Michigan C 3204 PDF Form

The Michigan C 3204 form, managed by the Michigan Department of Treasury, is designed for the annual reporting and payment of sales, use, and withholding taxes. This comprehensive document, which underwent a revision in October 2000, facilitates a streamlined way for businesses to comply with state tax regulations. Essential for ensuring the accuracy of tax calculations related to sales and rentals, rentals of tangible property and accommodations, and communications services, the form mandates the detailed enumeration of gross sales, including those by out-of-state vendors subject to use tax. Further breakdowns allow for the deduction of various allowable expenses such as resale activities, industrial processing, and food for human consumption, ensuring that businesses only pay taxes on net taxable sales and purchases. Tax rates, clearly delineated for both sales and use tax, guide the computation of the gross tax due, adjustments for overpayments or tax collected, and the final net tax obligation. Additional sections cater to the specifics of use tax on items bought for business or personal use and withholdings from Michigan payroll. The form underscores the importance of accurate record-keeping and timely submission, with a standard deadline of February 28th following the tax year or, in cases where a business discontinues operations, within 30 days thereafter. This document also includes areas for reporting pertinent details such as the type of business ownership and provides explicit instructions regarding where to send completed forms based on the payment status. Ultimately, the Michigan C 3204 form is a vital tool for business compliance, ensuring the correct calculation and remittance of taxes that support the state's public services.

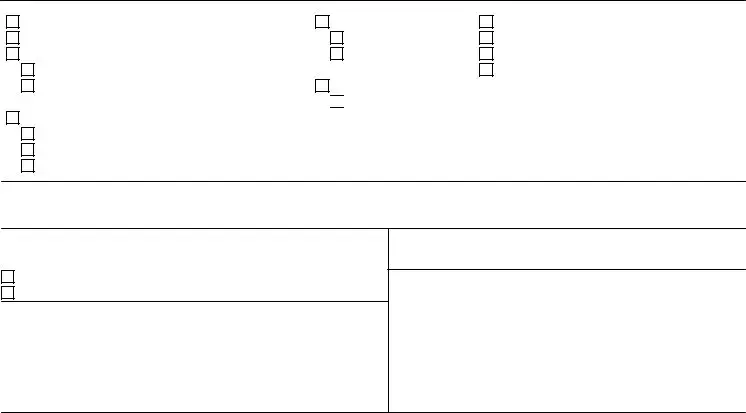

Preview - Michigan C 3204 Form

Michigan Dept. of Treasury, 165, formerly

ANNUAL RETURN FOR SALES, USE AND WITHHOLDING TAXES

Place Label from Your Coupon Book Here or Enter Taxpayer Name |

|

Account Number |

|

|

|

|

|

|

|

Return Year |

Date Due* |

|

|

|

|

Do not use this form to replace a monthly or quarterly return.

File this return by February 28

*If your business is discontinued during the year, this |

|

|

|

A. Use Tax: Sales & Rentals |

|

|

|

|

|

|

B. Sales Tax |

|

|

|

|

|||||||||||

return is due 30 days after the business is discontinued. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

6% |

|

|

|

4% |

|

|

|

6% |

|

|

|

|

|

4% |

|

|

|

||||

Sales and Use Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1. |

Gross sales (including sales by |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

vendors subject to use tax) |

1. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. |

Rentals of tangible property and accommodations . |

2. |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Communications services |

3. |

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Add lines 1, 2 and 3 |

4. |

4 |

|

|

|

|

4 |

|

|

4. |

4 |

|

|

|

|

|

|

4 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ALLOWABLE DEDUCTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5a. |

Resale |

5a. |

|

|

|

|

|

|

|

|

|

|

5a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

b. |

Industrial processing or agricultural producing |

b. |

|

|

|

|

|

|

|

|

|

|

b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

c. |

Interstate commerce |

c. |

|

|

|

|

|

|

|

|

|

|

c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

d. |

Exempt services |

d. |

|

|

|

|

|

|

|

|

|

|

d. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

e. |

Sales on which tax was paid to Secretary of State .... |

e. |

|

|

|

|

|

|

|

|

|

|

e. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

4 |

|

|

4 |

|

|

|

|

|

|

4 |

|

|

|

|

||||||

f. |

Food for human/home consumption |

f. |

|

|

|

|

|

|

f. |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

g. |

Bad debts |

g. |

|

|

|

|

|

|

|

|

|

|

g. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

h. |

Michigan motor fuel or diesel fuel tax |

h. |

|

|

|

|

|

|

|

|

|

|

h. |

|

|

|

|

|

|

|

|

|

|

|

|

|

i. |

Other. Identify: ____________________________ |

i. |

|

|

|

|

|

|

|

|

|

|

i. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

j. |

Tax included in gross sales (line 1) |

j. |

|

|

|

|

|

|

|

|

|

|

j. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

4 |

|

|

4 |

|

|

|

|

|

|

4 |

|

|

|

|

||||||

k. |

Total allowable deductions. Add lines 5a - j |

k. |

|

|

|

|

|

|

k. |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6. |

Taxable balance. Subtract line 5k from line 4 |

6. |

4 |

|

|

|

|

4 |

|

|

6. |

4 |

|

|

|

|

|

|

4 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

X |

|

.06 |

|

X |

|

.04 |

|

|

|

X |

|

.06 |

|

X |

|

.04 |

||||||||

7. |

Tax Rate |

7. |

|

|

|

|

|

7. |

|

|

|

|

|

|

||||||||||||

8. |

Gross tax due. Multiply line 6 by line 7 |

8. |

4 |

|

|

|

|

4 |

|

|

8. |

4 |

|

|

|

|

|

|

4 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

4 |

|

|

|

|

4 |

|

|

4 |

|

|

|

|

|

|

4 |

|

|

|

|

|||||||

9. |

Tax collected in excess of line 8 |

9. |

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

10. |

Add lines 8 and 9 |

10. |

|

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

11. |

TOTAL discount allowed (see instructions) |

11. |

4 |

|

|

|

|

4 |

|

|

11. |

4 |

|

|

|

|

|

|

4 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

12. |

Net tax due. Subtract line 11 from line 10 |

12. |

|

|

|

|

|

|

|

|

|

|

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

13. |

Sales tax license fee (due with annual return) |

13. |

|

|

|

|

|

|

|

|

|

|

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Tax payments in current year (after discounts) |

14. |

4 |

|

|

|

|

4 |

|

|

14. |

4 |

|

|

|

|

|

|

4 |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Use Tax on Items Purchased for Business or Personal Use (see back) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

15. |

Enter your purchases taxable at the 6% rate |

|

|

415a. |

|

|

|

|

|

|

X .06= |

|

|

15b. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

16. |

Tax payments made in the current year |

|

|

|

|

................................................................. |

|

|

|

|

|

|

|

|

|

416. |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Withholding Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

...........................................................................Gross Michigan payroll and other taxable compensation for the year |

|

|

|

|

|

|

|

|

|

417. |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

18. |

Number of W2s enclosed |

|

|

|

18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

19. |

Total Michigan income tax withheld per W2s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

419. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

20. |

Total Michigan income tax withholding paid during current tax year |

|

|

|

|

|

|

|

|

|

420. |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Summary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

Total sales, use and withholding taxes due. Add lines 12A and B (both rate columns), 13B, 15b and 19 |

21. |

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||

22. |

Total sales, use and withholding taxes paid. Add lines 14A and B (both rate columns), 16 and 20 |

|

|

|

|

22. |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

23. |

If line 22 is greater than line 21, enter overpayment |

|

|

4 23. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

24. |

Amount of line 23 to be credited to your account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

We will notify you when your credit is verified and available |

4 24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

25. |

Amount of line 23 to be refunded to you |

|

|

4 25. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

26. |

If line 22 is less than line 21, enter balance due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

426. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

27. |

If this return is filed late, enter penalty and interest. (See instructions.) |

|

|

|

|

|

|

|

|

|

427. |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

28. |

TOTAL PAYMENT DUE. Add lines 26 and 27. Make checks payable to "State of Michigan." |

|

|

|

|

|

428. |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Complete and sign the back of this return

www.treasury.state.mi.us

Type of Business Ownership (check one only)

Individual

Husband - Wife

Partnership

Registered Partnership, Agreement Date:

Limited Partnership

Limited Liability Company

Domestic (Michigan)

Professional

Foreign

Michigan Corporation

Subchapter S

Professional

Subchapter S

Subchapter S

Trust or Estate (Fiduciary)

Joint Stock Club or Investment Company Social Club or Fraternal Organization Other (Explain)

Signature

I declare, under penalty of perjury, that this return is true and complete to the best of my knowledge.

I authorize Treasury to discuss my return with my preparer. Do not discuss my return with my preparer.

Taxpayer's Signature

Taxpayer's Social Security Number |

Telephone Number |

|

|

( |

) |

|

|

|

Taxpayer's Title |

Date |

|

|

|

|

I declare, under penalty of perjury, that this return is based on all information of which I have any knowledge.

Preparer's Signature, Address and Phone and ID Number

If you are enclosing payment with your return, MAIL TO: Sales, Use and Withholding Taxes

Michigan Department of Treasury

Lansing, MI 48922

If your return is for a refund, credit or has no tax due, MAIL TO: Sales, Use and Withholding Taxes

Michigan Department of Treasury

Lansing, MI 48930

*Use Tax on Items Purchased for Business or Personal Use

Use lines 15 and 16 to report purchases made for use in your business or for items removed from your inventory for personal use. Do not repeat the amounts from Column A, lines 1 - 4 here.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Identifier | Michigan Dept. of Treasury, 165, formerly C-3204 |

| Revision Date | October 2000 |

| Submission Deadline | Annually by February 28. If the business is discontinued, the form is due 30 days after cessation. |

| Tax Types Covered | Sales, Use, and Withholding Taxes |

| Governing Laws | Michigan Sales and Use Tax Act for sales and use taxes. Michigan Income Tax Act for withholding tax components. |

Guidelines on Utilizing Michigan C 3204

Successfully completing the Michigan C 3204 form requires accurate information regarding a business's annual sales, use, and withholding taxes. This form is specifically designed for the annual reconciliation of these taxes and must be filed by February 28 of the following year, or 30 days after business discontinuation, whichever comes first. It's a crucial step to ensure compliance with Michigan tax regulations and to avoid potential penalties for late or incorrect filings.

Steps to Fill Out the Michigan C 3204 Form:- Place the label from your coupon book in the designated area or manually enter your taxpayer name, account number, return year, and the due date.

- Under Section A for "Use Tax: Sales & Rentals," input your gross sales numbers, including sales from out-of-state vendors subject to use tax, rentals of tangible property and accommodations, and communications services.

- Add the totals from lines 1, 2, and 3 to get the total for line 4 in each tax rate column.

- Proceed to the "ALLOWABLE DEDUCTIONS" section. List down all applicable deductions such as resale, industrial processing, interstate commerce, exempt services, and others, filling lines 5a to i.

- Include any tax already paid to the Secretary of State and sales tax included in gross sales, then calculate the total allowable deductions to fill in line k.

- Calculate the taxable balance by subtracting the total deductions (line k) from the total gross sales (line 4).

- Multiply the taxable balance by the respective tax rates (6% or 4%) to determine the gross tax due and fill in line 8.

- If tax was collected in excess of the gross tax due, report this amount on line 9.

- Add lines 8 and 9 to determine the total tax collected, then subtract the total discount allowed (if any), as per instructions, to fill out line 12 with the net tax due.

- Include the sales tax license fee due with the annual return, payments made in the current tax year, and use lines 15 and 16 for reporting use tax on items purchased for business or personal use.

- Under "Withholding Tax," enter gross Michigan payroll and other taxable compensation for the year, the number of W-2s enclosed, and the total Michigan income tax withheld and paid during the current tax year.

- Calculate the total sales, use, and withholding taxes due, then compare this to the total taxes paid to determine whether there's an overpayment or a balance due. Fill lines 23 through 27 as applicable.

- In the "Type of Business Ownership" section, check the appropriate box that represents your business structure.

- Sign and date the form, certifying under penalty of perjury that the information provided is true and complete. If a preparer is involved, ensure their signature, address, phone, and ID number are also included. Follow the instructions to determine whether to mail your return with payment or for other cases.

After completing and reviewing the form for accuracy, mail it to the appropriate address provided on the form based on your specific filing condition (owing tax, receiving a refund, or no tax due). This process ensures your business remains compliant with Michigan's tax regulations, avoiding unnecessary penalties or audits.

Crucial Points on This Form

What is the Michigan C 3204 form?

The Michigan C 3204 form, now referenced as Treasury Form 165, is an annual return document for reporting sales, use, and withholding taxes. This form is utilized by businesses to summarize and report their yearly tax liabilities related to sales, rentals, lease of tangible property, and certain services rendered in Michigan.

When is the Michigan C 3204 form due?

The due date for filing the annual return is February 28th of the year following the reportable tax year. However, if a business discontinues its operations within the tax year, the form is then due 30 days after the business has officially ceased operations.

Who needs to file this form?

Business entities operating within Michigan that collect sales tax, use tax, or withhold taxes from employees' wages are required to file this form. This includes, but is not limited to, entities such as sole proprietorships, partnerships, corporations, and limited liability companies.

What are the tax rates applied in this form?

- Sales Tax: 6%

- Use Tax on Sales and Rentals: 6%

- Use Tax on Communications Services: 4%

How do I calculate my taxable balance?

To calculate your taxable balance, you start by adding your gross sales, rentals, and communications services. From this total, you deduct any allowable deductions such as resale, industrial processing, exempt services, and others listed on the form. Subtracting the total allowable deductions from your gross sales and services amount will provide your taxable balance.

Can I deduct sales tax that has already been paid to the Secretary of State?

Yes, sales tax that has already been paid to the Secretary of State can be listed as an allowable deduction. This ensures that businesses are not double-taxed on the same amount.

What should I do if I collected more tax than what is due?

If you have collected more tax than is due, you should report this excess using the appropriate line on the form. This excess will then be adjusted against your gross tax due to determine the net amount payable or refundable.

Where do I send my completed Michigan C 3204 form?

The destination for your completed form depends on the specifics of your filing:

- If enclosing payment with your return, mail to: Sales, Use and Withholding Taxes, Michigan Department of Treasury, Lansing, MI 48922.

- If your return is for a refund, credit, or has no tax due, mail to: Sales, Use and Withholding Taxes, Michigan Department of Treasury, Lansing, MI 48930.

What happens if I file the form late?

If the form is filed after the due date, penalties and interest may be assessed. It is crucial to adhere to the filing deadlines to avoid these additional charges.

Common mistakes

Filling out the Michigan C 3204 form can sometimes be a complex process, prone to mistakes if not done carefully. One common error people make is not accurately reporting gross sales, including sales by out-of-state vendors subject to use tax. This inaccuracy can lead to underpayment or overpayment of taxes. Precise calculation and inclusion of all sales are critical to ensure that the tax liability is correctly assessed. The form specifically requests the inclusion of these sales in section 1, emphasizing the importance of a comprehensive review of all sales activities throughout the taxable year.

Another frequent mistake involves improperly claiming deductions on the form. The form allows for several specific deductions, such as for resale, industrial processing, or items sold on which tax was already paid to the Secretary of State. Sometimes, taxpayers miss eligible deductions or incorrectly calculate their allowable deductions, which can either result in paying more tax than necessary or underreporting their tax liability. It is crucial to carefully review the allowable deductions under sections 5a to j and ensure that only eligible deductions are claimed and that they are calculated correctly.

Incorrect handling of the tax rate and calculation of gross tax due represents a third common error. The form requests the taxable balance to be multiplied by the applicable tax rate to determine the gross tax due (section 8). Mistakes in applying the correct tax rate or in performing the multiplication can lead to incorrect tax amounts being reported. Whether it’s applying the 6% sales tax instead of the 4% use tax, or vice versa, understanding the correct tax rate to apply is essential for accurate tax reporting.

Lastly, a significant error is neglecting to report or incorrectly reporting tax collected in excess of the gross tax due. Businesses occasionally collect more tax from customers than is owed to the state. This excess tax collected needs to be accurately reported in section 9 of the form. Failing to report these amounts or reporting them inaccurately not only affects the tax liability but can also lead to compliance issues with the Michigan Department of Treasury. It's imperative for taxpayers to thoroughly reconcile their collected taxes with their actual tax liability to avoid this mistake.

In conclusion, accuracy, thoroughness, and a keen understanding of the Michigan C 3204 form’s requirements are key to avoiding these common errors. Proper attention to detail can prevent potential issues with tax liabilities and ensure compliance with state tax regulations.

Documents used along the form

When businesses in Michigan finalize their financial and tax obligations, the Michigan C 3204 form, known officially as the Annual Return for Sales, Use, and Withholding Taxes, plays a pivotal role. To ensure thorough compliance and accurate reporting, various other forms and documents typically accompany this form. Understanding these accompanying documents helps streamline the tax filing process and ensures businesses meet all statutory requirements efficiently.

- Form 5080 – This is the Sales, Use, and Withholding Taxes Monthly/Quarterly Return. It's used for regular reporting of these taxes throughout the year and helps businesses keep their accounts up to date before the annual consolidation on the C 3204 form.

- Form 165 – Notice of Change or Discontinuance. When a business changes its address, officers, or type of ownership, or when it ceases operations, this form updates the Department of Treasury on these changes.

- Form 5092 – Payroll withholding monthly/quarterly return. Companies utilize this for detailed reporting of payroll withholding taxes. It is essential for reconciling the total annual withholding tax reported on the C 3204 form.

- Form 5081 – Sales, Use, and Withholding Taxes Annual Return. This form is another annual reporting tool, which summarises monthly or quarterly filings. Similar to C 3204, but used in different contexts.

- UIA 1028 – Employer's Quarterly Wage/Tax Report. Filed with the Unemployment Insurance Agency, it reports wages paid, which impacts the withholding tax calculations.

- Form 3372 – Michigan Sales and Use Tax Certificate of Exemption. Businesses purchasing items for resale, for production, or as a nonprofit can use this form to buy goods without paying sales tax.

- Form 4891 – Michigan Corporate Income Tax Annual Return. Corporations operating in Michigan must file this form annually for corporate income tax purposes, affecting the overall tax standing, including sales and use tax aspects.

- Schedule W – Withholding Tax Schedule. Accompanies forms like the 5081, detailing the withholding tax from employees' wages, to reconcile with totals reported on the C 3204.

- Form 4061 – Petition for Redetermination. If a business disagrees with a tax decision by the Department of Treasury, this form is used to formally request a reconsideration of that decision.

Businesses often find themselves navigating through a maze of tax requirements and regulations. However, with a clear understanding of the key forms and documents associated with the Michigan C 3204 form, they can fulfill their obligations more confidently and accurately. Each document serves its unique role in ensuring businesses meet the comprehensive range of tax reporting and compliance requirements in Michigan.

Similar forms

The IRS Form 940 is similar to the Michigan C 3204 form, as both documents require annual reporting. The IRS Form 940 is used for reporting federal unemployment tax. Like the Michigan C 3204, it aggregates annual information, including total payments and deductions, but focuses on unemployment contributions rather than sales, use, and withholding taxes.

The IRS Form 941 is another document with similarities to the Michigan C 3204 form. This form is used by employers to report quarterly tax filings specifically related to federal withholdings, social security, and Medicare taxes from employees' wages. Though it's filed more frequently, it shares the purpose of reporting tax obligations and payments, akin to the Michigan C 3204's role for state-level taxes.

The IRS Form 1120 is the U.S. Corporation Income Tax Return, which parallels the Michigan C 3204 form in its function of reporting income, gains, losses, deductions, credits, and to calculate the income tax liability of corporations. Both forms serve as annual financial summaries for tax purposes, although the Form 1120 focuses on corporate income tax specifically.

State Unemployment Tax Act (SUTA) Forms across various states share similarities with Michigan's C 3204 form in that they require businesses to report wages paid to employees to calculate state unemployment insurance taxes. Like the C 3204, these forms are necessary for compliance with state tax laws and help fund state programs, though SUTA forms are specifically for unemployment insurance contributions.

Dos and Don'ts

Filling out the Michigan C 3204 form is a critical process for ensuring compliance with local tax laws. Below are insights on best practices to adopt and pitfalls to avoid to help streamline the process.

Do:

- Double-check the taxpayer name and account number at the top of the form for accuracy, ensuring they match your business records.

- Mark the correct return year and ensure the date due is noted and remembered, to avoid missing the deadline.

- Accurately calculate your gross sales, including sales by out-of-state vendors subject to use tax, to ensure correct tax liability.

- List all allowable deductions carefully, such as resale, industrial processing, and food for human consumption, to accurately calculate your taxable balance.

- Review the entire form before submission, verifying that all calculations are correct, and that no required section has been inadvertently overlooked.

Don't:

- Use this form to replace a monthly or quarterly return; it is specifically designed for annual submission.

- Forget to list the sales tax license fee due with the annual return, as it's a common oversight that can lead to discrepancies.

- Omit any purchases taxable at the 6% rate that were made for business or personal use, as these need to be reported separately.

- Overlook the signature section at the end of the return. The form is not valid without the taxpayer's and, if applicable, the preparer's signature.

- Ignore the mailing address distinction between returns enclosing payment and those for refund, credit, or with no tax due, as this could delay processing.

Following these guidelines can help ensure that the process of filling out the Michigan C 3204 form goes smoothly, thereby avoiding common mistakes that could lead to penalties or delays.

Misconceptions

There are several misconceptions about the Michigan Dept. of Treasury form 165, formerly known as C-3204, which is designed for the annual return of sales, use, and withholding taxes. Understanding these misconceptions can help taxpayers correctly complete and file their returns. Here are five common misunderstandings:

The form can be used instead of monthly or quarterly returns: One major misconception is that this annual form can be used as a substitute for monthly or quarterly sales, use, and withholding tax returns. However, the form explicitly states that it should not be used to replace monthly or quarterly returns, and is solely intended for annual filing purposes.

The due date is the same for all businesses: While the general due date for filing the annual return is February 28th, businesses that cease operations during the year have a different deadline. For these businesses, the form is due 30 days after the business is discontinued, reflecting a tailored approach to the filing requirement based on the specific circumstances of the business.

Only physical product sales are taxable: Another misconception is that the tax calculations on the form only apply to the sale of physical goods. In reality, the form encompasses a broad range of taxable transactions, including sales and rentals of tangible property, accommodations, and communication services, highlighting the extensive scope of sales and use taxation in Michigan.

All sales are subject to taxation: Taxpayers may mistakenly believe that all sales reported on the form are subject to taxation. However, the form provides for allowable deductions for certain types of sales and transactions, such as sales for resale, industrial processing, or agricultural producing activities, and sales exempt from tax. These deductions ensure that only net taxable sales are subjected to the sales and use tax.

Reporting and payment processes are complicated: Finally, some may assume that reporting sales, use, and withholding taxes and calculating the taxes due is complex. While tax compliance can be detailed, the form guides the taxpayer through the process, from reporting gross sales to calculating deductions, taxable balance, and the tax due, with clear instructions for each step. The structured format of the form, along with available instructions, serves to simplify the reporting and payment process.

Correctly understanding the nuances of the Michigan C 3204 (now form 165) is crucial for accurate and timely compliance with state tax regulations.

Key takeaways

When completing the Michigan C 3204 form, individuals and businesses engaged in sales, use, and withholding tax functions within the state need to be particularly mindful of the form’s intricacies. Here are five key points to consider:

- The due date for filing the C 3204 form is February 28th of the year following the tax year. However, if a business is discontinued during the tax year, the form becomes due 30 days after the business discontinues operations, making timeliness a critical factor for compliance.

- This form is not intended to replace monthly or quarterly tax returns but rather serves as an annual summary meant for reconciling sales, use, and withholding taxes within a singular period. This function underscores its role in the wider tax filing landscape.

- Section A through C outlines specific categories including sales, rentals, and communications services – each subjected to either a 6% or a 4% tax rate. Accurate reporting in these categories is crucial for determining the correct amount of tax due or refundable.

- Allowable deductions, as detailed from lines 5a to j, provide opportunities for businesses to reduce their taxable balance. These deductions include, but are not limited to, resale, industrial processing, exemptions, and bad debts, allowing for a nuanced approach to calculating the taxable balance.

- For tax overpayments, the form outlines a specific protocol allowing taxpayers to have the excess credited to their account or refunded. This highlights the importance of accurate computation and reporting, as it directly impacts financial transactions between taxpayers and the state treasury.

The completion and submission of this form can significantly impact a business’s financial and operational standing with the Michigan Department of Treasury. As such, meticulous attention to detail, coupled with an understanding of tax liabilities and credits, is indispensable. It is also recommended that taxpayers consult with a professional for guidance specific to their situation, to ensure compliance and optimize their fiscal outcome.

Popular PDF Templates

Blank Motion Form Michigan - It constitutes an official record of the court's endorsement of alternative service methods, facilitating enforceability.

2022 Michigan Tax Forms - With comprehensive instructions for completion, the Michigan 2271 form aids vendors in correctly reporting taxes, reducing errors and legal complications.