Michigan 4816 PDF Form

For individuals navigating the complexities of real estate transactions in Michigan, understanding the specifics of the Michigan Department of Treasury 4816 form is crucial. This form, developed under the authority of Public Act 206 of 1893, is a cornerstone document in situations where a Principal Residence Exemption (PRE) has been denied, and there is a need to bill the previous owner for additional taxes, interest, and penalties. Such a scenario typically arises when a property changes hands, transferring to a bona fide purchaser, someone who buys in good faith, without the property being encumbered by the financial liabilities resulting from the PRE denial. The 4816 form requires detailed information about the property, the PRE denial, and the billing instructions for the seller, mandating precision in its completion to avoid inaccuracies or processing delays. Furthermore, the form serves to ensure that the tax obligations fall on the correct party - primarily the seller who initially claimed the exemption, but under certain conditions, potentially an "acquiring entity" in more complex transactions. The involvement of bona fide and non-bona fide purchasers further complicates the matter, with specific guidelines determining who bears the financial responsibility. Through a thorough breakdown of the form's parts, including property information, denial details, billing directives, and contact information, the intricacies of this process are unveiled, highlighting the careful considerations required when a Principal Residence Exemption is denied in the Great Lakes State.

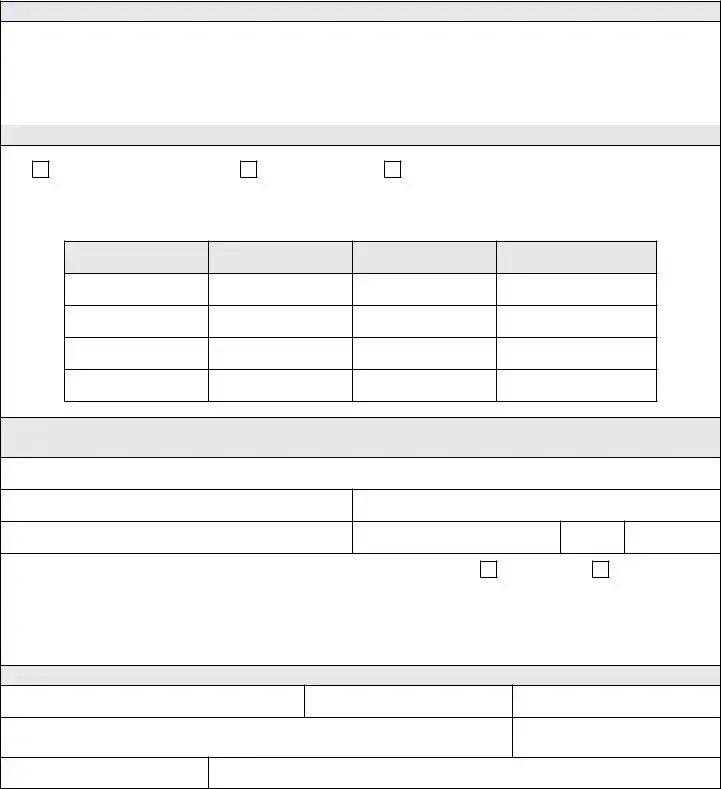

Preview - Michigan 4816 Form

Michigan Department of Treasury 4816

Request to Bill Seller Following a Principal Residence Exemption (PRE) Denial

Issued under authority of Public Act 206 of 1893.

Read the instructions before completing the form. This form and required documents must be submitted by the county or local treasurer

(whoever is in possession of the tax roll) when requesting that the Department of Treasury bill a seller for additional taxes, interest and penalties resulting from a PRE denial where the property has been transferred to a bona ide purchaser. Incomplete forms or a failure to

provide the required documentation will result in inaccurate billings or delays in processing. Use a separate form for each property tax identiication number.

PART 1: PROPERTY INFORMATION

Property Tax Identiication Number

Street Address |

|

|

County |

||

|

|

||||

Township or City Name (Check appropriate box, write in name) |

ZIP Code |

||||

|

|

Township |

|

City |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

PART 2: PRE DENIAL AND INTEREST INFORMATION — A copy of the denial notice must be attached.

Who denied the PRE?

Department of Treasury

County

Township/City Assessor

Date of Denial (MM/DD/YYYY) |

To whom was the denial issued? (Must not be the current owner.) |

|

|

In the table below, list the denied years to be billed and the corresponding tax information.

DENIAL YEAR

SchOOL OPERATINg

MILLAgE RATE

TAxABLE vALuE

DuE DATE

(Summer, Winter, combined)

PART 3: BILLINg INFORMATION — A copy of the deed, land contract or other legally executed document transferring the property from the seller to the bona ide purchaser must be attached.

First and last name of seller(s) to be billed. (Must not be the current owner. See instructions for details.)

Company Name (if applicable)

Federal Employer Identiication Number (FEIN)

Current Mailing Address

City

State

ZIP Code

Is the seller(s) to be billed the same person(s) or entity that was issued the denial notice and listed in Part 2?

Yes

No

If answered “no,” explain here and attach any supporting documents. (It is a rare exception for the two to be different. See instructions for details.)

PART 4: cOuNTY OR LOcAL uNIT cONTAcT INFORMATION

Name of Person Who Prepared Form (Print or Type)

Title

Name of County or Local Unit

Preparer’s Signature

Date

Telephone Number

Mail completed form and supporting documentation to: Michigan Department of Treasury, PRE Unit, P.O. Box 30440, Lansing, MI 48909.

4816, Page 2

Instructions for Form 4816

Request to Bill Seller Following a Principal Residence Exemption (PRE) Denial

This form must be submitted by the county or local treasurer (whoever is in possession of the tax roll) when requesting that the

Department of Treasury (Department) bill a seller for additional taxes, interest and penalties resulting from a PRE denial where the property has been transferred to a bona ide purchaser. Speciically, Subsections 6, 8 and 11 of Michigan Compiled Laws 211.7cc state that “if the property has been transferred to a bona ide purchaser before additional taxes were billed to the seller as a result of the

denial of a claim for exemption, the taxes, interest, and penalties shall not be a lien on the property and shall not be billed to the bona

ide purchaser ….” The local tax collecting unit in possession of the tax roll then notiies the Department, which “shall then assess the

owner who claimed the exemption under this section for the tax, interest, and penalties accruing as a result of the denial of the claim for exemption ….” In other words, the seller (the person denied) is responsible for all additional taxes, interest and penalties due for

the years up to and including the year of the sale if the purchaser is a “bona ide purchaser.” The PRE is not removed in these bona ide purchaser situations.

A “bona ide purchaser” is one who purchases in good faith for valuable consideration. Therefore, a person who receives property

through an inheritance, foreclosure or one who receives property through a quit claim without valuable consideration, would not qualify as a bona ide purchaser. If the new owner is not a bona ide purchaser, the taxes are added back to the tax roll and the purchaser is responsible for the additional taxes, interest and penalties which become a lien on the property.

There are rare situations, however, where the person(s) or entity that was denied the PRE lost the property in a foreclosure or some other circumstance to an “acquiring entity,” which then subsequently sold the property to a bona ide purchaser. In these situations, the “acquiring entity” that sold the property would be responsible for the additional taxes, interest and penalties although the denial notice was issued to the prior owner. In these unusual circumstances, since the property was not acquired for valuable consideration, the transfer to the “acquiring entity” is not considered a bona ide purchase. As a result, the “acquiring entity” is responsible for the additional taxes, interest and penalties. If this rare situation occurs, explain in Part 3 the circumstances involved and attach any supporting documents. If the “acquiring entity” has not sold the property to a bona ide purchaser, the billing of additional taxes, interest and penalties must occur at the county or local unit level (whichever is in possession of the tax roll) since the transfer was not a bona ide purchase.

In order for the Department to process a request to bill the seller (the person or entity who was issued the denial notice) for additional taxes, interest and penalties in a bona ide purchaser situation, this form must be completed with the required documents attached. Upon

review of the completed form and supporting documents, the Department will process and issue a bill, which will include additional taxes and applicable interest and penalties, to the person(s) or entity listed in Part 3.

PART 1: PROPERTY INFORMATION

All of the information in Part 1 must be provided to the Department to process the request. Use a separate form for each property tax identiication number.

PART 2: PRE DENIAL INFORMATION

A copy of the PRE denial notice relating to the property in Part 1 must be submitted with this form. The date of the denial notice must be listed on the form along with the person(s) or entity that issued the denial notice. If the denial notice was issued to the current owner of

the property, the billing of additional taxes, interest and penalties must occur at the county or local unit level (whichever is in possession of the tax roll) and does not qualify as a bona ide purchaser situation. In addition, if the purchaser is not a “bona ide purchaser,” as described earlier, the billing also must occur at the county or local level.

For each year the PRE was denied, requiring the Department to bill the seller, list the school operating millage rate, taxable value, and the due date of the school operating taxes (summer, winter, or combined summer/winter).

PART 3: BILLINg INFORMATION

A copy of the deed, land contract or other legally executed document transferring the property from the seller to the bona ide purchaser must be submitted with this form. Each seller to be billed must be listed including a current mailing address (if the mailing address is available). If the seller is a company, the complete company name, address, and Federal Employer Identiication Number (FEIN), if available, must be provided.

PART 4: cOuNTY OR LOcAL uNIT cONTAcT INFORMATION

Complete the contact information in the event the Department has a question or needs clariication. The completed form and supporting documents must be mailed to the address at the bottom of the form. Failure to provide complete information or adequate supporting documentation will result in delays in processing.

If you have any questions, call the PRE Unit at (517)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Michigan Department of Treasury 4816 form is used to request billing a seller for additional taxes, penalties, and interest resulting from a Principal Residence Exemption (PRE) denial after the property has been transferred. |

| Governing Law | Issued under the authority of Public Act 206 of 1893, along with specifics detailed in Michigan Compiled Laws 211.7cc subsections 6, 8, and 11 regarding the PRE denial and its implications. |

| Required Submitter | This form must be submitted by the county or local treasurer who is in possession of the tax roll. |

| Documentation Requirement | Submission must include a copy of the PRE denial notice and a legally executed document transferring the property from the seller to a bona fide purchaser. |

| Bona Fide Purchaser Definition | A bona fide purchaser is defined as one who purchases property in good faith for valuable consideration, excluding those acquiring property through inheritance, foreclosure, or without valuable consideration. |

| Special Circumstances | In rare cases where an "acquiring entity" sells the property to a bona fide purchaser after foreclosure or similar circumstance, the acquiring entity is responsible for the additional taxes, even if the denial was issued to the previous owner. |

| Processing and Submission Details | The completed form alongside required documents must be mailed to the Michigan Department of Treasury, PRE Unit. Incomplete submissions may result in delayed processing. |

Guidelines on Utilizing Michigan 4816

Filling out the Michigan Department of Treasury 4816 form might seem daunting at first glance, but it's a necessary step for county or local treasurers who need to request billing a seller for additional taxes, interest, and penalties following a Principal Residence Exemption (PRE) denial. This form is crucial when such a denial has occurred and the property in question has since been transferred to a bona fide buyer. The process calls for precision and attention to detail, requiring specific documentation and a thorough understanding of the circumstance that led to the request for billing the seller. Below is a step-by-step guide designed to help simplify these requirements and ensure the form is completed correctly.

- Begin with PART 1: PROPERTY INFORMATION. You need to provide all details about the property, including the Property Tax Identification Number, Street Address, County, whether it's in a Township or City (check the appropriate box and write the name), and the ZIP Code. Each property requires a separate form.

- Next, move on to PART 2: PRE DENIAL AND INTEREST INFORMATION. Here, you must attach a copy of the denial notice. Fill in details about who denied the PRE (Department of Treasury, County, Township/City Assessor), the date of denial, and to whom the denial was issued. For each year PRE was denied, list the school operating millage rate, taxable value, and the due date of the school operating taxes (Summer, Winter, or combined).

- In PART 3: BILLING INFORMATION, attach a copy of the deed, land contract, or other legally executed document that transferred the property from the seller to the bona fide purchaser. Enter the first and last name of the seller(s) to be billed (they must not be the current owner), and if a company is involved, include the company name and Federal Employer Identification Number (FEIN), along with the current mailing address. If the seller(s) being billed is not the same person(s) or entity issued the denial notice in Part 2, explain and attach any supporting documents.

- Finally, complete PART 4: COUNTY OR LOCAL UNIT CONTACT INFORMATION with the name and title of the person who prepared the form, as well as the name of the county or local unit, the preparer’s signature, date, telephone number, and email address.

- After completing the form and ensuring all required documents are attached, mail it to Michigan Department of Treasury, PRE Unit, P.O. Box 30440, Lansing, MI 48909.

Remember, the accuracy of this information and the completeness of the required documentation are essential to avoid delays or inaccuracies in processing. Providing detailed and precise information will facilitate a smoother and more efficient handling of your request.

Crucial Points on This Form

What is the purpose of the Michigan 4816 form?

The Michigan 4816 form is designed for use by county or local treasurers to request that the Department of Treasury bill a seller for additional taxes, interest, and penalties following a Principal Residence Exemption (PRE) denial. This situation occurs when property ownership transfers to a bona fide purchaser, and the property was previously denied PRE. Its primary function is to ensure that the financial liability for the denial of PRE does not pass to the new owner but remains with the seller.

Who needs to complete the Michigan 4816 form?

The Michigan 4816 form must be filled out and submitted by the county or local treasurer that has possession of the tax roll. This requirement applies when they need to request the Department of Treasury to bill a seller for the owed amounts resulting from a PRE denial, in cases where the property has already been transferred to a bona fide purchaser.

What documents are required to be submitted along with the Michigan 4816 form?

When submitting the Michigan 4816 form, several documents must accompany it to ensure accurate processing. These include:

- A copy of the PRE denial notice.

- A copy of the deed, land contract, or another legal document that proves the transfer of property from the seller to the bona fide purchaser.

- If the seller being billed is not the person or entity to whom the denial notice was issued, an explanation with supporting documents must be attached.

What happens if the Michigan 4816 form or its supporting documents are incomplete?

Incomplete submissions of the Michigan 4816 form or failure to provide all required supporting documentation can lead to inaccurate billings or delays in the processing of the request. The Department of Treasury needs complete and accurate information to correctly assess and bill the additional taxes, interest, and penalties to the seller. Therefore, it's crucial that the county or local treasurer submitting the form ensures all information is present and correct.

Common mistakes

Filling out the Michigan Department of Treasury 4816 form, related to billing a seller following a Principal Residence Exemption (PRE) denial, requires careful attention to detail. Unfortunately, many individuals make errors that can delay or affect the process negatively. One common mistake is not providing all the required property information in Part 1 of the form. Every field in this section is crucial for the Michigan Department of Treasury to process the request accurately, including the property tax identification number and the detailed address information.

Another frequent error occurs in Part 2, where individuals fail to attach a copy of the PRE denial notice. This document is essential as it substantiates the request to bill the seller for additional taxes, interest, and penalties. Additionally, accurately listing the denial year(s) along with the corresponding school operating millage rate and taxable value is vital. Any omission or inaccurately reported figures in this section can lead to incorrect billing.

The requirement to submit legal documentation evidencing the transfer of property to a bona fide purchaser in Part 3 is also often overlooked. Without a copy of the deed, land contract, or other legally executed document, the Department cannot verify the legitimacy of the sale or the bona fide status of the purchaser, which is necessary to proceed with billing the correct party.

Incorrectly identifying the seller or providing incomplete information about the seller in Part 3 is another pitfall. It's essential to list every seller to be billed accurately, including their current mailing address. If the seller is a company, the form requires not only the name but also the complete mailing address and the Federal Employer Identification Number (FEIN).

A misunderstanding related to who should be billed – the seller listed in Part 3 of the form or the current owner of the property – can lead to errors. This distinction is critical because the form specifically asks for the seller to be billed following a PRE denial, not the current owner. Assuming the two are the same without verifying can cause unnecessary confusion and delay.

Some filers mistakenly believe that if the seller has changed, no explanation or additional documentation is necessary. However, if the seller to be billed is not the person or entity that was issued the denial notice, an explanation for this discrepancy is required in Part 3, along with supporting documents.

Submitted forms often lack necessary contact information in Part 4 or provide inaccurate details. This part requires the name, title, telephone number, and email address of the person from the county or local unit who prepared the form. Missing or incorrect information here can impede communication and clarification efforts, further delaying processing.

Additionally, the neglect to sign the form by the person who prepared it or the omission of the submission date can result in the form being considered incomplete. The preparer's signature and the date are affirmations of the form’s accuracy and readiness for review by the Department of Treasury.

Last but not least, failing to mail the completed form and all supporting documentation to the correct address provided at the bottom of the form can result in the Department of Treasury never receiving the necessary information to proceed with the billing request. Ensuring that all materials are sent to the correct location is a simple but crucial step in this process.

Documents used along the form

When dealing with the Michigan 4816 form, specifically designed for situations following a Principal Residence Exemption (PRE) denial, it's important to recognize that the handling of this scenario requires a comprehensive approach, including the preparation and submission of various documents. The Michigan 4816 form is a crucial document for county or local treasurers in these instances, but it is typically not the only document needed to complete the process effectively.

- Deed or Land Contract: This document is crucial as it proves the transfer of property from the seller to the bona fide purchaser. It shows that the transaction has occurred and establishes the new ownership. This is vital for establishing who is liable for the additional taxes, interest, and penalties following a PRE denial.

- PRE Denial Notice: A copy of the PRE denial notice issued by the Department of Treasury, county, township, or city assessor must be attached with the Michigan 4816 form. This document is key as it provides details on the denial, including the rationale and the period for which the PRE was denied, forming the basis for the billing request.

- Property Tax Bill or Statement: While not always attached with the form submission, having the most recent property tax bill or statement at hand can be essential. It provides a current assessment of the property’s taxable value and ensures that the correct amount of additional tax, interest, and penalties are being billed to the seller.

- Supporting Documents for Special Circumstances: In rare situations where the property was acquired by an entity through foreclosure or other means before being sold to a bona fide purchaser, additional documents explaining these circumstances should be included. These can come in the form of legal documents, court orders, or formal statements outlining the situation, which can affect who is billed for the additional taxes.

Dealing with a Principal Residence Exemption (PRE) denial and the subsequent billing of additional taxes, interest, and penalties to the seller involves navigating through a series of bureaucratic steps and legal documentation. Each document plays a vital role in painting the full picture of ownership and liability. It's crucial that all documents are gathered, accurately completed, and submitted as required to ensure a smooth process. This holistic approach ensures that the local or county treasurer can effectively communicate with the Michigan Department of Treasury and rectify any issues related to PRE denials. Understanding and managing these documents can significantly reduce the potential for errors and delays in processing.

Similar forms

Mortgage Application Forms: These forms, similar to the Michigan 4816, often require detailed property information, including tax identification numbers and property location, to guide decisions regarding funding or mortgage approvals. Just as the 4816 form ensures proper billing after a PRE denial, mortgage applications determine eligibility and terms for a loan.

Property Tax Appeal Forms: These documents, much like the Michigan 4816, are used to challenge or appeal property tax assessments or decisions. Both types of forms necessitate detailed property and ownership information, including submission of supporting documents to make a case to the relevant authority.

Homestead Exemption Forms: Common in many states, these forms allow homeowners to claim an exemption on a portion of their property tax similar to the PRE exemption in Michigan. Detailed property information and proof of residency are required, paralleling the Michigan 4816 form's requirements for handling PRE denial billing issues.

Real Estate Transfer Declarations: These documents are filed when property changes hands, similarly requiring details about the property, the parties involved, and the terms of transfer – just as the Michigan 4816 form needs details about the seller and the deed or transfer document for billing after a PRE denial.

Property Tax Rebate Application Forms: Similar to the Michigan 4816, these forms are used to apply for a property tax rebate or refund, often requiring the property's tax identification number, owner information, and evidence of eligibility like a PRE denial in Michigan's case.

Land Use Application Forms: These forms, employed to request changes in zoning or land use, also demand comprehensive property information, such as identification numbers and ownership details, akin to the information required on the Michigan 4816 form.

Building Permit Applications: Required for many types of construction and renovation projects, these applications share similarities with the Michigan 4816 in that they require property identification, ownership details, and sometimes, details about the property's tax status.

Change of Address Forms for Property Tax Billing: These forms, used to update mailing addresses for property tax billing, necessitate precise property identification and ownership details similar to those required on the Michigan 4816 form, ensuring that tax bills are sent to the correct address after a PRE denial.

Dos and Don'ts

When completing the Michigan Department of Treasury 4816 form, for the Request to Bill Seller Following a Principal Residence Exemption (PRE) Denial, it’s vital to follow specific dos and don’ts to ensure the process is smooth and the submission is successful. Here is a list of things you should and shouldn't do:

Things You Should Do:- Read the instructions carefully before starting the form to understand each section's requirements.

- Use a separate form for each property tax identification number to keep the information organized and clear.

- Attach a copy of the PRE denial notice along with the form as it is crucial for the denial year and tax information sections.

- Ensure that the deed, land contract, or other legally executed document is attached when submitting the form to confirm the transfer of property to a bona fide purchaser.

- Fill out the seller’s current mailing address and all required information in Part 3 to avoid any billing issues.

- Provide complete county or local unit contact information in case the Department needs clarification or has questions.

- Mail the completed form and supporting documents to the specific address given at the bottom of the form.

- If the seller to be billed is a company, include the complete company name, address, and Federal Employer Identification Number (FEIN).

- Don't leave any fields incomplete; an incomplete form can result in inaccurate billings or processing delays.

- Avoid submitting the form without the required supporting documents as these are essential for the Michigan Department of Treasury to process your request accurately.

- Do not use the form if the property was transferred and the new owner is not a bona fide purchaser, as specified in the instructions.

- Don't provide outdated or incorrect contact information; this may result in delays or failure in communication.

- It's important not to ignore the instructions regarding rare exceptions (for example, when the acquiring entity is different from the one issued the denial notice), which require additional explanation and documentation.

- Don't forget to list the school operating millage rate, taxable value, and the due date for each denied year requiring billing by the Department.

- Avoid submitting the form to an incorrect address; ensure it is sent to Michigan Department of Treasury, PRE Unit, P.O. Box 30440, Lansing, MI 48909.

- Finally, do not disregard the advice to contact the PRE Unit for questions, as they can provide valuable assistance.

Misconceptions

There are several common misconceptions about the Michigan 4816 form, often leading to confusion or errors in its application. Let’s clear up four of these misunderstandings:

- Misconception 1: Anyone Can Submit Form 4816

Only the county or local treasurer holding the tax roll can submit Form 4816 to the Michigan Department of Treasury. This form is used specifically to request billing the seller for taxes, interest, and penalties after a Principal Residence Exemption (PRE) denial when property has been transferred. It's not for general taxpayer use.

- Misconception 2: The Form Is Used for Current Owners

Form 4816 is not targeted at current property owners but rather the sellers of the property following a PRE denial. There’s often confusion that it pertains to the current owner, but in reality, it deals with a past owner who sold the property after a PRE denial.

- Misconception 3: The Form Applies to All Buyers Equally

The purpose of Form 4816 is not to address all buyers but specifically bona fide purchasers. A bona fide purchaser is someone who buys the property in good faith, unlike those who acquire it through inheritance, foreclosure, or without valuable consideration. This distinction ensures the property is not unfairly burdened with past owners' liabilities.

- Misconception 4: Form 4816 Can Be Used to Bill For Any Tax Year

There's a misunderstanding that this form can be used to bill for any tax year's worth of additional taxes, interest, and penalties due to a PRE denial. In reality, it refers only to the tax years up to and including the year of the sale to a bona fide purchaser. This highlights the importance of the sale and transfer in the process.

Understanding these key points helps clarify the role and application of Form 4816, simplifying a complex process for those involved in property transactions in Michigan.

Key takeaways

Understanding the Michigan Department of Treasury 4816 form is crucial for ensuring that sellers are appropriately billed for additional taxes, interest, and penalties following a Principal Residence Exemption (PRE) denial. Here are five key takeaways that can help navigate the specifics of filling out and using the form effectively:

- Submission Requirements: The 4816 form must be submitted by either the county or local treasurer, depending on who holds the tax roll, when they need the Department of Treasury to bill a seller due to a PRE denial where the property has changed hands to a bona fide purchaser. This process allows the new owner to avoid being unjustly penalized for previous discrepancies.

- Documentation is Key: To avoid delays and ensure accurate billing, it is imperative to attach all required documents to the form. This includes a copy of the PRE denial notice, and if applicable, the deed, land contract, or any legally executed document that facilitated the property transfer to the bona fide purchaser.

- Clear Identification of Parties: Part 1 requires detailed property information, while Part 2 focuses on PRE denial and interest details, including who issued the denial and to whom it was issued. Notably, the seller being billed should not be the current property owner. This distinction is crucial for the Department of Treasury to direct the bill appropriately.

- Bona Fide Purchaser Clarification: The form serves to ensure that only sellers, not bona fide purchasers (those who buy in good faith for valuable consideration), are billed for additional taxes, interest, and penalties due to a PRE denial. It's important to understand the definition of a bona fide purchaser to apply this rule correctly.

- Completion and Submission: Every section of the form must be fully completed, and along with the necessary attachments, mailed to the Michigan Department of Treasury, PRE Unit. Failing to provide complete and accurate information or the required documents can lead to processing delays, making it vital to review the form thoroughly before submission.

Properly filling out and submitting the Michigan 4816 form is integral to ensuring that tax liabilities are assigned fairly following a PRE denial. By adhering to the guidelines and ensuring all documentation is in order, stakeholders can navigate this process with greater efficiency and accuracy.

Popular PDF Templates

How Old Do You Have to Be to Get Your Ged - Accelerate your career or education path by having your GED transcript sent to key institutions.

How Many Times Can a Judgement Be Renewed in Michigan - It marks the completion of court-imposed financial responsibilities by the defendant.