Michigan 3924 PDF Form

Every year, many residents of Michigan find themselves navigating the complexities of state taxes, including the meticulous process of claiming withheld taxes on their income. Central to this process is the Michigan Department of Treasury Schedule W 3924 (Rev. 9-09), a vital form for the 2009 tax year that facilitates the declaration of Michigan income tax withheld. Mandated by Public Act 281 of 1967, this form serves as an attachment to the Michigan Individual Income Tax Return (MI-1040) or the amended return (MI-1040X), specifically on line 34, where taxpayers report their state withholding. It requires meticulous attention to detail, including accurate reporting in blue or black ink and adherence to specific numerical formats. The form is segmented into detailed sections, including a table for reporting Michigan tax withheld from W-2, W-2G, or corrected W-2 forms, another for detailing withholdings from 1099 and 4119 forms among other documents, and instructions on how to complete these tables. This form is a gatekeeper for taxpayers seeking to claim their withholding accurately, ensuring a smoother processing of their tax returns. It underscores the importance of retaining copies of W-2s and 1099s for a period of six years, a practice that safeguards against potential requests for documentation by the Department of Treasury.

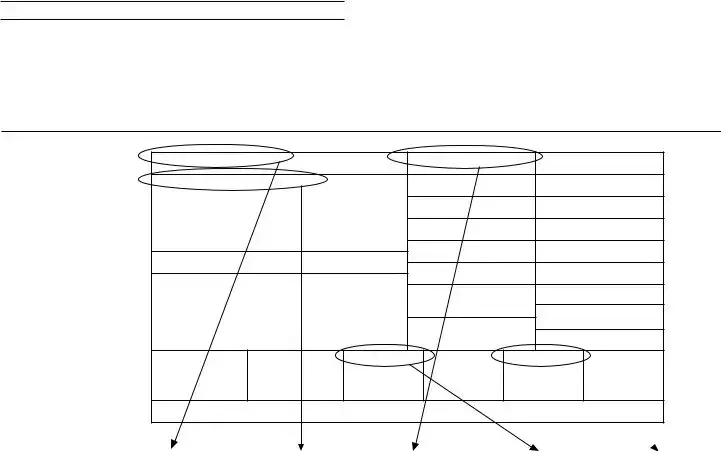

Preview - Michigan 3924 Form

Michigan Department of Treasury |

Schedule W |

|

3924 (Rev. |

||

|

||

2009 MICHIGAN Withholding Tax Schedule |

|

|

Issued under authority of Public Act 281 of 1967. |

|

INSTRUCTIONS: If you had Michigan income tax withheld in 2009, you must complete a Withholding Tax Schedule (Schedule W) to claim the withholding on your Individual Income Tax Return

Print numbers like this : 0123456789 - NOT like this: |

1 4 |

|

|

|

|

|

|

|

|

|

Attachment 13 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Filer’s First Name |

M.I. |

Last Name |

|

|

4Filer’s Social Security Number (Example: |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If a Joint Return, Spouse’s First Name |

M.I. |

Last Name |

|

|

|

Spouse’s Social Security Number (Example: |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE 1: MICHIGAN TAX WITHHELD ON |

|

|

|

|

||||||||||||||

4A |

4B |

|

|

C |

|

D |

4E |

|

F |

|||||||||

Enter “X” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if for: |

Box b - Employer’s federal |

|

|

|

|

Box 1 - Wages, tips, |

Box 17 - Michigan |

|

Box 19 - City |

|||||||||

You or Spouse |

identiication number |

|

|

Employer’s name |

|

other compensation |

income tax withheld |

income tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

|

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||

Enter Table 1 Subtotal from additional Schedule W forms (if applicable) |

|

00 |

|

00 |

||||||||||||||

1. SUBTOTAL. Enter total of Table 1, columns E and F. Carry total of column F to |

|

|

|

|

|

|

|

|

||||||||||

|

the City Income Tax Worksheet in the |

|

00 |

|

00 |

|||||||||||||

IMPORTANT: If you have no entries for Table 2, carry total of line 1, column E, to line 3 below.

TABLE 2: MICHIGAN TAX WITHHELD ON 1099 and 4119 FORMS

4A |

4B |

C |

D |

4E |

|

F |

||

Enter “X” |

|

|

Taxable pension |

|

|

|

||

if for: |

Payer’s federal |

|

distribution, misc. |

Michigan income |

|

Box 7 - Distribution |

||

You or Spouse |

identiication number |

Payer’s name |

income, etc. (see instr.) |

tax withheld |

|

Code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

Enter Table 2 Subtotal from additional Schedule W forms (if applicable) |

|

|

|

00 |

|

|||

2. SUBTOTAL. Enter total of Table 2, column E |

2. |

|

00 |

|

||||

3. TOTAL. Add line 1 and line 2, column E. Carry total to your |

43. |

00

+ 0000 2009 57 01 27 3

2009 Schedule W, Page 2

Instructions for Schedule W

Withholding Tax Schedule

Schedule W is designed to report State of Michigan and Michigan city income tax withholding. Schedule W is

imaged to enable us to process your individual income tax return more eficiently.

Attach the completed Schedule to your return.An attachment number is listed in the upper right corner to help you assemble your form in the correct order behind your

attached when required, the processing of your return

may be delayed. Do not submit

W.Keep copies of your

Michigan Residents. If you paid income tax to a governmental unit outside of Michigan, see instructions for

Schedule 2, line 5.

Completing the Withholding Tables

Lines not listed are explained on the form.

Complete the withholding tables using information from your

that contain Michigan tax withheld. If you need additional space, attach another Schedule W.

Column D

Table 1: From

Table 2: From 1099 or 4119 forms, or other withholding documents, enter unemployment compensation, taxable interest, ordinary dividends, miscellaneous income, bartering, taxable pension distributions in excess of contributions, state and local income tax refunds, credits or offsets, rents, royalties, and/or other taxable income from which Michigan tax was withheld.

Column F

Table 1: Enter city income tax withheld from Michigan

cities only.

Table 2: Enter Distribution Code from your

applicable).

Line 1: Subtotal. Enter the total of Table 1, columns E and

F.Carry total from Table 1, column F, to the City Income Tax Worksheet in the

Line 3: Total. Enter total of line 1 from Table 1 and line 2 from Table 2 on line 3 and carry total to Form

Sample

b. Employer Identiication Number |

1. Wages, tips, other comp. |

c. Employer’s name, address and ZIP code |

|

|

|

17. State income tax |

19. Local income tax |

Form |

2009 |

OMB No. |

Copy C for EMPLOYEE’S RECORDS |

Department of Treasury - Internal Revenue Service |

4A |

4B |

C |

D |

4E |

F |

Enter “X” |

|

|

|

|

|

if for: |

Box b - Employer’s federal |

|

Box 1 - Wages, tips, |

Box 17 - Michigan |

Box 19 - City |

You or Spouse |

identiication number |

Employer’s Name |

other compensation |

income tax withheld |

income tax withheld |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Number | Michigan Department of Treasury Schedule W 3924 |

| Revision Date | September 2009 (Rev. 9-09) |

| Purpose | To claim Michigan income tax withheld in 2009 on Individual Income Tax Return (MI-1040, line 34). |

| Attachment Requirement | Must be attached to Form MI-1040 or MI-1040X where applicable. |

| Submission Instructions | Type or print in blue or black ink, attaching additional Schedule W forms if needed. |

| Governing Law | Issued under authority of Public Act 281 of 1967. |

Guidelines on Utilizing Michigan 3924

Filling out the Michigan 3924 form, also known as Schedule W, is a necessary step for reporting state and city income tax withholding on your Michigan individual income tax return. This form is crucial for those who had Michigan income tax withheld in 2009. Following a series of steps can simplify the process. Remember, incorrect or missing information can delay the processing of your tax return, so take care to complete each section accurately.

- Start by entering the filer's first name, middle initial (M.I.), and last name in the designated boxes at the top of the form.

- Provide the filer’s Social Security Number in the format 123-45-6789.

- If filing a joint return, enter the spouse’s first name, M.I., and last name.

- Input the spouse’s Social Security Number, following the same format as above.

- For Table 1, related to W-2, W-2G, or corrected W-2 forms:

- Mark an “X” under columns A, B, C, or D to indicate if the income tax withheld was for you or your spouse.

- In column E, list the employer's federal identification number, employer's name, your wages, tips, other compensation, Michigan income tax withheld, and city income tax withheld (if applicable).

- Repeat these steps for each employer or income source that withheld Michigan income tax.

- Calculate the subtotal of Table 1, columns E and F, and enter these values in line 1.

- For Table 2, regarding 1099 and 4119 forms:

- Again, mark an “X” under the corresponding column for who the withheld tax was for (you or your spouse).

- Fill in the payer’s federal identification number, name, and the amounts related to taxable pension distribution, miscellaneous income, Michigan income tax withheld, and the distribution code from 1099-R (if applicable).

- Calculate the subtotal of Table 2, column E, and enter this amount in line 2.

- Combine the totals from line 1 and line 2, column E, to find the overall total. Enter this number on line 3.

- Carry the total from line 3 over to your MI-1040, line 34, to report your total Michigan income tax withheld.

After completing these steps, make sure to attach your completed Schedule W to your MI-1040 or MI-1040X form where applicable. Ensure all your documents are in order before submission to avoid any processing delays with your tax return.

Crucial Points on This Form

What is the Michigan 3924 form, also known as Schedule W?

The Michigan 3924 form, or Schedule W, is a document designed for Michigan taxpayers to report the total amount of Michigan state and city income tax withheld from their earnings during the tax year. This form is a crucial attachment to the MI-1040 Individual Income Tax Return or the MI-1040X Amended Tax Return. It helps ensure taxpayers receive proper credit for the taxes that employers have withheld from their paychecks.

Who is required to complete the Schedule W?

Any taxpayer who has had Michigan income tax withheld from their wages, bonuses, pensions, or other earnings during the tax year must complete a Schedule W. This includes both residents who worked in Michigan and non-residents who earned income from Michigan sources. The form is also necessary for those filing an amended return due to receiving a corrected W-2 after their original tax submission.

How do you fill out the withholding tables on Schedule W?

To accurately complete the withholding tables on Schedule W, you'll need to gather all relevant documents that show Michigan tax withheld. These documents typically include W-2 forms for traditional employment, 1099 forms for miscellaneous income, and 4119 forms for other earnings like unemployment compensation or pension distributions. Here's a quick guide on what to fill in:

- For W-2s and similar income documents, enter details such as wages and Michigan state and city tax withheld in Table 1.

- For 1099 and 4119 forms, report types of income like unemployment benefits, pensions, or dividends in Table 2.

- Enter corresponding totals in the columns as instructed, ensuring you carry the correct totals over to your MI-1040 or MI-1040X form.

Do I need to submit W-2 and 1099 forms with my Michigan tax return?

No, you should not submit W-2 or 1099 forms with your Michigan tax return. The purpose of Schedule W is to summarize the Michigan income tax withheld as reported on these documents. Taxpayers are advised to keep copies of their W-2s, 1099s, and other tax documents for six years in case the Department of Treasury requests them for verification purposes. However, if filing an MI-1040X due to a corrected W-2, completing a new Schedule W for the amended information is necessary.

What happens if I don't attach a Schedule W to my MI-1040 or MI-1040X?

Failing to attach a completed Schedule W when required can lead to delays in the processing of your Michigan tax return. This form is essential for the Department of Treasury to verify the Michigan income tax withheld from your earnings throughout the year. Without it, the state may not be able to accurately determine your tax liability or refund, potentially prolonging the time it takes to finalize your tax situation.

Common mistakes

Filling out the Michigan 3924 form, also known as the Withholding Tax Schedule, is a critical step in ensuring that one's state tax obligations are accurately reflected. However, several common mistakes can lead to complications, delays in processing, or even impact the amount refunded or owed. Understanding these pitfalls can significantly smooth the tax filing process.

One significant error is failing to attach the Schedule W to the MI-1040 or MI-1040X form where appropriate. This oversight can delay the return processing as the Department of Treasury needs this schedule to verify the claimed withholdings. Ensuring that this schedule is securely attached is a straightforward but crucial step in the tax filing process.

Another common mistake is inaccurately entering social security numbers or incorrectly filling out the filer’s name and details. Such inaccuracies can lead to processing delays or misattribution of tax payments. It's imperative to double-check these entries against official documents to avoid errors.

Individuals often misinterpret the instructions around Table 1 and Table 2, leading to incorrect entries for Michigan and city income tax withheld. This misunderstanding can affect the claimed refund or owed tax. It's crucial to correctly differentiate and report the state and city tax withheld as specified in the provided tables.

Typographical errors in entering the employers' federal identification numbers and payer’s identification in Tables 1 and 2, respectively, are also common. Since these numbers are critical for the treasury department to verify withholding information, inaccuracies here can have significant repercussions on the tax return process.

Another mistake involves the misreporting of income types in column D for both tables. Taxpayers sometimes incorrectly classify their income, leading to discrepancies in taxable amounts and withholdings. Understanding the nature of each income type and correctly categorizing it is vital.

Additionally, some filers overlook the necessity to tally a subtotal and carry these figures to the subsequent sections of the form or other related worksheets. This step is crucial for accurately calculating the total withholding claim. Missing or incorrect totals can lead to miscalculations on the main tax return form.

Incorrectly entering distribution codes, especially in Table 2 for 1099-R forms, is a frequent error. This code provides essential information on the nature of distributions, which can influence tax liability. Correct interpretation and entry of these codes are, therefore, essential.

Forgetting to account for additional withholding documents when filling out the initial form, then not attaching additional Schedule W forms if necessary, can also lead to underreported withholdings. Taxpayers with diverse sources of income must ensure all withholding documents are accounted for and attached as needed.

Failing to check the completed form for calculation errors or overlooked entries before attaching it to the MI-1040 can result in inaccuracies in one's tax obligations. A final review and double-checking of totals and carried-over amounts can prevent such errors.

Last but not least, ignoring the instructions on the preservation of W-2s, 1099s, and other withholding documents can complicate matters if the Michigan Department of Treasury requests them for verification purposes. Keeping these documents for at least six years is advisable for reference in potential future inquiries.

Documents used along the form

Filing taxes in Michigan requires meticulous attention to ensure that every credit and deduction is accurately claimed. Along with the Michigan 3924 form, a series of other forms and documents play crucial roles in the process. Here's a closer look at these essential forms and documents, each serving a specific purpose in the broader context of tax filing.

- Form MI-1040: This is the Individual Income Tax Return form for Michigan residents. It serves as the primary document where taxpayers summarize their income, deductions, and credits to determine their tax liability or refund.

- Form MI-1040X: Used for amending previously filed MI-1040 forms, this document allows taxpayers to correct errors or include information not previously reported, ensuring accuracy in their tax records.

- W-2 Form: This crucial wage and tax statement is issued by employers and outlines the employee's annual wages and the amount of taxes withheld from their paycheck, vital for accurate tax reporting.

- 1099 Forms: These forms report various types of income other than wages, such as freelance income, interest, dividends, and government payments, playing a key role in reporting non-wage income.

- MI-1040 Schedule 1 (Additions and Subtractions): This schedule allows taxpayers to adjust their income for specific Michigan additions and subtractions, tailoring their taxable income to state requirements.

- Michigan Schedule 2 (Nonrefundable Credits): Focused on tax credits, this form is where taxpayers claim any eligible nonrefundable credits that reduce their state tax liability directly.

- City Income Tax Forms: For residents of cities that impose their own income taxes, these forms are required to report earnings and calculate the tax owed to the local municipality.

- W-2G Form: This document reports gambling winnings and any taxes withheld from those winnings, essential for taxpayers who have received significant gains from gambling activities during the year.

Together, these forms and documents constitute the backbone of a Michigan taxpayer's filing requirements. By understanding and accurately completing each relevant form, taxpayers can navigate the complexities of state tax obligations and potentially maximize their refunds or minimize their tax liabilities.

Similar forms

Form W-2 (Wage and Tax Statement): This document is similar to the Michigan 3924 form as it also collects information about wages, tips, and other compensation earned by an employee. Both require the employer's identification number and detail the state and local income taxes withheld. The Schedule W specifically references using W-2 forms to complete certain sections, showcasing a direct link in their utilization for tax reporting purposes.

Form 1040 (U.S. Individual Income Tax Return): While the 1040 form is a federal tax return, it is similar to the Michigan 3924 in its need to gather information about income taxes that have been withheld over the tax year. Specifically, the MI-1040, the Michigan state equivalent, requires the attachment of Schedule W to accurately report state tax withholdings, mirroring the relationship between federal income reporting and withholding documentation on the federal 1040.

Form 1099 (Various Versions): Forms 1099, such as the 1099-MISC for miscellaneous income, are used to report income other than wages, salaries, and tips. The Michigan 3924 form is similar because it also uses information from 1099 forms to report taxable income and withholdings from sources outside of traditional employment, such as independent contractor work or other miscellaneous earnings that had Michigan income tax withheld.

Form MI-1040X (Amended Michigan Income Tax Return): This is the form used to make corrections or amendments to an already filed MI-1040 form. The similarity with the Michigan 3924 form arises in the instruction that if a corrected W-2 is received after submitting an original tax return, a Schedule W must be completed and attached to the MI-1040X, highlighting its role in ensuring accurate reporting of withholding amounts in amended returns.

Dos and Don'ts

When you're ready to tackle the Michigan 3924 form, also known as the Withholding Tax Schedule (Schedule W), it's essential to approach it with care and attention. This form is crucial for reporting Michigan income tax that has been withheld. Let's walk through what you should and shouldn't do to ensure the process is smooth and error-free.

Things You Should Do:

- Read the instructions carefully before you start filling out the form. This can save you from making common mistakes.

- Use blue or black ink for filling out the form if you're doing it by hand, or ensure your printer has enough ink if you're printing the completed form.

- Ensure that you enter numbers clearly and correctly, especially your Social Security Number and the amounts from your W-2 or 1099 forms.

- Attach your completed Schedule W to your MI-1040 or MI-1040X form where applicable. It's an essential step for your tax return's processing.

- Keep copies of your W-2s and other tax records for six years, as suggested. You might need them if requested by the Department of Treasury.

- If you need more space for additional entries, don’t hesitate to attach another Schedule W form.

Things You Shouldn't Do:

- Don't use ink colors other than blue or black when filling out the form manually, as this can lead to processing issues.

- Avoid entering incorrect Social Security Numbers for you or your spouse. Double-check these numbers to prevent processing delays.

- Don’t submit W-2 and/or 1099 forms with your return. These are not required and will not be processed.

- Try not to leave any fields incomplete that are applicable to you. Missing information can lead to delays or inaccuracies in your tax return.

- Do not forget to sign the form if you're filing a paper return. An unsigned form can be considered invalid.

- Ignoring the attachment order can result in processing delays. Ensure Schedule W is placed in the correct order behind your MI-1040 Individual Income Tax Return as indicated.

By following these dos and don'ts, you’ll navigate the process of completing Michigan’s Schedule W more effectively, ensuring a smoother experience with your tax filing.

Misconceptions

When taxpayers in Michigan encounter the 3924 form, commonly known as the Withholding Tax Schedule, several misconceptions often arise. This document is vital for accurately reporting state and some local taxes withheld from income, ensuring individuals claim the correct amounts on their tax returns. Let's explore and debunk four common misunderstandings about this form.

Only W-2 employees need to fill it out: A prevalent misconception is that the 3924 form is solely for individuals who receive a W-2 indicating Michigan income tax withheld. However, the form is also required for recipients of 1099 forms, among others, who have had Michigan income tax withheld. This includes various sources of income such as unemployment compensation, taxable interest, pensions, and more. The purpose of this form is not just for traditional employment but to account for all Michigan tax withholdings.

Attaching W-2 and 1099 forms is necessary: Another misunderstanding is the belief that taxpayers must attach their W-2 and 1099 forms along with the 3924 form when filing their return. The instructions clearly state that these forms should not be submitted with the return. Instead, detailed information from these documents should be transferred to the 3924 form. Keeping copies of W-2s and 1099s for personal records, however, is advised, as the Department of Treasury may request them if needed.

Completing it is optional if taxes were withheld: Some might think that filling out the 3924 form is optional if they had Michigan income tax withheld. However, to claim these withholdings on an Individual Income Tax Return (MI-1040, line 34), completing the 3924 form is mandatory. Skipping this step can result in the taxpayer not receiving credit for taxes already paid, potentially leading to a lower refund or a higher tax due amount.

It's only for Michigan residents: There's a misconception that only Michigan residents need to complete the form. While Michigan residents are the primary users, non-residents who had Michigan income tax withheld must also complete and attach Schedule W to claim these withholdings on their state income tax return. This ensures that all taxpayers, regardless of their residency status, are accurately reporting and claiming Michigan taxes withheld.

Clearing up these misconceptions is crucial for taxpayers to understand the importance and requirements of the 3924 form. It not only helps in avoiding common filing mistakes but ensures that individuals accurately report their tax withholdings, potentially affecting their refunds or amounts owed. Thus, a thorough understanding of the form's purpose and instructions is beneficial for all who must navigate Michigan's tax system.

Key takeaways

When it comes to completing and using the Michigan 3924 form, or Schedule W, which is a part of your state tax filing, there are several key points to take into account. This form is specifically designed for residents who need to claim withholding on their Michigan income tax returns for the amounts withheld from their earnings within the tax year. The implications of accurately completing this form are significant for ensuring that you claim all withholdings and potentially reduce your tax liability or increase your refund. Below are four major takeaways to keep in mind:

- Proper Documentation is Key: The importance of using the correct documents cannot be overstated. When filling out Schedule W, you'll need to refer to your W-2, 1099, and 4119 forms, if applicable, for the income and taxes withheld. This includes wages, tips, military pay, unemployment compensation, and more. Make sure to accurately transcribe the Michigan income tax withheld as this figure will direct the claims on your state tax return.

- Detailing Your Withholdings Accurately: In completing the withholding tables on Schedule W, specificity is crucial. You must enter the precise amounts for wages, taxes withheld, and other relevant income types as outlined. This accuracy ensures that you are claiming the correct amount of taxes already paid throughout the year, thereby avoiding discrepancies that could result in audits or penalties.

- Attachment and Submission: After completely and accurately filling out your Schedule W, attach it to your Form MI-1040 or MI-1040X where necessary. The form's integration into your tax return is critical for the Michigan Department of Treasury to assess and process your return efficiently. It's important to assemble your forms in the order specified in the instructions to facilitate this process.

- Record Keeping: Even though the Schedule W requires details from your W-2 and 1099 forms, you should not submit these documents with your return. Instead, keep copies of your W-2s and any other relevant documentation with your tax records for six years. Having these documents readily available will be invaluable in case the Department of Treasury requests them for verification purposes.

Your comprehension of these guidelines will not only streamline your tax filing process but also ensure you are compliant with Michigan's tax laws. Moreover, accurate completion and submission of the Schedule W can help expedite the processing of your tax return.

Popular PDF Templates

Eviction Filing Fee - An essential document for ensuring that economic status does not impede one's right to legal recourse and justice.

How to File for Divorce in Michigan for Free - Counter requests for expedited service (1925 to present) are processed within 1-3 hours.

What Reasons Can You Quit a Job and Still Get Unemployment Michigan - The requirement for companies to report sales or transfers of car marks ensures up-to-date records for state assessment purposes.