Michigan 632 PDF Form

In the state of Michigan, individuals involved in certain legal or financial operations may encounter the necessity to engage with the Michigan 632 form, a document designed to address specific requirements within these realms. This form, often pivotal in the accurate and timely execution of procedures, stands as a cornerstone for compliance and documentation in a variety of contexts. From facilitating transactions that have substantial economic implications to serving as a critical piece of the regulatory adherence landscape, the importance of the Michigan 632 form cannot be overstated. Moreover, it embodies the state's commitment to maintaining order and accountability in sectors where precision is paramount. Individuals and entities alike should be well-acquainted with the nuances of this form, comprehending its role, the precise manner of its completion, and the implications of its submission. Ensuring familiarity with such aspects is essential, as it not only aids in navigating the processes it's associated with but also mitigates the risk of potential legal complications arising from inaccuracies or oversights.

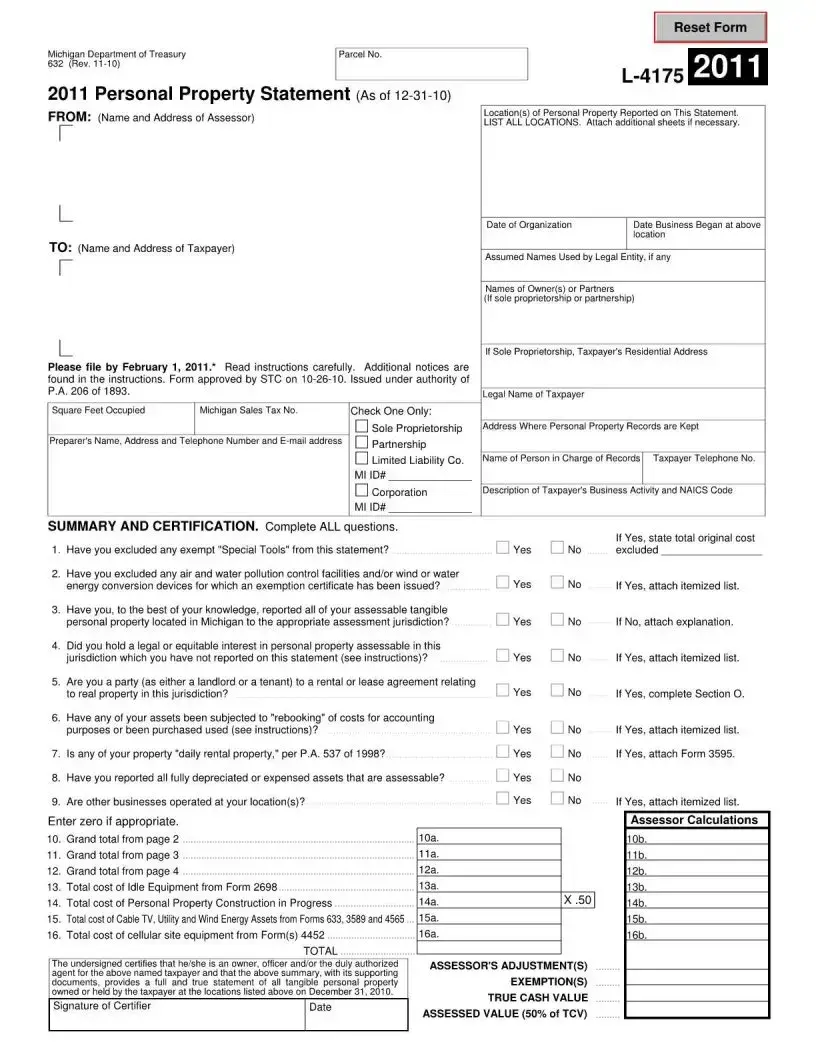

Preview - Michigan 632 Form

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Form Title | Michigan 632 Form |

| Purpose | Used by individuals or businesses to report and pay taxes on certain activities in Michigan |

| Who Files | Residents and businesses in Michigan engaging in activities subject to specific state taxes |

| When to File | Varies by tax type; please consult the form instructions or state tax authority |

| Governing Law | Michigan state tax law |

| Form Availability | Available on the Michigan Department of Treasury website |

| Online Submission Option | Yes, electronic filing is available and encouraged |

| Required Attachments | Depends on the tax type; may include supporting documentation or schedules |

| Deadline Extension | Possible with proper request to the Michigan Department of Treasury |

Guidelines on Utilizing Michigan 632

After filling out the Michigan 632 form, a crucial document for individuals residing in Michigan, the next steps usually involve submission and potential follow-up. This form is essential in various legal and administrative scenarios, and properly completing it is the first step in ensuring your requests or needs are addressed efficiently. Once the form is filled, it should be submitted according to the specific instructions provided, often to a local or state government office. Following submission, it's important to keep a copy of the form and any confirmation of its receipt for your records. Depending on the purpose of the form, you may need to keep an eye out for any correspondence regarding additional information or decisions made based on the information you provided.

- Begin by reading the entire form to understand the information required and gather any necessary documents or information ahead of time.

- Enter your full name as it appears on your official identification documents, ensuring spelling is correct and consistent with these records.

- Provide your current address, including street name, city, state, and ZIP code, to ensure any correspondence can be accurately directed to you.

- Fill in your telephone number and email address, if applicable, to facilitate easy contact regarding your form.

- Review the specific sections related to your situation or request, paying close attention to detailed instructions to ensure accurate completion.

- Sign and date the form in the designated area, confirming that all information provided is true and accurate to the best of your knowledge.

- Double-check each section to ensure no information has been missed and that all responses are clear and legible.

- Follow the submission instructions provided with the form, which may include mailing or hand-delivering it to a specified office or uploading it through an online portal.

Completing the Michigan 632 form accurately and submitting it to the correct office is vital to ensure your needs are addressed without unnecessary delay. While the form might seem straightforward, taking the time to review and provide accurate information can significantly impact the outcome of your request or application. If there are any questions or concerns during this process, it's advisable to seek guidance from a professional or the office receiving the form to clarify any confusion and avoid potential issues.

Crucial Points on This Form

What is the Michigan 632 form used for?

The Michigan 632 form, also known as the "Petition for Personal Protection Order," is a legal document individuals in Michigan can use to seek protection from someone who poses a threat to their personal safety. This form is commonly utilized in situations involving domestic violence, stalking, harassment, or any form of threatening behavior. Upon approval by the court, it places legal restrictions on the accused individual's ability to contact or approach the petitioner.

Who can file a Michigan 632 form?

Any Michigan resident or individual located in Michigan who feels threatened, harassed, or in fear for their personal safety can file a Michigan 632 form. This form is accessible to:

- Victims of domestic violence

- Individuals subjected to stalking

- People experiencing serious harassment

- Those in immediate fear for their safety due to the actions of another person

What information is required to complete the Michigan 632 form?

Completing the Michigan 632 form requires detailed information to ensure that the petition is processed correctly and efficiently. Information needed includes:

- The full legal names of both the petitioner (person seeking protection) and the respondent (person from whom protection is sought).

- Addresses and contact details of both parties, to the extent that they are known.

- A detailed description of the events or behavior prompting the need for a protection order. Specific dates, locations, and the nature of the incidents should be included.

- Evidence supporting the claims, if available. This could include police reports, witness statements, or any other documentation that substantiates the need for a protection order.

- The specific type of protection order requested and the terms of protection desired.

How does one file the Michigan 632 form?

The process of filing the Michigan 632 form involves several steps:

- First, the petitioner must complete the form with all required information and documentation to support their request for a protection order.

- Next, the completed form must be submitted to the Circuit Court in the county where either the petitioner or the respondent resides.

- The court will review the petition, and a judge may either issue a temporary order immediately, schedule a hearing, or deny the request based on the information provided.

- If a hearing is scheduled, both the petitioner and the respondent will have the opportunity to present their case before a final decision is made.

Is there a cost to file a Michigan 632 form?

In most cases, there is no fee to file a Michigan 632 form for a personal protection order. This policy removes financial barriers for individuals seeking legal protection from harm or harassment. Nevertheless, it's crucial to note that if the court finds the petition to be frivolous or unwarranted, the petitioner could be responsible for costs associated with the case. Furthermore, should the petition lead to legal representation or additional court proceedings, other fees may be incurred. Therefore, while the initial filing is typically free, potential additional costs should be considered.

Common mistakes

Filling out the Michigan 632 form, commonly encountered during the tax reporting process, often presents challenges. A common mistake is the incorrect or incomplete reporting of income. Individuals may overlook or mistakenly omit certain types of income, such as dividends or interest earned, which can lead to discrepancies and potential penalties. Accurate and complete disclosure of all income types is essential for compliance with state tax laws.

Another error frequently made involves calculation errors. The 632 form includes multiple fields where calculations are necessary to determine the tax owed or refund due. Errors in these calculations can stem from simple mathematical mistakes or misunderstanding the tax instructions. These miscalculations can either unintentionally overstate or understate tax liabilities, leading to further complications with the Michigan Department of Treasury.

Incorrect personal information is also a commonly observed issue. This includes entering the wrong Social Security number, misspelling names, or providing outdated addresses. Such inaccuracies can cause significant delays in processing the form. In some cases, it may even result in the misdirection of sensitive documents or refunds. Providing accurate and current personal information is critical.

Failure to claim eligible deductions and credits is another oversight many commit when completing form 632. Michigan offers a range of deductions and credits that can reduce tax liability, but taxpayers often miss these due to a lack of knowledge or misunderstanding of eligibility requirements. This mistake can lead to overpayment of taxes. It is important to thoroughly review and understand the deductions and credits available.

Last, but not least, is the issue of not signing or dating the form upon completion. This oversight might seem minor, but an unsigned or undated form is considered incomplete and cannot be processed. Always double-check that the form has been signed and dated to ensure it meets the filing requirements.

Documents used along the form

When dealing with contracts and official documentation in Michigan, particularly for those involving business transactions or personal matters, the Michigan 632 form is a crucial document. However, it is rarely the only document required to complete a process effectively. Several other forms and documents often accompany the Michigan 632 to ensure that all necessary legal and procedural bases are covered. Below are descriptions of five such documents that frequently accompany the Michigan 632 form.

- Michigan 1040 Form: This is the state's income tax return form. It is often used alongside the Michigan 632 form by individuals and entities to report their annual income. The form is essential for determining the amount of state tax owed or the refund due to the taxpayer.

- Articles of Incorporation: Required for businesses looking to establish themselves legally as corporations within Michigan. These documents are critical for proving the legality and legitimacy of a business when accompanying the Michigan 632 form, especially for new businesses.

- Operating Agreement: This document is used primarily by LLCs (Limited Liability Companies) to outline the business’s financial and functional decisions, including rules, regulations, and provisions. The operating agreement is vital for businesses that need to submit the Michigan 632 form as it establishes the internal operation procedures of the entity.

- Employer Identification Number (EIN) Confirmation Letter: The Internal Revenue Service issues this document to businesses. It confirms the company's EIN, a crucial number needed when filling out the Michigan 632 form because it identifies the business entity in its financial and tax transactions.

- Commercial Lease Agreement: For businesses that operate from leased premises, this document details the terms and conditions agreed upon by the lessee and the lessor. A Commercial Lease Agreement may need to be provided with the Michigan 632 form to clarify the business operations and the allocation of income or expenses related to the leased property.

In summary, the Michigan 632 form often necessitates accompanying documentation to provide a comprehensive and accurate representation of an individual or entity's financial and operational status. These documents, ranging from tax returns and company formation papers to operational agreements and lease arrangements, ensure that all relevant information is available for review by legal or financial authorities. Understanding the purpose and requirement of each document can significantly streamline the processing of Michigan 632 forms and its related proceedings.

Similar forms

In examining the documents that mirror the functions and purposes of the Michigan 632 form, which is pivotal in legal and administrative procedures within the state, it is crucial to acknowledge the diversity in these documents' application across various jurisdictions and sectors. The Michigan 632 form, commonly used for specific legal proceedings or administrative tasks, shares similarities with a range of documents designed to facilitate governmental, legal, or personal processes. Below is a list of 10 documents that parallel the Michigan 632 form in their utility and objectives.

- Affidavit Forms - Like the Michigan 632, affidavits serve as sworn statements of fact, used in courts or for other legal purposes, providing written evidence in a formally recognized manner.

- Power of Attorney Forms - These documents enable an individual to authorize another person to act on their behalf in legal, financial, or health decisions, sharing the delegation function with the Michigan 632 in specific contexts.

- Living Will Forms - Similar to the Michigan 632 in terms of outlining personal wishes, a living will specifies an individual’s preferences regarding medical treatment if they become unable to communicate these preferences themselves.

- Deed Forms - Used for the conveyance of ownership in real estate, deed forms share the Michigan 632's capacity to formalize the transfer of rights or property through a documented process.

- Business Registration Forms - These forms are used to legally establish a business within a state, akin to how the Michigan 632 form might be utilized in various legal engagements involving business matters.

- Vehicle Title Transfer Forms - Required for the legal transfer of a vehicle’s title from one owner to another, these forms share the Michigan 632's role in formalizing the change of ownership through documentation.

- Employment Eligibility Verification Form (I-9) - This form verifies an employee's eligibility to work in the United States, paralleling the Michigan 632 form's function in legal confirmations and verifications.

- Divorce Filing Forms - Initiate the legal proceedings for dissolution of marriage, resembling the Michigan 632 form in their application within the judicial system to start a specific legal process.

- Bankruptcy Forms - Required to initiate the process of declaring bankruptcy, these forms share with the Michigan 632 the essence of instigating a significant and formal legal process.

- Building Permit Applications - Utilized for obtaining authorization to start construction or renovation projects, these applications are similar to the Michigan 632 in how they facilitate official approvals.

This list encapsulates the multifaceted nature of documents like the Michigan 632 form, highlighting the integral role such documents play in governing diverse aspects of legal, personal, and administrative life. Each document, while unique in its application, shares the essence of formalizing processes, delineating rights or obligations, and facilitating crucial life events or changes within its respective framework.

Dos and Don'ts

When completing the Michigan 632 form, which pertains to tax matters, individuals should adhere to certain guidelines to ensure accuracy and compliance. Below are key recommendations to follow, along with actions to avoid in the process.

Do:

- Read through the entire form and instructions carefully before beginning to fill it out, ensuring full understanding of all requirements.

- Use black or blue ink when completing the form to ensure that the information is legible and can be scanned correctly.

- Double-check all entries for accuracy, including calculations, to prevent errors that could delay processing or affect tax liability.

- Sign and date the form where indicated, as an unsigned form may not be processed, which could lead to penalties or delays.

Don't:

- Rush through filling out the form without fully understanding each section, which can lead to mistakes or omissions.

- Use correction fluid or tape; if an error is made, it is advisable to start over with a new form to maintain neatness and legibility.

- Forget to attach necessary documents, such as W-2s or other supporting materials, which are essential for processing.

- Ignore the submission deadlines, as late filing can result in penalties, interest charges, or both.

Misconceptions

Understanding the intricacies of tax and business forms can be challenging. The Michigan 632 form, like many government documents, is surrounded by misconceptions that can confuse individuals and business owners. Below are ten common misconceptions debunked to help clarify the form's purpose and requirements.

- It's Only for Large Businesses: A common misconception is that the Michigan 632 form is exclusive to large businesses. In reality, this form applies to entities of various sizes, depending on the specific tax obligations or business reporting requirements in question.

- Filing is Optional: Some might believe filing this form is optional. However, compliance is mandatory for businesses that meet the specified criteria outlined by Michigan state law or tax regulations.

- It's the Same Every Year: Another assumption is that the information or requirements for the 632 form remain constant annually. Tax laws and business regulations can change, possibly altering the form's requirements or how it should be completed.

- Electronic Submission is Not Allowed: The belief that the form must be submitted in a paper format is outdated. Michigan often encourages or requires electronic submissions for efficiency and environmental considerations, subject to the specific form or filing in question.

- Only Michigan Residents Need to File: The misconception that only Michigan residents are required to file overlooks non-residents who do business in Michigan or have some other qualifying connection to the state, who may also need to complete the form.

- There's No Deadline: Assuming there's no deadline for submission can lead to penalties. Like most state forms, the Michigan 632 likely has a specific filing deadline that must be adhered to.

- Penalties for Late Filing are Minimal: Underestimating the penalties for late filing can be a costly mistake. Penalties can include fines, interest on owed amounts, and other repercussions.

- Personal Information isn't Necessary: Although business or tax forms often require specific business-related information, personal identification may also be important for verification purposes or when individual liability is a factor.

- The Form Can Be Submitted Without Payment: If the form relates to tax or other financial obligations, submitting it without the required payment (if applicable) will not fulfill a filer's responsibility, potentially leading to penalties.

- Assistance is Not Available: Many believe they must navigate the complexities of the form alone. However, Michigan provides resources, guidance, and sometimes even workshops or hotlines to assist individuals and businesses with their filings.

It's important to approach Michigan's 632 form (or any legal or tax-related form) with accurate information. Consulting the latest guidelines from Michigan's official state resources or seeking professional advice ensures compliance and minimizes the risk of errors.

Key takeaways

The Michigan 632 form plays a pivotal role in the realm of property transactions within the state. It's vital for those engaged in these transactions to understand the form's nuances to ensure compliance and smooth processing. Below are eight key takeaways regarding the completion and utilization of the Michigan 632 form that can serve as a guide for both professionals and laypersons alike.

- Accuracy is paramount: When filling out the form, ensure all information is accurate and complete. Mistakes or omissions can lead to processing delays or legal complications.

- Understand the purpose: The Michigan 632 form is used to report certain types of real estate transactions to the appropriate state authorities. Knowing why and when to use this form is crucial for proper compliance with state laws.

- Deadlines matter: There are specific deadlines by which the form must be submitted following the completion of a transaction. Be aware of these deadlines to avoid penalties.

- Seek legal advice if unsure: The complexities of real estate laws mean that seeking advice from a legal professional can help clarify any uncertainties about the form's requirements and ensure that all legal obligations are met.

- Review before submission: Always review the information provided on the form before submission. This step is crucial for catching and correcting any errors that could complicate the transaction.

- Keep a copy: After submitting the form, keep a copy for your records. This copy will be important for future reference or in case questions arise concerning the transaction.

- Electronic filing may be available: Depending on the specific requirements and capabilities of Michigan's state systems, electronic filing of the form might be an option, offering convenience and efficiency.

- Update information if circumstances change: If any relevant information changes after the form has been submitted but before the transaction has been fully processed, ensure that the updated information is communicated to the relevant authorities promptly.

Understanding and adhering to the guidelines available for the Michigan 632 form is critical for anyone involved in the transfer of property within the state. By following these key points, individuals and professionals can navigate the intricacies of real estate transactions with greater confidence and legal compliance.

Popular PDF Templates

Michigan Amended Tax Return Instructions - If amending a return due to changes in federal tax obligations, taxpayers must attach a copy of the amended federal return and any relevant schedules.

Michigan 1099 Tax Calculator - Crucial for taxpayers who must navigate the complexities introduced by earning income in a foreign country.

State of Michigan 1099 Filing Requirements - Multi-volume tapes are not acceptable for submissions as per the technical requirements stated in Form 447, ensuring consistency in submission formats.