Michigan 5156 PDF Form

When business owners in Michigan face the significant milestones of selling, closing, or restructuring their business, understanding the Michigan Department of Treasury 5156 form becomes crucial. Issued under the authority of Public Act 228 of 1975, as amended, this form serves as a Request for Tax Clearance Application, a vital step for ensuring all state tax obligations are met before making major changes to a business's status. Depending on the specific action—whether selling business assets, closing a business registered with the Michigan Department of Licensing and Regulatory Affairs, or requiring a tax clearance certificate post-sale—different sections of the form need to be completed. This form collects general information about the business, details on corporate dissolution or withdrawal if applicable, and information regarding the sale of business or assets, including whether the sale has resulted in money being held in escrow pending tax clearance. The form culminates in a section where the applicant must certify the truthfulness of the information provided and authorize the disclosure of tax clearance information if necessary. Understanding each part of this form, from general business details to the specifics of corporate dissolution or asset sales, is essential for compliance and the smooth transition of business changes, ensuring that all sales, use, income withholding, and other state taxes have been appropriately addressed.

Preview - Michigan 5156 Form

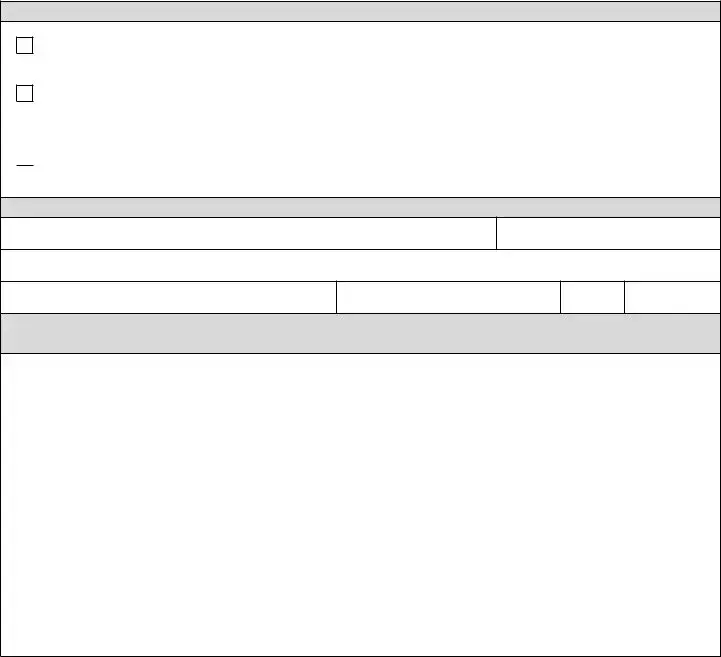

Michigan Department of Treasury 5156 (Rev.

Request for Tax Clearance Application

Issued under authority of Public Act 228 of 1975, as amended.

ReAson foR The RequesT

I am selling my business or business assets. l Complete Part 1 and Part 4 ONLY

I am closing my business and my business is registered as a corporation with the Michigan Department of Licensing and Regulatory Affairs.

l Complete Part 1, Part 2, and Part 4 ONLY

I have completed the sale of my business or business assets and require a tax clearance certiicate. l Complete Part 1, Part 3, and Part 4 ONLY

I have completed the sale of my business or business assets and require a tax clearance certiicate. l Complete Part 1, Part 3, and Part 4 ONLY

PART 1: GeneRAl InfoRmATIon — To be completed by ALL applicants.

Current Business or Corporation Name

FEIN or TR Number

Previous Business or Corporation Name

Address

City

State

ZIP Code

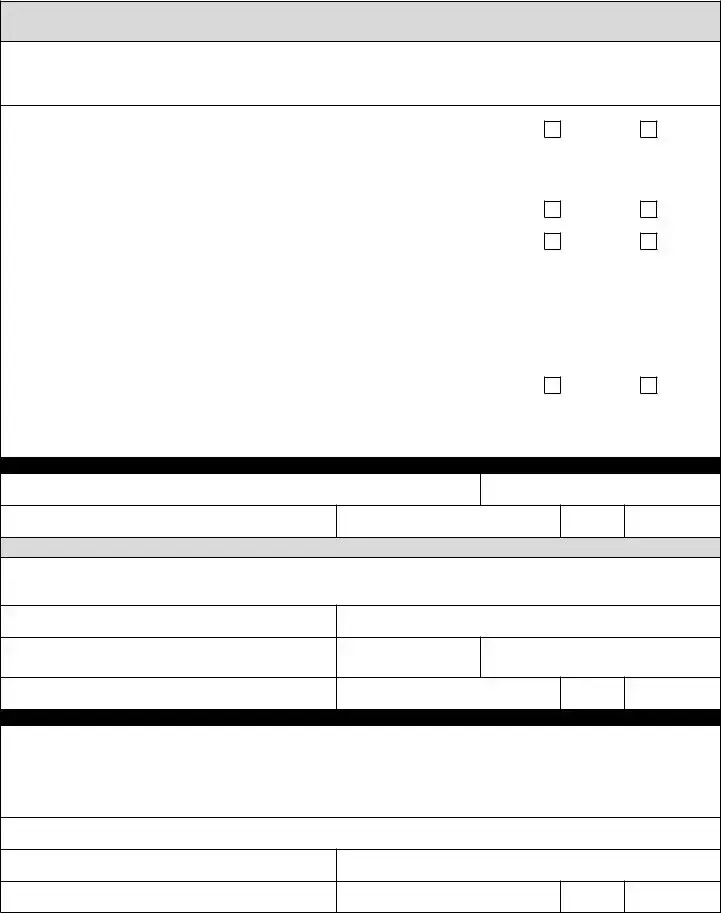

PART 2: CoRPoRATe DIssoluTIon oR WIThDRAWAl — To be completed by any business entity incorporated through the Michigan Department of Licensing and Regulatory Affairs (LARA).

noTe: The date that the business is actually discontinued (below) should relect the date on the Form 163 Notice of Change or Discontinuance submitted to the Michigan Business Tax Registration Unit. If this form has not been submitted, please complete and attach with this request. If the business and its FEIN number were not registered with the Michigan Department of Treasury, please submit the last four years of Federal Business Tax Returns in place of the Form 163.

Corporate ID Number Assigned by LARA |

Date Incorporated with the State through LARA |

Date Business Actually Discontinued in Michigan |

|

|

|

If this corporation had no tax liability or was not required to register with the Michigan Department of Treasury, provide a detailed explanation in the space below. Substantiate with attachments:

Continue and sign on Page 2

Form 5156, Page 2

PART 3: sAle of BusIness oR AsseTs — To be completed by any business (all types) that has sold all or part of the business prior to submitting this application.

ImPoRTAnT: This is a request by any business entity that has sold most of its assets, but the business shell will remain in place to continue iling tax returns (when due) until the business later determines whether it will ile a Certiicate of

Dissolution with the LARA Corporation Division.

Does the business operate under a trade name? |

Yes |

No |

|

|

|

|

|

||

|

|

|

|

|

If yes, list the name it is doing business as |

|

|

|

|

Will you continue business activity after clearance under this FEIN or TR number? |

Yes |

No |

|

|

If no, have you submitted a Notice of Change or Discontinuance (Form 163)? |

Yes |

No |

|

|

|

|

|

||

If yes, date of discontinuance reported on Form 163 |

|

|

|

|

|

|

|

||

If no, attach a completed Form 163 with this request. |

|

|

|

|

.........................................Date of sale of business or business assets to another entity |

|

|

|

|

Is money being held in escrow pending receipt of a tax clearance? |

Yes |

No |

|

|

If yes, how much is held in escrow? |

|

|

|

|

|

|

|

||

|

|

|

|

|

PuRChAseR InfoRmATIon |

|

|

|

|

Purchaser Business Name

Purchaser FEIN

Purchaser Address

City

State

ZIP Code

PART 4: CeRTIfICATIon AnD AuThoRIzATIon foR DIsClosuRe of InfoRmATIon

I declare under penalty of perjury that I am the owner, oficer, or member of the business for which tax clearance is requested and that the information entered is true.

Name (Print or Type)

Title

Signature

Date

Telephone Number

Address

City

State

ZIP Code

AuThoRIzATIon foR DIsClosuRe of TAx CleARAnCe InfoRmATIon (This is not a required section)

use this section to designate a third party to receive all tax clearance information for the business listed in Part 1.

The above signed authorizes the Michigan Department of Treasury, Tax Clearance Section, to release any and all tax information and outstanding balances due for the purpose of tax clearance to the individual(s) listed below. This authorization does not include signature power. This authorization is only valid for 90 days from the date of the signature above.

Name

Telephone Number

Fax Number

Address

City

State

ZIP Code

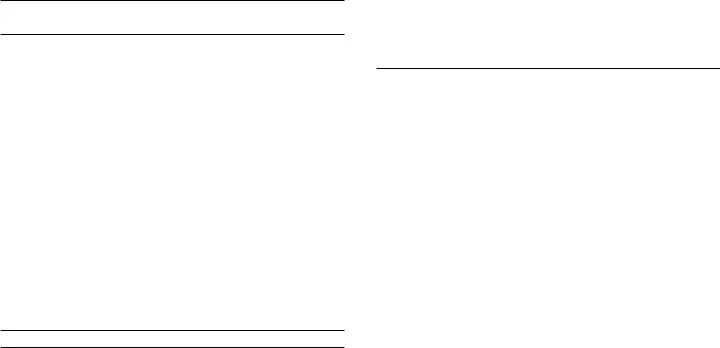

Instructions for form 5156,

Request for Tax Clearance

Part 1: General Information – All fIelDs In ThIs seCTIon musT Be ComPleTeD

NOTE: If you are selling a business but the sale has not occurred, the Michigan Department of Treasury (Treasury) will provide known or estimated tax liability for the purpose of

establishing a tax escrow. Once the sale is complete, submit a new request completing Part 1 and Part 3 to obtain a certiicate

for the release of the escrowed funds.

Current Business or Corporation Name: Enter the

legal business/corporation name. If the business is a sole proprietorship, enter the owner’s name here, with the last name

irst.

Federal Employer Identiication Number (FEIN) or Treasury Issued Account Number (TR): Enter the business’

Business Street Address/City/State/ZIP Code: Enter the

physical business address. (A PO Box is not acceptable in this ield.)

Part 2: Corporate Dissolution or Withdrawal

Complete this section if you are dissolving a domestic (Michigan) corporation or if you have a foreign corporation (incorporated outside Michigan) that is withdrawing from

Michigan. A corporation is any business entity that has iled

and incorporated with the Michigan Department of Licensing and Regulatory Affairs (LARA).

NOTE: A Tax Clearance Certiicate must be requested from

Treasury within 60 days of dissolution or withdrawal of business from Michigan.

Corporate Identiication Number: Enter the business’

Date Business Discontinued in Michigan: Enter the date

your business ceased operations in Michigan. This date should relect the date entered on the Notice of Change or

Discontinuance (Form 163). If you have failed to complete and submit Form 163 to the Registration Unit, you must complete and remit Form 163 with this application. In the event your business’ FEIN was never registered with Treasury, you must include the last four years of Federal Returns for the business in place of Form 163.

Date Incorporated with the State of Michigan through

LARA: Enter the date of incorporation. For additional

information, go to LARA’s Web site: www.michigan.gov/lara.

If the corporation had no tax liability or was not required to register with Treasury, provide a detailed explanation. In rare cases, a corporation may not have had any tax liability or may not have registered for taxes with the State of Michigan. If your business falls into this category, use the space provided

to explain why no taxes were due and registration was not required. Include dates of operation and the nature of the business. You must include attachments with your application to substantiate your position in order for it to be fully reviewed.

Part 3: sale of Business or Assets has occurred

Complete this section if your business or any of the assets have been sold.

NOTE: You must continue to ile all returns by their due date until you elect to ile a dissolution or withdrawal. A Tax Clearance Certiicate for Sale of Business and/or Business

Assets is required when a bulk sale or transfer is made under

the Uniform Commercial Code. A Tax Clearance Certiicate

for Sale of Business and/or Business Assets is granted after Treasury determines that all Sales, Use, Income Withholding, Cigarette, Motor Fuel, Single Business, Michigan Business,

and Corporate Income taxes have been paid for the period of operation. When a Tax Clearance Certiicate for Sale of

Business and/or Business Assets is issued, money held in escrow is released and the purchaser is relieved of successor liability. The seller agrees to keep all books and records of the business until they are released by Treasury. The seller is liable

for all taxes due from the operation of the business during the time speciied by Treasury.

Does the business operate under a trade name? If your business operates under any name other than the legal corporation name, check (with an “X”) yes in the appropriate box. On the next line, enter the trade name, assumed name, or doing business as name. If your business only operates under its legal corporation name, check (with an “X”) no.

Are you continuing business activity after clearance under this FEIN or TR number? If you plan to continue

to operate your business within the State of Michigan, check (with an “X”) yes in the appropriate box. If you do not plan to continue operating, check (with an “X”) no. If you have already

submitted a Form 163 to the Registration Unit, enter the discontinuance date listed on that form. If you have yet to ile

Form 163 with the Registration Unit, attach a completed Form 163 with this application.

NOTE: The following items should ONLY be illed out if the

sale has occurred, not before.

Date of Sale of Business or Business Assets to Another

Entity. Enter the date all or part of the business was sold.

Is money being held in escrow pending receipt of a Tax Clearance Certiicate? If money is being held in escrow from

the sale, check (with an “X”) yes and enter the amount being held.

Business Name, Street Address, and FEIN of Purchaser.

Enter purchaser’s legal name, address, and FEIN.

Part 4: Certiication and Authorization for Disclosure of Tax Clearance Information

NOTE: All ields directly under the Certiication must be completed. If authorizing the disclosure of information, all ields in that section must be completed as well.

This section must be completed for all requests. All requests must be submitted by an owner, oficer, or member of the business. By completing the Certiication, you are declaring

under penalty of perjury that all information entered is true.

Complete this section with your printed name, title, signature, daytime phone number, contact address, and the date in which the application was completed.

submitting form 5156

Complete and mail this form to:

Michigan Department of Treasury

Tax Clearance Section

P.O. Box 30778

Lansing, MI 48909

For additional information, call (517)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Number and Revision | Michigan Department of Treasury 5156 (Rev. 05-15) |

| Governing Law | Issued under the authority of Public Act 228 of 1975, as amended |

| Purpose | Request for Tax Clearance Application |

| Application Conditions | Varying sections to be completed based on whether the applicant is selling, closing, or has sold a business or its assets |

| Part 1: General Information | All applicants must complete this section, providing business or corporation name, FEIN or TR Number, address, and more |

| Part 2: Corporate Dissolution or Withdrawal | For businesses incorporated in Michigan, requiring details on incorporation, business discontinuance, and a request if the corporation had no tax liability |

| Part 3: Sale of Business or Assets | Applicable to businesses that have sold all or part of their business prior to application, detailing the sale and the potential continuation of the business |

| Part 4: Certification and Authorization | The applicant must certify the truthfulness of the information provided and may authorize a third party to receive tax clearance information |

Guidelines on Utilizing Michigan 5156

When businesses in Michigan undergo significant changes like selling, dissolving, or transferring assets, they may need to submit a Request for Tax Clearance using Form 5156. This process ensures that any outstanding tax liabilities are settled, providing a clean slate for the business or its new owners. Follow these detailed steps to accurately complete the form, ensuring you provide all necessary information for a smooth review by the Michigan Department of Treasury.

- Part 1: General Information

- Enter the current name of your business or corporation. If it’s a sole proprietorship, use the owner’s name, starting with the last name first.

- Provide your Federal Employer Identification Number (FEIN) or the Treasury Issued Account Number (TR).

- Fill in the physical street address of your business. Note that a P.O. Box is not acceptable here.

- List your city, state, and ZIP code accurately.

- Part 2: Corporate Dissolution or Withdrawal (Complete only if applicable)

- Enter your LARA-assigned Corporate Identification Number (CID).

- Specify the date you incorporated with the state through LARA.

- Indicate the date your business was discontinued in Michigan, reflecting the Form 163 Notice of Change or Discontinuance.

- If your corporation had no tax liabilities or was not required to register with the Michigan Department of Treasury, provide a detailed explanation and attach supporting documents.

- Part 3: Sale of Business or Assets (Complete only if applicable)

- Mark whether your business operates under a trade name and provide that name if applicable.

- Indicate whether you’ll continue business activities under the same FEIN or TR number.

- If a Form 163 has been submitted, note the discontinuance date. If not, attach a completed Form 163 with your application.

- Enter the sale date of your business or business assets.

- Specify if money is held in escrow pending the receipt of a tax clearance certificate and the amount.

- Provide the purchaser’s business name, FEIN, and complete address.

- Part 4: Certification and Authorization for Disclosure of Information

- Print your name, title, and sign the form to certify that the provided information is accurate.

- Include the date of signing and your daytime telephone number.

- If authorizing the disclosure of tax clearance information to a third party, complete the entire section with the required third-party information.

After filling out the form, review it carefully to ensure all information is correct and nothing has been overlooked. Mail the completed form to the address provided: Michigan Department of Treasury, Tax Clearance Section, P.O. Box 30778, Lansing, MI 48909. For additional assistance, you may contact the provided phone number during business hours. By completing these steps diligently, you can facilitate the smooth processing of your tax clearance request.

Crucial Points on This Form

What is the Michigan Form 5156 used for?

Michigan Department of Treasury Form 5156, also known as the Request for Tax Clearance Application, is utilized for several key business-related purposes. This form plays a crucial role for business owners in the following scenarios: if they are in the process of selling their business or business assets, closing their business, or if the sale of the business has been finalized and they require a tax clearance certificate. The form helps in ensuring that all tax obligations have been met before the business is sold, closed, or transferred, protecting both the seller and the buyer in the process.

Who needs to complete Michigan Form 5156?

The requirement to fill out Form 5156 varies depending on the specific business change taking place:

- Selling a business or its assets: Complete Parts 1 and 4.

- Closing a business registered as a corporation: Complete Parts 1, 2, and 4.

- After the sale of a business or its assets: Complete Parts 1, 3, and 4.

What information do I need to provide on Form 5156?

To effectively complete the Request for Tax Clearance, the information needed will largely depend on the parts of the form you are required to fill out. Generally, all applicants must provide the current and previous business name, Federal Employer Identification Number (FEIN) or Treasury Number (TR), and the business address. If the business is dissolving or withdrawing, additional details about the dissolution and tax obligations need to be supplied. For those selling a business or assets, information about the sale, including the buyer's details and whether escrow is involved, is necessary.

How do I submit Form 5156, and is there a deadline?

Form 5156 should be completed and mailed to the Michigan Department of Treasury, Tax Clearance Section, at the specified address. It's essential to ensure that all required sections for your specific situation are filled clearly and accurately. The submission does not have a strictly defined deadline but aiming to submit the form shortly after deciding to sell, close, or having sold the business assets is advisable for a smooth transition and to ensure compliance with state regulations.

Can I authorize someone else to receive tax clearance information for my business?

Yes, the Michigan Form 5156 includes a section for Authorization for Disclosure of Tax Clearance Information. This section allows you to designate a third party, such as an accountant or attorney, to receive all relevant tax clearance information on your behalf. This authorization does not grant signature power, meaning the designated individual can receive information but cannot sign or complete actions on the business's behalf. It's valid for 90 days from the date of the signature, making it a temporary but useful tool for managing the tax clearance process.

Common mistakes

Filling out the Michigan 5156 form incorrectly can lead to delays or even denial of the tax clearance certificate that businesses require for various operations. Understanding common mistakes can help streamline the process.

One major mistake is not accurately completing Part 1, which is required for all applicants. Businesses often enter a PO Box instead of the physical business address. Since the state requires the physical location for verification purposes, this error can cause immediate processing delays.

Another common error occurs in Part 2, regarding corporate dissolution or withdrawal. Business owners sometimes forget to attach Form 163, Notice of Change or Discontinuance, or the last four years of Federal Business Tax Returns when the business’s FEIN number wasn't registered with the Michigan Department of Treasury. This oversight can lead to incomplete submission, as this document is vital for proving the discontinuation of the business officially.

In Part 3, related to the sale of business or assets, applicants often miss checking whether the business operates under a trade name. This detail is crucial because it affects how the business is identified and could impact the taxes and liabilities being cleared. Additionally, failing to specify if the business activity will continue under the same FEIN or TR number or neglecting to attach a completed Form 163 if no prior notice of discontinuance was submitted can stall the clearance process.

A further mistake involves the misinterpretation of the purpose of the escrow amount field. Sellers sometimes enter incorrect information regarding money held in escrow, which is essential for ensuring that all tax liabilities are settled before the sale is finalized, thereby protecting both parties from future tax-related disputes.

Lastly, inaccuracies in Part 4, specifically in the Certification and Authorization for Disclosure of Information section, are common. A failure to sign or properly delegate authorization for someone else to receive tax clearance information nullifies the request. The authorization must include clear, accurate details for the individual appointed to handle tax clearance matters on behalf of the business, as any mismatch in information can lead to delays in communication.

Documents used along the form

When business owners in Michigan are looking to sell their businesses, close them, or need a tax clearance for other reasons, Form 5156 from the Michigan Department of Treasury is a crucial piece of paperwork. However, this form is often accompanied by several other forms and documents that are necessary through this process. Understanding these additional documents can help business owners navigate the complexities of transitioning business ownership or closure smoothly and ensure all legal and financial obligations are met.

- Form 163 Notice of Change or Discontinuance: This form is required if a business is changing its status, such as closing or ending its operations in Michigan. It notifies the Michigan Department of Treasury about the discontinuance or change in business.

- Articles of Incorporation: When a corporation is dissolved, the original Articles of Incorporation or a certified copy must be submitted to the state. This document initially established the corporation with the Michigan Department of Licensing and Regulatory Affairs (LARA).

- Articles of Dissolution: To officially dissolve a corporation in Michigan, the Articles of Dissolution must be filed with LARA. This document signifies the end of the corporation's existence.

- Last Four Years of Federal Business Tax Returns: If the business has not been registered with the Michigan Department of Treasury, the last four years of federal tax returns are required as proof of tax compliance.

- Proof of Sales Tax Payment: This is pertinent if the business sold tangible goods. It demonstrates that all applicable sales taxes have been paid up to the point of sale or closure.

- Employee Withholding Tax Documents: These documents provide proof that the business has complied with employee withholding tax requirements, including federal and state income taxes, Social Security, and Medicare taxes.

- Unemployment Insurance Documents: Shows compliance with Michigan’s unemployment insurance requirements, including any final contributions and reporting.

- Successor Liability Agreement: If the business or its assets are sold, a Successor Liability Agreement might be required. It outlines the responsibilities of the new owner for any existing or future tax liabilities.

- Escrow Agreement (if applicable): In situations where money is held in escrow pending the issuance of a tax clearance certificate, an Escrow Agreement specifies the conditions under which the funds will be released.

Working through the sale, closure, or restructuring of a business involves a lot of paperwork and legal considerations. Forms like Michigan Form 5156 and its accompanying documents ensure that the business remains compliant with state laws and regulations until all responsibilities have been satisfactorily transferred or concluded. While the list above is comprehensive, specific situations might require additional forms and documentation. It's always recommended to consult with a legal or tax professional to ensure all necessary paperwork is complete and accurate.

Similar forms

IRS Form 8822-B: Similar to the Michigan 5156 form, the IRS Form 8822-B is used to report a change in address or business location to the Internal Revenue Service. Both forms are crucial for ensuring that tax-related communications are properly directed. The 5156 also integrates changes in business details, much like the 8822-B highlights the need for updating the IRS with current information.

Uniform Commercial Code (UCC) Financing Statement: Although the UCC Financing Statement primarily serves to notify of a secured transaction, it shares a common purpose with the Michigan 5156 in the context of business asset sales. Just as the 5156 is used when selling a business or its assets, the UCC Financing Statement is filed to indicate a secured interest in the assets, ensuring the rights of the creditor are protected in the transaction.

IRS Form 8594: This form is used in asset acquisitions, where the buyer and seller of a business need to report the same price allocation to the IRS to ensure taxes are correctly assessed on sale. The Michigan 5156 form resembles Form 8594 in its application to the sale of business assets and the resultant tax implications, although the 5156 specifically addresses tax clearance for the transaction within the state of Michigan.

Form 163 Notice of Change or Discontinuance: This form is directly referenced in the Michigan 5156 and is used by businesses to inform the Michigan Department of Treasury of a cessation or alteration in business activities. The direct relationship between these forms highlights their similarity in managing updates to business operations that affect tax responsibilities and state records.

Articles of Dissolution: When a business decides to legally dissolve, Articles of Dissolution must be filed with the state's Department of Licensing and Regulatory Affairs (LARA), similar to part 2 of the Michigan 5156 form, which is used when a corporation is dissolving. Both documents are fundamental in the cessation of operations, albeit the Articles officially terminate the entity, while the 5156 ensures all tax concerns are addressed.

Dos and Don'ts

Do ensure all sections of the form applicable to your situation are fully completed. For instance, if you are selling your business and require a tax clearance certificate, complete Parts 1, 3, and 4.

Don't use a PO Box for the business street address in Part 1. Provide a physical location to ensure the form is processed correctly.

Do attach Form 163 if your business and its FEIN number were not previously registered with the Michigan Department of Treasury, as specified in Part 2 for corporate dissolution or withdrawal.

Don't leave the current business or corporation name, FEIN or TR Number, and business address sections blank in Part 1. These are crucial for identifying your business.

Do provide a detailed explanation and substantiating attachments in cases where your corporation had no tax liability or was not required to register with the Michigan Department of Treasury, as mentioned in Part 2.

Don't forget to indicate whether your business operates under a trade name in Part 3 if applicable. This information is important for correct processing.

Do check the correct boxes regarding the continuation of business activity under the same FEIN or TR number and declare the date of discontinuance or attach Form 163 if you have not yet submitted it.

Don't omit the purchaser information in Part 3 if the sale of business or business assets has occurred. This data is vital for the clearance process.

Do complete the certification and authorization for disclosure of information in Part 4 accurately, ensuring to sign and date the form to validate your request.

Misconceptions

When it comes to navigating the complexities of tax documents, it's easy to fall prey to misconceptions, particularly with forms like the Michigan Department of Treasury 5156. This form, crucial for those selling or closing their business within Michigan, can be a source of confusion. Let's clarify six common misconceptions about this form:

- The Michigan 5156 form is only for corporations. It's a common belief that this form applies exclusively to corporations. However, the form is necessary for any business entity, including sole proprietorships and partnerships, planning to sell or dissolve their business assets. Any business registered with the Michigan Department of Licensing and Regulatory Affairs (LARA) and requiring tax clearance must complete the relevant sections of this form.

- Completion of the entire form is mandatory. This misunderstanding could lead to unnecessary work. Depending on the specific transaction or change regarding the business, only certain parts of the form need to be completed. The form clearly indicates which sections are relevant for different scenarios, such as selling the business, complete closure, or after the sale has occurred for tax clearance certificate purposes.

- Filing the form means instant tax clearance. Filing the 5156 form is actually just the beginning of the tax clearance process. The Michigan Department of Treasury reviews the submitted information to ensure all tax liabilities are settled before issuing a tax clearance certificate. This process can take some time, depending on the complexity of the business’s tax situation and the department's workload.

- The form requires extensive financial disclosure. While it's true that financial information relating to taxes is needed, the form primarily requests information about the business’s identity, type of request (sale, dissolution, etc.), and whether the business anticipates continuing operations under a different FEIN or TR number. Detailed financial disclosures are typically handled through the attached tax documents and returns, not within the form 5156 itself.

- Any business discontinuance requires a 5156 form. Not all business changes necessitate this form. It specifically addresses those seeking a tax clearance certificate from the Michigan Department of Treasury, usually in the context of selling, dissolving, or buying a business. Simple modifications, like a change of address or restructuring that doesn't involve selling or closing, do not require this form.

- An attorney or CPA must complete the form. While seeking professional advice is advisable for complex transactions or tax situations, a business owner, officer, or member is fully capable of completing this form, provided they have the necessary information about the business transaction. The certification section of the form only requires the signature of an authorized individual confirming the accuracy of the provided information.

In conclusion, the Michigan 5156 form is an essential document for businesses undergoing significant changes like sales, closures, or dissolutions. Understanding its requirements can ensure compliance with Michigan's tax laws, ultimately facilitating a smoother transition during what can be a complex process.

Key takeaways

Understanding how to properly complete and use the Michigan Department of Treasury 5156 form is crucial for business entities that are selling, closing, or have sold their business assets. Here are nine key takeaways:

- Identify the Purpose: Before filling out the form, understand the specific reason for your request - selling your business, closing a corporation, or after a sale for tax clearance.

- Required Sections: Not all parts of the form apply to every applicant. Depending on your situation, you may only need to complete specific sections as directed by the form’s instructions.

- General Information Is a Must: Part 1, requesting general information about the business or corporation, is required for all applicants.

- Corporate Dissolution or Withdrawal: Part 2 is specific to businesses incorporated through the Michigan Department of Licensing and Regulatory Affairs (LARA) that are dissolving or withdrawing.

- Sale of Business or Assets: Part 3 must be completed by businesses that have sold all or part of their business prior to submitting the application.

- Documentation: If certain registrations or changes have not been previously submitted to the Michigan Department of Treasury or LARA, additional documents like the Form 163 Notice of Change or Discontinuance or Federal Business Tax Returns may be required.

- Tax Clearance Certificate: A Tax Clearance Certificate is needed to finalize the sale of business assets and release any funds held in escrow. This certificate confirms all tax liabilities have been settled.

- Certification and Authorization: Part 4 requires the declaration and signature of the business owner, officer, or member, affirming that all provided information is true and correct under penalty of perjury.

- Submitting the Form: Once completed, the form should be mailed to the Tax Clearance Section at the provided address, ensuring it meets any specified deadlines.

Accurately filling out and submitting the Michigan 5156 form is pivotal for businesses in transition to ensure compliance with state tax obligations and facilitate smooth operational changes.

Popular PDF Templates

Board of Law Examiners - Maintaining workers’ safety starts with the Michigan F 6 form, allowing employers to apply for workers’ compensation insurance.

How to Lower Property Taxes in Michigan - The 4816 form helps local government units communicate with the Michigan Department of Treasury regarding PRE denial tax billing for sellers.