Michigan 4652 PDF Form

In the state of Michigan, navigating the complexities of legal forms is a crucial step for individuals pursuing various legal actions. Among these documents, the Michigan 4652 form stands out as an essential tool. This form serves a pivotal role, assisting applicants in a specific area of state regulatory compliance. Its significance cannot be overstated, as it directly impacts the applicant's ability to proceed with their intended legal action under Michigan law. The form is designed to be comprehensive, yet straightforward, ensuring that individuals can complete it with accuracy and efficiency. By providing necessary personal and case-related information, applicants are guided through the process, which is a testament to the form's role in facilitating a smoother interaction with Michigan's legal and regulatory frameworks. Understanding the major aspects of this form is the first step toward achieving one's legal objectives within the state, highlighting its position as a key component in the legal process in Michigan.

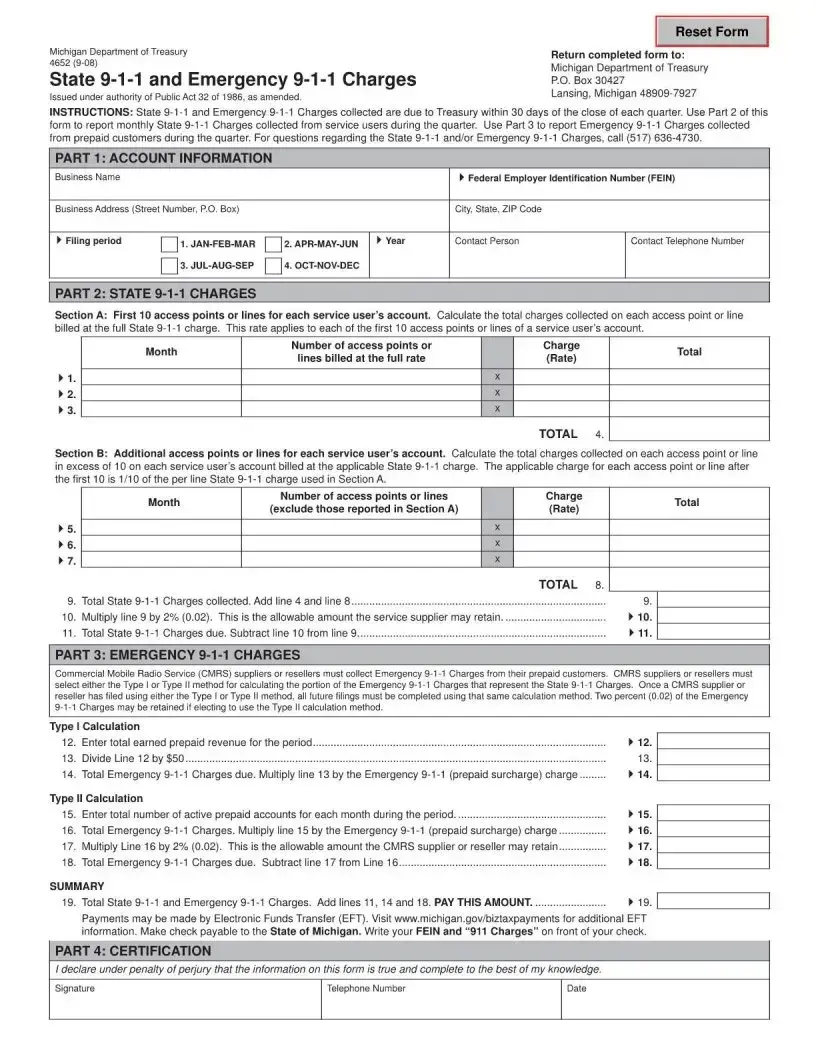

Preview - Michigan 4652 Form

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Michigan 4652 form is used for reporting specific types of transactions or changes in business status to the relevant state authorities. |

| Governing Law | This form is governed by Michigan state laws relevant to the type of transaction or change being reported. |

| Who Must File | Businesses operating within Michigan that undergo certain transactions or changes must complete and submit this form. |

| Submission Method | Depending on the specific requirements, the form may be submitted online or in paper form to the designated state department. |

Guidelines on Utilizing Michigan 4652

Filling out Form 4652 for the state of Michigan is an important step in ensuring your documentation is up to date. Whether you are handling this form for professional or personal reasons, understanding how to complete it correctly will save time and effort. Following the necessary steps carefully will make the process more manageable and help ensure your submission is successful. After completing the form, it's advisable to review all the information provided to avoid any errors. Then, sign where required and submit the form to the designated address or online portal, if applicable. Below, you'll find step-by-step instructions to assist you in filling out the form accurately.

- Start by obtaining a copy of Form 4652 from the official website of the state of Michigan or by visiting a local government office that provides them.

- Read through the entire form first to familiarize yourself with the information required and the instructions provided.

- Fill in your personal details in the designated sections. This typically includes your full name, address, and contact information.

- Provide any additional information that the form requests. This could pertain to employment, financial details, or specific circumstances relevant to the form's purpose.

- Make sure to answer every question to the best of your knowledge. If a question is not applicable to your situation, indicate this with a "N/A" or "Not Applicable."

- Review your answers and ensure all the information provided is accurate and complete. Pay special attention to numbers and dates to ensure they are correct.

- If the form requires documentation to support your entries, attach these documents. Ensure they are clearly legible and properly secured to the form.

- Sign and date Form 4652 in the designated areas. This usually requires a handwritten signature, but check if a digital signature is acceptable if submitting online.

- Before submitting the form, make a copy for your records. This will be useful for reference or in case the original submission is lost.

- Submit the completed form and any additional documentation to the address provided on the form or through the official online portal if applicable. Ensure you follow any specific submission guidelines noted on the form.

Once you have submitted Form 4652, the relevant Michigan department will process your submission. Processing times can vary, so it is a good idea to note when you submitted your form and follow up if necessary. Keep your copy of the submitted form and any submission confirmations you receive as part of your personal records.

Crucial Points on This Form

What is the Michigan 4652 form?

The Michigan 4652 form, also known as the Request for Hearing, is a document used in the state of Michigan to request a formal hearing before a judge or administrative hearing officer. This form is commonly used in various situations where individuals or entities wish to dispute or appeal decisions made by state agencies or departments. It provides a structured process for bringing grievances or disputes for review, allowing for a fair and impartial hearing.

Who needs to fill out the Michigan 4652 form?

Individuals or representatives of entities who seek to challenge decisions or actions taken by Michigan state agencies or departments need to fill out the Michigan 4652 form. This could include, but is not limited to, disputes related to taxes, unemployment benefits, licensing, or regulatory decisions. Filling out this form is the initial step in the formal appeal process, enabling the person or entity to have their case heard before an impartial decision-maker.

How do you obtain the Michigan 4652 form?

The Michigan 4652 form can be obtained in several ways:

- Downloading it from the official website of the Michigan Department of State or the specific agency involved in the dispute.

- Requesting a copy by contacting the customer service or support center of the relevant state agency.

- Visiting a local office of the state agency in question to pick up a hard copy.

What information do you need to complete the Michigan 4652 form?

To complete the Michigan 4652 form correctly, you will need to provide:

- Your personal information, such as full name, address, and contact details, for communication purposes.

- The case or account number related to the decision or action you are appealing, if applicable.

- A detailed explanation of the decision or action being contested and the reasons for the appeal.

- Any relevant evidence or documentation that supports your appeal should be referenced in the form and attached if required.

Where should the completed Michigan 4652 form be submitted?

Once completed, the Michigan 4652 form should be submitted to the specific Michigan state agency or department whose decision or action is being appealed. Each agency may have a designated office or division for handling appeals, so it is crucial to send the form to the correct address. This information can usually be found on the agency's official website or by contacting their customer service. Ensure to keep a copy of the form and any accompanying documents for your records.

What happens after submitting the Michigan 4652 form?

After the Michigan 4652 form is submitted, the following steps typically occur:

- The agency will review the submitted form to ensure it is complete and meets the requirements for a formal appeal.

- If the appeal meets the necessary criteria, the agency will schedule a hearing date and notify you of the time and place.

- During the hearing, both you (or your representative) and representatives from the state agency will have the opportunity to present evidence, testify, and make arguments regarding the appeal.

- After the hearing, the judge or administrative hearing officer will make a decision based on the information provided. You will receive notification of the decision, usually in writing.

Common mistakes

When filling out the Michigan 4652 form, one common mistake is not verifying the accuracy of personal information. Individuals often overlook the importance of double-checking their name, address, and social security number. This oversight can lead to processing delays or issues with form acceptance.

Another issue is leaving sections blank that should be completed. Many times, people skip over questions they may not immediately know the answer to, intending to return to them later, but then forget. Every question that applies to the filer's situation should be answered to ensure the form is processed correctly.

A third mistake involves misunderstanding the instructions for specific questions. Not thoroughly reading or misinterpreting the guidelines can lead to incorrect responses, which might impact the individual's situation negatively. It's crucial to read each instruction carefully and seek clarification if necessary.

Individuals also frequently use incorrect dates or formats when providing information. Date format errors, such as writing the month before the day when the form specifies the opposite, can cause confusion and potential delays in processing the form.

Not signing the form before submission is another common error. A signature is often required to verify the information provided; therefore, an unsigned form may be considered incomplete and could be returned or not processed.

Submitting outdated versions of the form is also a mistake people make. Forms like Michigan 4652 are periodically updated. Using an old version might result in the rejection of the form since it may lack current and necessary information fields.

Another error is not keeping a copy of the form for personal records. Individuals often submit the only copy they have, leaving them without necessary documentation if there are queries or issues with their submission. Always keep a copy for personal records.

Last but not least, failing to consult with a professional when unsure about how to properly fill out the form can lead to mistakes. Whether it's misunderstanding complex sections or missing crucial details, professional advice can help avoid errors that could result in significant setbacks.

Documents used along the form

When dealing with the Michigan 4652 form, which is typically associated with business operations and specific transactions within the state of Michigan, individuals or entities may find it necessary to complement this form with additional documentation. This need arises from the requirement to provide comprehensive details or adhere to legal requisites tied to the form’s context. The documents listed here are often submitted alongside the Michigan 4652 form to ensure that all aspects of the transaction or operation are thoroughly and accurately represented.

- Articles of Incorporation: This document is essential for businesses aiming to establish themselves legally as a corporation within Michigan. It details the corporation's fundamental aspects, such as its name, purpose, and the information concerning its incorporators and initial directors.

- Operating Agreement: Particularly relevant for LLCs, this document outlines the operational procedures, financial decisions, and rules governing the relationship among the members of an LLC. It's pivotal in establishing rights and responsibilities.

- Employer Identification Number (EIN) Confirmation Letter: Issued by the IRS, this document serves as proof of a business's EIN, a unique number that is vital for tax purposes and needed for hiring employees, opening a bank account, and conducting other business activities.

- Business License Application: Depending on the nature of the business and its location, various state or local licenses may be required. This document initiates the process of obtaining those necessary permits to operate legally within Michigan.

- Zoning Permit: This is crucial for businesses to ensure their operations are in compliance with local zoning laws, which dictate where certain types of businesses can physically operate within the municipality or county.

- Property Deed or Lease Agreement: For businesses that own or lease their operational spaces, this document provides legal proof of the right to use the property for business purposes and outlines the terms of use.

- Annual Report: Required for certain entities on a yearly basis, this document updates the state on the business's activities and changes in structure or management, ensuring compliance with state regulations.

In summary, while the Michigan 4652 form is significant in its own right, the necessity of accompanying documents cannot be overstated. These additional forms and documents serve to provide a full picture of the business's legal, operational, and structural status, ensuring that all the legal requirements are met in a comprehensive manner. Whether incorporating a business, adhering to tax obligations, or ensuring operational compliance, each document plays a crucial role in the holistic approach to business documentation within Michigan.

Similar forms

Michigan 5080 Form: This form, used for Sales, Use, and Withholding Taxes monthly/quarterly return in Michigan, is similar to the Michigan 4652 form in its function as a tax-related document. Both forms are integral to the tax filing process, focusing on different types of tax responsibilities and help businesses in Michigan comply with state tax regulations.

California Form BOE-401-A2: This document is used for reporting sales tax in California. Like the Michigan 4652 form, it is designed for tax reporting purposes, specifically for businesses to declare their sales tax. Although it serves a similar purpose, it is tailored to California's tax laws, illustrating how states have unique forms for managing sales tax.

New York ST-100 Form: This form is used for quarterly sales tax returns in New York. Similar to the Michigan 4652 form, the ST-100 is essential for businesses to report and pay sales taxes. Both forms highlight the necessity for businesses to periodically report their taxable sales, underscoring the uniformity in tax reporting practices across states, albeit with state-specific details.

IRS Form 940: This federal form is used for reporting unemployment taxes. While it is a federal form and not state-specific, it shares similarities with the Michigan 4652 form in terms of its purpose of tax reporting. Both forms are part of broader tax compliance and report different types of taxes—unemployment tax at the federal level and state-specific taxes in the case of the Michigan 4652 form.

Texas Sales and Use Tax Return (Form 01-114): Similar to the Michigan 4652 form, this document is used by businesses in Texas to report and pay sales and use taxes. Both forms cater to the specific needs of state tax systems, allowing businesses to maintain compliance with their tax obligations. Each form, though serving an analogous function, is customized to fit the tax codes and regulations of its respective state.

Dos and Don'ts

When filling out the Michigan 4652 form, there are several dos and don'ts to keep in mind to ensure the process is completed accurately and efficiently. Below are ten essential guidelines:

Do:- Read through the entire form before starting to fill it out, ensuring a clear understanding of all the requirements and questions.

- Use black or blue ink if the form is being filled out manually to ensure legibility.

- Provide accurate and up-to-date information in every section to avoid processing delays.

- Ensure all signatures and dates are provided where required; these are crucial for the validation of the form.

- If unsure about a question, seek clarification from a Michigan Department of form guidance or a professional to avoid errors.

- Leave any required fields blank; incomplete forms may be returned or rejected.

- Use correction fluid or tape; if a mistake is made, it's best to start over with a new form to maintain cleanliness and readability.

- Guess on any information; verify all details to ensure their accuracy.

- Overlook the instructions for specific sections; each part of the form might have unique requirements.

- Rush through filling out the form; taking the time to double-check responses can prevent mistakes.

Misconceptions

Misconceptions about legal forms can lead to unnecessary confusion and anxiety. Below are six common misunderstandings about the Michigan 4652 form, aiming to provide clarity and assist in navigating this process more smoothly.

Only businesses need to file it. Many believe Michigan 4652 form is solely for businesses. However, it's designed for both individuals and businesses that engage in certain transactions. Understanding its applicability can prevent overlooking potential obligations.

It's the same as federal forms. People often confuse state forms with federal ones, assuming they serve identical purposes. The Michigan 4652 form, however, has specific state requirements and is separate from any federal paperwork, highlighting the importance of adhering to state-specific guidelines.

Filing it once is enough. Another misconception is that once submitted, the form no longer requires attention. Depending on the circumstances, it might need to be filed annually or according to specific triggering events, emphasizing the necessity to stay informed about filing obligations.

Electronic submission isn’t allowed. In today's digital age, many still mistakenly believe that all legal forms must be submitted in paper format. For the Michigan 4652 form, electronic filing options are available, offering convenience and efficiency.

There are no deadlines. Like most legal forms, the assumption that the Michigan 4652 can be submitted at any time leads to procrastination. However, there are specific deadlines to adhere to. Missing these deadlines can result in penalties or other negative consequences, making it crucial to mark calendar dates.

It doesn’t require personal information. A common myth suggests that forms like Michigan 4652 limit personal information to protect privacy. While privacy is a concern, certain personal details are crucial for identification and verification processes, balancing the need for privacy with the requirements of the law.

Understanding the facts about the Michigan 4652 form can demystify the process, ensuring compliance, and reducing the risk of errors. When in doubt, seek professional advice to navigate these requirements effectively.

Key takeaways

Understanding the nuances of the Michigan 4652 form is crucial for anyone looking to navigate the complexities of legal documentation within the state. This form, pivotal in its function, encompasses a range of applications that require a meticulous approach to completion and submission. Here are four key takeaways to guide you through the process:

- Accuracy is paramount: When filling out the Michigan 4652 form, every detail matters. From personal information to the specific data requested on the form, ensuring accuracy is non-negotiable. Mistakes or inaccuracies can lead to delays or even the rejection of your application. Double-check all entries before submission.

- Understand the form's purpose: The Michigan 4652 form serves a specific legal function. Whether it's used for registration, application, or certification, understanding its purpose will help you fill it out correctly. Knowing what the form is for allows you to gather all necessary information beforehand, streamlining the process.

- Timeliness matters: Just as with many legal documents, there's often a timeline associated with the Michigan 4652 form. Missing a deadline can have significant repercussions, from delaying legal processes to incurring penalties. Always be aware of the time frame you're working within, and strive to submit the form well in advance of any deadlines.

- Keep a copy for your records: After you've filled out and submitted the Michigan 4652 form, it's wise to keep a copy for your own records. This ensures you have a reference in case of discrepancies or if you need to revisit the information you've provided. It's also helpful for future legal or administrative needs.

By adhering to these guidelines, individuals can navigate the process of completing and using the Michigan 4652 form with greater ease and confidence. Every form serves as a key piece in the larger puzzle of legal and governmental documentation, and its proper handling is essential for smooth operational proceedings.

Popular PDF Templates

Michigan Department of Health and Human Services - A submission process for Michigan entities, marking the proactive disclosure of lead abatement plans to health authorities.

Michigan 4363 - A detailed application process outlined in form 4363 for accessing Michigan's tuition grants for veterans' children.

What Is a Sales Tax Permit - Describes the roles of corporate officers in managing and ensuring the corporation's tax compliance.