Michigan 4568 PDF Form

Within the complex landscape of Michigan's business taxation, the Michigan Department of Treasury's 4568 form plays a critical role in calculating a business's tax liability after considering nonrefundable tax credits. This form, officially known as the 2011 Michigan Business Tax Nonrefundable Credits Summary, operates under the authority of Public Act 36 of 2007. It meticulously summarizes the various nonrefundable credits a business can claim, including but not limited to compensation and investment tax credits, research and development credits, and credits for small businesses and renaissance zones. Each credit mentioned in the form has specific eligibility requirements and benefits, designed to encourage and support diverse business activities within Michigan. The form not only benefits standard taxpayers but also accommodates financial institutions, with certain restrictions on the credits that can be claimed by the latter. Special considerations are given to Unitary Business Groups (UBGs) regarding how credits are calculated and applied, emphasizing the form’s accommodating design for different business structures. Instructions provided with Form 4568 guide taxpayers through each line, ensuring clarity in the claiming process and aiding in the efficient preparation of tax returns. By detailing credits from compensation and investment to specific incentives for emerging industries, the form encapsulates key facets of Michigan’s approach to business taxation, fostering a supportive environment for businesses while streamlining the tax filing process.

Preview - Michigan 4568 Form

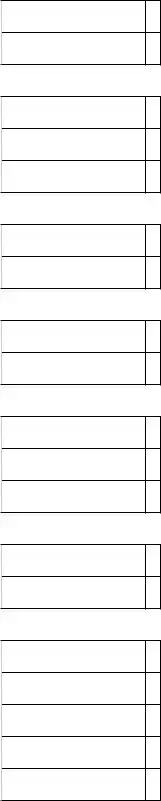

Michigan Department of Treasury 4568 (Rev.

Attachment 02

2011 MICHIGAN Business Tax Nonrefundable Credits Summary

Issued under authority of Public Act 36 of 2007.

Name |

Federal Employer Identiication Number (FEIN) or TR Number |

|

|

1. |

Tax before all credits from Form 4567, line 53, or Form 4590, line 26 |

1. |

|||

2. |

SBT credit carryforwards used from Form 4569, line 13 |

2. |

|||

3. |

Tax After SBT credit carryforwards. Subtract line 2 from line 1. |

|

|

|

|

|

If less than zero, enter zero |

3. |

|

00 |

|

4. |

a. Compensation and Investment Tax Credits from Form 4570, line 26 |

|

4a. |

||

|

b. If Form 4570, line 20, is negative, enter here as a negative number. Otherwise, leave blank |

|

4b. |

||

5. |

Research and Development Credit from Form 4570, line 33 |

5. |

|||

6. |

Tax After Research and Development Credit. Subtract lines 4a, 4b |

|

|

|

|

|

and 5 from line 3 (see instructions) |

6. |

|

00 |

|

7. |

Small Business Alternative Credit from Form 4571, line 13 or 19, whichever applies |

7. |

|||

8. |

Gross Receipts Filing Threshold Credit from Form 4571, line 27 |

8. |

|||

9. |

Tax After Gross Receipts Filing Threshold Credit. Subtract lines 7 and |

|

|

|

|

|

8 from line 6 (see instructions) |

9. |

|

00 |

|

10. |

Community and Education Foundations Credit from Form 4572, line 5 |

10. |

|||

11. |

Homeless Shelter/Food Bank Credit from Form 4572, line 9 |

11. |

|||

12. |

Tax After Homeless Shelter/Food Bank Credit. Subtract lines 10 and |

|

|

|

|

|

11 from line 9. If less than zero, enter zero |

12. |

|

00 |

|

13. |

NASCAR Speedway Credit from Form 4573, line 3 |

13. |

|||

14. |

Stadium Credit from Form 4573, line 6 |

|

14. |

||

15. |

If less than zero, enter as a negative number |

15. |

|||

16. |

Tax After |

|

|

|

|

|

line 12. If less than zero, enter zero |

16. |

|

00 |

|

17. |

Public Contribution Credit from Form 4572, line 14 |

17. |

|||

18. |

Arts and Culture Credit from Form 4572, line 19 |

|

18. |

||

19. |

Tax After Arts and Culture Credit. Subtract lines 17 and 18 from line |

|

|

|

|

|

16 (see instructions) |

19. |

|

00 |

|

20. |

Next Energy Business Activity Credit from Form 4573, line 12 |

20. |

|||

21. |

Renaissance Zone Credit from Form 4573, line 14 |

21. |

|||

22. |

Historic Preservation Credit Net of Recapture from Form 4573, line 17b |

22. |

|||

23. |

23. |

||||

24. |

New Motor Vehicle Dealer Inventory Credit from Form 4573, line 27 |

24. |

|||

+ 0000 2011 15 01 27 6

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Continue on Page 2

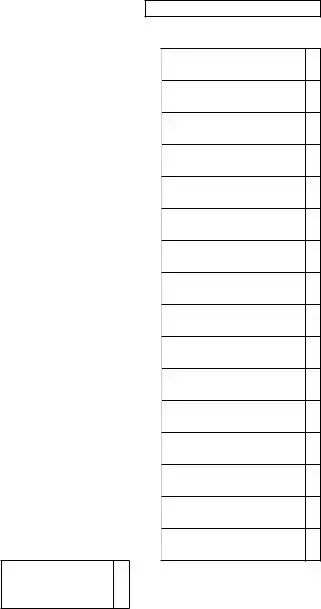

4568, Page 2 |

FEIN or TR Number |

25. |

Large Food Retailer Credit from Form 4573, line 31 |

25. |

26. |

26. |

|

27. |

Bottle Deposit Administration Credit from Form 4573, line 39 |

27. |

28. |

MEGA Federal Contract Credit from Form 4573, line 41 |

28. |

29. |

Biofuel Infrastructure Credit from Form 4573, line 44 |

29. |

30. |

Individual or Family Development Account Credit from Form 4573, line 50 |

30. |

31. |

Bonus Depreciation Credit from Form 4573, line 54 |

31. |

32. |

International Auto Show Credit from Form 4573, line 57 |

32. |

33. |

Brownield Redevelopment Credit from Form 4573, line 59 |

33. |

34. |

Private Equity Fund Credit from Form 4573, line 64 |

34. |

35. |

Film Job Training Credit from Form 4573, line 69 |

35. |

36. |

Film Infrastructure Credit from Form 4573, line 75 |

36. |

37. |

MEGA |

37. |

38. |

Anchor Company Payroll Credit from Form 4573, line 80 |

38. |

39. |

Anchor Company Taxable Value Credit from Form 4573, line 82 |

39. |

40. |

Total Nonrefundable Credits. Add lines 2, 4a, 4b, 5, 7, 8, 10, 11, 13, 14, 15, 17, 18, and 20 through 39. |

|

|

Enter total here and carry total to Form 4567, line 54, or Form 4590, line 27 |

40. |

41.Tax After Nonrefundable Credits. Subtract line 40 from line 1. If less than zero, enter zero. (This line must be equal to Form 4567, line 55,

or Form 4590, line 28.) |

41. |

00 |

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

+ 0000 2011 15 02 27 4

Instructions for Form 4568

Michigan Business Tax (MBT) Nonrefundable Credits Summary

Purpose

The purpose of this form is to determine a taxpayer’s tax liability after application of nonrefundable tax credits.

Form 4568 is intended to summarize all applicable nonrefundable credits. Speciic eligibility criteria, including varying credit carryforward life spans, apply to each of the

nonrefundable credits. For more details about each of the

credits, refer to the MBT Act or the instructions for the speciic

forms referenced on this form.

NOTE: This form may be used by both standard taxpayers and inancial institutions. Insurance companies use the

Miscellaneous Credits for Insurance Companies (Form 4596) to claim credits for which they may be eligible. Of the credits listed on this form, inancial institutions may only claim the following:

•Single Business Tax (SBT) Credit Carryforwards

•Compensation Credit

•Renaissance Zone Credit

•Historic Preservation Credit

•Individual or Family Development Account Credit

•Brownield Redevelopment Credit

•Film Infrastructure Credit.

The goal of arranging credits in this fashion is to minimize the need for taxpayers to go through all the available forms before deciding which ones may be applicable to them. Under the present arrangement, taxpayers are able to identify the forms pertaining to them, and eficiently prepare the tax return. Taxpayers should claim all credits for which they are eligible.

Special Instructions for Unitary Business Groups

Credits are earned and calculated on either an

statute.

be attributed an entity type based on the composition of its members.

Complete one Form 4568 for the group.

Further UBG instructions are provided on the forms where the

credits are calculated.

Lines not listed are explained on the form.

NAME AND ACCOUNT NUMBER: Enter name and account number as reported on page 1 of the applicable MBT annual return

(either the MBT Annual Return (Form 4567) for standard taxpayers or the MBT Annual Return for Financial Institutions (Form 4590)).

LINE 6: Although most of the entries on this form are credits that cause tax liability to decrease, if there is an entry on line 4b, subtracting that negative number will cause tax liability to

increase.

The total created by the calculations in this line cannot be less than zero. A total of less than zero is only possible through a

calculation error or an incorrect line entry.

LINE 9: The total created by the calculations in this line cannot be less than zero. A total of less than zero is only possible through a calculation error or an incorrect line entry.

LINE 16: Although most of the entries on this form are credits that cause tax liability to decrease, if there is a negative entry on line 15, subtracting that negative number will cause tax

liability to increase.

LINE 19: The total created by the calculations in this line cannot be less than zero. A total of less than zero is only possible through a calculation error or an incorrect line entry.

Include completed Form 4568 as part of the tax return iling.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Number and Revision Date | Michigan Department of Treasury 4568, Revision Date May 2011 |

| Form Purpose | Determines a taxpayer's tax liability after the application of nonrefundable tax credits. |

| Governing Law | Issued under the authority of Public Act 36 of 2007. |

| Applicability | Used by standard taxpayers and financial institutions, with specific credits available to insurance companies listed on Form 4596. Certain credits are exclusive to financial institutions. |

| Unitary Business Group (UBG) Instructions | Credits earned by UBG members are generally applied against the UBG's tax liability, with credits calculated on an entity-specific or group basis as per statutory provisions. |

Guidelines on Utilizing Michigan 4568

When dealing with the Michigan 4568 form, taxpayers aim to outline their tax liabilities after the application of nonrefundable tax credits. This form summarises all applicable nonrefundable credits, following specific eligibility criteria and credit carryforward life spans for each credit. To ensure accuracy and compliance, it's important for taxpayers to carefully follow step-by-step instructions for filling out this form, ensuring all applicable credits are claimed and calculated correctly.

- Enter the name as reported on the applicable Michigan Business Tax (MBT) annual return at the top of the form. This includes either Form 4567 for standard taxpayers or Form 4590 for financial institutions.

- Provide the Federal Employer Identification Number (FEIN) or TR Number next to the name at the top of the form.

- On line 1, enter the tax before all credits from Form 4567, line 53, or Form 4590, line 26.

- Fill in any Single Business Tax (SBT) credit carryforwards used on line 2, from Form 4569, line 13.

- Calculate the figure for line 3 by subtracting line 2 from line 1. If the result is less than zero, enter zero.

- For lines 4a and 4b, determine the Compensation and Investment Tax Credits from Form 4570, line 26, entering any negative amounts as directed.

- Enter the Research and Development Credit from Form 4570, line 33 on line 5.

- Calculate the Tax After Research and Development Credit on line 6 by subtracting lines 4a, 4b, and 5 from line 3, ensuring to follow any specific instructions if line 4b has a negative entry.

- Include figures for the Small Business Alternative Credit and Gross Receipts Filing Threshold Credit from Form 4571 on lines 7 and 8 accordingly.

- Determine the amount for line 9 by subtracting lines 7 and 8 from line 6, again ensuring that the resulting figure is not less than zero.

- Proceed to enter the Community and Education Foundations Credit and the Homeless Shelter/Food Bank Credit on lines 10 and 11 from Form 4572.

- Subtract lines 10 and 11 from line 9 to calculate the Tax After Homeless Shelter and Food Bank Credit on line 12.

- Continue with entries for specific credits such as the NASCAR Speedway Credit, Stadium Credit, and the Start-up Business Credit on lines 13 to 15, using Form 4573.

- Calculate the Tax After Start-up Business Credit on line 16, adjusting for any negative entries as necessary.

- Complete entries for the Public Contribution Credit, Arts and Culture Credit, and any others listed through line 24 on Form 4572 and Form 4573 as applicable.

- For lines 25 through 40, continue to fill in any other credits from Form 4573, such as the Large Food Retailer Credit, through to the Individual or Family Development Account Credit, adding these to get the Total Nonrefundable Credits.

- Finish by calculating the Tax After Nonrefundable Credits on line 41 by subtracting line 40 from line 1. Ensure the total is not less than zero.

After completing Form 4568, remember to attach it to the applicable MBT annual return form. Accurate and thorough completion of this form plays a vital part in the tax return filing process, helping both standard taxpayers and financial institutions to accurately determine their tax liability after all applicable nonrefundable tax credits have been accounted for.

Crucial Points on This Form

What is the purpose of the Michigan 4568 form?

The Michigan 4568 form, also known as the Business Tax Nonrefundable Credits Summary, is designed to summarize a taxpayer's tax liability after the application of nonrefundable tax credits. It encompasses a wide range of credits, each with specific eligibility criteria, including various carryforward life spans. This form ensures that taxpayers can efficiently decide which credits may apply to them, ultimately simplifying the tax return preparation process.

Who should file the Michigan 4568 form?

The form is meant for use by standard taxpayers and financial institutions under the Michigan Business Tax (MBT) Act. However, insurance companies are directed to use the Miscellaneous Credits for Insurance Companies (Form 4596) for eligible credits. Among the credits listed, financial institutions may only claim specific ones like the Single Business Tax (SBT) Credit Carryforwards and the Renaissance Zone Credit.

What are the key sections of the Michigan 4568 form?

The form includes various sections where taxpayers can enter details about different nonrefundable credits such as SBT credit carryforwards, Compensation and Investment Tax Credits, Research and Development Credit, Small Business Alternative Credit, among others. Each section requires the input of information from other forms related to specific credits.

How do Unitary Business Groups (UBGs) file the Michigan 4568 form?

UBGs should complete one Form 4568 for the group as a whole. Credits can be earned and calculated on either an individual entity basis or a group basis, depending on the statutory provisions for the credits. Intercompany transactions are generally not eliminated for credit calculations. Statutory provisions that are specific to entities are applied on a member-by-member basis within the UBG.

Are there any specific lines on the Michigan 4568 form that might increase tax liability instead of decreasing it?

Yes, while most entries on the form are aimed at decreasing tax liability through credits, there are exceptions. For example, a negative number entered on line 4b or line 15, when subtracted, actually increases tax liability. These entries reflect specific scenarios where tax liabilities are adjusted upwards.

What happens if the calculations on the Michigan 4568 form result in a total less than zero?

A total resulting in less than zero on lines such as line 9 or line 19 indicates a calculation error or an incorrect entry. The design of the form and its calculations ensures that tax liabilities cannot drop below zero through the application of these nonrefundable credits.

Where can taxpayers find more information or guidance on filling out the Michigan 4568 form?

For detailed guidance, taxpayers should refer to the instructions provided with the form, the Michigan Business Tax Act, or specific form instructions for the credits being claimed. Additionally, contacting a tax professional or the Michigan Department of Treasury directly can provide further assistance.

Common mistakes

Filling out the Michigan 4568 form accurately is crucial for businesses seeking to claim nonrefundable credits. However, errors are common and can lead to missed benefits or complications with the Michigan Department of Treasury. One frequent mistake is missing or incorrect Federal Employer Identification Numbers (FEIN) or TR Numbers at the beginning of the form. It's essential that this identification is accurately reported to ensure the form is associated with the correct entity.

Another area where mistakes occur is in the calculation of tax before all credits (line 1), where taxpayers might not correctly transfer the amount from Form 4567, line 53, or Form 4590, line 26. This baseline figure is critical as it impacts all subsequent calculations. Similarly, inaccuracies in reporting SBT credit carryforwards used (line 2) from Form 4569, line 13 can lead to an incorrect calculation of the tax after SBT credit carryforwards, distorting the taxpayer's true tax obligation.

Further errors are often found in lines 4a and 4b, where compensation and investment tax credits from Form 4570, line 26, and adjustments are made. The entry on line 4b is particularly prone to mistakes since it requires a negative number if Form 4570, line 20, is negative. Understanding that subtracting a negative number effectively increases the taxpayer’s liability requires careful attention to detail.

Numerous taxpayers overlook the need to accurately report the Research and Development Credit from Form 4570, line 33 (line 5), leading to an incorrect calculation of tax after this credit is applied. The sequential nature of the calculations on this form means that early errors can have a cascading effect, leading to a significant misrepresentation of the tax liability after nonrefundable credits are applied.

Another critical oversight involves the calculation of tax after Gross Receipts Filing Threshold Credit (line 9). Failing to subtract lines 7 and 8 from line 6 as instructed can result in an incorrect representation of tax liability, with possible under- or overestimation.

Incorrect entries on lines involving specific credits, such as the Homeless Shelter/Food Bank Credit (line 11) or the Renaissance Zone Credit (line 21), often happen due to misinterpretation of eligibility requirements or calculation errors. These lines demand accurate transcription of amounts from respective detailed forms. Overlooking these can lead to understated tax benefits.

The sum of all nonrefundable credits (line 40) is another area fraught with potential errors. This line requires accurate addition of various credits. Incorrect summation here can impact the final determination of tax after nonrefundable credits (line 41), potentially leading to an incorrect tax payment.

Failure to properly address negative numbers, particularly in the calculation of tax increases due to negative adjustments on lines such as 4b and 15, shows a misunderstanding of how subtraction of negative values works. This conceptual error can lead to an inaccurate tax liability projection.

Finally, overlooking the importance of completing Form 4568 as part of the tax return filing as directed in the instructions can result in an incomplete filing, potentially delaying the processing of nonrefundable credits. Ensuring that all forms are filled out correctly and submitted together is crucial for a smooth processing experience.

Documents used along the form

When preparing the Michigan Department of Treasury 4568 form, which is focused on summarizing nonrefundable credits for businesses, various other documents are often required. These documents are critical in accurately computing the tax credits and ensuring compliance with Michigan’s tax laws.

- Form 4567: This is the Michigan Business Tax Annual Return. It serves as the primary form for reporting the annual tax liability for businesses operating in Michigan. Tax before all credits, as mentioned in the Michigan 4568 form, is derived from this form.

- Form 4569: This document is used to document Single Business Tax (SBT) credit carryforwards. It helps in determining the SBT credit carryforwards used, which is necessary for line 2 of the 4568 form.

- Form 4570: Form 4570 details the Compensation and Investment Tax Credits and the Research and Development Credit. Data from this form are crucial for lines 4a, 4b, and 5 of the 4568 form.

- Form 4571: This form is utilized to calculate the Small Business Alternative Credit and the Gross Receipts Filing Threshold Credit. These credits are vital for lines 7 and 8 on the 4568 form.

- Form 4572: It focuses on credits related to Community and Education Foundations, Homeless Shelter/Food Bank, Public Contribution, and Arts and Culture. Inputs from this form are necessary for lines 10, 11, 17, and 18 of the 4568 form.

- Form 4573: This forms reports on several specific tax credits including the NASCAR Speedway Credit, Stadium Credit, Start-up Business Credit, and others related to energy, historic preservation, and various industry-specific incentives. These are vital for completing lines 13 through 24 and subsequent lines involving specific credits on the 4568 form.

- Form 4590: Used by financial institutions for the Michigan Business Tax Annual Return, providing the initial tax liabilities needed for the 4568 form's computations for those entities.

Ensuring all relevant forms are accurately completed and attached is crucial for correctly applying for nonrefundable credits on the Michigan 4568 form. This not only aids in compliance but also maximizes potential tax benefits for the business. Careful attention to each document’s requirements and deadlines will facilitate a smoother filing process.

Similar forms

Form 4567 (Michigan Business Tax Annual Return): Similar to Form 4568, Form 4567 is used by businesses to file their annual tax returns in Michigan. The crucial link between these two forms is that Form 4568 compiles the nonrefundable credits that will be carried over to Form 4567, directly affecting the tax liabilities reported.

Form 4590 (MBT Annual Return for Financial Institutions): This form shares a connection with Form 4568 in the way that it also deals with annual tax reporting for a specific sector – financial institutions. Credits summarized on Form 4568 may impact the liabilities on Form 4590.

Form 4570 (Compensation and Investment Tax Credits): Specifically mentioned on Form 4568, this document concerns the calculation of certain tax credits based on compensation and investment activities. Data from Form 4570 influences the total nonrefundable credits reported on Form 4568.

Form 4571 (Small Business Alternative Credit): This form's results feed directly into Form 4568, specifically for calculating the Small Business Alternative Credit and Gross Receipts Filing Threshold Credit, which are essential components of the overall tax credit summary.

Form 4572 (Community and Education Foundations Credit): The credits calculated on this form, including those for homeless shelters and food banks as well as for public contribution and arts and culture, are integral to the composite nonrefundable credits total on Form 4568.

Form 4573 (Various Business Credits): This form encompasses a wide array of business credits such as the NASCAR Speedway Credit, Stadium Credit, and Start-up Business Credit among others, all of which are summarized on Form 4568.

Form 4569 (SBT Credit Carryforwards): A direct link exists between these forms, where SBT credit carryforwards calculated on Form 4569 are utilized in the calculations on Form 4568, specifically to adjust the tax before all credits.

Form 4596 (Miscellaneous Credits for Insurance Companies): While Form 4568 is used largely by standard taxpayers and financial institutions, Form 4596 serves a similar purpose for insurance companies, allowing them to claim applicable nonrefundable credits.

Form 4597 (Sales and Use Tax Refund Request): Although dealing primarily with sales and use tax rather than business income tax, Form 4597 shares the conceptual framework of claiming refunds or credits similar to the various credits consolidated on Form 4568.

Form 4574 (MEGA Credits): This form, related to specific Michigan Economic Growth Authority (MEGA) credits, contributes to the compilation of nonrefundable credits on Form 4568, highlighting the interconnectedness of state tax incentives for businesses.

Dos and Don'ts

When filling out the Michigan 4568 form, it is important to pay attention to details and follow specific guidelines to ensure accuracy and compliance with tax regulations. Here are 10 dos and don'ts to consider:

Do:- Verify your Federal Employer Identification Number (FEIN) or TR Number for accuracy before entering it on the form.

- Read the specific line-by-line instructions provided for the Michigan 4568 form to avoid common mistakes.

- Use the instructions for the specific forms referenced on this form for detailed guidance on calculating your credits.

- Include all nonrefundable credits you are eligible for to minimize your tax liability.

- Ensure the sum of your nonrefundable credits does not exceed your tax liability before credits, as these credits cannot reduce your tax due to less than zero.

- Double-check your calculations, especially for lines where additions or subtractions are required, to prevent math errors.

- Omit any applicable credits. Failure to claim all credits you are eligible for can lead to unnecessarily high tax liabilities.

- Enter a negative number on lines where it is not explicitly allowed according to the instructions.

- Assume the calculations for unitary business groups are the same as for a single taxpayer. Special instructions may apply.

- Forget to include the completed Form 4568 as part of your tax return filing, as it is a crucial component of your overall tax documentation.

By closely following these guidelines, you can help ensure that your Michigan 4568 form is accurately and efficiently completed, which will aid in the proper determination of your tax liabilities after the application of nonrefundable tax credits.

Misconceptions

When dealing with the Michigan 4568 form, also known as the Business Tax Nonrefundable Credits Summary, there are several common misconceptions that can create confusion. Understanding these misconceptions can help ensure that the form is filled out correctly, allowing for a smoother tax filing process.

- It's only for big businesses: The Michigan 4568 form is applicable to a wide range of businesses, not just large corporations. Small and medium-sized enterprises can also qualify for nonrefundable credits listed on this form.

- It's too complicated for individual use: Although the form can seem daunting at first, with proper guidance or assistance, individuals operating businesses can accurately complete it. Instructions are available to help clarify the requirements.

- All credits lead to tax reductions: While most credits on the form can reduce tax liability, certain entries, like a negative number on line 4b, can actually increase the amount owed.

- Any business can claim any credit: Specific eligibility criteria apply to each nonrefundable credit. Businesses must meet these criteria to qualify for the credits they claim.

- Unitary Business Groups (UBGs) can't use this form: UBGs can and should use Form 4568, following specific instructions that apply to their unique filing status. Credits earned by UBG members can offset the group’s overall tax liability.

- Negative entries always decrease tax liability: A negative entry on line 15, for instance, increases tax liability instead of decreasing it. It's critical to understand the impact of such entries on the overall calculation.

- All sections must be filled out: Not all sections of the form apply to every business. Taxpayers should only complete the parts relevant to the credits for which they are eligible.

- Tax liability cannot be increased by this form: There are instances, as mentioned, where subtracting negative numbers or incorporating specific credits can actually result in an increased tax liability. This is contrary to the common belief that tax credits only decrease the amount owed.

- Completing Form 4568 is the final step: Form 4568 should be included as part of the overall tax return filing. It is one component of the documentation needed and not the final step in the tax filing process.

By understanding and addressing these misconceptions, businesses can more accurately determine their tax obligations and make the most of the credits available to them. Always refer to the instructions provided with the form for the most accurate and up-to-date information.

Key takeaways

- The Michigan Department of Treasury Form 4568, also known as the Business Tax Nonrefundable Credits Summary, is designed under the authority of Public Act 36 of 2007. It serves to calculate a taxpayer’s liability after the application of nonrefundable credits.

- Form 4568 consolidates the various nonrefundable tax credits a taxpayer is eligible to claim, streamlining the identification and preparation of applicable credits.

- Tax credits outlined in Form 4568 include SBT credit carryforwards, Compensation and Investment Tax Credits, Research and Development Credit, Small Business Alternative Credit, and several others catering to specific industries or initiatives.

- Financial institutions, unlike standard taxpayers, have limitations on the credits they can claim, which include the Compensation Credit, Renaissance Zone Credit, Historic Preservation Credit, among others.

- Special instructions are provided for Unitary Business Groups (UBGs), highlighting how credits are earned and applied, whether on an entity-specific or group basis, and addressing intercompany transactions and entity-specific provisions.

- Taxpayers must complete and attach Form 4568 to their Michigan Business Tax Annual Return (Form 4567 for standard taxpayers or Form 4590 for financial institutions) as part of their tax filing.

- Specific lines on Form 4568, such as lines 6, 9, 16, and 19, are structured to ensure a taxpayer’s calculated tax liability does not fall below zero, with guidance to avoid common calculation errors or incorrect line entries.

- The form emphasizes the need for accuracy in subtracting credits from the tax before all credits, with certain lines designed to increase tax liability if negative numbers are entered.

- Eligibility criteria for each credit vary, and the form includes references to the relevant statutory provisions and specific forms where these credits are calculated.

- Form 4568 aims to minimize the complexity of identifying and claiming applicable tax credits by providing a summarized and efficient approach for taxpayers and financial institutions alike.

Popular PDF Templates

Michigan Land Contract Form - Emphasizes the mutual consent of the parties to enter the land contract, underscoring the contract's validity.

Michigan Workers Independent Contractor Worksheet - Enables the Michigan Workers' Compensation Placement Facility to gather necessary details for precise audit outcomes.

Michigan Des 025 - The DES-025 form is an integral part of the licensing process for driving instructors and examiners in Michigan.