Michigan 777 PDF Form

Residents of Michigan who have earned income in a Canadian province are presented with a unique set of tax obligations and opportunities, specifically through the Michigan Department of Treasury form ITD 777, updated in January 2001 from its former designation C-4402 RC. This form enables these individuals to claim a credit for taxes imposed by Canadian provinces, a potential relief articulated under the Public Act 281 of 1967. The intricate design of the form demands that filers calculate their Canadian income and taxes in U.S. currency, requiring an annualized conversion rate to ensure accuracy. Part 1 focuses on this conversion, detailing steps to calculate the portion of Canadian income subject to Michigan tax, while Part 2 guides filers through computing their Michigan tax, taking into account both the U.S. and Canadian income and adjustments. The final section, Part 3, is pivotal as it outlines the allowable credit for tax paid to the Canadian province. Given the voluntary nature of this filing, meticulous attention to the conversion rates, along with a thorough understanding of both Michigan and Canadian tax laws, is imperative for maximizing potential benefits. The necessity to attach this completed form to one's MI-1040 return underscores the interconnectivity of U.S. and Canadian tax systems for residents living and working across these borders.

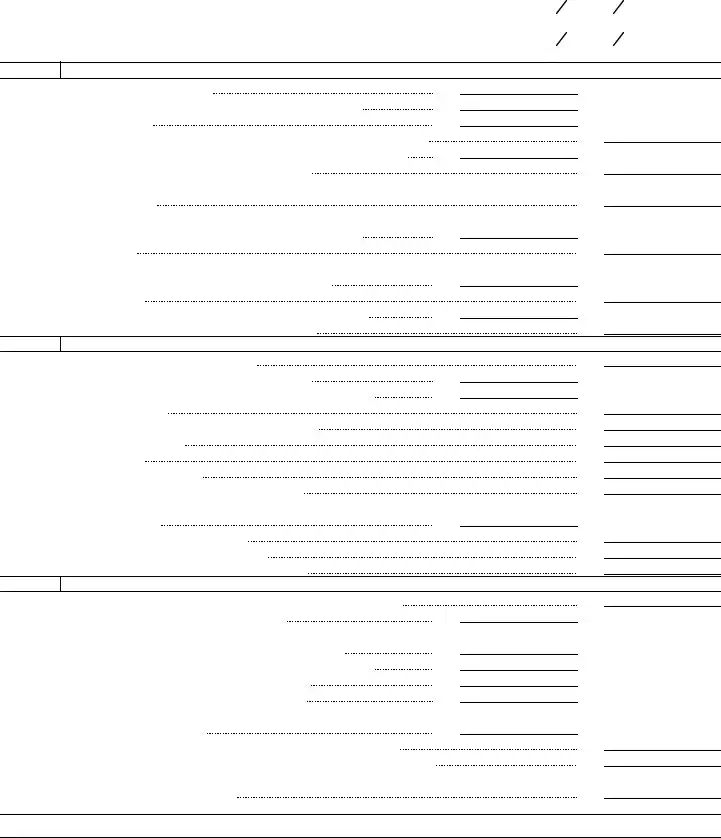

Preview - Michigan 777 Form

Michigan Department of Treasury, ITD

777 (Rev.

RESIDENT CREDIT FOR TAX IMPOSED |

|

|

|

BY A CANADIAN PROVINCE |

For Tax Year |

Issued under P.A. 281 of 1967. Filing is voluntary. |

2000 |

|

|

Name(s) as shown on your |

Social Security Number |

|

|

Address, City, State and ZIP |

Spouse's Social Security Number |

|

|

PART 1

CONVERSION OF CANADIAN WAGES AND TAXES TO UNITED STATES CURRENCY

1. |

Canadian income taxed by Michigan |

1. |

|

|

|

2. |

Fringe benefits included in Box 14 of the |

2. |

|

|

|

3. |

Subtract line 2 from line 1 |

3. |

|

|

|

4. |

Multiply line 3 by the annualized conversion rate of 67.40% (.6740) (see inst.) |

|

5. |

Total Canadian income from line 150 of your Canadian income tax return |

5. |

|

|

6.Multiply line 5 by the conversion rate of 67.40% (.6740)

7.Divide line 4 by line 6 (percentage of Canadian income taxed by Michigan to total Canadian income)

8.Multiply the Canadian federal tax (line 420 of Canadian return)

|

$__________________by the conversion rate of 67.40% (.6740) |

8. |

|

|

|

9. |

Multiply line 8 by line 7 |

|

10. |

Multiply the provincial tax (line 428 of Canadian return) |

|

|

$_____________ by the conversion rate of 67.40% (.6740) |

10. |

11. |

Multiply line 10 by line 7 |

|

12. |

Contribution to Canadian Pension Plan from |

12. |

13. |

Multiply line 12 by the conversion rate of 67.40% (.6740) |

|

4.

6.

7.%

11.

13.

PART 2 COMPUTATION OF MICHIGAN TAX

14.Adjusted gross income from

15.Canadian income taxed by Michigan from line 4, above

16.U.S. adjustments to Canadian wages (from U.S. 1040 lines 23

17.Subtract line 16 from line 15

18.Subtract line 17 from line 14 for Michigan source income

19.Additions from

20.Add lines 17, 18 and 19

21.Subtractions from

22.Subtract line 21 from line 20 for income subject to tax

23.Divide line 17 by line 22 for percentage of Canadian income to

total income subject to tax

24.Exemption allowance from

25.Subtract line 24 from line 22 for taxable income

26.Multiply line 25 by the Michigan tax rate of 4.2% (.042)

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.%

24.

25.

26.

PART 3 ALLOWABLE CREDIT FOR TAX PAID CANADIAN PROVINCE

27. |

Multiply line 26 by line 23 for Michigan tax on Canadian province income |

|

|

28. |

Add lines 9, 11 and 13 for total tax paid in Canada |

28. |

|

29. |

Adjustments to credit claimed on U.S. 1040: |

|

|

|

29a. |

Canadian portion of credit claimed on U.S. 1040, line 43 |

29a. |

|

29b. |

Canadian income taxed by Michigan from all U.S. 1116 forms |

29b. |

|

29c. |

Gross Canadian income from all U.S. 1116 forms |

29c. |

|

29d. |

Divide line 29b by line 29c and enter percentage |

29d. |

|

29e. |

Multiply line 29a by line 29d for adjusted |

|

|

|

amount claimed on U.S. 1040 |

29e. |

30.Subtract line 29e from line 28 for amount available for credit on

31.Canadian provincial tax from line 11. Enter here and on form

32.Credit for tax paid Canadian province (lesser of lines 27, 30 or 31). Enter here and on form

27.

%

30.

31.

32.

ATTACH THIS FORM TO YOUR

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | This form is issued under the authority of P.A. 281 of 1967. |

| Form Purpose | It is designed to provide a credit for tax imposed by a Canadian province to residents filing a Michigan tax return. |

| Voluntary Filing | Filing this form is voluntary for those who qualify for the credit. |

| Conversion Rate | All Canadian wages, taxes, and pension contributions must be converted to United States currency using an annualized conversion rate of 67.40% (0.6740). |

| Attachment Requirement | This form (Michigan 777) must be attached to your MI-1040 return when filed. |

Guidelines on Utilizing Michigan 777

Filling out the Michigan 777 form is an essential step for residents who have income taxed by a Canadian province and wish to claim a credit on their Michigan state tax return. This form helps in calculating the credit for taxes paid to a Canadian province, which in turn could reduce the amount of state tax owed. Accuracy and attentiveness to detail are crucial during this process to ensure that all calculations are correct and that the maximum allowable credit is claimed. The instructions outlined below provide a straightforward approach to completing this form.

- Begin by entering the tax year for which you are claiming the credit at the top of the form.

- Write your name(s), as shown on your MI-1040 tax return, along with your Social Security Number in the designated spaces.

- Include your spouse’s Social Security Number, if applicable.

- Fill out your address, including City, State, and ZIP code.

- Under Part 1, enter your Canadian income that was taxed by Michigan in the space provided.

- List any fringe benefits included in Box 14 of the T-4 form that are not taxable in the U.S.

- Subtract the amount in step 6 from the income reported in step 5 and enter the result.

- Multiply the outcome of step 7 by the annualized conversion rate of 67.40% (.6740) and enter this in the space provided.

- Report your total Canadian income from line 150 of your Canadian income tax return and multiply it by 67.40% (.6740).

- Calculate the percentage of Canadian income taxed by Michigan to total Canadian income by dividing the result of step 8 by that of step 9.

- Convert the Canadian federal tax and provincial tax from your Canadian return to U.S. currency using the 67.40% conversion rate, then multiply each by the percentage calculated in step 10.

- Include any contributions to the Canadian Pension Plan from T-4, converting to U.S. currency using the same conversion rate.

- For Part 2, start with your adjusted gross income from MI-1040, line 10, and follow the instructions to calculate your Michigan source income and the income subject to Michigan tax.

- Calculate the Michigan tax rate of 4.2% (.042) on the taxable income and then determine the Michigan tax on Canadian province income.

- In Part 3, combine the total tax paid in Canada and adjust based on credits claimed on your U.S. 1040 form, if applicable.

- Deduct any adjusted amount claimed on the U.S. 1040 from the total tax paid in Canada to find the amount available for credit on the MI-1040.

- Enter the Canadian provincial tax from line 11 and then determine the credit for tax paid to a Canadian province, making sure it is the lesser of the calculations from the previous steps. Enter this on your MI-1040 tax return as instructed.

- Finally, attach this form to your MI-1040 return upon completion.

This methodical approach ensures that all relevant information is accurately captured and correctly calculated, allowing for the appropriate credit to be applied to your Michigan tax return. It is imperative to thoroughly review all entries and calculations to avoid any errors that could impact the credit received.

Crucial Points on This Form

What is the Michigan 777 form?

The Michigan 777 form is a document used by residents of Michigan who have paid taxes to a Canadian province. It allows them to claim a credit on their Michigan tax return for taxes imposed by Canadian provinces. This form, officially known as the ITD 777, is issued under the Public Act 281 of 1967. The purpose of the form is to provide a method for converting Canadian wages and taxes into United States currency, compute the amount of Michigan tax, and determine the allowable credit for tax paid to a Canadian province. Filing this form is voluntary and it should be attached to the Michigan 1040 tax return.

Who needs to file the Michigan 777 form?

The Michigan 777 form must be filed by residents of Michigan who have earned income in Canada and have paid taxes on that income to a Canadian province. If you have Canadian income that was taxed by Michigan and you wish to claim a credit for the taxes paid to Canada, you must complete and file this form with your MI-1040 tax return.

How is Canadian income and tax converted to U.S. currency on the Michigan 777 form?

Canadian income and tax amounts are converted to U.S. currency on the Michigan 777 form through a two-step process:

- Conversion Rate: Income and taxes are multiplied by the annualized conversion rate of 67.40% (.6740) as specified on the form. This percentage converts Canadian dollars into their U.S. dollar equivalent based on exchange rates.

- Income and Tax Calculation: The form guides the taxpayer through a series of calculations to determine the portion of Canadian income taxed by Michigan, convert fringe benefits, and compute the Michigan tax on Canadian province income.

How is the credit for tax paid to a Canadian province calculated on the form?

The credit for tax paid to a Canadian province is calculated in Part 3 of the Michigan 777 form. This involves several steps:

- Multiply the Michigan tax rate applied to the Canadian income by the percentage of Canadian income to total income subject to tax.

- Add the amounts of Canadian federal tax, provincial tax, and contribution to Canadian Pension Plan, all converted to U.S. dollars using the specified conversion rate.

- Adjust the credit based on other credits claimed on U.S. Form 1040 to ensure no double benefit is obtained. The final credit is the lesser of the Michigan tax on Canadian province income, the total tax paid in Canada, or the Canadian provincial tax specifically.

Where do you attach the Michigan 777 form once completed?

The completed Michigan 777 form must be attached to your MI-1040 tax return when filing. This ensures that the credit for tax paid to a Canadian province is properly accounted for in your Michigan tax filings.

Is there a deadline for filing the Michigan 777 form?

The Michigan 777 form must be filed by the same deadline as your Michigan state tax return. Typically, this is April 15 of the year following the tax year for which you are claiming the credit. If you request an extension for filing your MI-1040 tax return, the same extension applies to the Michigan 777 form. It's important to adhere to these deadlines to ensure your credit is claimed correctly and to avoid potential penalties for late filing.

Common mistakes

Filling out the Michigan 777 form, which is designed for residents claiming a credit for tax imposed by a Canadian province, involves some complexities that can lead to errors. One common mistake is failing to accurately convert Canadian wages and taxes to United States currency. The form requires conversions based on the annualized conversion rate, but individuals often use an incorrect or outdated conversion rate. It's crucial to ensure that the conversion rate applied is the one specified for the tax year in question to avoid discrepancies in reported amounts.

Another area where errors frequently occur is in the calculation of the proportion of Canadian income taxed by Michigan compared to total Canadian income. This calculation affects the credit amount one may claim on the Michigan tax return. Mistakes in this section usually stem from incorrect income amounts entered in lines 4 and 5, leading to faulty percentages in line 7. It's essential to meticulously verify these income figures to guarantee the accuracy of the final credit calculation.

A further mistake involves overlooking or inaccurately reporting the Canadian federal and provincial taxes before applying the conversion rates. Specifically, errors in lines 8 and 10 can significantly alter the credit calculated. Taxpayers sometimes mistakenly enter the tax amounts in Canadian dollars without applying the specified conversion rate or they enter the incorrect tax figures altogether. Ensuring the right amounts from the Canadian tax return are converted with the correct rate is key to accurately determining the credit.

Last but not least, taxpayers often mishandle the adjustment of Canada-sourced income taxed by both the U.S. and Michigan. This issue primarily appears in PART 3 of the form, particularly in lines 29 and 30, where individuals fail to properly adjust the credit claimed on the U.S. tax return. This results in claiming an incorrect credit amount on the Michigan return. Paying close attention to the adjusted amount of the credit claimed on the U.S. return and properly applying it to the Michigan return can help avoid this error.

Documents used along the form

Filing taxes can be a complex process, especially when it involves income or taxes paid in another country. Michigan residents who have income from Canada must navigate through additional paperwork to ensure they are compliant with state and federal tax laws. The Michigan 777 form is a crucial document for those individuals, enabling them to claim a credit for taxes imposed by a Canadian province. However, to complete this process accurately, several other documents are often necessary to support the claims made on the Michigan 777 form.

- MI-1040 Individual Income Tax Return: This is the standard form used by Michigan residents to file their state income tax returns. It provides the foundational details of the taxpayer's income, tax liability, and refunds or payments due to or from the state.

- Form T4 - Statement of Remuneration Paid: Issued by Canadian employers, this slip outlines the employee's income and deductions for the year. Information from the T4 is crucial for accurately reporting Canadian income on the Michigan 777 form.

- Form 1040 - U.S. Individual Income Tax Return: This form is required for reporting yearly income to the Internal Revenue Service (IRS). It includes all taxable income earned by the taxpayer, including international income, which is essential for determining the correct amount of credit on the Michigan 777 form.

- Form 1116 - Foreign Tax Credit (Individual, Estate, or Trust): For taxpayers who must file U.S. taxes on international income, Form 1116 allows them to claim a credit for foreign taxes paid, which helps avoid double taxation. This form supports the calculations on the Michigan 777 form by showing the amount of foreign tax paid.

- Canadian Income Tax Return: A copy of the taxpayer's Canadian income tax return is often necessary to provide a comprehensive view of income earned and taxes paid in Canada. This can include the Notice of Assessment, which verifies the amounts entered on the Canadian return.

Accurately completing and submitting these forms are critical steps for Michigan residents to properly report international income and claim the appropriate credits. With the meticulous preparation of these documents, taxpayers can ensure compliance with tax laws and optimize their tax outcomes. It's advisable to seek guidance from professionals when dealing with complex tax situations that span across international borders.

Similar forms

The Form 1116 (Foreign Tax Credit) used by U.S. citizens and resident aliens to claim a credit for taxes paid to foreign countries, is similar to the Michigan 777 form in its purpose of allowing taxpayers to reduce their tax liability by the amount of taxes paid to a foreign government. Both forms require the taxpayer to convert foreign income and taxes to U.S. dollars and to calculate the allowable credit based on specific formulas.

Form 1040 (U.S. Individual Income Tax Return) shares similarities with the Michigan 777 form, especially in the sections that involve reporting foreign income and calculating adjustments to income. Both necessitate detailed income information and involve calculations to determine taxable income and applicable credits.

The Schedule A (Itemized Deductions) of the Form 1040 parallels the Michigan 777 form in that taxpayers can claim certain deductions (or credits in the case of Michigan 777) against their income. Although Schedule A focuses on deductions rather than tax credits, the conceptual process of reducing tax liability is a common goal.

Form 2555 (Foreign Earned Income) allows taxpayers to exclude a portion of their foreign earned income from U.S. taxation, similar to how the Michigan 777 form permits the reduction of Michigan state tax liability through a credit for Canadian provincial taxes paid. Both forms recognize the principle of not subjecting income to double taxation and require detailed financial and personal information to compute the exclusion or credit.

The Form 8960 (Net Investment Income Tax) involves calculations to determine additional taxes owed on investment income, which is akin to the Michigan 777's requirement to compute taxes and credits based on Canadian income and taxes paid. While Form 8960 focuses on U.S. taxpayers with certain types of investment income, both forms add complexity to the tax filing process with their specialized calculations.

Form 8833 (Treaty-Based Return Position Disclosure) is related to the Michigan 777 form as both involve reporting elements tied to international agreements and foreign tax considerations. Form 8833 is used to claim tax treaty benefits that override or modify the provisions of the U.S. Internal Revenue Code, similar to how the Michigan 777 allows for a credit based on taxes paid to a foreign country (Canada) according to bilateral tax agreements.

The Form 8938 (Statement of Specified Foreign Financial Assets) and the Michigan 777 form both deal with foreign elements in U.S. tax returns. Form 8938 requires disclosure of certain foreign financial assets, highlighting the U.S. taxpayer's global financial presence, akin to how the Michigan 777 form addresses cross-border income and tax liabilities.

Form 8621 (Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund) requires detailed information on foreign investments, somewhat mirroring the Michigan 777 form's focus on foreign income and taxation. Although oriented towards investment entities rather than individual income, both forms underscore the complexities of dealing with foreign-sourced earnings.

The Form 5471 (Information Return of U.S. Persons With Respect to Certain Foreign Corporations) is connected to the Michigan 777 form through their mutual emphasis on international taxation issues. Form 5471 is for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, highlighting the global nature of tax obligations, similar to how Michigan 777 addresses tax credits for foreign taxes paid.

Dos and Don'ts

Filing the Michigan 777 form, a document designated for residents seeking credit for taxes imposed by a Canadian province, requires careful attention to detail and thoroughness. Here are essential dos and don'ts to ensure accuracy and compliance in the filing process:

- Do verify your eligibility for the credit before starting the form to ensure you meet the requirements under P.A. 281 of 1967.

- Do have all pertinent documents at hand, including your MI-1040 return, Canadian income tax return, and any relevant T-4 slips for fringe benefits and Canadian Pension Plan contributions.

- Do use the annualized conversion rate of 67.40% (.6740) precisely as instructed for converting Canadian wages and taxes to United States currency. This ensures accurate computation of the credit.

- Do carefully calculate the percentage of Canadian income taxed by Michigan to total Canadian income, as this will directly affect the credit amount.

- Don't overlook the adjustments section, including U.S. adjustments to Canadian wages and additions or subtractions to/from MI-1040. Errors here can lead to inaccuracies in your Michigan source income and subsequently the credit calculation.

- Don't guess or estimate figures; ensure all numbers entered are accurate and verifiable through your documentation. Approximations can lead to discrepancies and potential issues with the Department of Treasury.

- Don't neglect to attach the form to your MI-1040 return. It's a common mistake but crucial for processing your credit.

- Don't hesitate to seek professional advice if you're uncertain about any part of the form. Tax professionals or accountants knowledgeable in U.S.-Canada tax matters can provide valuable assistance.

By adhering to these guidelines, you can navigate the complexities of the Michigan 777 form more smoothly and ensure a compliant and accurate submission for your credit claim.

Misconceptions

The Michigan 777 form, officially known as the Resident Credit for Tax Imposed by a Canadian Province, often causes confusion among taxpayers. Created to navigate the intricacies of international taxation, this document helps Michigan residents who pay taxes in Canada to correctly apply those amounts against their Michigan tax obligations. However, several misconceptions persist about how the form works and its purpose. Let’s clarify some of these misunderstandings.

- Misconception 1: The form is only for those who work in Canada. While it's true that Michigan residents working in Canada might benefit from this form, it's also applicable to individuals who receive income from pensions, investments, or any other sources taxed by a Canadian province. The key factor is not the type of income but rather that the income is subject to Canadian provincial tax.

- Misconception 2: Filing this form is mandatory if you have any Canadian income. The phrase "Filing is voluntary" indicates that individuals should file this form only if it benefits their tax scenario. The form is intended to prevent double taxation but not everyone with Canadian income will find it advantageous to file.

- Misconception 3: The form drastically complicates your tax filing. Although dealing with taxes across two countries can be complex, the Michigan 777 form is designed to simplify the process of claiming a credit. By converting Canadian income and taxes into U.S. currency at a standard rate, it streamlines the declaration of international income on a Michigan tax return.

- Misconception 4: All Canadian income is taxable in Michigan. This misunderstanding likely stems from confusion around different types of income and tax treaties. The form itself calculates the portion of Canadian income that is subject to Michigan tax. Certain types of income may be tax-exempt due to various tax treaties or legislation between the U.S. and Canada.

- Misconception 5: The conversion rate used is arbitrary. The form specifies an annualized conversion rate for converting Canadian dollars to U.S. dollars. This rate is not chosen at random but is instead a calculated average that reflects the currency conversion rates throughout the tax year, making the process fair and uniform across all filings.

- Misconception 6: Any Michigan resident can file this form if they have paid Canadian taxes. While residency is a primary criterion for utilizing the form, not all Michigan residents will be eligible or find it beneficial to file. Eligibility largely depends on the nature of the Canadian income and the specific tax situation of the filer, including how much tax was paid to a Canadian province and how it relates to their taxable income in Michigan.

In sum, the Michigan 777 form serves as a tool for Michigan residents who pay taxes to a Canadian province, allowing them to potentially lower their tax burden by avoiding double taxation. As with any tax document, understanding the nuances and accurately applying the provisions can lead to substantial savings and ensure compliance with tax laws across both countries.

Key takeaways

Understanding the Michigan 777 form, officially titled "Resident Credit for Tax Imposed by a Canadian Province," is crucial for Michigan residents who earn income in Canada. This guide provides key takeaways for accurately completing and utilizing the form.

- The purpose of the form is to allow Michigan residents to claim a credit for taxes paid to a Canadian province, reducing double taxation on income earned across the border.

- Filing the Michigan 777 form is voluntary but beneficial for those who qualify, potentially lowering the overall tax burden.

- Begin the process by reporting your Canadian income and taxes in U.S. dollars, converting them using the specified annual conversion rate of 67.40%.

- Any fringe benefits, as indicated in Box 14 of the Canadian T-4 slip, that are not taxable in the U.S., should be subtracted from your Canadian income.

- The form requires you to compute the percentage of your Canadian income that is taxed by Michigan compared to your total Canadian income, which is essential for accurately determining the credit.

- You are required to calculate both the converted Canadian federal and provincial taxes paid, which are part of calculating your allowable Michigan credit.

- Contributions to the Canadian Pension Plan, found in Boxes 16 and 17 of the T-4, are part of the calculations and should be converted to U.S. dollars as well.

- The form includes a section for computing the Michigan tax on your Canadian income, requiring information from your MI-1040 form.

- Adjustments may need to be made if you've claimed any credit for the Canadian taxes on your U.S. 1040 form, ensuring you are not claiming the same tax relief twice.

- The final credit, which is the lesser of the computed Michigan tax on Canadian province income or the actual tax paid in Canada, will be reported on your MI-1040 tax return.

- Be sure to attach the completed Michigan 777 form to your MI-1040 return when filing, to ensure proper processing and credit application.

Accurately filling out the Michigan 777 form can seem complex, but by following these guidelines, you can navigate the process more effectively. Always ensure that your computations are precise and that you have attached all necessary documentation to your tax return. If you require further clarification, consulting with a tax professional is advised.

Popular PDF Templates

Eviction Filing Fee - Designed for individuals unable to afford the cost of probate court fees, offering a chance at justice without the financial strain.

How Long Can Probate Stay Open - Through detailed criteria, it helps prevent the mishandling or misinterpretation of a decedent's final wishes.