Michigan 3891 PDF Form

In an effort to streamline tax processes and ensure fairness in tax reimbursement for businesses, the Michigan Department of Treasury provides a specific form, the 3891, tailored for a very specialized function: the refund request for prepaid sales tax on gasoline. Established under the auspices of Public Act 167 of 1933, this form serves as a critical tool for businesses that find they have made an overpayment on the prepaid sales tax specifically attributed to gasoline purchases. The form requires businesses to provide essential details, such as the business name, the Federal Employee Identification Number (FEIN), and the business address including city, state, and ZIP code, all aimed at accurately identifying the claimant. It also mandates a detailed account of the overpayment specifying the tax reporting period and the amount overpaid. Importantly, an integral part of this procedure is the certification section, where an authorized individual must affirm under penalty of perjury that the information provided is accurate and truthful. For convenience and accessibility, the completed form can be faxed or mailed to the Michigan Department of Treasury, with additional resources and contact information available through their website and customer contact division. This form underscores Michigan’s commitment to ensuring that businesses can recuperate any undue financial outlays pertaining to gasoline sales tax, a reflection of the state’s broader efforts to uphold tax compliance and fairness.

Preview - Michigan 3891 Form

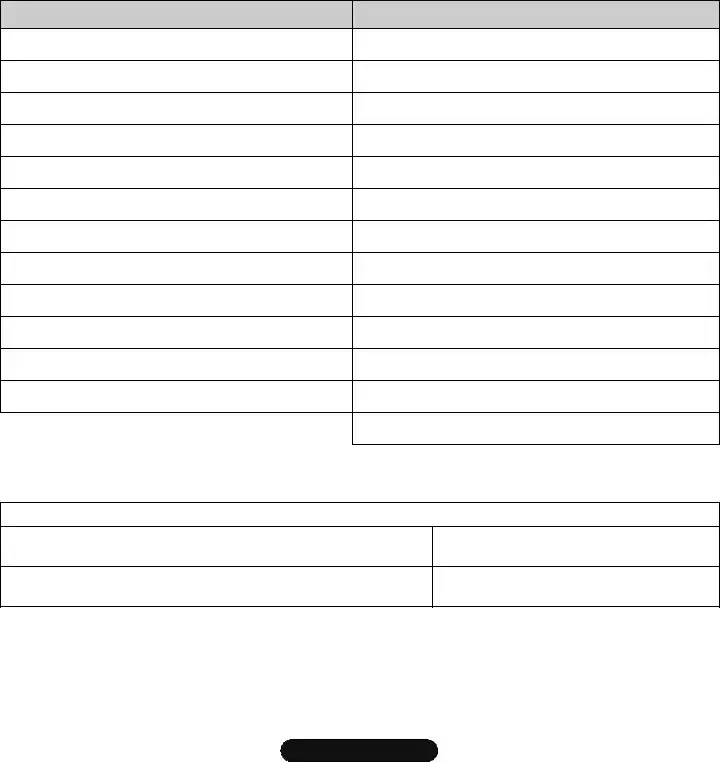

Michigan Department of Treasury 3891 (Rev.

Refund Request for Prepaid Sales Tax on Gasoline

Issued under the authority of Public Act 167 of 1933. Filing is voluntary.

Business Name |

Federal Employee Identification Number (FEIN) |

|

|

|

|

|

|

Business Address (No., Street) |

City |

State |

ZIP Code |

|

|

|

|

OVERPAYMENT DETAIL

Tax Reporting Period

Amount Overpaid

TOTAL OVERPAYMENT

CERTIFICATION

I certify under penalty of perjury that I have examined this request and to the best of my knowledge and belief, it is true and correct.

Authorized Signature

Telephone Number

Name and Title Printed

Date

Fax the completed form to (517)

Michigan Department of Treasury Lansing, MI 48922.

If you have questions, call (517)

www.michigan.gov/treasury

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Michigan 3891 form is designed for requesting a refund of prepaid sales tax on gasoline. |

| Governing Law | This form is issued under the authority of Public Act 167 of 1933. |

| Filing Method | Filing this form is voluntary and can be done via fax to (517) 636-4491 or mail to the Customer Contact Division, Michigan Department of Treasury, Lansing, MI 48922. |

| Contact Information | For inquiries, individuals can call (517) 636-4730 or visit www.michigan.gov/treasury. |

Guidelines on Utilizing Michigan 3891

Filling out the Michigan 3891 form is a straightforward process crucial for requesting a refund for prepaid sales tax on gasoline. This form ensures the validity of the claim and compliance with Public Act 167 of 1933. Completing the form accurately guarantees a smooth review and processing by the Michigan Department of Treasury. Here is a step-by-step guide to assist with filling out this form.

- At the top of the form, enter the Business Name.

- Next, provide the Federal Employee Identification Number (FEIN) in the designated space.

- Fill in the Business Address, including the Number, Street, City, State, and ZIP Code in their respective fields.

- Under the section titled OVERPAYMENT DETAIL, specify the Tax Reporting Period. This refers to the timeframe for which the overpayment occurred.

- In the next line, enter the Amount Overpaid, ensuring to double-check the figure for accuracy.

- Record the TOTAL OVERPAYMENT in the assigned space. This total should match the amount listed above.

- Proceed to the CERTIFICATION section. By signing, you attest under penalty of perjury that the information provided on the form is both true and correct to the best of your knowledge. Signature also signifies a thorough examination of the request.

- Enter the date on which the form is being signed in the Date field.

- Print the Name and Title of the authorized signatory.

- Include a Telephone Number where the signatory or business can be reached.

- Before sending, verify all the information entered is accurate and complete.

- The completed form can be faxed to (517) 636-4491 or mailed to the Customer Contact Division, Michigan Department of Treasury, Lansing, MI 48922.

- If there are any questions or if further clarification is needed, contact the Michigan Department of Treasury directly at (517) 636-4730 or visit www.michigan.gov/treasury.

Once the form is submitted, the Michigan Department of Treasury will review the request. The process may involve additional verification of the information provided. Timely and accurate completion of the form is crucial to avoid delays. Keep a copy of the submitted form and any correspondence for future reference.

Crucial Points on This Form

What is the Michigan 3891 form?

The Michigan 3891 form is designed for businesses seeking a refund for the prepaid sales tax on gasoline. It is a document issued under the authority of Public Act 167 of 1933. By filling out this form, businesses can officially request a refund for the overpayment of sales tax to the Michigan Department of Treasury.

Who needs to file the Michigan 3891 form?

Any business that has made an overpayment on prepaid sales tax for gasoline in Michigan should file the Michigan 3891 form. This form allows businesses to request a refund for the taxes they have overpaid.

What information is required to complete the form?

To successfully complete the form, the following information is necessary:

- Business Name

- Federal Employee Identification Number (FEIN)

- Business Address, including city, state, and ZIP code

- Tax Reporting Period

- Amount Overpaid

- Name and Title of the person certifying the form

- Signature, Telephone Number, and Date

How can the Michigan 3891 form be submitted?

The completed Michigan 3891 form can be submitted either by fax or mail. For fax submissions, use the number (517) 636-4491. To submit via mail, send the form to the Customer Contact Division, Michigan Department of Treasury, Lansing, MI 48922.

Is it mandatory to file the Michigan 3881 form?

No, filing the Michigan 3881 form is voluntary. It is only necessary for businesses that wish to request a refund for the overpayment of prepaid sales tax on gasoline.

What should be done if a business has questions about the form?

If there are any questions regarding the form or the refund process, businesses can contact the Michigan Department of Treasury's Customer Contact Division at (517) 636-4730 for assistance or visit their website at www.michigan.gov/treasury.

What is the deadline for filing the Michigan 3891 form?

There is no specific deadline mentioned for filing the Michigan 3891 form. However, it is advisable to submit the request as soon as possible after identifying an overpayment of prepaid sales tax to expedite the refund process.

What happens after submitting the form?

After submission, the Michigan Department of Treasury will review the request. If approved, the refund for the overpaid sales tax will be processed. The timeline for processing and receiving the refund may vary, so it is recommended to keep records of submission and follow up if necessary.

Common mistakes

Filing forms with the Michigan Department of Treasury, especially form 3891 for the refund request of prepaid sales tax on gasoline, can sometimes be tricky. People often make mistakes that can delay or complicate the process. Being mindful of these common errors can help ensure a smoother experience.

One frequent mistake is not double-checking the Business Name and Federal Employee Identification Number (FEIN). It's critical these match exactly with your official business documents. Any discrepancy, even minor, can result in delays. Remember, accuracy is key when dealing with official forms.

Another area often filled out incorrectly is the Business Address. Providing an outdated or incomplete address can lead to problems with document delivery. Ensure the address matches the one on file with the Michigan Department of Treasury to avoid any unnecessary confusion.

When it comes to the OVERPAYMENT DETAIL section, precise calculation is crucial. An error in reporting the Tax Reporting Period or the Amount Overpaid can lead to discrepancies that might require additional verification or correction, further delaying your refund.

The TOTAL OVERPAYMENT is where many applicants simply reiterate their mistakes from the overpayment detail section. It's essential to review these numbers thoroughly. Inaccuracies here directly affect the refund amount and can raise red flags, leading to audits or reviews.

A common oversight is neglecting the CERTIFICATION portion. Not having the correct Authorized Signature, Telephone Number, Name and Title Printed, and Date can invalidate your submission. This area confirms your claim's authenticity, so give it the attention it deserves.

Moreover, many forget to double-check the contact information before submitting. Ensure the Fax number and Address for mailing the completed form are up-to-date. Using outdated contact methods can misroute your important documents, leading to delays in processing your request.

Failing to leverage available resources is another pitfall. The Michigan Department of Treasury's website and customer contact division are there to assist. It's a good idea to review the website or call for guidance before filling out your form to prevent common mistakes.

In the digital age, it's easy to overlook the importance of keeping a copy of your submission for your records. Whether you're faxing or mailing your form, always retain a duplicate. This practice saves a lot of time and hassle if there are questions or you need to follow up on your refund request.

Lastly, people often rush through filling out their forms at the last minute. This hurried approach can lead to mistakes. Taking your time to carefully review each section, ensuring all information is accurate and complete, can significantly streamline the process. Remember, accuracy is more efficient than speed when it comes to official documentation.

Documents used along the form

When handling the Michigan Department of Treasury 3891 form, which is a refund request for prepaid sales tax on gasoline, it's often not the only document needed to complete your tax-related tasks. Understanding and compiling the necessary additional documents can streamline the process, making it more efficient and ensuring compliance with all applicable laws and regulations.

- Business Registration Forms: Before filing a Michigan 3891 form, your business must be properly registered with the State of Michigan. This includes obtaining a Federal Employer Identification Number (FEIN) and completing any necessary state business registration forms, which provide the legal groundwork for your business's operations in Michigan.

- Michigan Sales Tax License: To manage sales tax, including prepaid sales tax on gasoline, a Michigan Sales Tax License is required. This document ensures that your business is authorized to collect sales tax on taxable sales made within Michigan.

- Monthly/Quarterly Sales Tax Returns: Along with the Michigan 3891 form, businesses typically need to file regular sales tax returns, detailing taxable sales, the amount of sales tax collected, and any prepaid sales tax on gasoline. These returns provide a record of tax activities and are essential for accurate refund requests.

- Records of Prepaid Sales Tax Payments: Documentation of all payments made for the prepaid sales tax on gasoline is crucial when filing a refund request. This includes invoices, receipts, and bank statements, which serve as proof of the amount overpaid and support your claim.

- Taxpayer’s Declaration of Intent (TDI): Some businesses might also need to complete a Taxpayer’s Declaration of Intent if they are requesting a refund based on specific circumstances, such as a fuel purchase exemption. This document clarifies the reason behind the refund claim and provides necessary declarations from the taxpayer.

Collecting these documents before starting the refund request process with the Michigan 3891 form can make the procedure smoother. It ensures that all the requisite information and proof are at hand, reducing the likelihood of delays or complications. Handling business taxes might seem daunting, but having the right documents organized is a step towards simplifying the process and ensuring compliance with Michigan tax regulations.

Similar forms

IRS Form 941 - Employer's Quarterly Federal Tax Return: Similar to the Michigan 3891 form, the IRS Form 941 is used by employers to report federal withholdings from employee wages including federal income tax, Social Security, and Medicare taxes. Both forms involve the reporting of taxes to a government entity, require the business’s identification details, and include a certification section where the filer attests to the truthfulness of the information under penalty of perjury.

Form 1040-ES - Estimated Tax for Individuals: This form is used by individuals to estimate and pay their federal income tax on income that is not subject to withholding. Like the Michigan 3891 form, Form 1040-ES involves calculating an owed amount (in this case, estimated taxes rather than overpaid taxes) and submitting personal identification information along with a payment to the IRS. Both forms also provide instructions for mailing or faxing submissions.

State Tax Refund Form (varies by state) - Almost every state has its version of a tax refund request form for different scenarios, such as sales tax or income tax refunds. These forms, like Michigan's 3891, require the filer to detail the amount being requested for refund and usually ask for the business or individual's identifying information, similar reporting periods, and a section for official certification.

Form 8822 - Change of Address: While primarily intended for updating contact information with the IRS, Form 8822 shares similarities with the Michigan 3891 form in that both require detailed personal or business identification information to be processed. Each form also functions as a communicative document between the taxpayer and the tax authority, ensuring accurate and up-to-date information is on file.

Form W-4 - Employee's Withholding Certificate: Employed individuals use Form W-4 to determine the amount of federal income tax to withhold from their paychecks. Similar to the Michigan 3891 form, the W-4 requires personal identification details and includes instructions for submission. Although serving different purposes, both forms are integral to the tax filing and processing ecosystem, ensuring accurate tax collection and refund processes.

Dos and Don'ts

Filling out the Michigan 3891 form, a Refund Request for Prepaid Sales Tax on Gasoline, requires attention to detail and accuracy to ensure your submission is accepted. This can be an important process for businesses looking to claim a refund for overpaid taxes, and following the right steps can make a big difference. Below are some do's and don'ts to consider when completing this form.

Do:

- Ensure all business information is current and correct, including the Business Name and Federal Employee Identification Number (FEIN).

- Accurately report the Tax Reporting Period and the Amount Overpaid to prevent any delays in processing the refund.

- Double-check the Business Address, City, State, and ZIP Code for any errors to ensure all correspondence from the Michigan Department of Treasury reaches you.

- Review the entire form before submission to confirm that all the information provided is true and correct to the best of your knowledge.

- Sign the form in the certification section to verify its accuracy. This confirms your agreement under penalty of perjury that the information is correct.

- Keep a copy of the completed form and any documents sent as a part of your submission for your records.

Don't:

- Leave any required fields blank. Incomplete forms may result in delays or denial of the refund.

- Misstate the overpayment details. Providing incorrect amounts can lead to processing errors or possible audits.

- Forget to include the signature of the authorized individual. An unsigned form is considered incomplete.

- Neglect to print the name and title of the person signing the form. This information is crucial for verifying the form’s legitimacy.

- Assume electronic submission options are unavailable. Although mailing is an option, faxing to (517) 636-4491 might expedite your request.

- Hesitate to call (517) 636-4730 if you have questions or need clarification on how to properly fill out the form.

Submitting the Michigan 3891 form correctly helps ensure a smoother process in seeking a refund for prepaid sales tax on gasoline. It's always beneficial to approach such tasks with care and diligence, ensuring all information is accurately portrayed and all procedures are duly followed.

Misconceptions

Many people have misconceptions about the Michigan 3891 form, which is used to request a refund for prepaid sales tax on gasoline. These misunderstandings can lead to confusion or errors when submitting a request. Let's clarify some common misconceptions:

It's only for big businesses: The form is not exclusive to large corporations. Small businesses and sole proprietors who have overpaid their prepaid sales tax on gasoline can also use this form.

Filing is mandatory: Filing this form is voluntary. Businesses choose to file it if they believe they have overpaid their taxes and are due a refund.

It's difficult to file: While tax forms can seem daunting, the Michigan 3891 form is straightforward. It requires basic business information, the tax reporting period, and the amount overpaid.

It's only for gasoline taxes: Although it's specifically for requesting a refund of prepaid sales tax on gasoline, understanding this form is crucial for businesses in industries where gasoline purchases are significant.

You need a lawyer to file it: While consulting with a tax professional can be beneficial, especially for complex situations, businesses can complete and file the form on their own.

Refunds are guaranteed: Filing the form does not automatically guarantee a refund. The Michigan Department of Treasury reviews each request to verify the claim before issuing a refund.

The process takes years: While government processes can sometimes be slow, the Michigan Department of Treasury aims to process these requests in a timely manner. If you provide all the required information accurately, the process can be relatively quick.

There's a fee to file: There is no fee to submit the Michigan 3891 form. Businesses seeking a refund for overpaid taxes should not be deterred by the misconception of filing costs.

Any amount of overpayment can be claimed: It's important to ensure that the claimed overpayment is correct and substantiated by records. Minor discrepancies may not be worth the effort or could be adjusted in future filings.

Electronic filing is not available: While the form mentions faxing or mailing as submission methods, always check the latest filing procedures on the Michigan Department of Treasury's website or contact them directly. Electronic filing options may be available or introduced.

Understanding the purpose and process of the Michigan 3891 form is important for businesses managing their finances. Dispelling these misconceptions ensures businesses can confidently navigate tax regulations and potentially recover funds rightfully owed to them.

Key takeaways

Understanding the Michigan Department of Treasury 3891 form is essential for businesses looking to request a refund for the prepaid sales tax on gasoline. This document, governed under Public Act 167 of 1933, offers a path for businesses to reclaim overpaid taxes. Here are eight key takeaways to guide you through filling out and utilizing this form effectively:

- Voluntary Filing: It is important to note that filing Michigan 3891 is a voluntary process. Businesses opt to file this form if they believe there has been an overpayment in sales taxes on gasoline.

- Business Information: The form requires detailed business identification including the official business name, Federal Employee Identification Number (FEIN), and complete address. This information should be accurate to ensure the refund process proceeds smoothly.

- Overpayment Detail: An essential part of the form is the overpayment detail section. Businesses must accurately report the tax reporting period and the amount believed to be overpaid. Precision here is crucial for a successful claim.

- Total Overpayment: Summarizing the total overpayment is a critical step that involves consolidating the damages for the Department's review. This total gives a clear picture of the refund amount being requested.

- Certification: The certification section mandates the signature of an authorized individual. By signing, the signatory asserts that the information provided on the form is both accurate and truthful, under penalty of perjury.

- Submitting the Form: Michigan 3891 can be submitted either by fax or mail. The fax number and mailing address are clearly provided, offering flexibility in how businesses can choose to submit their request.

- Contacting for Questions: For any queries or clarification, the form lists a phone number. This direct line to the Customer Contact Division can be invaluable for guidance or addressing specific concerns regarding the form or the refund process.

- Online Resources: Lastly, the mention of the website (www.michigan.gov/treasury) serves as a reminder of the additional resources available online. The Department of Treasury’s website may offer further assistance, including guidelines, contact information, and updates regarding the 3891 form and its submission process.

Comprehending these key aspects of the Michigan 3891 form not only simplifies the process but also maximizes the likelihood of a successful refund claim. Attention to detail, from accurately filling out the business and overpayment details to ensuring proper submission, plays a vital role in navigating this process effectively.

Popular PDF Templates

Michigan Complaint for Divorce Form - Contains prerequisites for filing, such as the duration of residency in Michigan and in the specific county, critical for establishing jurisdiction.

Electronic Certificate of Origin - The primary document in Michigan for identifying crucial manufacturing details of new vehicles.