake.

Preview - Michigan Cts 02 Form

CTS - 02

AUTHORITY: MCL 400.271 et seq.

PENALTY: civil, criminal

State of Michigan Department of Attorney General

RENEWAL SOLICITATION FORM

Charitable Organizations and Solicitations Act (COSA)

Who should file this form?

Charitable organizations:

•Renewing their solicitation registration;

•Whose prior solicitation registration has expired. If your registration has expired, provide copies of any changes to your organizing documents, bylaws, IRS status, or charitable purposes since your previous submission.

Who should not file this form?

•Charitable organizations filing for the first time to solicit in Michigan. Instead, use Form CTS- 01;

•Organizations exempt from registration. See Form

INSTRUCTIONS

GENERAL INFORMATION

Extensions – Your solicitation registration will expire 7 months after the close of your fiscal year (financial accounting period). Your renewal form is due 30 days before the expiration of your registration. If you need an extension of time to file the Renewal Solicitation Form, it must be requested in writing before your registration expires. Your registration expiration date will be extended for 5 additional months.

Use of file number – The organization has been assigned a file number that must be used on correspondence and forms sent to this office. Your file number will be printed on the registration.

Fees – There is currently no fee to register to solicit in Michigan.

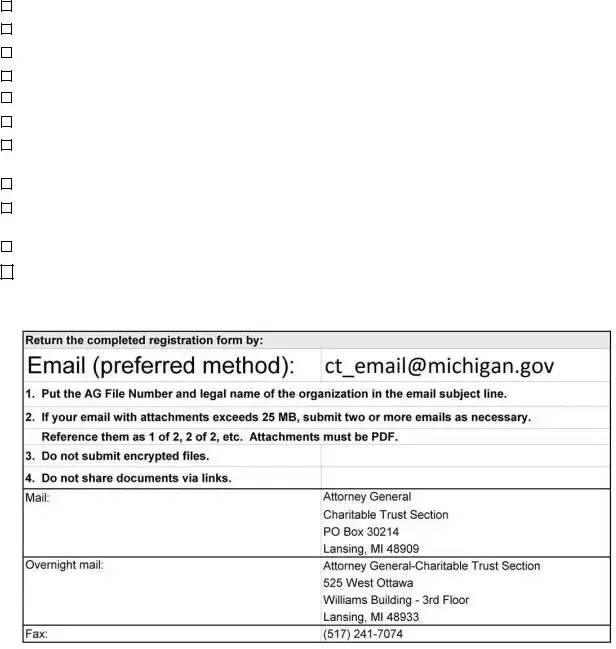

Filing the renewal form – You may renew your registration by email, efiling, fax, or by mail. For

faster processing, use email or efiling.

Email - Put the AG file number and legal name in the email subject line. The Form and

all required documents should be attached in PDF form.

Efile – On the Attorney General’s website, http://www.michigan.gov/agcharity, scroll down to the link for How to

Mail - Send the Renewal Solicitation Form to:

Department of Attorney General Charitable Trust Section

PO Box 30214 Lansing, MI 48909

Telephone: (517)

Fax: (517)

Email: ct_email@michigan.gov

For additional information, visit our website at www.michigan.gov/agcharity.

Verify that we have received your filing

Search for the organization at www.michigan.gov/AGCharitySearch. The search results will state, “Application/registration pending.”

SPECIFIC INSTRUCTIONS

To avoid delays and unnecessary correspondence, answer all questions completely.

Name – Enter the organization's exact legal name on the renewal form. This will be the same name as is currently on the articles of incorporation or other organizing document. If you use any names other than the legal name, enter each name on the solicitation form in the space All other names under which you intend to solicit.

Item 2. If your charitable purposes or activities have changed since submitting your last registration form, summarize in 50 words or less the organization's current charitable purposes. This summary will be added to our database and our searchable website. Do not simply quote or refer to the articles of incorporation or provide the standard IRS 501(c)(3) language.

Item 3. A Michigan resident agent must be named for the acceptance of process issued by any court. The renewal form will not be processed without this information. You must provide a street address, not a P.O. box. The organization cannot name itself, the Michigan Attorney General, or the

1

Michigan Secretary of State as its resident agent. You may designate a private individual residing in Michigan. If you need information on companies that will act as resident agent for a fee, you may wish to do your own internet research. Our office does not provide lists of such companies.

Item 9. The engagement and compensation of all professional fundraisers providing services on Michigan campaigns must be reported in the

schedule.

A professional fundraiser (PFR) is anyone who “plans, conducts, manages, or carries on a drive or

campaign of soliciting contributions for or on behalf of a charitable organization.” A consultant that only has consulting contracts does not have to be licensed as a professional fundraiser. Y ou do not have to report consulting contracts. E mployees of

a charitable organization are PFRs if they are

paid wholly or in part by commissions – including bonuses – based on funds raised.

If you are unsure if the services provided by a person or firm you contracted with are such that a PFR license is required, provide a copy of the contract with your renewal form and request to have the contract reviewed. You will be notified if you must complete Part II and if the contractor should be licensed as a PFR.

Verification of license of PFR - Michigan law requires that you verify that any PFR with which you contract for fundraising in Michigan is currently licensed with this office.

PFR Contract - You are required to provide copies of contracts with PFRs within 10 days of signing a new contract or extending an existing contract.

Campaign Financial Statement -

Campaign Financial Statements, Form

PFR Chart on Renewal Form-

Sum of all payments to / retained by PFR during the year reported – Include all fees, reimbursements, or other payments to the PFR that were related to the campaign or activity conducted by the PFR for the organization. Any monies that were retained by the professional fundraiser before remitting the proceeds of a campaign or activity to the charity must also be

included here. If the PFR listed was engaged after the close of the fiscal year reported in Item 10, enter "N/A" in this column.

Consultants - To qualify as a consultant, all of the following conditions must be met:

•the PFR is usually retained by a charitable or religious organization for a fixed fee or rate that is not computed on the basis of funds raised or to be raised;

•the PFR does not solicit funds, assets or property, but only plans, advises, consults, or prepares materials for a solicitation or fundraising event in Michigan;

•the PFR does not receive or control funds, assets, or property solicited in Michigan; and

•the PFR does not employ, procure, or engage any compensated person to solicit, receive, or control funds, assets, or property.

Item 10. An organization registering to solicit must provide a financial statement for its most recently completed fiscal year. If an organization files Form 990,

The IRS return must be prepared in accordance with IRS instructions. If you do not follow the instructions, we may question the return even if the IRS does not. All applicable schedules and attachments required by the IRS form or instructions must be submitted. However, if you file Form 990 or

Organizations that file Form

Item 11. - Briefly describe the organization's activities or accomplishments during the fiscal period. Provide a sheet if additional space is needed. Do not simply restate the organization's charitable purpose.

Item 12. – Complete all lines. You must enter the end date of the accounting period. Do not leave any lines blank. Enter "0" if applicable.

On line D, enter all costs related to conducting the charitable activities and accomplishments discussed in Item 11.

2

Item 13. Audited or reviewed financial statements requirement - If audited financial statements have been prepared for the year being reported, provide a copy with the renewal form. It is not necessary to complete the schedule.

For all others, complete the schedule to calculate if audited or reviewed financial statements will be required. Total support may be reduced by the amount of governmental grants received during the year.

Audited financial statements must be prepared in accordance with generally accepted accounting principles.

If audited or reviewed financial statements are required, but they have not been prepared:

•You may request a

•If the required financial statements are in the process of being prepared or you have already engaged an auditor to perform the necessary review or audit, provide a letter requesting a conditional registration. In your letter, state when you expect the financial statements to be available. Also, provide a copy of the signed engagement letter agreement with the audit firm. The solicitation registration will

include the condition that the required financial statements are to be provided by a specified date.

•The financial statements requirement may be suspended for food banks and similar organizations whose contributions are substantially

typically converted to cash. Provide your suspension request, with the reason for the request, with the registration form. This must be done each year when applicable.

Item 14. Select YES and provide the information requested on the form if you are a parent organization that directly supervises and controls a local, county, or area division or chapter that is also a separate legal entity.

Unless previously submitted, you MUST provide:

•

appropriate documentation to show that you directly supervise and control the

•chapter;

names and addresses of each chapter to

•be included in your registration; and separate financial statements for each chapter

3

CTS - 02

AUTHORITY 1975 PA 169 PENALTY: civil, criminal

State of Michigan

Department of Attorney General

RENEWAL SOLICITATION FORM

Full legal name of organization

All other names under which you intend to solicit

Attorney General File Number |

Telephone number |

Fax number |

|

|

|

Employer Identification Number (EIN) |

Organization email address |

Organization website |

|

|

|

All items must be answered. Provide additional sheets if necessary. If you have questions, see the instructions.

1.Organization addresses –

A. Street address of principal office. If you do not have a principal office, provide the name and address of the person having custody of the financial records.

B.Organization mailing address, if different.

C.Provide the address of all other offices in Michigan.

Yes No

2. Has there been any change in the organization's purposes? . . . . . . . . . . . . .

If yes, summarize organization's current purposes below in 50 words or less. This summary appears on our website.

3. You must designate a resident agent located in Michigan authorized to receive official mail sent to your organization.

Name ___________________________________________________________________________________________

Address (Michigan street address, not PO box) _______________________________________________________________

4. Methods of solicitation. Check all that apply.

Telephone

Internet

Personal contact

Personal contact

Radio / television

Special events

Newspaper/magazines

Other (specify) ____________________________

Other (specify) ____________________________

None (explain) ____________________________

Yes No

5. Has there been a change in the organization's tax status with the IRS since your last filing? . . . .

If yes, explain and document.

4

6. List all current officers and directors unless they are included on your IRS return. Mark the box to indicate whether the person is an officer, director, or both. Provide an additional sheet if necessary.

Name

Officer Director

Name

Officer

Director

|

|

|

|

Yes |

No |

7. |

Is there any officer or director who cannot be reached at the organization’s mailing address? . . . . |

|

|

||

|

If “yes,” provide the names and addresses on an additional sheet. |

|

|

|

|

|

|

|

|

||

8. |

Since your last registration form, has the organization or any of its officers, directors, employees or fundraisers: |

Yes |

No |

||

|

A. Been enjoined or otherwise prohibited by a government agency/court from soliciting? |

|

|

||

|

B. Had its solicitation registration or license denied or revoked by any jurisdiction? |

. . . . . . . . |

|

|

|

|

C. Been the subject of a proceeding regarding any license, registration, or solicitation? |

|

|

||

|

D. Entered into a voluntary agreement of compliance with a government agency or in a case |

|

|

||

|

before a court or administrative agency? |

. . . . . . . . . . . . . . . . . . . . |

|

|

|

If any "yes" box is checked, provide a complete explanation on a separate sheet.

Has the organization engaged a professional fundraiser (PFR) for Michigan

9. fundraising activity for either the financial accounting period reported in item 10 or the current period? See instructions for definition of "professional fundraiser."

A consultant is not a PFR.

Yes No

If no, go to question10.

If yes, in the chart below list all PFRs that your organization has engaged for Michigan fundraising activity. Provide additional sheets if necessary. Provide copies of contracts for each PFR listed if not already provided.

Note – You are required to verify that all PFRs under contract for Michigan campaigns are currently licensed.

Professional Fundraisers Under Contract for Michigan Campaigns

|

|

|

Is contract |

|

|

|

|

in effect |

|

|

|

Sum of all payments |

now (as you |

If no, enter |

|

|

|

||

|

|

to / retained by PFR |

complete |

date contract |

Name |

Mailing address |

during year reported |

the form)? |

ended |

|

|

|

|

|

End date:

y n

End date:

y n

End date:

y n

5

10. All organizations must report on their most recently completed financial accounting period.

Check the box to indicate the type of return filed with the IRS and follow the instructions:

Form 990 or

Form

Total program services expense: $

If your organization does not file the above returns with the IRS, check the appropriate box below to explain the reason, and follow the instructions:

Files Form

Included in IRS group return. Provide a copy of the group return. Complete 11 and 12 below.

Other reason. Explain: _______________________________________________________________

Complete 11 and 12 below.

11.Briefly describe your charitable accomplishments during the period. ____________________________________

12.Complete this section only if directed to in item 10 because your organization does not complete a Form 990,

Enter the end date of the financial accounting period reported below: |

____/_____/_____ |

REVENUE

AContributions and fundraising received B All other revenue

C Total revenue (add lines A and B)

Expenses

DCharitable program services expense

EAll remaining expenses (supporting services) F Total expense (Sum of lines D and E)

G Revenue less expenses (subtract line F from line C)

Balance Sheet

HTotal assets at end of fiscal period I Liabilities at end of fiscal period

J Net assets (subtract line I from line H)

6

13. Audited or reviewed financial statements requirement

Complete the following schedule to determine if audited or reviewed financial statements are required. If audited or reviewed financial statements are required, but they have not been prepared, see the instructions.

|

Item |

Where to Find it: |

Amount |

|

|

Form 990: Part VIII, line 1h; |

|

A. |

Contributions from IRS return |

Form |

|

|

|

Form |

|

|

|

|

|

B. |

Net income from special fundraising |

Form 990: Part VIII, line 8c; |

|

events |

Form |

|

|

C. |

Net income from gaming activities |

Form 990: Part VIII, line 9c |

|

D. |

Total contributions and fundraising |

Add lines A, B, and C |

|

|

|

|

|

|

|

|

|

E. |

Governmental grants |

Form 990: Part VIII, line 1e; |

|

Form |

|

||

|

|

|

|

|

|

grants included above on line A. |

|

|

|

|

|

F. |

|

Subtract line E from line D |

|

|

|

|

After completing the schedule:

•If line F is $550,000 or more, audited financial statements are required. They must be audited by an independent certified public accountant and prepared in accordance with generally accepted accounting principles.

•If line F is greater than $300,000, but not greater than $550,000, financial statements either reviewed or audited by a certified public accountant are required.

Yes No

14. Do you have chapters in Michigan that are to be included in the solicitation registration?

Tip: If you have offices in Michigan with no separate reporting or filing requirements, answer “no.”

If yes, provide the following:

•a listing of the names and addresses of all Michigan chapters to be included

•a financial report for each chapter (see instructions)

•a copy of your organization's IRS group return (if applicable)

Note – if you have chapters but have not previously informed us of your intent to include them, see the instructions.

15. I certify that I am an authorized representative of the organization and that to the best of my knowledge and belief the information provided, including all accompanying documents, is true, correct, and complete. False statements are prohibited by MCL 400.288(1)(u) and MCL 400.293(2)(c) and are punishable by civil and criminal penalties.

Type or print name (must be legible): |

________________________________________________________ |

||

Title: |

|

|

Date: ______________________ |

Check here if you would like to request an automatic

THIS IS A PUBLIC RECORD, COPIES OF WHICH ARE SENT, UPON REQUEST, TO ANY INTERESTED PERSON.

7

CHECKLIST:

Have all parts of the form been fully completed unless instructed otherwise?

Have you provided the name and Michigan street address of a resident agent in item 3? Is a list of the officers and directors provided or included with the IRS return?

Have you provided a complete IRS 990,

If you file Form

If you file Form

If audited or reviewed financial statements are required, are they provided? If not, have you requested a conditional registration or

Are the Form 990 and financial statements prepared for the same reporting period?

Have you submitted contracts and addenda to contracts with professional fundraisers that have not been previously submitted?

Have you typed or printed your name, date, and title in Item 15 to certify the form?

If you are requesting a

Revised |

8 |

2/20/2020

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The CTS-02 form is used by charitable organizations in Michigan to renew their solicitation registration or to update their registration if it has expired. |

| Governing Law | The form is governed by the Michigan Charitable Organizations and Solicitations Act (COSA), specifically MCL 400.271 et seq. |

| Exemptions | Charitable organizations filing in Michigan for the first time or those exempt from registration, such as organizations outlined in Form CTS-03, should not use this form. |

| Registration Expiration and Extension | Registration expires 7 months post the close of the fiscal year. Organizations can request an extension 30 days before expiration for an additional 5 months. |

| Filing Method Options | Organizations can renew their registration via email, e-filing, fax, or mail, with email and e-filing being recommended for faster processing. |

| Financial Statements and Registration Fees | There is no fee for registration. Financial statements for the organization's most recently completed fiscal year are required, except for certain exemptions. |

| Professional Fundraiser Regulations | Organizations must report the engagement and compensation of all professional fundraisers, verifying their license and providing copies of contracts within 10 days of signing. |

Guidelines on Utilizing Michigan Cts 02

After you complete the Michigan CTS 02 form, which is for charitable organizations renewing their solicitation registration, the next steps involve ensuring all required documents accompany the form and adhering to submission guidelines. This process is crucial to maintain your organization's authority to solicit donations within Michigan. The following step-by-step guide is designed to help you fill out the form correctly.

- Begin with the full legal name of your organization as it appears on your articles of incorporation or other organizing document.

- Enter all other names under which you intend to solicit in the space provided.

- Provide your Attorney General file number, contact telephone number, fax number (if available), Employer Identification Number (EIN), organization email address, and website.

- For organization addresses:

- A. Enter the street address of the principal office, or if not applicable, the name and address of the person with custody of financial records.

- B. If different, provide your organization's mailing address.

- C. List all other Michigan office addresses, if any.

- If there has been any change in your organization's purposes, mark "Yes" and summarize the current purposes in 50 words or less. This summary will also appear on the Department of Attorney General's website.

- Designate a resident agent in Michigan authorized to receive official mail, including a Michigan street address (no P.O. boxes).

- Check all methods of solicitation your organization will use.

- If there's been a change in your organization's tax status with the IRS since the last filing, mark "Yes" and explain, providing necessary documentation.

- List all current officers and directors unless they are included in your IRS return. Specify if each person is an officer, director, or holds both positions. Use an additional sheet if necessary.

- If any officer or director cannot be reached at the organization's mailing address, mark "Yes" and provide their names and addresses on an additional sheet.

- If since your last registration, your organization or any officers, directors, employees, or fundraisers have faced legal or regulatory action related to solicitation, mark "Yes" to the appropriate questions and provide details on a separate sheet.

- Determine if you have engaged a professional fundraiser (PFR) for Michigan fundraising activities for the reported financial period or currently. If "Yes," list all engaged PFRs in the chart provided and attach copies of contracts if not already submitted. Verify that all listed PFRs are currently licensed.

- Complete Item 10 by providing a financial statement for the most recently completed fiscal year. Attach IRS Form 990, 990-EZ, or 990-PF if applicable.

- Briefly describe your organization's activities or accomplishments during the fiscal period in Item 11. Use an additional sheet if more space is needed.

- Complete all lines in Item 12, providing the end date of the accounting period and ensuring no lines are left blank.

- For Item 13, if audited or reviewed financial statements have been prepared, attach a copy. Otherwise, complete the schedule to see if such statements are required and follow the specified instructions based on your situation.

- If you are a parent organization, select "Yes" for Item 14 and provide the required information about any separate legal entity that is directly supervised and controlled by your organization.

After completing the form and gathering all necessary attachments, choose your preferred method of submission (email, eFiling, fax, or mail) based on the guidelines provided. Ensure you use the correct Attorney General file number and legal name in your correspondence. For email and efiling, attach the form and documents in PDF format. If mailing, send everything to the specified address. It is recommended to verify receipt of your filing through the provided search tool on the Attorney General's website.

Crucial Points on This Form

Who needs to file the Michigan CTS 02 form?

Charitable organizations that are renewing their solicitation registration or whose prior registration has expired should file this form. This includes providing updates to any changes in their organizing documents, bylaws, IRS status, or charitable purposes since their last submission.

Who should not file this form?

Charitable organizations filing for their initial registration to solicit in Michigan should instead use Form CTS-01. Likewise, organizations that are exempt from registration should refer to Form CTS-03, Request for Exemption, rather than filing this form.

What is the deadline for filing the renewal form?

The renewal form is due 30 days prior to the expiration of your current registration, which expires 7 months following the close of your fiscal year. If necessary, extensions can be requested in writing before your registration expires, extending the expiration date by an additional 5 months.

Is there a fee to register to solicit in Michigan?

No, currently there is no fee required to register for solicitation in Michigan.

How can I submit my renewal form?

- Email - Subject line should include the AG file number and legal name, with the form and required documents attached as PDFs.

- Efile - Via the Attorney General’s website.

- Fax

- Mail - To the Department of Attorney General Charitable Trust Section.

How do I ensure my filing has been received?

Verification can be done by searching for your organization on www.michigan.gov/AGCharitySearch. The status "Application/registration pending" indicates receipt of your filing.

What should I do if our charitable purposes or activities have changed?

Item 2 of the form requires a 50-word summary of your organization's current charitable purposes. This summary will update the database and the searchable website, reflecting any modifications since your last submission.

Who can be named as a Michigan resident agent on the form?

Your Michigan resident agent must be a private individual residing in the state or a company designated for this role. The named agent must have a street address within Michigan, as P.O. boxes are not accepted.

What is required regarding the engagement of professional fundraisers?

You must report the involvement and compensation of all professional fundraisers active in Michigan campaigns. Verification of their license and copies of contracts within 10 days of engagement are mandatory requirements, aiming to ensure transparency and legal compliance.

Are financial statements required with the renewal application?

Yes, organizations must provide a financial statement for their most recently completed fiscal year. If Form 990, 990-EZ, or 990-PF is filed with the IRS, a copy should be included. Specific items on the form must be completed based on the information provided on these IRS forms, excluding Schedule B of Form 990 or 990-EZ.

Common mistakes

Filling out the Michigan CTS-02 form can be tricky, and many charitable organizations stumble along the way. One common mistake is not using the organization's exact legal name as currently listed on the articles of incorporation or other organizing documents. This oversight can lead to confusion and delay the renewal process. Organizations should ensure the name on the form matches exactly with official documents.

Another mistake is leaving sections incomplete or providing vague answers. The form requires specific information about any changes in the organization's purposes, activities, or charitable programs since the last submission. A simple "no changes" or broad statements might not suffice. Organizations should summarize any updates succinctly, ensuring they are clear and concise.

Not naming a Michigan resident agent or using a P.O. box instead of a street address for the agent's contact information is a misstep. The form specifies that a street address is necessary, and the agent cannot be the organization itself, the Michigan Attorney General, or the Secretary of State. It's important to designate an appropriate and compliant resident agent.

Failing to include all names under which the organization intends to solicit is another frequent mistake. This section helps the public identify the organization across different platforms or campaigns. Not listing all aliases can hinder transparency and trust.

Overlooking the requirement to report the engagement and compensation of professional fundraisers is a significant error. This includes providing details about the fundraiser's activities for the organization and ensuring any professional fundraiser used is licensed in Michigan. This information is crucial for maintaining regulatory compliance and public trust.

Submitting the form without the necessary financial documents, like the IRS Form 990, 990-EZ, or 990-PF, or failing to complete the alternative financial statement sections if the organization does not file such forms, can delay processing. These financial details are vital for assessing the organization's health and compliance.

Ignoring the instructions about audited financial statements can also lead to issues. If audited or reviewed financial statements have been prepared, they must be provided with the form. Otherwise, the organization must follow the guidelines to determine if these documents are required and take appropriate action.

Another common error is not providing updates on the organization's tax status with the IRS since the last filing. Changes to tax status can affect the organization's eligibility and obligations under Michigan law, so accurate and current information is essential.

Forgetting to mention any changes in solicitation methods or not updating the list of officers and directors on the form can also be problematic. The state needs current information on how the organization solicits donations and who is leading the group to ensure compliance and accountability.

Lastly, omitting information on any legal actions, proceedings, or agreements related to solicitation activities or registration can have serious consequences. Transparency about such matters is crucial for maintaining the organization's good standing and the public's trust.

Avoiding these common errors can smooth the renewal process, helping charitable organizations stay compliant and focused on their mission.

Documents used along the form

When handling the renewal and operational proceedings for charitable organizations in Michigan, the CTS-02 form is pivotal. This form, specifically designed for charities renewing their solicitation registrations or updating registration due to an expiration, works within a broader ecosystem of documentation and procedures to ensure compliance under the Michigan Charitable Organizations and Solicitations Act. Additionally, several other forms and documents are commonly used in conjunction with the CTS-02 to provide a thorough representation of an organization's activities, changes, and financial condition. Understanding these additional forms is crucial for organizations aiming to maintain transparency and adherence to state regulations.

- Form CTS-01: This is the initial registration form for charitable organizations looking to solicit in Michigan for the first time. It collects comprehensive information about the charity, including its purpose, organizational structure, and planned fundraising activities. This form lays the groundwork for an organization's compliance and is necessary before engaging in solicitation activities within the state.

- Form CTS-03: The Request for Exemption form is for organizations that believe they are exempt from the registration requirements under the Charitable Organizations and Solicitations Act. By submitting this form, a charity can clarify its status and, if applicable, avoid the detailed registration process. However, eligibility for exemption must be thoroughly documented and justified as per the state guidelines.

- Form CTS-10: The Campaign Financial Statement form is a critical document for organizations that have engaged a professional fundraiser for their campaigns. It requires detailed financial reporting of the campaign, including amounts raised, expenses incurred, and net proceeds. This form ensures transparency and accountability for the funds raised through solicitation.

- IRS Form 990: While not a Michigan-specific document, the IRS Form 990 or its variants (990-EZ, 990-PF) are often submitted alongside the CTS-02 as it provides a federal-level financial snapshot of the organization. This form details the charity's income, expenses, and adherence to its non-profit mission. It serves as a crucial component for both tax compliance and state registration renewal by offering insights into the organization's financial health and operational integrity.

Together, these documents form a comprehensive suite necessary for charitable organizations to navigate the regulatory landscape in Michigan effectively. Whether renewing registration, claiming an exemption, or detailing financials, each form plays a unique role in fostering a transparent, accountable environment for charitable solicitation and operation within the state. Understanding and accurately completing these forms underscore an organization's commitment to compliance, integrity, and the principles of charity it stands to uphold.

Similar forms

The Michigan CTS-01 form bears a resemblance to the CTS-02 form primarily in their foundational purpose—both are dedicated to the registration and regulation of charitable solicitations within the state. While the CTS-02 serves as a renewal solicitation form for charities that have previously registered, the CTS-01 is utilized by charitable organizations looking to register for the first time. This primary distinction highlights the procedural pathway for charities at different stages of their solicitation activities in Michigan, though both forms fundamentally operate under the Charitable Organizations and Solicitations Act.

Form CTS-03, Request for Exemption, while distinct, shares a connection with the CTS-02 form through the Michigan Charitable Organizations and Solicitations Act. The CTS-03 form is for organizations seeking exemption from registration requirements, a critical procedural aspect for qualifying charities that wish not to undergo the traditional registration or renewal process as outlined in the CTS-02. This form delineates which organizations may bypass standard registration based on specific criteria, setting it apart yet keeping it related in terms of regulatory context.

The Campaign Financial Statement, Form CTS-10, is intricately linked to the CTS-02 form in terms of ensuring financial transparency and accountability for charitable organizations engaging in solicitation activities. Where the CTS-02 provides a general overview for renewal registration, including changes in solicitation practices or charitable purposes, the CTS-10 demands detailed financial disclosure of a campaign's income and expenses managed by or for the organization. This close relationship underscores the comprehensive regulatory framework aimed at safeguarding the integrity of charitable solicitations.

The IRS Form 990, although a federal document, complements the information required by the CTS-02 form by providing a detailed financial accounting of the organization's operations. Organizations that are renewing their solicitation registration with form CTS-02 are often required to submit their most recent Form 990 as part of their financial documentation. This ensures a holistic financial review by aligning state-level renewal requirements with federal accountability standards, thus promoting greater transparency and oversight of charitable entities.

Dos and Don'ts

When preparing to fill out the Michigan CTS-02 form for your organization, there are specific steps you can take to ensure a correct and successful submission. Familiarize yourself with the following do's and don'ts to streamline the process and avoid common pitfalls:

Do:

- Verify all information is current and accurate. Before submitting, double-check the organization's legal name, address, and contact information to ensure it matches the current records. This applies to answering any questions regarding changes in charitable purposes or IRS status.

- Answer all questions completely and concisely. Incomplete answers can delay processing, so ensure every question is answered fully. For questions that require summarization, such as the description of the organization's current charitable purposes, clarity, and brevity are crucial.

- Designate a Michigan resident agent. This person or entity must be authorized to receive official and legal correspondence on behalf of your organization. Ensure the address provided is a physical street address in Michigan, not a P.O. Box.

- Include all necessary documentation. Along with the CTS-02 form, ensure to attach any required supporting documents, such as changes to your organizing documents, bylaws, a copy of the IRS determination letter if your tax status has changed, and a completed financial statement for the most recently completed fiscal year.

- Use the assigned file number. This number is crucial for tracking and should be included in all correspondence with the Department of Attorney General. It ensures your submission is correctly matched to your organization's records.

Don't:

- Leave any questions blank. If a question does not apply or the answer is zero, clearly indicate this by writing "N/A" or "0". This helps avoid the appearance of incomplete forms which can lead to processing delays.

- Forget to sign and date the form. An unsigned form is considered incomplete and will not be processed. Ensure the authorized representative's signature is included.

- Miss the filing deadline. Submit your renewal form 30 days before the registration expiration date. Late filings can result in a lapse of registration and potentially affect your organization's ability to legally solicit donations.

- Overlook the need for a financial statement. Whether you're including a copy of the IRS Form 990 or completing the financial sections of the CTS-02, accurate financial reporting is essential. Don't omit any required schedules or attachments.

- Use a P.O. Box for the Michigan resident agent's address. The form specifically requires a physical street address within Michigan. This stipulation ensures there's a reliable way to reach your organization through your designated agent.

By adhering to these guidelines, you'll facilitate a smoother renewal process for your charitable organization's solicitation registration in Michigan.

Misconceptions

One common misconception is that the Michigan CTS 02 form is only for organizations based in Michigan. While it is true that the form is used for charitable solicitations within the state, organizations based outside Michigan but intending to solicit donations within the state also need to use this form to renew their registration. The requirement spans beyond geographic location, focusing instead on the act of solicitation within the state.

Another misunderstanding is related to the fees associated with filing the CTS 02 form. Some may wrongly assume that there are fees involved in the renewal process. As clearly stated in the form's instructions, there is currently no fee to register or renew solicitation registration in Michigan. This makes it easier for charitable organizations to comply without worrying about additional financial burdens.

There’s also confusion about the extension request process. The belief that extensions are automatically granted upon request is incorrect. Instead, an extension of the registration expiration requires a written request before the registration expires. This process is designed to ensure that all requests are properly documented and considered, without automatic extensions that could lead to oversight or misuse.

Many believe that any change in the organization's structure or purpose does not need to be reported if the organization is merely renewing its registration. However, the CTS 02 form clearly requires organizations to provide updates on any changes to their organizing documents, bylaws, IRS status, or charitable purposes since their previous submission. This requirement ensures that the state has current information about each organization and can monitor compliance with applicable laws.

Another misconception is that professional fundraisers are the only third-party entities that need to be reported on the CTS 02 form. While the form does require information about professional fundraisers, it also specifies that consulting contracts do not have to be reported. Nevertheless, the distinction between the two can be nuanced, highlighting the need for organizations to carefully review the nature of their contracts with third parties engaged in their fundraising efforts.

Finally, there's a misconception about the need to file a Campaign Financial Statement (CTS-10) for all campaigns conducted by a professional fundraiser. It is sometimes thought that if a professional fundraiser is solely providing consulting services and not directly soliciting donations, then a Campaign Financial Statement is not required. The form clarifies that Campaign Financial Statements are necessary for all campaigns conducted by a professional fundraiser with whom the organization has contracted, except when the individual acts solely as a consultant. This distinction is vital for compliance and accurate financial reporting.

Key takeaways

- Filling out the Michigan CTS-02 form is a requirement for charitable organizations looking to renew their solicitation registration or for those whose registration has expired. This process is crucial for maintaining the legal status needed to solicit donations within the state. Organizations must ensure that changes to their organizing documents, bylaws, IRS status, or charitable purposes since their last submission are captured and submitted with the renewal application.

- The form also mandates the designation of a Michigan resident agent who is authorized to receive official correspondence on behalf of the organization. It's critical to remember that the designated agent must have a physical street address within Michigan; P.O. boxes are not acceptable. The significance of this requirement lies in ensuring that there is a reliable point of contact within the state for legal and official matters.

- Organizations must report the engagement and compensation of all professional fundraisers involved in Michigan campaigns. These details are crucial for the state’s oversight and regulation of fundraising activities. It ensures transparency and accountability in how charitable solicitations are conducted and how funds are raised and utilized. The distinction between professional fundraisers and consultants is also highlighted, clarifying that consultants do not require licensing as professional fundraisers under Michigan law.

- Completing and summing the financial details accurately is a significant portion of the renewal process. Organizations must provide a financial statement for their most recently completed fiscal year. If an organization files an IRS Form 990, 990-EZ, or 990-PF, a copy of that filing must be included with the form. This requirement underscores the importance of financial transparency and accountability, providing assurance to the public and regulators about the proper utilization of funds.

Popular PDF Templates

Is Car Insurance Required in Michigan - The effective and expiration dates on the certificate help vehicle owners keep track of their policy status.

Unconditional Release - A contractor's formal waiver of rights to claim a lien against a property, following the settlement of accounts.