Michigan 5092 PDF Form

The Michigan Department of Treasury Form 5092 stands as an integral document for businesses operating within the state, facilitating the amendment of sales, use, and withholding taxes for monthly or quarterly returns. Released under the auspices of Public Acts 167 of 1933 and 94 of 1937—as subsequently amended—the form caters to varied tax adjustments necessitated by reasons ranging from correcting previously submitted figures to claiming initially unclaimed pre-paid sales tax. Businesses are required to accurately disclose their gross sales, rentals, services, and the corrected figures for sales and rentals, alongside detailing use tax on purchases made for either business or personal use and the total Michigan income tax withheld. The form empowers businesses to rectify inaccuracies, ensuring compliance with state tax regulations by providing a comprehensive breakdown of the tax payable or refundable, inclusive of any applicable discounts, penalties, or interests. Additionally, the form mandates taxpayer certification, underscoring the importance of truthful and complete submissions under the penalty of perjury. Guidance on completing this return is thoughtfully included, addressing potential errors and providing clear directives on computing taxes due, applicable discounts, and penalty interests, streamlining the amendment process for Michigan's business taxpayers.

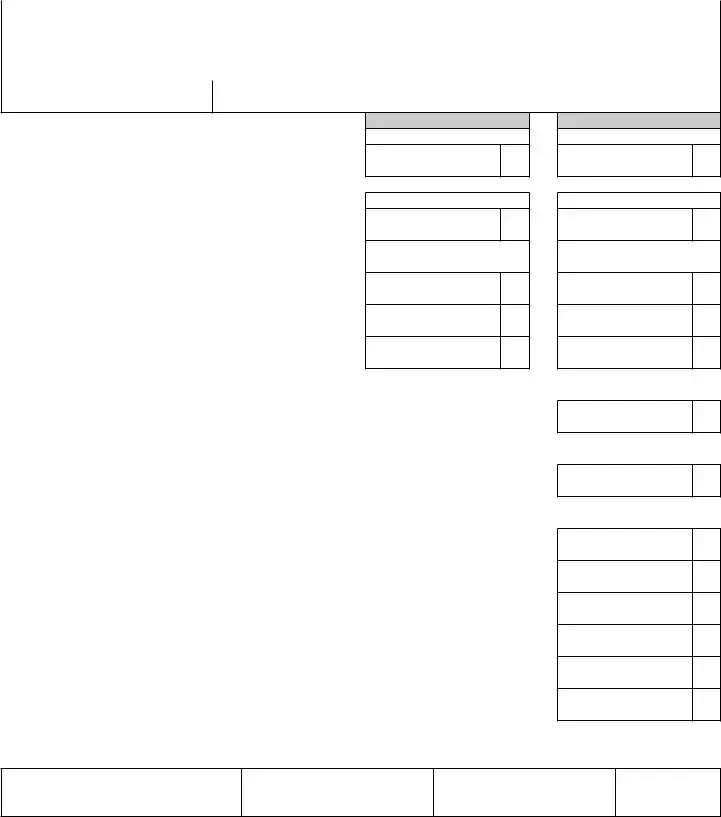

Preview - Michigan 5092 Form

Michigan Department of Treasury 5092

2015 Sales, Use and Withholding Taxes Amended Monthly/Quarterly Return

Issued under authority of Public Acts 167 of 1933 and 94 of 1937, as amended.

Taxpayer’s Business Name |

|

|

|

|

|

Business Account Number (FEIN or TR Number) |

|||

|

|

|

|

|

|

|

|

|

|

Tax type being amended |

|

|

|

|

|

Return Period Ending |

|||

|

|

|

|

|

|

|

|

|

|

|

|

Sales Tax |

|

Use: Sales and Rentals |

|

Withholding Tax |

|

Use Tax on Purchases |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason Code for Amending Return (See Instr.)

If other, provide explanation

PART 1: SAlES AnD USE TAx

1. Gross sales, rentals and services |

1a. |

CORRECTED

Sales

1b.

CORRECTED

Use: Sales and Rentals

2.Total sales and/or use tax. Taxable amount multiplied

by 6% (0.06) ..................................................................................

3.Total

4.Remaining amount of sales and use tax eligible for discount. Subtract line 3 from line 2..............................................................

5.Total of allowable discounts. Multiply line 4 by your applicable discount rate..................................................................................

6.Total sales and use tax due. Subtract line 5 from line 4 .............

2a.

3a.

4a.

5a.

6a.

A. Sales Tax

XXXXXXX

2b.

3b.

4b.

5b.

6b.

B. Use Tax

XXXXXXX

PART 2: USE TAx On ITEMS PURChASED fOR BUSInESS OR PERSOnAl USE

7. Total amount of use tax from purchases and withdrawals from inventory. Multiply taxable amount |

|

by 6% (0.06) |

7. |

PART 3: WIThhOlDIng TAx

8. Total amount of Michigan income tax withheld |

8. |

PART 4: TOTAl TAx/PAyMEnT DUE

9. |

Amount of sales, use and withholding tax due. Add lines 6a, 6b, 7 and 8. If amount is negative, this is the |

|

|

amount available for future tax periods (skip lines |

9. |

10. |

Total amount applied for this return period including overpayments available from previous periods or |

|

|

amount previously paid for this return period |

10. |

11. |

Amount of tax due. Subtract line 10 from line 9. If line 10 is greater than line 9, this is the amount |

|

|

available for future tax periods (skip lines |

11. |

12. |

Penalty paid with this return (for late iling) |

12. |

13. |

Interest paid with this return (for late iling) |

13. |

14. |

TOTAl PAyMEnT DUE. Add lines 11, 12 and 13 |

14. |

TAxPAyER CERTIfICATIOn: I declare under penalty of perjury that this return is true and complete to the best of my knowledge.

Signature of Taxpayer or Oficial Representative (must be Owner, Oficer, Member, Manager, or Partner)

Printed Name

Title

Date

Make check payable to “State of Michigan” and include your account number on your check.

Send your return and any payment due to: Michigan Department of Treasury, P.O. Box 30324, Lansing, MI

+ 0000 2015 88 01 27 5

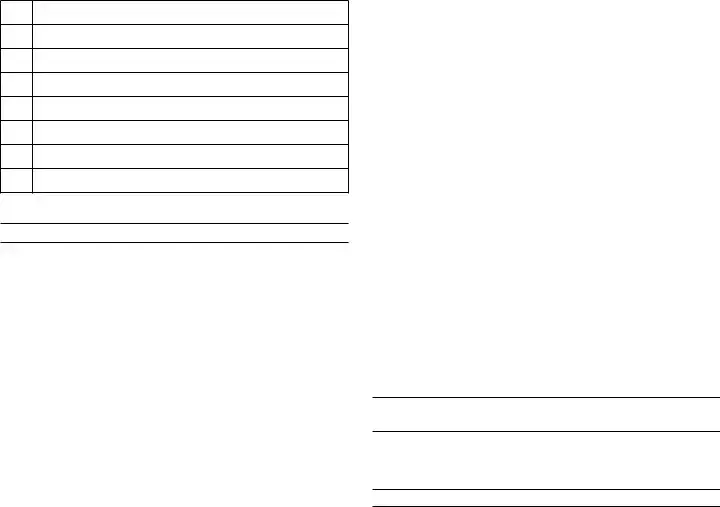

Instructions for Sales, Use and Withholding Taxes Amended Monthly/Quarterly Return (form 5092)

NOTE: You must use Form 165 to amend tax years prior to 2015.

Form 5092 is used to amend monthly/quarterly periods in the current year. Complete the return with the corrected figures. Check the box for each tax type you are amending and provide the amended reason code located in the instructions. If the reason code is “Other,” write an explanation for the amendment.

IMPORTANT: This is a return for Sales Tax, Use Tax, and/ or Withholding Tax. If the taxpayer inserts a zero on (or leaves blank) any line for reporting Sales Tax, Use Tax, or Withholding Tax, the taxpayer is certifying that no tax is owed for that tax type. If it is determined that tax is owed, the taxpayer will be liable for the deficiency as well as penalty and interest.

Reason code for amending return: Using the table below, select the

01Increasing tax liability

02Decreasing tax liability

03Incorrect information/igures reported on original return

04Original return was missing information/incomplete

05Claiming previously unclaimed

06Dispute an adjustment

07Tax Exempt

08Other

PART 1: SAlES AnD USE TAx

Line 1a: Total gross sales for tax period being reported. Enter the total of your Michigan sales of tangible personal property including cash, credit and installment transactions and any costs incurred before ownership of the property is transferred to the buyer (including shipping, handling, and delivery charges).

Line 1b: This line is used to report the following:

•

•Lessors of tangible personal property: Enter amount of total rental receipts.

•Persons providing accommodations: This would include but not limited to hotel, motel, and vacation home rentals. This also includes assessments imposed under the Convention and Tourism Act, the Convention Facility Development Act, the Regional Tourism Marketing Act, the Community Convention or Tourism Marketing Act.

•Telecommunications Services: Enter gross income from telecommunications services.

Line 2a: Total sales tax. Negative figures are not allowed or valid.

Line 2b: Total use tax. Negative figures not allowed or valid.

Line 5: Enter total allowable discounts. Discounts apply only to 2/3 (0.6667) of the sales and/or use tax collected at the 6 percent tax rate. See below to calculate your discount based on filing frequency:

Monthly Filer

•If the tax is less than $9, calculate the discount by multiplying the tax by 2/3 (.6667).

•Enter $6 if tax is $9 to $1,200 and paid by the 12th, or $9 to $1,800 and paid by the 20th .

•If the tax is more than $1,200 and paid by the 12th,

calculate discount using this formula: (Tax x .6667 x .0075). The maximum discount is $20,000 for the tax period.

•If the tax is more than $1,800 and paid by the 20th,

calculate discount using this formula: (Tax x .6667 x .005). The maximum discount is $15,000 for the tax period.

Quarterly Filer

•If the tax is less than $27, calculate the discount by multiplying the tax by 2/3 (.6667)

•Enter $18 if tax is $27 to $3,600 and paid by the 12th, or $27 to $5,400 and paid by the 20th.

•If the tax is more than $3,600 and paid by the 12th,

calculate discount using this formula: (Tax x .6667 x .0075). The maximum discount is $20,000 for the tax period.

•If the tax is more than $5,400 and paid by the 20th,

calculate discount using this formula: (Tax x .6667 x .005). The maximum discount is $15,000 for the tax period.

Accelerated Filer

•If the tax is paid by the 12th, calculate discount using this formula: (Tax x .6667 x .0075).

•If the tax is paid by the 20th, calculate discount using this formula: (Tax x .6667 x .005).

PART 2: USE TAx On ITEMS PURChASED fOR BUSInESS OR PERSOnAl USE

Line 7: To determine your use tax due from purchases and withdrawals, multiply the total amount of your inventory value by 6% (0.06) and enter here.

PART 3: WIThhOlDIng TAx

Line 8: Enter the total Michigan income tax withheld for the tax period.

PART 4: TOTAl TAx/PAyMEnT DUE

Line 9: If amount is negative, this is the amount available for

future tax periods (skip lines

Line 10: Enter any payments you submitted for this period, enter any payments for this period including any overpayments available from previous periods. If you are using an overpayment from a previous period only enter the amount needed to pay the total liability for this return. In the event an overpayment still exists declare it on the next return you file with a liability. (Liability minus overpayments/prior payment for this period must be greater than or equal to zero).

how to Compute Penalty and Interest

If your return is filed with additional tax due, include penalty and interest with your payment. Penalty is 5% of the tax due and increases by an additional 5% per month or fraction thereof, after the second month, to a maximum of 25%. Interest is charged daily using the average prime rate, plus 1 percent.

Refer to www.michigan.gov/taxes for current interest rate information or help in calculating late payment fees.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Number | Michigan Department of Treasury 5092 |

| Issuance Date | August 2014 |

| Tax Year | 2015 |

| Form Purpose | Sales, Use, and Withholding Taxes Amended Monthly/Quarterly Return |

| Governing Laws | Public Acts 167 of 1933 and 94 of 1937, as amended |

| Tax Types Covered | Sales Tax, Use Tax on Sales and Rentals, Withholding Tax, Use Tax on Purchases |

| Amendment Reason Code | Includes specific codes for common reasons for amending returns and an 'Other' option for different reasons |

| Calculation of Discounts | Varies based on filing frequency with specific formulas for Monthly, Quarterly, and Accelerated Filers |

| Penalty and Interest Computation | Penalty starts at 5% and can increase, interest charged daily with rates specified on the Michigan Department of Treasury's website |

Guidelines on Utilizing Michigan 5092

Filling out the Michigan 5092 form, which is used for amending monthly or quarterly sales, use, and withholding tax returns, is a detailed process that requires accuracy and attention to detail. This guide aims to simplify the steps involved in completing the form, making it accessible for taxpayers looking to amend their tax records. Following these instructions carefully will help ensure that the form is filled out correctly and submitted to the Michigan Department of Treasury without errors.

- Begin by writing the taxpayer’s business name at the top of the form.

- Enter the Business Account Number next. This can be either the FEIN or TR Number.

- Choose the tax type(s) being amended by checking the appropriate box(es) for Sales Tax, Use: Sales and Rentals, Withholding Tax, or Use Tax on Purchases.

- For the Return Period Ending, fill in the month and year (MM-YYYY) that you are amending.

- Identify the reason code for amending the return by referring to the provided instructions. If the reason is not listed, select "08Other" and give a brief explanation.

- In PART 1: SALES AND USE TAX, update the corrected figures for gross sales, rentals, and services in lines 1a and 1b.

- Calculate the total sales and/or use tax by multiplying the taxable amount by 6% and enter this in lines 2a and 2b for Sales Tax and Use Tax, respectively.

- Enter any previously paid taxes from Form 5083, 5085, or 5086 in line 3.

- Subtract line 3 from line 2 to find the remaining amount of sales and use tax eligible for discount, and input this in line 4.

- Figure out the total of allowable discounts based on your filing frequency and enter this in line 5.

- Subtract line 5 from line 4 to find the total sales and use tax due and input this in line 6.

- In PART 2: USE TAX ON ITEMS PURCHASED FOR BUSINESS OR PERSONAL USE, calculate your use tax due by multiplying the total purchase amount by 6% and input this in line 7.

- For PART 3: WITHHOLDING TAX, enter the total Michigan income tax withheld for the tax period in line 8.

- In PART 4: TOTAL TAX/PAYMENT DUE, start with calculating the amount of sales, use and withholding tax due by adding lines 6a, 6b, 7, and 8, then input this total in line 9.

- Enter any total amount applied for this return period, including overpayments from previous periods or amounts previously paid, in line 10.

- Determine if additional tax is due by subtracting line 10 from line 9, and enter this amount in line 11.

- If applicable, calculate and enter the penalty for late filing in line 12 and any interest in line 13.

- Add lines 11, 12, and 13 to find the total payment due, and input this amount in line 14.

- Complete the taxpayer certification section by signing and dating the form. Include your title and printed name.

- Lastly, make your check payable to "State of Michigan," noting your account number on the check, and mail the completed form and any payment due to the address provided on the form.

By following these steps carefully, you should be able to accurately complete the Michigan 5092 form and amend your sales, use, and withholding taxes. Remember to double-check your calculations and the completeness of your information to avoid any delays in processing your amended return.

Crucial Points on This Form

What is the Michigan 5092 form?

The Michigan 5092 form is a document issued by the Michigan Department of Treasury for the amendment of Sales, Use, and Withholding Taxes for monthly or quarterly returns. It is specifically designed for corrections to previously submitted tax details within the current year, pertaining to taxpayers' business names, account numbers, and the type of tax being amended among other details.

Who needs to file the Michigan 5092 form?

This form must be filed by any taxpayer who needs to make amendments to their previously filed Sales, Use, or Withholding Taxes. It applies to instances where there is a need to correct gross sales, rentals, services figures, or tax amounts due for sales, use, and withholding tax segments.

How can I amend my tax return using Form 5092?

To amend your tax return using Form 5092, complete the return with the corrected figures for the tax period being reported. Indicate which tax type(s) you are amending by marking the appropriate box(es) and provide the amended reason code located in the instructions. If the reason code is "Other," a written explanation for the amendment is necessary.

What are the reason codes for amending a return?

Reason codes for amending a return include but are not limited to:

- 01 - Increasing tax liability

- 02 - Decreasing tax liability

- 03 - Incorrect information/figures reported on the original return

- 04 - Original return was missing information/incomplete

- 05 - Claiming previously unclaimed pre-paid sales tax

- 06 - Dispute an adjustment

- 07 - Tax Exempt

- 08 - Other

What should I do if my reason for amending is not listed?

If your reason for amending is not listed among the standard reason codes, select "08 Other" and provide a detailed explanation for your amendment in the space provided on the form.

How are corrections to sales and use tax calculated?

Corrections to sales and use tax should reflect the accurate total gross sales, rentals, and services. For sales and use tax, accurately calculate the taxable amount, pre-paid tax, and allowable discounts to determine the corrected tax due. Use the formula provided for your filing frequency to calculate any applicable discounts to the sales and/or use tax collected at the 6 percent rate.

How do I calculate the total tax/payment due when amending?

To calculate the total tax/payment due, add the correct amounts for sales tax, use tax, and withholding tax due. From this sum, subtract any payments already made for this return period, including overpayments available from previous periods. If the result is negative, this amount is available for future tax periods.

Where should I send my completed Michigan 5092 form and payment?

The completed Michigan 5092 form and any payment due should be made payable to the "State of Michigan" and sent to the Michigan Department of Treasury at the address provided: P.O. Box 30324, Lansing, MI 48909-7824. Remember to include your account number on your check for proper attribution.

How are penalty and interest calculated for late filings?

Penalty for late filings starts at 5% of the tax due and increases by an additional 5% per month or fraction thereof, after the second month, to a maximum of 25%. Interest is charged daily using the average prime rate plus 1 percent. You can find the current interest rate information and help calculating late payment fees on the Michigan Department of Treasury website.

Can Form 5092 be used to amend tax years prior to 2015?

No, Form 5092 cannot be used to amend tax years prior to 2015. For amending tax years before 2015, you must use Form 165. Form 5092 is specifically designed for amending monthly/quarterly periods in the current year.

Common mistakes

Filling out the Michigan 5092 form, which is designed for amending Sales, Use, and Withholding Taxes, requires careful attention to detail. A common mistake is inaccurately reporting gross sales in Part 1, Line 1a. Taxpayers should ensure the total of Michigan sales of tangible personal property is correctly entered, including all transactions and applicable costs.

Another error occurs on Line 2, where taxpayers must accurately calculate the total sales and use tax. This calculation involves multiplying the taxable amount by a 6% rate. Errors here can result from simple mathematical mistakes or from misunderstanding which transactions are taxable.

Often overlooked is the pre-paid tax from forms 5083, 5085, or 5086, as mentioned in Line 3. Not reporting pre-paid tax correctly can lead to discrepancies in the total sales and use tax calculations.

On Line 5, taxpayers sometimes mistakenly calculate their allowable discounts incorrectly. This discount is only applicable to 2/3 of the sales and/or use tax collected at the 6 percent rate. Understanding the precise discount rate for your filing frequency is crucial for accurate reporting.

In Part 2, Line 7, where use tax on purchased items for business or personal use is reported, a frequent mistake is failing to correctly determine the use tax due. This involves accurately multiplying the total inventory value by a 6% rate.

When it comes to withholding tax in Part 3, Line 8, a common error is not reporting the total Michigan income tax withheld for the tax period accurately, which can affect the overall tax obligations of the business.

In Part 4, Line 9, taxpayers often misunderstand how to report their total tax or payment due. If the amount is negative, indicating overpayment, this must be clearly indicated to avoid confusion with future tax periods.

Another point of confusion is found in Line 10, concerning the total amount applied for this return period. Taxpayers must accurately report any payments submitted within this period, including overpayments from previous periods correctly.

Calculating penalty and interest, for those who file their returns with additional tax due, is another common stumbling block. The penalty is 5% of the tax due, increasing by an additional 5% per month after the second month, up to 25%. Interest is charged daily, and taxpayers often miscalculate these amounts.

Finally, a significant mistake is not appropriately signing and dating the taxpayer certification section. This declaration under penalty of perjury affirms that the return is true and complete to the best of the taxpayer’s knowledge. An omission here can cause the return to be considered incomplete.

Documents used along the form

When managing Michigan sales, use, and withholding taxes, it’s beneficial to understand the companion forms and documents that often accompany the Michigan Department of Treasury 5092 form. This understanding ensures accurate and comprehensive tax reporting. Here’s a list of other forms and documents that are frequently used alongside form 5092:

- Form 165: Utilized to amend tax years prior to 2015. When you need to make changes to older tax records, this form is necessary.

- Form 5083: This form is used for Prepaid Sales Tax on Motor Fuel. Businesses that deal in motor fuel use this form to report and pay the prepaid sales tax.

- Form 5085: Filed for Prepaid Sales Tax. Similar to Form 5083, but used by businesses selling items other than motor fuel that require the collection of prepaid sales tax.

- Form 5086: Used for reporting and paying Use Tax on Items Purchased for Business Use. If you buy goods outside of Michigan or via the internet for business use, this form helps calculate and pay use tax on those purchases.

- Michigan Annual Sales Tax Return Form 5081: This form is essential for summarizing the year’s sales, use, and withholding taxes. It’s often used to reconcile the amounts reported monthly or quarterly on Form 5092.

- Change of Business Information Form 163: Necessary for updating the Michigan Department of Treasury about changes in business address, ownership, or business status. This information must be current to ensure proper processing of 5092 and related documents.

- Application for Michigan Business Tax Account Form 518: Before filing Form 5092, new businesses must use this form to apply for a sales tax, use tax, and withholding tax account with the Michigan Department of Treasury.

- Michigan New Hire Reporting Form: Employers are required to report new and rehired employees. This complements the withholding tax component of Form 5092 by ensuring all employee taxes are correctly withheld and remitted.

Comprehension and proper utilization of these documents in conjunction with the Michigan Department of Treasury 5092 form facilitate a smoother handling of tax obligations. This not only aids in maintaining compliance with Michigan tax laws but also streamlines tax processes for businesses. Keeping these forms in mind and understanding when they are needed can greatly assist in the efficient management of business taxes in Michigan.

Similar forms

The Form 1040 (U.S. Individual Income Tax Return) - Similar to the Michigan 5092 form, the Form 1040 is used by taxpayers to file their annual income tax returns. Both forms require detailed financial information from the taxpayer, including income and deductions, to determine the amount of tax owed or the refund due. While Form 1040 is for federal income tax, the Michigan 5092 form deals with sales, use, and withholding taxes at a state level. They both include sections for calculating taxes owed, deductions, and credits.

Form 941 (Employer's Quarterly Federal Tax Return) - This form is used by employers to report federal withholdings from employees for income tax, Social Security, and Medicare. Similar to the withholding tax section of the Michigan 5092 form, Form 941 also deals with taxes withheld from individuals' earnings. Both documents are crucial for reconciling the amount of tax withheld from earnings with the actual tax liability of employees or transactions.

Form 1120 (U.S. Corporate Income Tax Return) - Like the Michigan 5092, Form 1120 is used by entities to report their income, gains, losses, deductions, and credits to calculate their federal income tax liability. Though Form 1120 is for corporations operating at the federal level, and the Michigan 5092 targets state-level taxes, both share the foundational purpose of reporting and amending tax-related information based on business activities.

Sales and Use Tax Return forms in other states - Many states have their own versions of sales and use tax return forms that function similarly to the Michigan 5092 form. These documents are used by businesses to report taxable sales, calculate tax dues, and remit tax payments for sales and use within the state. While the specific details and rates may vary from state to state, the fundamental purpose aligns with the Michigan 5092's aim to consolidate and amend sales, use, and withholding tax liabilities for accurate state tax reporting and compliance.

Dos and Don'ts

When filling out the Michigan 5092 form for amended monthly/quarterly sales, use, and withholding tax returns, it's important to pay attention to details to ensure compliance and accuracy. Here are key dos and don'ts:

- Do ensure you correctly identify the tax type being amended by checking the appropriate box at the top of the form. Whether you're adjusting sales tax, use tax, or withholding tax, this step is crucial for proper processing.

- Do enter the “Reason Code for Amending Return” accurately. The code, which can be found in the instructions, indicates the reason for the amendment, ranging from increasing tax liability to claiming previously unclaimed pre-paid sales tax.

- Do use the corrected figures for gross sales, rentals, and services when filling out the sales and use tax section (Part 1). It's essential that these numbers accurately reflect any adjustments from the original return.

- Do calculate the allowable discounts correctly if applicable. Depending on your filing frequency (monthly, quarterly, or accelerated), the formula and discount rates vary. This ensures you take advantage of any potential discounts on the taxes collected.

Similarly, here are things you should avoid:

- Don't leave any fields that apply to you blank, unless you are certifying that no tax is owed for that line item. Inaccurate or incomplete forms can lead to delays or incorrect assessments.

- Don't enter negative figures in the total sales tax (line 2a) and total use tax (line 2b) sections. The form does not allow for negative numbers in these fields, and doing so could result in errors in processing.

- Don't forget to include your signature and the date at the bottom of the form. The Taxpayer Certification section requires an authorized signature to verify that the return is true and complete to the best of your knowledge.

- Don't omit details about your method of payment. If you’re making a payment with the return, ensure your business account number is included on your check, and follow the provided instructions for making the check payable to the “State of Michigan.”

Misconceptions

When dealing with the Michigan Department of Treasury 5092 form, it's crucial to have accurate information. This form is used for amending Sales, Use, and Withholding Taxes either on a monthly or quarterly basis. Misunderstandings about this form can lead to errors in tax filings. Here are ten common misconceptions about the Michigan 5092 form and clarifications to set the record straight.

- Misconception 1: The 5092 form is only for businesses with a physical presence in Michigan.

In reality, the form applies to all entities that collect sales, use, or withholding taxes in Michigan, including out-of-state retailers with no physical presence but who are required to collect tax due to nexus laws.

- Misconception 2: You can use Form 5092 to amend any tax year.

Form 5092 is specifically designed for amending monthly/quarterly periods within the current year. For tax years prior to 2015, Form 165 must be used.

- Misconception 3: Negative figures are acceptable for total sales and use tax.

Negative figures are not permitted on lines 2a (Sales Tax) or 2b (Use Tax). These lines must reflect positive amounts owed.

- Misconception 4: The form can be submitted without selecting a reason code for amending.

A two-digit reason code, indicating why the return is being amended, is required. If the specific reason does not match any provided codes, "Other" must be selected and an explanation provided.

- Misconception 5: Discounts on sales and use tax do not have a maximum limit.

Contrarily, the allowable discounts have a ceiling based on filing status and payment timeliness, such as a maximum of $20,000 for monthly filers who pay by the 12th.

- Misconception 6: The form covers just sales and use tax adjustments.

It also includes sections for adjusting withholding taxes, making it a comprehensive tool for various tax amendments.

- Misconception 7: Overpayments from previous periods can't be applied.

Actually, overpayments can be applied to the current return period. Form 5092 includes sections for documenting such payments and their application to current tax liabilities.

- Misconception 8: Penalty and interest calculations are optional for late filings.

If additional tax is due, penalty and interest calculations are required. The penalty starts at 5% and can increase, and interest is calculated using the prime rate plus 1%.

- Misconception 9: Electronically filing is not an option for the 5092 form.

Electronic submission is an available and often encouraged option for filing this form, offering a more convenient and faster processing method.

- Misconception 10: The 5092 form cannot be used to claim a refund.

While primarily for amending tax amounts due, if adjustments result in a negative amount, this indicates funds available for future periods or potential refunds, subject to state tax department approval.

Understanding the specific requirements and correct applications of the Michigan 5092 form is crucial for accurate tax reporting and compliance. Misconceptions can lead to errors, potential penalties, or missed opportunities for tax corrections. Always consult the instructions provided by the Michigan Department of Treasury or a tax professional when completing this form to ensure accuracy and compliance.

Key takeaways

When dealing with the Michigan 5092 form, for amending sales, use, and withholding taxes, understanding its requirements and benefits is crucial for ensuring compliance and making the most of potential savings. Here are seven key takeaways to guide you through this process:

- Specific Purpose: The 5092 form is specifically designed for amending previously submitted monthly or quarterly tax returns within the current tax year, including corrections to sales, use, and withholding taxes.

- Amendment Reasons: When submitting an amendment, it's essential to indicate the reason for your changes. The form provides a list of reasons, such as correcting erroneous figures or claiming unclaimed pre-paid sales tax. If your reason doesn't fit any listed, select "Other" and provide a detailed explanation.

- Discounts Available: Taxpayers can take advantage of allowable discounts for sales and use taxes collected, based on their filing frequency (monthly, quarterly, or accelerated). Understanding how to calculate these discounts correctly can lead to significant savings.

- Reporting Requirements: The form requires details on gross sales, use tax on purchases, and Michigan income tax withheld. Ensuring accuracy in these areas is crucial for both compliance and maximizing any applicable discounts or credits.

- Payment Calculations: The form includes sections for calculating the total tax/payment due, taking into account any overpayments from previous periods or payments already made. This step is vital for accurately determining if additional payment is due or if amounts are available for future tax periods.

- Penalties and Interest: If additional tax is due with the amendment, the form outlines the calculation for penalties and interest. Staying informed on the current rates and how to calculate these additional amounts can prevent surprises and further liabilities.

- Submission Guidelines: It is essential to sign and certify the accuracy of the information under penalty of perjury. Additionally, payments should be made payable to the "State of Michigan," and all documentation must be sent to the provided address for the Michigan Department of Treasury, ensuring proper submission and processing.

By taking these details into account, taxpayers can navigate the complexities of amending their tax returns with confidence, ensuring both compliance with state guidelines and the optimal outcome for their financial obligations.

Popular PDF Templates

Mi State Income Tax Rate - Stresses the finalization of tax due, including summation of sales, use, and withholding taxes.

Mi Courts - Explanation on how to navigate the Michigan Court's Self-Help Center resources for further assistance with civil complaints.

Uia 1733 - The UIA 1015-C includes questions about working under a written agreement, shedding light on formal employer-worker relationships.