Michigan 5107 PDF Form

In Michigan, the Department of Treasury provides a significant form, known as the 5107 form, specifically designed for disabled veterans to apply for a property tax exemption. This privilege, established under Public Act 161 of 2013, allows those veterans who have been honorably discharged and suffer from a service-connected disability, or their unremarried surviving spouses, to seek relief from real property taxes on their homes. This form must be filed annually between December 31 and the Tuesday following the second Monday in December, with the local assessing officer or supervisor. The document gathers comprehensive details on the homeowner, such as their name, contact information, and the homestead property for which the exemption is sought. Additionally, it requests information about a legal designee if applicable, providing an avenue for those unable to file personally. Eligibility hinges on several criteria, including the veteran's discharge under honorable conditions, a permanent and total disability as determined by the United States Department of Veterans Affairs, or receipt of pecuniary assistance for specially adapted housing. The affirmation of eligibility section mandates the submission of supporting documentation from the U.S. Department of Veterans Affairs to confirm the veteran’s status. By certifying that all provided information is accurate to the best of their knowledge, the applicant attests to their eligibility under Michigan Compiled Law, Section 211.7b, underscoring the form’s pivotal role in granting tax relief to disabled veterans or their qualifying survivors in Michigan.

Preview - Michigan 5107 Form

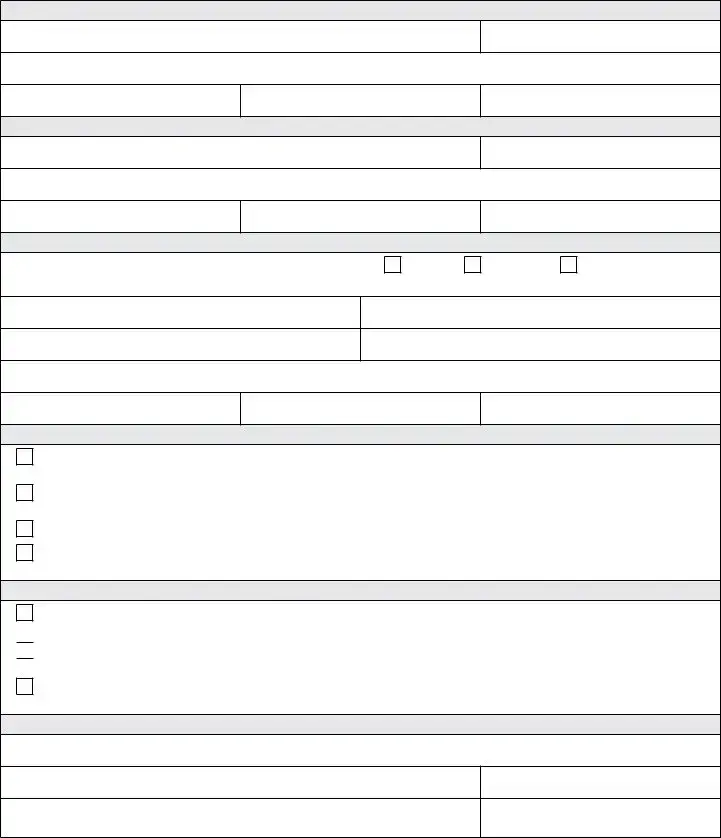

Michigan Department of Treasury 5107

State Tax Commission Afidavit for Disabled Veterans Exemption

Issued under authority of Public Act 161 of 2013, MCL 211.7b. Filing is mandatory.

Instructions: This form is to be used to apply for an exemption of property taxes under MCL 211.7b, for real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or his or her unremarried surviving spouse.

The property owner, or his or her legal designee, must annually ile the Afidavit with the supervisor or assessing oficer after December 31 and before the

Tuesday following the second Monday in December.

OWNER INFORMATION (Enter information for the disabled veteran or unremarried surviving spouse)

Owner’s Name

Owner’s Telephone Number

Owner’s Mailing Address

City

State

ZIP Code

LEGAL DESIGNEE INFORMATION (Complete if applicable)

Legal Designee Name

Daytime Telephone Number

Mailing Address

City

State

ZIP Code

HOMESTEAD PROPERTY INFORMATION (Enter information for the property in which the exemption is being claimed)

City, Township or Village (Check the appropriate box and provide the name)

City

Township

Village

County

Name of the Local School District

Parcel Identiication Number

Date the Property was Acquired (MM/DD/YYYY)

Homestead Property Address

City

State

ZIP Code

ACKNOWLEDGEMENT (Check all boxes that apply)

I am a disabled veteran, or the legal designee of the disabled veteran, who was discharged under honorable conditions from the armed forces of the United States of America with a service connected disability.

I am the unremarried surviving spouse, or the legal designee of the unremarried surviving spouse, of a disabled veteran who was discharged under honorable conditions from the armed forces of the United States of America with a service connected disability.

I am a Michigan resident.

I own the property in which the exemption is being claimed and it is used as my homestead. Homestead is generally deined as any dwelling with

its land and buildings where a family makes its home.

AFFIRMATION OF ELIGIBILITY (Check the appropriate box and provide a copy of the required documentation)

The disabled veteran has been determined by the United States Department of Veterans Affairs to be permanently and totally disabled as a result

of military service and entitled to veterans’ beneits at the 100% rate (must attach a copy of the letter from the U.S. Department of Veterans Affairs).

The disabled veteran is receiving or has received pecuniary assistance due to disability for specially adapted housing (must attach a copy of the certiicate from the U.S. Department of Veterans Affairs).

The disabled veteran is receiving or has received pecuniary assistance due to disability for specially adapted housing (must attach a copy of the certiicate from the U.S. Department of Veterans Affairs).

The veteran has been rated by the United States Department of Veterans Affairs as individually unemployable (must attach a copy of the letter from the U.S. Department of Veterans Affairs).

CERTIFICATION

I hereby certify to the best of my knowledge that the information provided in this Afidavit is true and I am eligible to receive the disabled veteran’s exemption from property taxes pursuant to Michigan Compiled Law, Section 211.7b.

Printed Name of Owner or Legal Designee

Title of Signatory

Signature of Owner or Legal Designee

Date

DESIGNEE MUST ATTACH LETTER OF AUTHORITY

Form Characteristics

| Fact | Detail |

|---|---|

| Form Name and Number | Michigan Department of Treasury 5107 |

| Issuance Authority | Issued under authority of Public Act 161 of 2013, MCL 211.7b |

| Purpose of Form | To apply for an exemption of property taxes for real property used and owned as a homestead by a disabled veteran or his or her unremarried surviving spouse |

| Filing Requirement | Mandatory annual filing with the supervisor or assessing officer after December 31 and before the Tuesday following the second Monday in December |

| Eligibility | Disabled veterans discharged under honorable conditions or unremarried surviving spouses, with the property being used as the homestead and the veteran having a service-connected disability |

| Documentation Required | Evidence of the disability from the U.S. Department of Veterans Affairs, and potentially evidence of pecuniary assistance for specially adapted housing or a rating of individual unemployability |

Guidelines on Utilizing Michigan 5107

The Michigan Department of Treasury Form 5107, known as the Affidavit for Disabled Veterans Exemption, plays a crucial role in providing relief for disabled veterans or their unremarried surviving spouses by exempting them from property taxes on their homestead. The process for filling out this form is straightforward but must be followed carefully to ensure eligibility for the exemption. Below are the detailed steps to accurately complete the form.

- Owner Information: Start by filling out the section labeled "OWNER INFORMATION." Enter the full name of the disabled veteran or the unremarried surviving spouse. Include a current telephone number and mailing address, ensuring the city, state, and ZIP code are clearly indicated.

- Legal Designee Information: If the form is being completed by a legal designee on behalf of the veteran or surviving spouse, provide the legal designee’s name, daytime telephone number, and mailing address, including city, state, and ZIP code, in the specified section.

- Homestead Property Information: In the section titled "HOMESTEAD PROPERTY INFORMATION," select the type of location of the property by checking the appropriate box: City, Township, or Village. Then fill in the name of the City, Township, or Village, county name, local school district name, parcel identification number, the date when the property was acquired, and provide the detailed address of the homestead property.

- Acknowledgement: In the acknowledgement section, check all boxes that apply to confirm the status of the disabled veteran or the unremarried surviving spouse. This includes affirmations about discharge conditions, residency, ownership, and use of the property as a homestead.

- Affirmation of Eligibility: Check the appropriate box to indicate the basis for the exemption claim. This could be due to a determination of permanent and total disability by the U.S. Department of Veterans Affairs, receipt or eligibility for pecuniary assistance for specially adapted housing, or being rated as individually unemployable by the VA. Attach a copy of the required documentation as indicated.

- Certification: Read the certification statement carefully. Then, print the name of the owner or legal designee, title of the signatory (if applicable), and sign and date the form to certify that the information provided is true and in compliance with Michigan Compiled Law, Section 211.7b.

- If a legal designee is completing the form on behalf of the owner, ensure that a letter of authority is attached as indicated at the bottom of the form.

After completing all sections of the form accurately and attaching the necessary documentation, submit the form to the supervisor or assessing officer as required. It's important to do this annually after December 31 and before the deadline in December to maintain the exemption for each tax year.

Crucial Points on This Form

What is the Michigan 5107 form?

The Michigan 5107 form, officially titled "Affidavit for Disabled Veterans Exemption," is a document used to apply for a property tax exemption under MCL 211.7b. This exemption is specifically for real property used and owned as a homestead by a disabled veteran, discharged from the armed forces of the United States under honorable conditions, or his or her unremarried surviving spouse.

Who is eligible to file the 5107 form?

Eligibility to file the 5107 form includes disabled veterans who have been discharged under honorable conditions from the armed forces of the United States with a service-connected disability or their unremarried surviving spouses. The applicant must be a Michigan resident, own the property in question, and use it as their homestead.

What documents are required to file this form?

- A copy of the letter from the U.S. Department of Veterans Affairs showing that the disabled veteran has been determined to be permanently and totally disabled as a result of military service and entitled to veterans’ benefits at the 100% rate.

- A copy of the certificate from the U.S. Department of Veterans Affairs if the disabled veteran is receiving or has received pecuniary assistance due to disability for specially adapted housing.

- A copy of the letter from the U.S. Department of Veterans Affairs if the veteran has been rated as individually unemployable.

When is the deadline to file the 5107 form?

The form must be annually filed with the supervisor or assessing officer after December 31 and before the Tuesday following the second Monday in December. It is crucial to adhere to this timeline to benefit from the property tax exemption for the relevant tax year.

Where should the 5107 form be submitted?

The affidavit should be submitted to the supervisor or assessing officer of the city, township, or village where the property is located. It is recommended to contact the local assessing office directly to confirm any additional submission requirements or documentations that might be needed.

What is the definition of "homestead" for the purposes of this exemption?

For the purpose of the disabled veteran’s property tax exemption, a homestead is defined as any dwelling with its land and buildings where a family makes its home. This includes the residence of the disabled veteran or their unremarried surviving spouse that is being claimed for the exemption.

Common mistakes

Filling out the Michigan Department of Treasury 5107 form incorrectly can lead to a rejection of the Disabled Veterans Exemption. One common mistake is not providing all the necessary owner information. This includes the full name of the disabled veteran or their unremarried surviving spouse, alongside their telephone number, mailing address, and ZIP code. Missing or inaccurate details in this section can cause delays or denial of the exemption application.

Another area often overlooked is the legal designee information. If a legal designee is applying on behalf of the owner, completing this section is crucial. It requires the legal designee's name, daytime telephone number, and mailing address. Failure to include a letter of authority for the legal designee is a critical error, leading to the inability of the assessing officer to process the form.

Incorrectly identifying the homestead property is a mistake with significant repercussions. Applicants must accurately provide the city, township, or village name where the property is located, as well as the county name, local school district, parcel identification number, date the property was acquired, and the full address of the homestead. Ambiguity or mistakes in this section jeopardize the exemption's approval.

Not checking the correct boxes under the acknowledgment section is another error. This part requires clear acknowledgment about the claimant's status — whether they are a disabled veteran, the unremarried surviving spouse, or their legal designee, alongside confirmation of Michigan residency and homestead property ownership and use. Neglecting to verify these details can invalidate the claim.

Failure to provide the necessary documentation under the affirmation of eligibility section is a significant oversight. Depending on the applicant's circumstances, it's essential to attach a copy of the letter from the U.S. Department of Veterans Affairs, showing the disabled veteran's permanent and total disability due to military service, receipt of pecuniary assistance for specially adapted housing, or being rated as individually unemployable. Omitting these documents will result in the form being incomplete.

Incorrect certification is a mistake not to be underestimated. The owner or the legal designee must certify that the information provided is accurate and truthful to the best of their knowledge. Failing to sign or date this certification, or inaccurately doing so, can nullify the entire application. The authenticity of the application hinges on this act of certification.

Not annually filing the affidavit after December 31 and before the Tuesday following the second Monday in December is a timing mistake many make. This strict deadline is often overlooked, leading to missed opportunities for tax exemption in the relevant year. Timeliness is key in ensuring the application is processed for the current year's exemption.

Overlooking the requirement to own the property and use it as a homestead is another blunder. The law mandates that the property must serve as the primary residence or homestead of the disabled veteran or their unremarried surviving spouse. Applicants mistakenly claiming exemptions for rental properties or second homes find their applications rejected.

Lastly, applicants sometimes misinterpret their eligibility for the exemption. Misunderstanding the criteria set forth by Public Act 161 of 2013 for disabled veterans can lead to futile applications. Only those discharged under honorable conditions, with a service-connected disability, or their unremarried surviving spouses qualify. Misreading or overlooking these eligibility requirements can waste both the applicant’s and the assessing officer's time.

Documents used along the form

In addition to the Michigan Department of Treasury 5107 form, used for Disabled Veterans Exemption, there are several other critical documents and forms often necessary to support or accompany the application process. Whether it's for verification of eligibility, legal representation, or other pertinent matters related to property and exemption status, these documents play a significant role in ensuring that all requirements are met and the process runs smoothly.

- DD214 Form - This document serves as evidence of a veteran's discharge under honorable conditions from the armed forces of the United States. It is crucial for verifying the veteran's service and eligibility for benefits.

- VA Disability Rating Letter - This letter from the United States Department of Veterans Affairs confirms the percentage of the veteran's service-connected disability. It is required to prove that the veteran meets the disability criteria for the exemption.

- Proof of Ownership - Documents such as a deed or property title confirm the ownership of the property. They are essential to establish that the applicant owns the property and that it is used as their homestead.

- Power of Attorney (POA) - If the application is being submitted by a legal designee or representative, a POA document is necessary. It authorizes the designee to act on behalf of the veteran or their unremarried surviving spouse.

- Death Certificate - For unremarried surviving spouses applying for the exemption, a death certificate of the deceased veteran is required. It verifies the applicant's status as the unremarried surviving spouse of the veteran.

- Letter of Authority - This is specifically mentioned in the Michigan 5107 form and is needed when a legal designee is acting on behalf of the veteran or surviving spouse. It grants formal permission for representation in the exemption application process.

Each of these documents plays a vital role in the application for the Michigan Disabled Veterans Exemption, ensuring clarity, compliance, and correctness in representation of eligibility. It's crucial for applicants to gather and submit these documents timely and accurately to facilitate a smooth process and favorable outcome.

Similar forms

The Homestead Property Tax Credit (Form MI-1040CR) shares similarities with Form 5107 as both are designed to provide tax relief to Michigan residents. While the MI-1040CR form assists low-income residents by reducing the amount of property taxes they owe to the state, the 5107 form specifically benefits disabled veterans and their unremarried surviving spouses by exempting them from property taxes on their homesteads.

The Principal Residence Exemption (PRE) Affidavit (Form 2368) is another document closely related to the 5107 form. Both forms assist Michigan residents by providing tax exemptions related to their homes. Form 2368 enables homeowners to declare their property as a principal residence, thus exempting a portion of its value from local school operating taxes, similarly to how Form 5107 provides a tax exemption for disabled veterans.

The Property Transfer Affidavit (Form L-4260) also bears resemblance to the 5107 form. While Form L-4260 must be filed whenever there is a transfer of ownership to ensure accurate property tax assessments, Form 5107 involves the declaration of an eligible status (disabled veteran or their unremarried surviving spouse) for tax exemption purposes. Both forms are integral in the accurate and fair administration of property taxes.

The Veteran’s Exemption Claim (Form BOE-261), while not a Michigan-specific form but used in other states like California, serves a similar purpose to Michigan's Form 5107 by providing property tax exemptions to veterans. Both forms recognize the service of veterans and offer tax relief, differing mainly in state-specific eligibility requirements and administration processes.

The Disabled Persons' Homestead Exemption Application in various states mirrors the intent behind Michigan's Form 5107 by offering tax exemptions to disabled individuals. Though the target beneficiaries may include a wider demographic, both forms aim to reduce the financial burden on disabled individuals by lowering or eliminating property tax obligations.

The Senior Citizens' Homestead Exemption in many jurisdictions, similar to those for disabled persons, shares objectives with the 5107 form. This exemption aims to provide financial relief to senior citizens by reducing their property tax load, much like how the 5107 form benefits disabled veterans and their families.

The Affidavit for Disabled Veterans Exemption in other states, such as the Texas Property Tax Code Section 11.131 Exemption for Disabled Veterans, offers property tax exemptions similar to Michigan's 5107 form. Both documents are tailored to recognize and alleviate the financial burdens faced by disabled veterans, though specific benefits and eligibility criteria may vary by state.

Dos and Don'ts

Filling out the Michigan Department of Treasury 5107 form is a crucial step for disabled veterans or their unremarried surviving spouses seeking a property tax exemption in Michigan. Here are some tips to help ensure that the process is smooth and error-free.

Do:

- Read through the entire form before starting to fill it out, to understand all the required information and instructions.

- Ensure that all owner information is accurately filled in, including the name, telephone number, and mailing address.

- Verify the property information section is correctly completed, including the property identification number and acquisition date.

- Check all the boxes that accurately reflect your status, such as being a disabled veteran discharged under honorable conditions or being the unremarried surviving spouse.

- Attach a copy of the required documentation, such as the letter from the U.S. Department of Veterans Affairs, to prove eligibility for the exemption.

- Review the form for accuracy and completeness before submitting it, making sure the certification section is signed and dated.

Don't:

- Leave any fields blank. If a section does not apply to you, make sure to mark it as "N/A" or "Not Applicable."

- Forget to check the boxes that acknowledge your status and affirm your eligibility; this part of the form is vital for your application.

- Miss attaching the required evidence. The absence of necessary documentation can lead to the rejection of your application.

- Overlook the due dates for filing the affidavit. It must be filed annually with the supervisor or assessing officer after December 31 and before the Tuesday following the second Monday in December.

- Sign and date the form without ensuring that all the information provided is correct and truthful. Incorrect information may lead to legal issues.

- Assume completion of this form guarantees exemption. Stay in communication with the appropriate Michigan Department of Treasury office to confirm the status of your application.

By following these guidelines, applicants can enhance their chances of successfully obtaining the property tax exemption they are entitled to as disabled veterans or their unremarried surviving spouses in Michigan.

Misconceptions

There are several misconceptions about the Michigan Department of Treasury 5107 form, specifically the Affidavit for Disabled Veterans Exemption, that need to be addressed to ensure clarity and correct understanding for those intending to apply for the property tax exemption it offers. These misconceptions can lead to confusion and potential errors during the application process. Here are four common misunderstandings:

- Only the veteran can apply for the exemption: It’s commonly misunderstood that only the disabled veteran themselves can file the 5107 form. However, the form allows for a legal designee or the unremarried surviving spouse of a deceased disabled veteran to file the affidavit. This inclusion ensures that those who are eligible but unable to file themselves or have passed away can still benefit from the exemption through their designated representatives or surviving spouses.

- The exemption is automatically renewed: Some may believe that once approved, the exemption is automatically renewed each year. However, the affidavit must be filed annually with the local assessing officer after December 31 and before the Tuesday following the second Monday in December to continue receiving the exemption. This requirement underscores the importance of staying abreast of filing deadlines to maintain the exemption.

- Exemption applies to all property types: A common assumption is that the exemption can be applied to any type of property owned by the disabled veteran or their unremarried surviving spouse. In reality, the exemption specifically applies to real property used and owned as a homestead by the eligible individual. The term "homestead" is defined as any dwelling with its land and buildings where a family makes its home, which excludes other property types such as investment properties or second homes.

- Eligibility is based solely on disability rating: Another misconception is that eligibility for the exemption depends solely on any level of disability rating by the United States Department of Veterans Affairs. The criteria for eligibility are more specific, requiring that the disabled veteran be determined by the U.S. Department of Veterans Affairs to be permanently and totally disabled as a result of military service and entitled to veteran's benefits at the 100% rate, or receiving or has received pecuniary assistance due to disability for specially adapted housing, or has been rated as individually unemployable. This clarification ensures that those applying understand the specific conditions that must be met for eligibility.

By addressing these misconceptions, individuals seeking to apply for the Michigan Disabled Veterans Exemption can do so with a clearer understanding of the requirements, processes, and criteria involved, thereby enhancing the accessibility and utilization of this beneficial exemption.

Key takeaways

Navigating the complexities of property tax exemptions in Michigan for disabled veterans can seem daunting. However, understanding the Michigan Department of Treasury 5107 form is a crucial step for disabled veterans or their unremarried surviving spouses to possibly reduce financial burdens. Here are five key takeaways to help ensure that the application process is as smooth as possible:

- Eligibility Matters: The 5107 form is specifically designed for disabled veterans who have been honorably discharged from the armed forces of the United States, or their unremarried surviving spouses. It's essential to verify eligibility, including Michigan residency and ownership and occupancy of the claimed homestead property, before proceeding.

- Annual Filing Requirement: The property owner, or their legal designee, needs to file the affidavit annually between December 31 and before the Tuesday following the second Monday in December. This strict deadline underscores the importance of timely preparation and submission to avoid missing out on potential benefits for the year.

- Documentation is Key: Along with the completed form, applicants must attach relevant documentation that affirms the disabled veteran's eligibility. This includes proof of a service-connected disability rated at 100% disability by the United States Department of Veterans Affairs, proof of receiving pecuniary assistance for specially adapted housing, or evidence of being rated as individually unemployable.

- Detailed Information Required: The form requires detailed information about both the applicant and the homestead property in question. This includes the owner's name, telephone number, mailing address, the property's parcel identification number, and the date the property was acquired. Ensuring accuracy and completeness of this information is crucial for the proper processing of the application.

- The Role of a Legal Designee: In situations where the property owner cannot file the affidavit themselves, a legal designee can do so on their behalf. However, it is mandatory to attach a letter of authority, which confirms the designee's legal right to act for the owner. This provision ensures that the process respects the privacy and rights of the disabled veteran or the unremarried surviving spouse.

By carefully adhering to these guidelines, disabled veterans or their unremarried surviving spouses can navigate the application process for a property tax exemption more confidently. It's a recognition of their sacrifice and service, offering some financial relief in acknowledgment of their contributions to our country.

Popular PDF Templates

Michigan Tr 205 - The TR-205 form requires the vehicle or watercraft's year, make, model, body style, and VIN or HIN details.

Mi-1040 Form 2023 - Details procedures for the handling of escrow funds, including collection practices, account estimations, and the potential for interest payment on such funds.