Michigan 4106 PDF Form

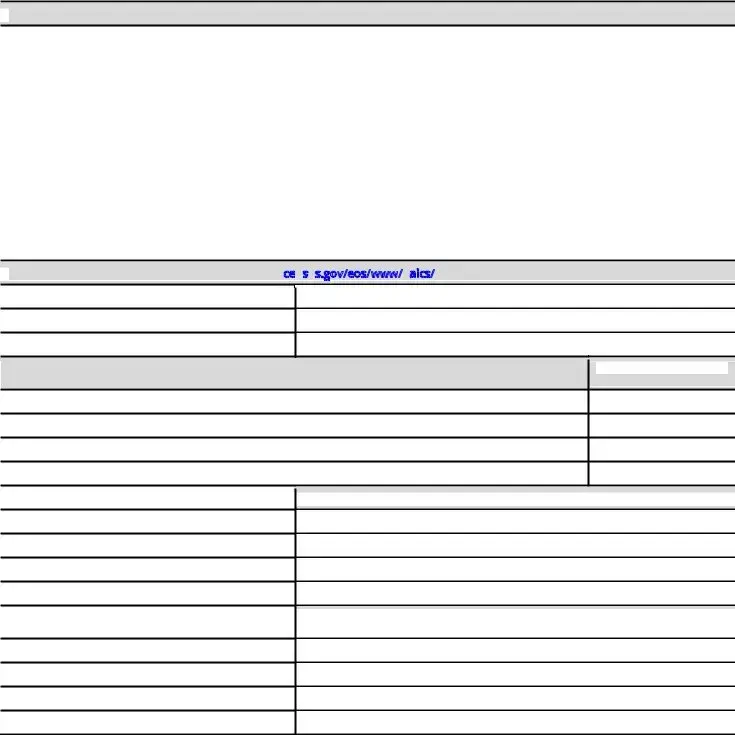

For small businesses aiming to engage with the Michigan Department of Transportation (MDOT) Small Business Program, understanding and completing the Michigan 4106 form is a crucial step. Available to non-Disadvantaged Business Enterprises (non-DBEs), this form acts as a gateway for eligibility to bid on MDOT projects, necessitating annual submission 30 days before bidding. In stark contrast, certified DBEs are spared this requirement, with their small business size subject to periodic verification as a condition of their certification. The Michigan 4106 encompasses detailed sections about the applicant business, including basic identification details, a description of the products or services offered, and information concerning the business's size determined through gross receipts or the number of employees. Furthermore, it delves into the specifics of any affiliates and subsidiaries, consistent with the United States Small Business Administration (SBA) size regulations found at 13 Code of Federal Regulations Part 121, to ascertain eligibility based on the average of the previous three years' gross receipts or the number of employees, ensuring no single entity, including its affiliates and subsidiaries, exceeds the $22.41 million threshold. The meticulousness of the application process, underscored by the certification of truthfulness by the business's authorized signer, underscores the MDOT's commitment to a comprehensive evaluation of small business eligibility for its Small Business Program.

Preview - Michigan 4106 Form

Michigan Department

Of Transportation

4106 (10/12)

SMALL BUSINESS PROGRAM APPLICATION

Page 1 of 9

This form is used to determine eligibility of

Certified DBEs do not need to complete this form - annual verification of small business size is a requirement of certification.

Part 1. Information relating to applicant business only

Part 1. Information relating to applicant business only

NAME OF BUSINESS

ADDRESS OF BUSINESS |

|

CITY |

|

STATE |

ZIP CODE |

|

|

|

|

|

|

NAME AND TITLE OF AUTHORZIED SIGNER FOR THIS BUSINESS |

|

|

|

||

|

|

|

|

||

TELEPHONE NO. |

FAX NO. |

|

|||

|

|

|

|

|

|

WHAT IS THE FEDERAL YEAR END TAX DATE FOR THE APPLICANT BUSINESS (Month/Date) |

|

|

|

||

|

|

|

|

||

DESCRIBE THE MAJOR PRODUCTS OR SERVICES YOUR BUSINESS PROVIDES |

|

|

|

||

1A. Business Major Products or Services – see FH

1A. Business Major Products or Services – see FH V

V VJRYHRVZZZ

VJRYHRVZZZ DLFV

DLFV

Products/Services

NAICS Code

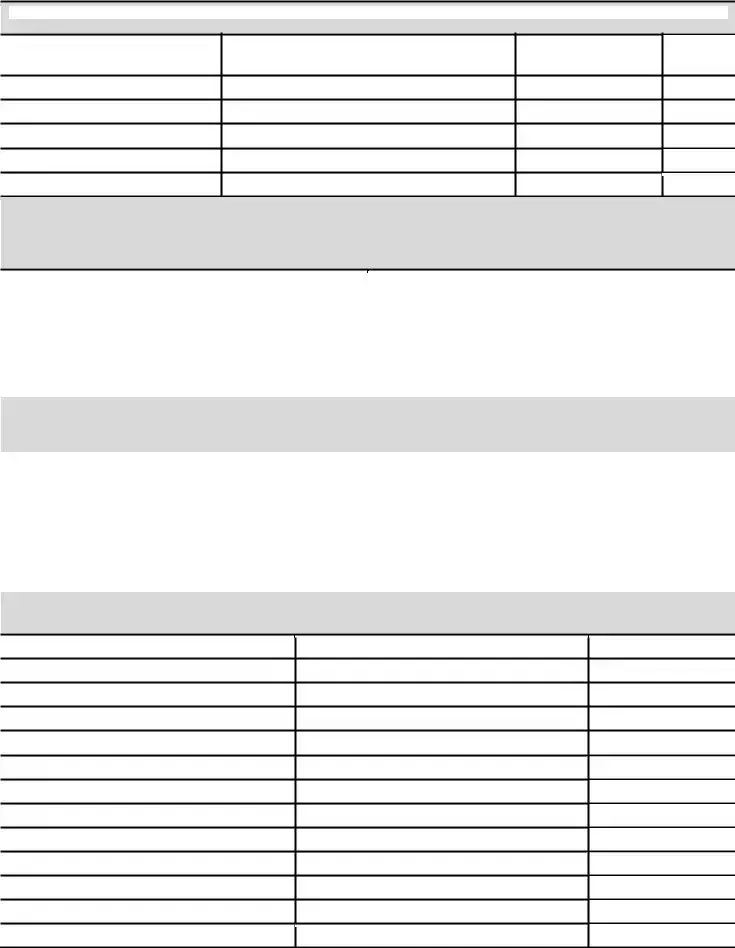

1B. Name and address of owner, partners, principal stockholders, or members of business

organization. Please denote the type of partners

Percent of voting stock or

kinds of interest

|

|

|

|

|

|

1C. Name of all officers |

|

|

Address for each officer |

|

|

|

|

|

|

|

|

|

|

|

|

1D. Name of the Board of Directors of this |

|

|

|

|

|

|

|

|

Address of each member of the Board of Directors |

|

|

business, if a corporation |

|

|

|

|

|

|

|

|

|

MDOT 4106 (10/12) |

Page 2 of 9 |

1E. If any person listed in 1B, 1C, or 1D is an owner, partner, director, officer, member, employee or principal stockholder in

another business, please provide the following information (add extra pages if needed).

Name of Person

Business Name and Address

Position Held

%Interest in

Business

1F. Small Business Size Determination – Business Gross Receipts per tax form

Please complete this section if the NAICS codes identified is section 1A. base business size on gross receipts. The small business size table is available at http://www.sba.gov/sites/default/files/files/Size_Standards_Table.xls Under “Table of Size Standards.” You must provide copies of U.S. business tax forms showing gross receipts earned for the three consecutive fiscal years reported below for this business.

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

Total |

$ |

|

|

1G. Total number of employees of the applicant business

Please complete this section if the NAICS codes identified in 1A determine business size using total number of employees. See http://www.sba.gov/sites/default/files/files/Size_Standards_Table.xls “Table of Size Standards.” You must provide copies of U.S. business tax forms showing total number of employees.

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

|

|

|

|

|

|

|

Part 2. Affiliates and Subsidiaries, including those identified in Part 1E.

13 CFR 121 – Stock ownership has to be 50% or more in another company – including when ownership is shared among several people.

BUSINESS NAME

PRODUCTS/SERVICES

NAICS CODE

MDOT 4106 (10/12) |

Page 3 of 9 |

2A. Gross sales or receipts of 1st affiliate business for the past three fiscal years

You must provide copies of U.S. business tax forms for the fiscal years reported below which show gross receipts of all subsidiaries or affiliates.

NAME AND ADDRESS OF AFFILIATE OR SUBSIDIARY

YEAR

20

DOLLARS

$

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

Total |

$ |

|

|

2B. Gross sales or receipts of 2nd affiliate business for the past three fiscal years

You must provide copies of U.S. business tax forms for the fiscal years reported below which show gross receipts of all subsidiaries or affiliates. If you have more than two affiliates or subsidiaries, please attach additional pages for those affiliates.

NAME AND ADDRESS OF 2nd AFFILIATE

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

YEAR |

DOLLARS |

20 |

$ |

Total |

$ |

2C. Total number of employees of 1st affiliate |

|

Please complete this section if the NAICS codes identified in section 1A. base business size on number of employees. The small business size table is available at http://www.sba.gov/sites/default/files/files/Size_Standards_Table.xls under “Table of Size Standards.” You must provide copies of U.S. business tax forms showing total numbers of

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

2D. Total number of employees of 2nd affiliate

Please complete this section if the NAICS codes identified in section 1A. base business size on number of employees.

The small business size table is available at http://www.sba.gov/sites/default/files/files/Size_Standards_Table.xls under “Table of

Size Standards.” You must provide copies of U.S. business tax forms showing total numbers of

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

|

|

|

|

YEAR |

20 |

TOTAL NUMBER OF ALL |

|

|

|

|

|

|

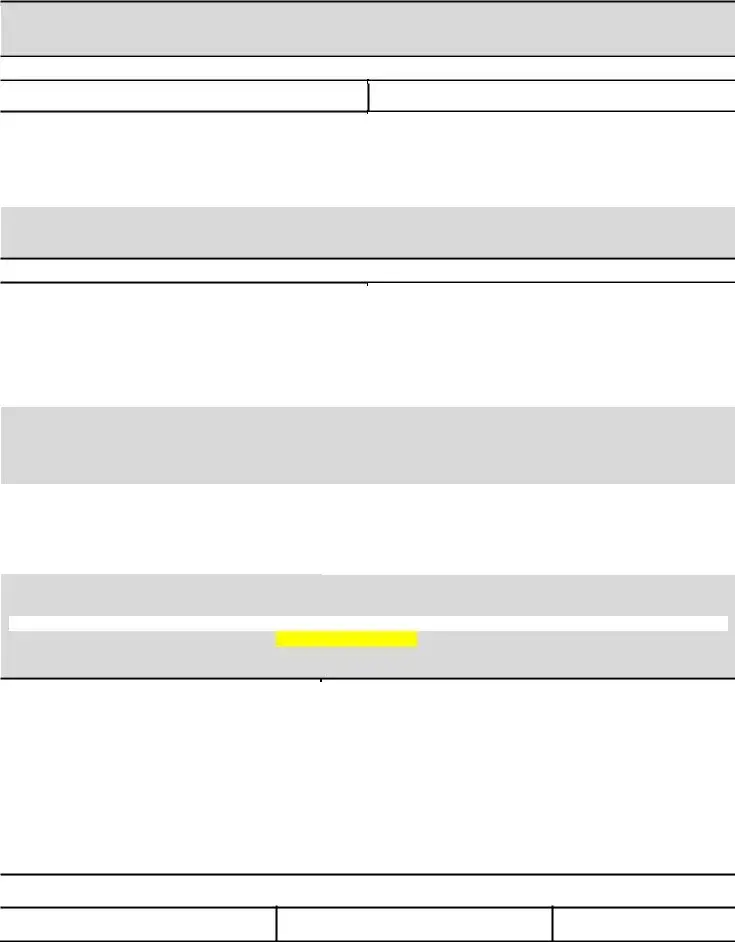

CERTIFICATION

I hereby certify that all information provided on this form and in attachments are true and correct to the best of my knowledge and belief. This information is submitted for the purpose of assisting the MDOT in making a size determination in order that my business may participate in the

NAME OF SOLE PROPRIETORSHIP, PARTNERSHIP, LIMITED LIABILITY COMPANY, OR CORPORATION

SIGNATURE

NAME AND TITLE

DATE OF SIGNING

MDOT 4106 (10/12) |

Page 4 of 9 |

Instructions FOR SMALL BUSINESS Program application

For participation in the Michigan Department of Transportation (MDOT)

SMALL BUSINESS PROGRAM

Carefully read these instructions and the United States Small Business Administration (SBA) size regulations found at 13 Code of Federal Regulations Part 121 before completing this form.

To qualify for the Small Business Program, applicants must meet SBA small business size standards for the industry in which the applicant will be bidding.

No business, including affiliates and subsidiaries, will qualify for this program if gross receipts as averaged over the previous three years exceed $22.41 million.

General Instructions

1.Information provided will be used by the MDOT to determine small business size of non- disadvantaged business enterprises

a.

b.

2.Select North American Industry Classification System (NAICS) codes that best describe your business and then determine if the business meets size standards for the selected codes. SBA size standards are usually stated either in number of employees over the past 12 months, or average annual receipts over the past three years – whichever number represents the largest size of your business right now (including subsidiaries and affiliates). Size standards are available for every private sector industry in the U.S. economy, with the NAICS used to identify the industries. The steps are simple to determine your size:

a.Identify the NAICS code(s) that best describe(s) your business activities. http://www.census.gov/eos/www/naics/

See Identifying Industry Codes at

b.Determine your Industry's size standard using the Table of Small Business Size Standards at

3.One copy of MDOT SBP Application, with additional sheets attached as needed, must be returned to the MDOT Office of Business Development.

4.The person signing this form must be authorized to do so.

5.All affiliates of the business, whether acknowledged or not, and whether foreign or domestic, must be disclosed. SBA's criteria for defining affiliates should be carefully reviewed. In 13 CFR §121.103, SBA identifies various forms of affiliation.

MDOT 4106 (10/12) |

Page 5 of 9 |

6.Where the applicable size standard involves "number of employees", a business' average number of employees on payroll before for the 12 months preceding the application or offers is examined, including all individuals who are fulltime,

7.Where applicable size standards involve "average annual receipts", a business' annual receipts mean total income (or gross income in the case of a sole proprietorship) plus cost of goods sold as these terms are defined and reported on the business' Federal Income Tax Return, which must be attached to this eligibility request determination. See 13 CFR § 121.104 of SBA's regulations.

8.MDOT must determine the primary industry activity or the NAICS code of a business as part of its size determination for the Small Business Program. In making this size determination, consideration is given to various criteria, such as the distribution of a business' revenues, employment and costs associated with doing business. See 13 CFR 121.107.

9.For purposes of this form, MDOT considers a principal of the business as those persons or affiliated businesses that own 10 percent or more of its ownership. In cases where no individual or affiliated business owns at least 10 percent interest, the five largest interest holders and their percentages of interest must be listed. Additionally, the principal officers and their interest in the business must be listed.

10.Affiliation is defined in the Small Business Administration (SBA) regulations, 13 CFR part 121.

(1)Except as otherwise provided in 13 CFR part 121, concerns are affiliates of each other when, either directly or indirectly:

(i)One concern controls or has the power to control the other; or

(ii)A third party or parties controls or has the power to control both; or

(iii)An identity of interest between or among parties exists such that affiliation may be found.

(2)In determining whether affiliation exists, it is necessary to consider all appropriate factors, including common ownership, common management, and contractual relationships. Affiliates must be considered together in determining whether a concern meets small business size criteria and the statutory cap on the participation of firms in the DBE program.

(6)In determining the concern's size, SBA counts the receipts, employees, or other measure of size of the concern whose size is at issue and all of its domestic and foreign affiliates, regardless of whether the affiliates are organized for profit.

(b)Exceptions to affiliation coverage. (1) Business concerns owned in whole or substantial part by investment companies licensed, or development companies qualifying, under the Small Business Investment Act of 1958, as amended, are not considered affiliates of such investment companies or development companies.

(7)(c) Affiliation based on stock ownership. (1) A person (including any individual, concern or other entity) that owns, or has the power to control, 50 percent or more of a concern's voting stock, or a block of voting stock which is large compared to other outstanding blocks of voting stock, controls or has the power to control the concern.

(7)(4)(e) Affiliation based on common management. Affiliation arises where one or more officers, directors, managing members, or partners who control the board of directors and/or management of one concern also control the board of directors or management of one or more other concerns.

MDOT 4106 (10/12) |

Page 6 of 9 |

(f)Affiliation based on identity of interest. Affiliation may arise among two or more persons with an identity of interest. Individuals or firms that have identical or substantially identical business or economic interests (such as family members, individuals or firms with common investments, or firms that are economically dependent through contractual or other relationships) may be treated as one party with such interests aggregated. Where SBA determines that such interests should be aggregated, an individual or firm may rebut that determination with evidence showing that the interests deemed to be one are in fact separate.

PENALTIES FOR CRIMINAL VIOLATIONS

It is a criminal offense to misrepresent in writing the status of a concern as a small business in order to obtain a prime or subcontract contract awarded pursuant to Section 9 or 15 of the Act (15 U.S.C. § 638 and § 644) and Section 8(a) of the Act ( 15 U.S.C. § 637(a)) or subcontract included as part or all of a goal contained in a subcontracting plan required according to the Section 8(d) of the Act (15 U.S.C. § 637 (d)), or prime or subcontract awarded under Federal Law that references Section 8(d) of the Act (15 U.S.C. § 637 (d)) that defines eligibility for such programs as the Small and Disadvantaged Business contracting program. Under Section 16(d) of the Act (15 U.S.C. 645(d)), the punishment for this offense is imprisonment of not more than 10 years or a fine of not more than $500,000 or both. It can also result in certain administrative penalties, such as suspension or debarment from further contracting with the US Government.

MDOT 4106 (10/12) |

Page 7 of 9 |

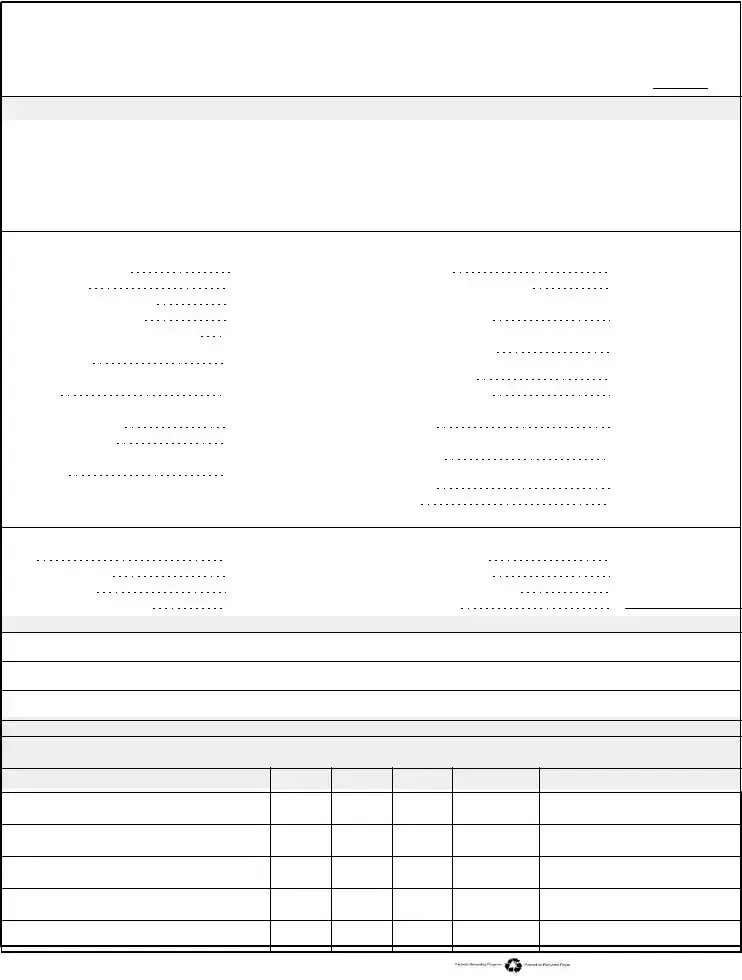

PERSONAL FINANCIAL STATEMENT

As of |

|

, |

|

Complete this form for: (1) each proprietor, or (2) each limited partner who owns 20% or more interest and each general partner, or (3) each stockholder owning or (4) any person or entity providing a guaranty loan.

Name |

|

|

|

|

|

|

|

Business Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residence Address |

|

|

|

|

|

|

Residence Phone |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

City, State, & Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Name of Applicant/Borrower |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

(Omit Cents) |

|

|

LIABILITIES |

|

(Omit Cents) |

||

|

|

|

|

|

|

|

|

|

|||

Cash on hand & in Banks |

$ |

|

|

|

Accounts Payable |

|

|

|

$ |

|

|

Savings Accounts |

$ |

|

|

|

Notes Payable to Banks and Others |

$ |

|

||||

IRA or Other Retirement Account |

$ |

|

|

|

(Describe in Section 2) |

|

|

||||

Accounts & Notes Receivable |

$ |

|

|

|

Installment Account (Auto) |

|

|

|

$ |

|

|

Life |

$ |

|

|

|

Mo. Payments |

$ |

|

|

|

|

|

(Complete Section 8) |

$ |

|

|

|

Installment Account (Other) |

$ |

|

||||

Stocks and Bonds |

|

|

|

Mo. Payments |

$ |

|

|

|

|

||

(Describe in Section 3) |

$ |

|

|

|

Loan on Life Insurance |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|||||

Real Estate |

|

|

|

|

Mortgages on Real Estate |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||||

(Describe in Section 4) |

|

|

|

|

(Describe in Section 4) |

|

|

||||

$ |

|

|

|

Unpaid Taxes |

|

|

|

$ |

|

||

Other Personal Property |

$ |

|

|

|

(Describe in Section 6) |

|

|

||||

(Describe in Section 5) |

|

|

|

|

Other Liabilities |

|

|

|

$ |

|

|

Other Assets |

|

$ |

|

|

|

(Describe in Section 7) |

$ |

|

|||

(Describe in Section 5) |

|

|

|

|

Total Liabilities |

|

|

|

|

||

|

|

|

|

|

|

|

|

||||

|

|

$ |

|

|

|

Net Worth |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|||

|

Total |

|

|

|

|

|

Total |

$ |

|

||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Section 1. |

Source of Income |

|

|

|

|

Contingent Liabilities |

|

|

|

|

|

Salary |

|

$ |

|

|

|

As Endorser or |

|

|

|

$ |

|

Net Investment Income |

$ |

|

|

|

Legal Claims & Judgments |

|

|

|

$ |

|

|

Real Estate Income |

$ |

|

|

|

Provision for Federal Income Tax |

$ |

|

||||

Other Income (Describe below)* |

$ |

|

|

|

Other Special Debt |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Other Income in Section 1.

*Alimony or child support payments need not be disclosed in "Other Income" unless it is desired to have such payments counted toward total income.

Section 2. Notes Payable to Banks and Others. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed.)

Name and Address of Noteholder(s)

Original Balance

Current Balance

Payment

Amount

Frequency

(monthly,etc.)

How Secured or Endorsed

Type of Collateral

(tumble)

MDOT 4106 (10/12)

Section 3. Stocks and Bonds. (Use attachments if necessary. Each attachment must be identified as a part of this statement and signed).

Number of Shares

Name of Securities

Cost

Market Value

Quotation/Exchange

Date of

Quotation/Exchange

Total Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 4. Real Estate Owned. |

(List each parcel separately. Use attachment if necessary. Each attachment must be identified as a part |

|||||||||

|

|

of this statement and signed.) |

|

|

|

|

|

|||

|

|

Property A |

|

Property B |

Property C |

|||||

Type of Property |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Date Purchased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Original Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Present Market Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address of Mortgage Holder |

|

|

|

|

|

|

|

|

|

|

Mortgage Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Mortgage Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Amount of Payment per Month/Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Status of Mortgage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Section 5. Other Personal Property and Other Assets. |

|

(Describe, and if any is pledged as security, state name and address of lien holder, amount of lien, terms |

||||||||

of |

payment and if delinquent, describe delinquency) |

|

|

|||||||

|

|

|

|

|

||||||

Section 6. |

Unpaid Taxes. |

(Describe in detail, as to type, to whom payable, when due, amount, and to what property, if any, a tax lien attaches.) |

Section 7. Other Liabilities. (Describe in detail.)

Section 8. |

Life Insurance Held. |

(Give face amount and cash surrender value of policies - name of insurance company and beneficiaries) |

I authorize SBA/Lender to make inquiries as necessary to verify the accuracy of the statements made and to determine my creditworthiness. I certify the above and the statements contained in the attachments are true and accurate as of the stated date(s). These statements are made for the purpose of either obtaining a loan or guaranteeing a loan. I understand FALSE statements may result in forfeiture of benefits and possible prosecution by the U.S. Attorney General (Reference 18 U.S.C. 1001).

Signature: |

Date: |

Social Security Number: |

|

|

|

Signature: |

Date: |

Social Security Number: |

|

|

|

|

|

|

MDOT 4106 (10/12) |

Page 9 of 9 |

Small Business Program (SBP) Application Checklist and

required attachments:

Legal business name: ______________________________

PERSONAL NET WORTH (PNW)

All owners of businesses applying for the SBP must have a pnw less than $1.32 million. This figure excludes each owner’s primary residence, and the value of the business applying for participation in the SBP.

SMALL BUSINESS PROGAM SIZE

Businesses, including affiliates, qualifying for the SBP must not exceed the U.S. Small Business Administration size standard(s) for the North American Industry Classification (NAICS) code for the type(s) of work performed. In no case shall any eligible business, including affiliate businesses, have gross receipts over $22.41 million as averaged over the three most recent tax years.

The following documents must be provided in order for MDOT to determine eligibility to participate in the SBP:

A completed copy of the entire SBP application, signed and notarized with last 4 digits of SS #.

All assets listed as joint on PNW must provide a break down for each individual.

The personal financial statement must include the value of ownership in all other companies owned by the applicant.

United States 1040 Personal Income Tax Returns for the most recent three (3) consecutive years (i.e., 2009, 2010, 2011)

O Include all schedules and

Federal business tax returns for the most recent three (3) consecutive years for the applicant business and all affiliate businesses:

O Include all business tax schedules and required attachments and

Please DO NOT bind or staple the application

Mail completed application to the following address:

MDOT Office of Business Development,

P.O. Box 30050,

Lansing, Michigan 48909

Note: Incomplete application packages will be returned.

Form Characteristics

| Fact Number | Description |

|---|---|

| 1 | The form is designed to assess the eligibility of non-Disadvantaged Business Enterprises (non-DBEs) for Michigan Department of Transportation (MDOT) Small Business Program projects. |

| 2 | Applicants must submit the form annually, at least 30 days before bidding on projects. |

| 3 | Certified DBEs are not required to complete this form but must undergo annual verification of small business size as part of their certification. |

| 4 | The application requires detailed information about the business including the name, address, contact information, and the nature of the business. |

| 5 | Businesses must provide financial data including gross receipts and the total number of employees to determine if they meet the SBA small business size standards. |

| 6 | The SBA's "Table of Size Standards" is the reference used for determining if a business qualifies as small under the selected NAICS codes. |

| 7 | A section of the form is dedicated to affiliates and subsidiaries information, crucial for the size determination process due to SBA's affiliation rules. |

| 8 | The form is governed by federal law, specifically the Small Business Administration (SBA) size regulations found at 13 Code of Federal Regulations Part 121. |

Guidelines on Utilizing Michigan 4106

Filling out the Michigan 4106 form is a vital step for non-Disadvantaged Business Enterprises (non-DBEs) aiming to participate in the Michigan Department of Transportation (MDOT) Small Business Program. This process requires careful attention to detail as it involves providing comprehensive information about your business. The objective is to verify the eligibility of your business based on size and other criteria to bid on MDOT Small Business Program projects. Here’s a straightforward guide to help you complete the form accurately.

- Start by providing detailed information about your business, including the business name, address, and the name and title of the authorized signer for the business. Additionally, fill in the telephone number, fax number, and e-mail address.

- Indicate your federal year-end tax date by specifying the month and date relevant to your business.

- Describe the major products or services your business provides. Refer to the provided link (http://www.sba.gov/sites/default/files/files/Size_Standards_Table.xls) to classify your business's products or services according to the North American Industry Classification System (NAICS) codes.

- Fill in the information about the business's owners, partners, principal stockholders, or members, including their names, addresses, and the percentage of voting stock or interest they hold.

- Provide details about all officers and the Board of Directors of the business, including the names and addresses for each person.

- If any person listed in the previous sections has a significant interest in another business, supply their details, including the name of the person, business name and address, position held, and % interest in the business.

- For the Small Business Size Determination section, input your business's gross receipts per tax form for the last three fiscal years. Attach copies of the U.S. business tax forms that show these gross receipts.

- Enter the total number of employees (full-time, part-time, temporary, etc.) for each of the last three fiscal years. Relevant U.S. business tax forms must be provided as well.

- Detail information about affiliates and subsidiaries, including their names, products/services, NAICS codes, gross sales or receipts, and total number of employees for the past three fiscal years. Attach additional pages as necessary.

- Finally, the certification section requires the business name, the signature of the authorized individual, their name and title, and the date of signing.

Once the form is completed and all necessary documents are attached, it should be submitted to the MDOT Office of Business Development at least 30 days before intending to bid on a Small Business Program project. This step is crucial for ensuring your readiness and eligibility to partake in upcoming projects under the program. Remember, presenting accurate and complete information is key to preventing delays and ensuring smooth participation in the MDOT Small Business Program.

Crucial Points on This Form

What is the Michigan 4106 form?

The Michigan 4106 form, provided by the Michigan Department of Transportation (MDOT), is designed to determine the eligibility of non-Disadvantaged Business Enterprises (non-DBEs) to bid on MDOT Small Business Program projects. This form requires annual submission, at least 30 days before bidding on projects. Certified DBEs are exempt from filling out this form due to their annual verification requirements.

Who needs to complete the Michigan 4106 form?

Non-DBE entities looking to participate in MDOT Small Business Program projects must complete this form annually. It is necessary for these entities to provide detailed information about their business, including financial information and business size, to qualify. Certified DBEs do not need to complete this form.

What information is required to fill out the Michigan 4106 form?

To complete the form, businesses are required to provide:

- General business information, including the name, address, and contact details of the business.

- Details about the major products or services the business provides.

- Information on the business ownership and management structure, including names and percentages of ownership or control.

- Financial information to determine small business size status, including gross receipts or the total number of employees, depending on the relevant North American Industry Classification System (NAICS) codes.

- Affiliate and subsidiary information, if applicable.

What are the size standards for qualifying as a small business under the Michigan 4106 form?

Size standards vary based on industry and are determined by the U.S. Small Business Administration (SBA). In general, no business including its affiliates and subsidiaries will qualify if average gross receipts exceed $22.41 million over the past three years. The relevant NAICS code for the business's industry will dictate specific size standards.

How often must the Michigan 4106 form be submitted?

The form must be submitted annually, at least 30 days before bidding on any MDOT Small Business Program project. This ensures that the business's information is up-to-date and accurately reflects its current size and eligibility status.

Where can I find the Michigan 4106 form?

The Michigan 4106 form is available for download on the Michigan Department of Transportation's official website. Additionally, it can be obtained from the MDOT Office of Business Development.

What documentation is required along with the Michigan 4106 form?

Besides the completed form, businesses must provide copies of U.S. business tax forms that demonstrate gross receipts for the past three fiscal years, as well as documents evidencing the total number of employees if the size standard is based on employee count.

How does the Michigan 4106 form affect bidding on MDOT projects?

Completion and approval of the Michigan 4106 form are prerequisites for non-DBE businesses to bid on MDOT Small Business Program projects. Without an approved application, businesses may be ineligible to bid or participate in these projects.

Can the information provided in the Michigan 4106 form be used for other purposes?

Yes, the MDOT uses the information from the Michigan 4106 form for making size determinations and for ensuring that businesses participating in the Small Business Program meet the eligibility criteria. MDOT may also use the information for administrative purposes, such as verifying compliance with program requirements.

What happens if the information in the Michigan 4106 form is found to be inaccurate?

If any information on the form is discovered to be false or inaccurate, the business may face disqualification from the Small Business Program, and it could impact their ability to bid on future MDOT projects. Honesty and accuracy in completing the form are crucial for maintaining eligibility and good standing in MDOT programs.

Common mistakes

Filling out the Michigan 4106 form can be a complex process that entails a detailed provision of information regarding a business's eligibility for the Michigan Department of Transportation Small Business Program. Common mistakes can often delay the application process or potentially disqualify an application. Recognizing and avoiding these errors can enhance the chances of a successful application.

Firstly, applicants frequently overlook the requirement to submit the application at least 30 days in advance of bidding on projects. This stipulation ensures there is adequate time for the application review process. Neglecting this timeframe can result in missed opportunities for bidding, especially for projects that align closely with a business's service offerings.

Another common mistake is inaccurately identifying the North American Industry Classification System (NAICS) codes that best describe the business's primary activities. Selecting the wrong NAICS code can lead to incorrect size standard affiliations and possibly render a business ineligible, despite actually qualifying under the correct classification.

Incomplete or incorrect information on the gross receipts or total number of employees can also compromise an application. The form requires precise financial data and employee counts over specific fiscal years to determine the small business size standard. Omitting this information or providing estimates instead of actual figures from U.S. business tax forms can significantly impact the size determination process.

Failure to disclose all affiliates and subsidiaries, as mandated in the instructions, is a frequent oversight. Some applicants may not realize the extent of the requirement for full disclosure, including all domestic and foreign affiliations, which directly influences the size determination under SBA standards. This mistake can lead to an inaccurate assessment of a business's size and eligibility.

A lack of authorization from non-employee representatives, such as attorneys or accountants, is another area where errors occur. Submitting an application without the necessary authorization letter can delay the process, as MDOT needs to verify that the individual submitting the form has the legal right to represent the business.

Furthermore, incorrectly or incompletely filling out the section related to the certification of information can result in processing delays or rejection of the application. It is crucial for the authorized signer to certify that all information provided is true and accurate to the best of their knowledge. Any discrepancies or omissions here can cast doubts on the application's validity.

Lastly, applicants often forget to attach additional sheets when the space provided in the form is insufficient, especially in sections that require detailed information about the business, its officers, and affiliates. This omission can leave the application incomplete, as MDOT requires comprehensive information to make an informed decision regarding eligibility.

Attention to detail and thoroughness can significantly smooth the application process for the Michigan 4106 form. Applicants are encouraged to carefully review all sections, adhere to submission timelines, and provide accurate and comprehensive information to avoid these common pitfalls.

Documents used along the form

When preparing to participate in the Michigan Department of Transportation (MDOT) Small Business Program, various forms and documents play a crucial role alongside the primary application form, Michigan 4106. These supplementary documents are essential for providing a comprehensive overview of a business's eligibility and compliance with the size standards set forth by the Small Business Administration (SBA).

- U.S. Business Tax Returns: These documents provide detailed information on a business’s financial activities, including gross receipts and the number of employees, which are crucial for size determination under SBA standards.

- NAICS Code Documentation: Identification of the primary North American Industry Classification System (NAICS) code is essential for determining the relevant size standards. Documents or evidence supporting the business’s primary industry classification may be required.

- Ownership and Control Documents: These may include articles of incorporation, partnership agreements, or operating agreements for LLCs, which detail the business structure, ownership percentages, and control mechanisms.

- Affiliation Disclosure: For businesses that have subsidiaries, affiliates, or both, detailed information about these entities, including ownership percentages and financial statements, may be necessary to assess the overall size and eligibility.

- Personal Financial Statement: Depending on the thresholds for size determination, the personal financial statements of the owners may be required to substantiate the separation of personal and business assets.

- Employee List: A comprehensive list of employees, specifying their employment status (full-time, part-time, temporary) is needed to confirm compliance with the employee-based size standards.

- Letter of Authorization: If the application is being completed by a representative of the business, such as an attorney or accountant, a letter of authorization will be necessary.

- Proof of Business Size: Documents that verify the business size, which can include payroll records, annual reports, and other financial statements, are essential for confirming eligibility under specific NAICS codes.

- Resume of Principals: Resumes or biographies of the business’s principals might be required to demonstrate their experience, capabilities, and role in the business to support the application.

- Certification of Non-Disadvantaged Status: For non-DBEs, a formal statement or certification may be necessary to confirm that the business does not qualify as a disadvantaged business enterprise under the relevant criteria.

Each of these documents plays a critical role in substantiating a business's compliance with the eligibility criteria of the MDOT Small Business Program. Proper preparation and submission of these forms and documents facilitate a smoother review process, enhancing the chances for approval and participation in program opportunities.

Similar forms

The 8(a) Business Development Program Application shares similarities with the Michigan 4106 form in that both require detailed business and personal information to assess eligibility for specific programs aimed at small businesses. These applications evaluate the business size, ownership, and operational capacities to ensure compliance with program standards.

HUBZone Certification Application parallels the Michigan 4106 form by requiring companies to submit detailed information about their business operations, primary industry classification, ownership, and financial data. This process ensures that businesses meet the criteria specific to the HUBZone program, similar to how the 4106 form determines qualification for MDOT's Small Business Program.

The Disadvantaged Business Enterprise (DBE) Certification Application is akin to the Michigan 4106 form in its purpose to collect comprehensive business information, including ownership structure, financial data, and employee information, to verify eligibility for disadvantaged business status. Both forms are crucial for businesses seeking to participate in government-related contracts and programs designed for small or disadvantaged businesses.

System for Award Management (SAM) Registration requires businesses to provide detailed information about their operations, financials, and management structure, similar to Michigan 4106. Though the SAM is broader in scope, with a focus on eligibility for federal contracts beyond just small business programs, the depth of information required is comparable.

Small Business Administration (SBA) Size Standard Tool Verification, while not a form per se, demands businesses to assess and verify their size status based on detailed criteria similar to the Michigan 4106 form's requirements. Both processes require businesses to examine their receipts, employee numbers, and affiliations to determine eligibility for small business standards.

Women-Owned Small Business (WOSB) Program Certification requires extensive documentation relating to business size, ownership, and operational control by women. Like the Michigan 4106 form, this application is designed to authenticate a business's eligibility for a specific designation, in this case, women-owned status, based on detailed business information.

The Veteran-Owned Small Business (VOSB) Certification Application necessitates a comprehensive overview of the business similar to the Michigan 4106 form. It focuses on veteran ownership and control, alongside financial and operational data, to establish eligibility for programs targeting veteran-owned entities.

Minority Business Enterprise (MBE) Certification Application resembles the Michigan 4106 form through its requirement for detailed business information, including minority ownership status, company financials, and business operations. Both applications serve to qualify businesses for programs aimed at providing special considerations or opportunities based on the business's status.

Dos and Don'ts

When filling out the Michigan 4106 form for the Small Business Program Application, there are important dos and don'ts to help ensure your application is accurate and complete. Here's a guide to assist you:

Do:

Review the United States Small Business Administration (SBA) size regulations and the instructions for the Michigan 4106 form carefully before starting your application.

Ensure all information provided about your business, including the NAICS codes, accurately reflects your current operations and size.

Provide complete copies of U.S. business tax forms as required to demonstrate your business's gross receipts and number of employees for the specified periods.

Disclose all affiliates and subsidiaries of your business, as failing to do so might result in a delay or a negative determination of your application.

Have the application signed by an authorized person within your organization with the authority to provide the required information.

Submit the application and all necessary attachments, at least 30 days in advance of bidding, to comply with the deadlines set by the MDOT.

Don't:

Overlook the need to identify and include the NAICS codes that best describe your primary business activities.

Misrepresent the size and scope of your business, including gross receipts, the number of employees, or affiliates.

Leave sections of the form blank. If a section does not apply, it is better to mark it as "Not Applicable" rather than leaving it unanswered.

Forget to attach supporting documentation, such as tax returns and authorization letters (if applicable), which are crucial for validating the information provided.

By following these dos and don'ts, you can avoid common pitfalls and enhance the likelihood of successfully participating in the Michigan Department of Transportation Small Business Program.

Misconceptions

The Michigan Department of Transportation 4106 form, intricately designed for the Small Business Program application, often is the subject of misunderstandings. Clarifying these misconceptions is crucial for businesses aiming to engage in MDOT projects effectively. Below are four common misconceptions and the truths behind them:

- Misconception 1: Only Disadvantaged Business Enterprises (DBEs) need to complete the MDOT 4106 form. Actually, the form is specifically for non-DBEs seeking to participate in the Small Business Program. Certified DBEs must fulfill other requirements but aren't required to complete this form.

- Misconception 2: Submission of the application can be done anytime before bidding on a project. In reality, the form must be submitted at least 30 days in advance of bidding, emphasizing the importance of planning and timely submission to avoid missing out on potential opportunities.

- Misconception 3: The form is a one-time requirement. This is incorrect; businesses must submit this form annually to confirm their eligibility and adherence to the small business size standards set by the Small Business Administration (SBA).

- Misconception 4: The form requires exhaustive financial documentation for the present year only. Contrary to this belief, businesses must provide copies of U.S. business tax forms showing gross receipts for the three consecutive fiscal years prior to the application, along with details on the total number of employees. This offers a comprehensive view of the business size over a significant period, ensuring accurate size determination.

Understanding these aspects of the MDOT 4106 form is pivotal for non-DBE businesses pursuing participation in MDOT's Small Business Program projects. It not only ensures compliance with the procedural requirements but also assists in the strategic planning for bidding on upcoming projects.

Key takeaways

Filling out the Michigan 4106 form is a crucial step for non-Disadvantaged Business Enterprises (non-DBEs) aiming to participate in Michigan Department of Transportation (MDOT) Small Business Program projects. Here are six key takeaways to ensure accurate and successful submission:

- Annual Submission Requirement: It's mandatory to submit this form annually, at least 30 days before bidding on MDOT Small Business Program projects. This ensures your business's information is up to date, enabling your participation in upcoming opportunities.

- Exemption for DBEs: Certified Disadvantaged Business Enterprises (DBEs) are not required to fill out this form. Instead, they must undergo annual verification to confirm their small business status, following a separate process dedicated to DBEs.

- Comprehensive Business Information: The form requires detailed information about your business, including its primary products or services, the names and addresses of owners, partners, and principal stockholders, and any affiliations with other businesses. Providing complete and accurate information is crucial for MDOT to assess your eligibility properly.

- Small Business Size Determination: Your eligibility hinges on your business meeting the Small Business Administration (SBA)'s size standards, determined either by the average number of employees over the previous year or by average annual receipts over the past three years. You must provide pertinent U.S. business tax forms to support your claims.

- Affiliates and Subsidiaries: The form requires disclosure of all affiliates and subsidiaries, regardless of their location. This information helps MDOT understand the full scope of your business operations and evaluate your size according to SBA standards.

- Certification of Accuracy: The person signing the form must certify that all provided information is true and correct. This certification serves as a testament to the integrity of the application and the authenticity of the data presented. It's a reminder of the legal obligations and the importance of honesty in the application process.

Understanding these key aspects can significantly streamline the application process for the Michigan 4106 form, helping businesses accurately demonstrate their eligibility for the MDOT Small Business Program.

Popular PDF Templates

Mi State Income Tax Rate - Delineates the required tax payments in the current year after discounts are applied, for accurate reporting.

Michigan Bottle Return Law - The form's design enhances transparency and accountability in the reimbursement process for handling returnable containers.