Michigan 3778 PDF Form

The complexity and nuanced requirements of modern tax documentation can often seem daunting to individuals and businesses alike. A pertinent example of such documentation is the Michigan Department of Treasury 3778 form, a critical document for those engaged in the import or diversion of motor fuels into Michigan. This form, being a cornerstone of compliance with P.A. 403 of 2000, as amended, outlines the obligation for filers to calculate and remit taxes on fuel within a three-day window following the import or diversion event. Distinct sections within the form cater to various fuel types—ranging from gasoline and ethanol products to undyed and dyed diesel, including aviation fuel—and require detailed inputs like product names, codes, gallons imported, and the corresponding taxes due. Additionally, it mandates inclusion of a company's crucial information and the stipulation of penalties for late filings. This form not only serves as a voucher for prompt tax payment but also as a comprehensive declaration affirming the accuracy and completeness of the information provided under the penalty of perjury. Its design to facilitate regulatory compliance underscores the importance of accurate reporting and timely payment, encapsulating both the transactional specifics and the overarching legal framework. Thus, engaging with Form 3778 entails not just an understanding of its procedural requirements but also recognition of its role within the broader context of fuel taxation and regulatory compliance in Michigan.

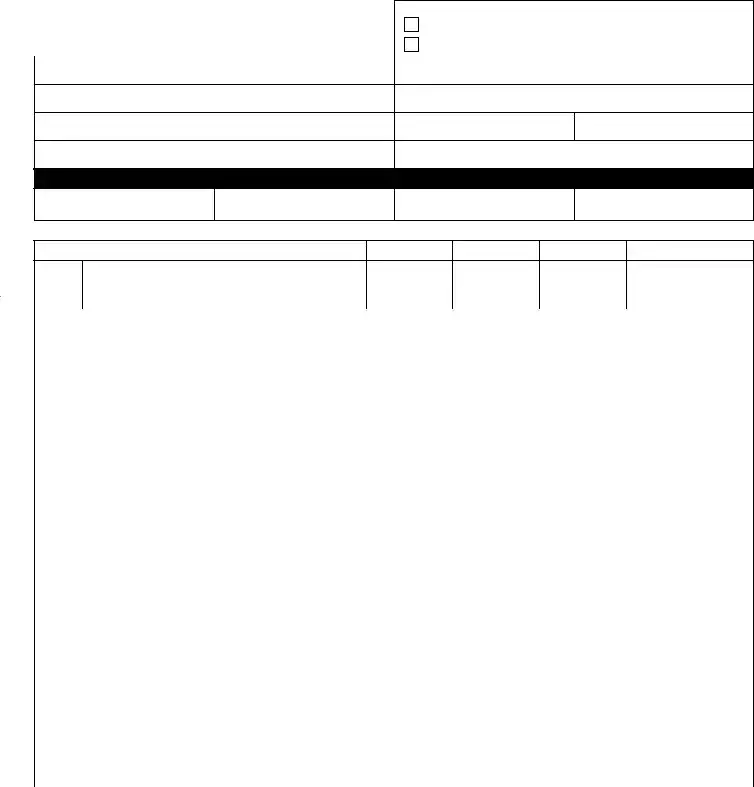

Preview - Michigan 3778 Form

Michigan Department of Treasury |

|

3778 (Rev. |

Reason for |

|

Three Day Payment Voucher |

|

|

Import from outside the United States |

Issued under authority of P.A. 403 of 2000, as amended. Filing is mandatory. |

|

|

Diversion requiring |

|

|

||

|

|

|

|

Company Name |

Account Number (FEIN or TR) |

||

|

|

|

|

DBA

Contact Person Name

Address (Street, RR#, P.O. Box)

Telephone Number

Fax Number

City, State, ZIP

IMPORT/DIVERSION INFORMATION

Date Import Entered Michigan

Document Number

Import Verification/Diversion Number

Date Verification Number Assigned

Enter Product Name, Codes and Gallons. See page 2 for instructions, product classification and codes.

Gasoline Products |

Product Codes |

Gallons |

Tax Rate |

Calculated Tax Due |

|

|

|

|

|

1. |

Gasoline |

065 |

|

x .19 |

1. |

2. |

Product Name |

|

|

x .19 |

2. |

Ethanol |

Products E70 - E99 |

|

|

|

3. |

3. |

Product Name |

E____ |

|

x .19 |

3. |

Undyed Diesel Products (see instructions on page 2) |

|

|

|

|

|

4. |

Undyed Diesel |

160 |

|

x .15 |

4. |

5. |

Product Name |

|

|

x .15 |

5. |

|

|

|

|||

Undyed |

Biodiesel Products B05 - B00 |

|

|

|

|

6. |

Product Name |

B____ |

|

x .15 |

6. |

|

|

|

|||

Dyed Diesel Products (dyed to U.S. Standards) |

|

|

|

|

|

7. |

Dyed Diesel |

228 |

|

x .00 |

7. |

Dyed |

Biodiesel |

|

|

|

|

8. |

Product Name |

D____ |

|

x .00 |

8. |

Aviation Products |

|

|

|

|

|

9. |

Aviation Fuel |

125 |

|

x .03 |

9. |

10. |

Jet Fuel |

130 |

|

x .03 |

10. |

Miscellaneous |

|

|

|

|

|

11. |

Product Name |

|

|

x ____ |

11. |

Tax Calculation |

|

|

|

|

|

12. Total Tax Due. Add lines 1 through 11 |

|

|

12. |

|

|

|

|

|

|

|

|

13. Penalty for late filing (100%). Enter amount from line 12 |

13. |

|

|||

|

|

|

|

|

|

14. Interest. (1% above prime rate set January 1 and July 1 of each year) |

14. |

|

|||

15. TOTAL REMITTANCE. Add lines 12, 13 and 14 |

|

|

15. |

|

|

Under penalty of perjury, I declare that I have examined this voucher, and to the best of my knowledge and belief, it is correct and complete.

Authorized Signature |

|

Signature of Preparer |

|

|

|

I authorize Treasury to discuss my return and attachments with my preparer. |

|

Do not discuss my return with my preparer. |

|||

|

|

|

|

|

|

Printed Name |

|

Printed Name |

|

Preparer FEIN |

|

|

|

|

|

|

|

Title |

|

Address |

|

|

|

|

|

|

|

||

Telephone Number |

Date |

Telephone Number |

Date |

||

|

|

|

|

|

|

Questions ???? - Please call (517)

3778, Page 2

Instructions for Form 3778, Three Day Payment Voucher

General Information - Tax is due on imported or diverted motor fuel within 3 business days after either of the following events:

•Imports from outside the United States by persons other than licensed Bonded Importers or Suppliers, when tax is not paid to supply source. An import verification number must be obtained prior to import.

•Diversions on all fuel intended for export from Michigan but diverted to a destination within Michigan. A diversion number must be obtained prior to the diversion. Attach a copy of Form 3750, SCHEDULE OF DIVERSION (11B) and/or a shipping document.

•Diversions by unlicensed importers on all fuel acquired outside Michigan, not intended for a Michigan destination, but diverted to Michigan. A diversion number must be obtained prior to the diversion. Attach a copy of Form 3750, SCHEDULE OF DIVERSION (11A) and/or a shipping document.

Payments not postmarked within three business days of the event are subject to 100% penalty, plus interest.

TO OBTAINAPPROPRIATEAUTHORIZATION CALL:

Import Verification Number

To obtain a Diversion Number, log on to www.trac3.net. If you do not have access to the Internet, contact Motor Fuel at (517)

Instructions

Occasional Importers must include all products and payments reported on this Three Day Payment Voucher, and also on their quarterly Fuel Importer Return.

Provide all requested information: company name, complete address, federal employer identification number, contact person and telephone number, Date Import Entered Michigan, Document Number (bill of lading, manifest), Import Verification/Diversion Number, Date Authorization Number Assigned (either Import Verification Number or Diversion Number).

Report gallons being imported or diverted on the appropriate line of the Voucher (page 1, lines 1 through 11).

If the product being imported or diverted is not

Diesel fuel dyed to Canadian standards must be reported as undyed diesel and applicable taxes must be paid.

Line 11, Miscellaneous: Enter name and product code (if applicable) of the miscellaneous product.

(a)If additional space is needed for a product, use line 11 to identify the fuel type. Multiply the gallons on line 11 by the appropriate tax rate.

(b)All other unidentified products: enter the name of the product, product code 092, the number of gallons and 0.19 in the tax rate column. Multiply the gallons by 0.19.

Fuel type categories and product codes: The tax rates and most common product and product code are listed below. See our Web site at www.michigan.gov/treasury for additional products and product codes.

Fuel Types and Product Codes |

|

Tax Rate |

|||

|

|

|

|

(per gallon) |

|

|

|

|

|||

Gasoline Products E01 - E69, E00 (denatured) (1% - 69%, and 100%) including: |

|

|

|||

065 |

- Gasoline |

199 - Toluene |

|

$.19 |

|

100 |

- Transmix |

092 - Undefined Other Product |

|

|

|

126 |

- Napthas |

|

|

|

|

Ethanol Products E70 - E99 (70% - 99%): |

|

|

|

||

E plus percentage (limit 2 digits) |

|

$.19 |

|

||

Undyed Biodiesel B05 - B00 (5% - 100%): |

|

|

|

||

B plus percentage (limit 2 digits) |

|

$.15 |

|

||

|

|

|

|

||

Dyed Biodiesel D01 - D00 (1% - 100%) |

|

|

|

||

D plus percentage (limit 2 digits) |

|

$.00 |

|

||

|

|

|

|||

Undyed Diesel Products (including diesel dyed to Canadian standards) including: |

|

|

|||

160 |

- Undyed Diesel |

142 - Undyed Kerosene |

281 - Mineral Oils |

$.15 |

|

B01 - B04 Biodiesel Blend (1% - 4%) |

(including mineral spirits) |

|

|

||

|

|

|

|||

Dyed Diesel Products (diesel dyed to US standards) including: |

$.00 |

|

|||

228 - Dyed Diesel |

072 - Dyed Kerosene |

|

|

|

|

Aviation Products including: |

|

$.03 |

|

||

125 - Aviation Gasoline |

130 - Jet Fuel |

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Designation | Michigan Department of Treasury 3778 (Rev. 09-12) |

| Purpose | Three Day Payment Voucher for motor fuel imported or diverted in Michigan |

| Governing Law | Issued under authority of P.A. 403 of 2000, as amended |

| Filing Requirement | Filing is mandatory for imports from outside the United States and diversions within Michigan |

| Penalty | Payments not postmarked within three business days of the event are subject to 100% penalty, plus interest |

| Payment Instruction | Make check payable to "State of Michigan-Special Taxes" |

| Contact Information | Questions can be directed to (517) 636-4600 |

| Submission Address | Mail with remittance to: Michigan Department of Treasury, Special Taxes Division, P.O. Box 30474, Lansing, MI 48909-7974 |

Guidelines on Utilizing Michigan 3778

Filling out the Michigan 3778 form is a straightforward process that requires attention to detail. This form is used for reporting tax due on motor fuel imported or diverted into Michigan. It's important to complete each section accurately to ensure compliance with state regulations. After following these steps to complete the form, it should be mailed with any necessary remittance to the specified address to meet the three-day payment requirement.

- Gather required documentation: Before filling out the form, ensure you have all necessary import or diversion documentation, including the import verification or diversion number and the bill of lading or manifest.

- Enter company information: At the top section, provide your company name, account number (FEIN or TR), DBA (if applicable), and the contact person's name.

- Provide contact details: Fill in your address, telephone number, fax number, city, state, ZIP, and email address in the designated areas.

- Import/Diversion Information: Enter the date the import entered Michigan, document number (bill of lading, manifest), import verification/diversion number, and the date the verification number was assigned.

- Enter Product Information: For each product imported or diverted, enter the product name, product code, and gallons. Utilize the product classification and codes provided in the instructions. Calculate the tax due using the applicable tax rate and enter this in the ‘Calculated Tax Due’ column.

- Calculate Taxes: Add up the total tax due from all listed products and enter this in line 12. Compute and enter any penalty for late filing (100%) on line 13, interest on line 14, and the total remittance on line 15.

- Authorization: Sign the form to declare the information is correct and complete. If someone prepared the form on your behalf, they should also sign and provide their details including FEIN and title. Choose whether you authorize the Treasury to discuss your return with your preparer by marking the appropriate box.

- Payment: Make a check payable to “State of Michigan-Special Taxes”. Ensure your account number is printed on the front of your check.

- Mail the Form: Mail the completed form and your payment to the Michigan Department of Treasury, Special Taxes Division, P.O. Box 30474, Lansing, MI 48909-7974.

Remember, accuracy is key to successfully fulfilling the requirements of the Michigan 3778 form. Take your time to double-check all entered information and calculations to ensure compliance and avoid any unnecessary penalties or interest due to errors or omissions. Following these steps carefully will guide you through the process smoothly.

Crucial Points on This Form

What is the Michigan 3778 form used for?

The Michigan 3778 form, issued by the Michigan Department of Treasury, is a Three Day Payment Voucher that needs to be filed for the tax on imported or diverted motor fuel. It is necessary for instances where fuel is imported from outside the United States by entities other than licensed Bonded Importers or Suppliers without tax being paid to the supply source, as well as for fuel intended for export from Michigan but diverted to a location within Michigan.

Who needs to file the Michigan 3778 form?

Any entity that imports or diverts motor fuel to Michigan and does not pay tax at the supply source must file this form. This includes occasions when fuel purchased for export from Michigan is diverted within the state or imports by unlicensed parties into Michigan.

What are the key sections of the Michigan 3778 form?

The form includes sections for:

- Company and contact person information

- Import/diversion details

- Product name, codes, and gallons imported or diverted

- Tax calculation based on the type of fuel

- Signature of the authorized representative and preparer

How is the tax calculated on the Michigan 3778 form?

The tax is calculated by multiplying the gallons of each type of fuel by its respective tax rate. These rates vary depending on the fuel type—gasoline, ethanol, undyed diesel, dyed diesel, undyed biodiesel, dyed biodiesel, and aviation fuels. The form provides a section to calculate the total tax due, including any penalty for late filing and interest.

When is the Michigan 3778 form due?

Payment of the tax is required within three business days following the import or diversion event. Payments not postmarked within this timeframe are subject to a 100% penalty, in addition to interest charges.

Where should the Michigan 3778 form be sent?

The completed form, along with the total remittance, should be mailed to the Michigan Department of Treasury, Special Taxes Division, at the address provided on the form. Make sure to include the account number on the front of the check.

Can digital payments be made for the Michigan 3778 form?

The instructions do not specify digital payment options directly on the form. For the most current payment methods, including possible electronic payment options, it is advisable to contact the Michigan Department of Treasury or visit their official website.

What happens if the information provided on the Michigan 3778 form is incorrect?

Filing the form under penalty of perjury means it's crucial that all information is correct and complete. If incorrect information is submitted, it can lead to penalties, interest on unpaid taxes, or even legal consequences. If an error is discovered after submission, it is recommended to contact the Michigan Department of Treasury immediately to correct the mistake.

Common mistakes

Filling out the Michigan 3778 form accurately is crucial for companies dealing with imported or diverted motor fuel. Unfortunately, errors can often occur in the process, leading to unnecessary complications. One common mistake is overlooking the importance of the exact product codes when listing gasoline products. The form demands specificity, and using incorrect or generalized product codes could result in incorrect taxation.

Another area prone to errors is the calculation of taxes due. Users sometimes mistakenly apply a flat tax rate across different fuel types without consulting the detailed instructions or acknowledging different rates for various fuel categories such as Ethanol or Undyed Diesel Products. Such inaccuracies not only affect the total tax due but can also lead to penalties for underpayment.

Additionally, the treatment of dyed and undyed diesel fuels often confuses filers. Diesel fuel dyed according to Canadian standards must be reported as undyed diesel, with applicable taxes paid accordingly. Failure to recognize this distinction results in incorrect tax submissions, a mistake easily overlooked by those unfamiliar with the specifics of fuel classification.

Many companies fail to include all imported or diverted products and their payments on this form, as well as on their quarterly Fuel Importer Return. This oversight can lead to discrepancies between recorded and actual fuel transactions. Ensuring all products are accounted for on both documents is essential for maintaining accurate tax records.

There is also a tendency to neglect obtaining or noting the Import Verification or Diversion Number and the date this number was assigned. This information is crucial for the Michigan Department of Treasury to verify the legitimacy of the import/diversion and to process the form correctly. Omitting these numbers or failing to acquire them before filing can lead to processing delays or rejection of the submitted form.

Incorrect identification of the product being imported or diverted is another frequent mistake. If the specific product is not pre-identified on the form, it is imperative to enter the product name and the appropriate code in the space provided. Guessing or misidentifying these entries can lead to improper tax calculations.

Another critical error involves the penalty and interest calculation lines (lines 13 and 14). Filers often misunderstand how to correctly calculate these amounts or fail to realize that late filings will incur a 100% penalty based on the total tax due. Proper attention to submission deadlines and accurate penalty calculations are paramount to avoid doubling the tax liability unexpectedly.

The signature fields at the bottom of the form sometimes receive insufficient attention. Authorized signatories must review, sign, and date the document to affirm its correctness and completeness. Allowing an unauthorized individual to sign or neglecting to include a preparer's identification can invalidate the form. This procedural oversight can lead to the form's rejection, necessitating a resubmission and potentially resulting in further delays and penalties.

Documents used along the form

When dealing with the Michigan Department of Treasury, specifically concerning the 3778 Form for three-day payment vouchers on tax due from imported or diverted motor fuels, it's important to be aware of other potential forms and documents that might be needed. This form is a key component in managing fuel imports and diversions, ensuring that taxes are properly calculated and paid within the required timeframe. However, to fully comply with regulations, businesses might need to prepare and submit additional forms or documents.

- Form 3750, Schedule of Diversion (11B): This document is critical for recording details about fuel intended for export from Michigan that was subsequently diverted within the state. It helps in confirming the diversion and in calculating the necessary tax payments.

- Form 3750, Schedule of Diversion (11A): Similar to the 11B, this form is used by unlicensed importers to detail fuel acquisitions from outside Michigan intended for destinations outside the state which were then diverted to Michigan.

- Fuel Importer Return: This quarterly return form is necessary for occasional importers. It requires the submission of all products and payments reported on the Three Day Payment Voucher, ensuring ongoing compliance.

- Bill of Lading/Manifest: These documents serve as evidence for the transportation and receipt of goods. They must match the details provided in the Three Day Payment Voucher to authenticate the import or diversion.

- Import Verification Number Application: Before importing fuel, a verification number must be obtained. While not a form, applying for this number is a critical step in the import process.

- Diversion Number Application: Similar to the import verification, this application process is necessary for obtaining a diversion number prior to the act, ensuring that diverted fuels are properly documented and taxed.

- Authorized Signature Documentation: While not a standalone document, ensuring that the individual signing the Three Day Payment Voucher and related forms is authorized to do so is critical. This might include corporate resolutions or power of attorney documentation.

- Interest and Penalty Computation Sheets: If payments are late, detailed calculations using these sheets will be necessary to understand the additional amounts due.

- Payment Checks: While technically not a form, ensuring that a check is correctly filled out, with the account number printed on the front, is essential for successful payment processing.

Understanding and preparing the correct forms and documents when importing or diverting motor fuels into Michigan ensures compliance with the law and avoids costly penalties. Each document plays a role in affirming the details of the transaction and confirming that all tax responsibilities are met. It's important for businesses to stay informed about these requirements and seek guidance if there are uncertainties about the forms or the process.

Similar forms

The Michigan Motor Fuel Importer Return is closely aligned with the Michigan 3778 form as both require detailed reporting of fuel quantities imported, the tax calculations based on those quantities, and personal or company information for who is filing the return or voucher. The Importer Return focuses on quarterly reporting, whereas form 3778 is designed for specific instances requiring a three-day payment.

Form 3750, SCHEDULE OF DIVERSION (11A and 11B) complements form 3778 by providing a method to document fuel diversions, whether for export from Michigan diverted to a destination within Michigan or for diversions by unlicensed importers. Both forms necessitate the submission of accurate fuel types and quantities to comply with state tax regulations.

The Quarterly Fuel Tax Return shares similarities with form 3778 in its function to report fuel activities and calculate taxes due. Although it is on a quarterly basis, it still demands comprehensive details about fuel transactions, paralleling the immediate reporting and payment requirements of the 3778 voucher for specific import or diversion events.

The Payment Voucher for Prepaid Sales Tax and form 3778 are alike in that they both involve the calculation and remittance of taxes to the Michigan Department of Treasury. While the prepaid sales tax voucher focuses on sales tax, the 3778 form pertains specifically to motor fuel taxes resulting from importation or diversion activities.

Fuel Tax License Application is indirectly related to form 3778 as it deals with the authorization aspect of fuel importing and handling within Michigan. Though primarily for licensing, understanding the responsibilities, including tax payments and reporting as outlined in the 3778 form, is crucial for applicants.

The Diesel Fuel Tax Return parallels the 3778 form through its detailed accounting of diesel fuel transactions and the associated tax responsibilities. Both require accurate reporting of fuel quantities and applicable taxes, albeit for different operational conditions and tax periods.

A Tax Exempt Fuel Sale Certificate contrasts with form 3778 by documenting transactions exempt from tax, while the 3778 form addresses taxable transactions requiring prompt reporting and payment. Both forms ensure compliance with Michigan's tax laws from opposite perspectives - taxable versus tax-exempt transactions.

Dos and Don'ts

When dealing with the Michigan 3778 form, which is essential for reporting tax on imported or diverted motor fuel, accuracy and timeliness are paramount. To ensure a smooth process, here's a list of dos and don'ts:

- Do ensure you have the correct import verification or diversion number before filling out the form. This is crucial for a valid filing.

- Do have all relevant product names, codes, and gallons ready. This information must be accurate to calculate the correct tax due.

- Do double-check the tax rates for each product you are reporting. Mistakes here could lead to under or overpayment of taxes.

- Do include your company name, contact information, and federal employer identification number (FEIN or TR) clearly at the top of the form.

- Do sign and date the form. An unsigned form is not valid and will not be processed.

- Don't delay in mailing the form. It must be postmarked within three business days of the import or diversion event to avoid penalties.

- Don't forget to include all products and payments reported on this Three Day Payment Voucher on your quarterly Fuel Importer Return if you are an Occasional Importer.

- Don't use the form to report diesel fuel dyed to Canadian standards as dyed diesel; it must be reported as undyed diesel with the applicable taxes paid.

- Don't neglect attaching a copy of Form 3750, SCHEDULE OF DIVERSION (11B) or a shipping document if applicable. This documentation supports the reported diversions.

Adherence to these guidelines will help ensure that your filing is accurate and compliant, minimizing the risk of errors and potential penalties.

Misconceptions

When it comes to filing the Michigan Department of Treasury 3778 form, there are several misconceptions that can lead to errors or misunderstanding. Below are ten of the most common misconceptions and clarifications to help ensure accurate and compliant submissions.

Only Imports Need the 3778 Form: It's a misconception that the 3778 form is exclusively for imports from outside the United States. In reality, the form is also required for diversion of fuel intended for export but diverted to a destination within Michigan, and for diversions by unlicensed importers of fuel acquired outside Michigan but diverted to Michigan.

Form 3778 is Optional: Some people mistakenly believe that submitting Form 3778 is optional. However, filing this form is mandatory for reporting taxes on imported or diverted motor fuel within 3 business days after the import or diversion event.

Late Filing Has Minor Penalties: A significant misconception is that penalties for late filing are minor. The reality is quite the opposite; payments not postmarked within three business days of the import/diversion event are subject to a 100% penalty, plus interest.

Internet Access Not Required: While some may think you do not need internet access to obtain a Diversion Number, the primary method to obtain one is online via www.trac3.net. Though if internet access is unavailable, Motor Fuel can be contacted directly by phone.

All Diesel is Taxed Equally: Many are unaware that diesel fuel dyed to Canadian standards must be reported as undyed diesel on the Form 3778 and is thus taxed accordingly. This misconception could lead to incorrect tax calculations.

Only Physical Documents Accepted: There’s a misconception that the Michigan Department of Treasury only accepts physical documents. However, the form and accompanying documents can be filed and documents such as the Schedule of Diversion can be attached digitally.

Filing Applies Only to Large Businesses: Some small business owners believe that the 3778 form filing requirements do not apply to them. In fact, any entity, regardless of size, that imports or diverts motor fuel to Michigan, must comply with these filing requirements.

One Time Importers are Exempt: Occasional or one-time importers might think they are exempt from this requirement. However, even occasional importers must include all products and payments reported on this form and also on their quarterly Fuel Importer Return.

Authorized Signature is Optional: It's incorrectly assumed that the authorized signature is optional. Under penalty of perjury, the authorized signature certifies that the information provided is correct and complete, which is a legal requirement.

Penalty Calculation is Negotiable: Finally, there's a mistaken belief that penalty calculations for late filing or inaccuracies are negotiable. The penalties are clearly defined by law and are strictly enforced without negotiation.

Understanding these misconceptions and correcting them is crucial for compliant and accurate filing of the Michigan Department of Treasury 3778 form. Complying with these regulations helps avoid unnecessary penalties and ensures the proper taxation of motor fuels.

Key takeaways

The Michigan 3778 form is critical for any transaction involving the importation or diversion of motor fuel into Michigan, ensuring compliance with tax obligations. Here are key takeaways to guide you through accurately filling out and using this form:

- Filling out the Michigan 3778 form is mandatory for reporting taxes due on imported or diverted motor fuel within three business days following the import or diversion event.

- A unique Import Verification Number or Diversion Number is required prior to importing or diverting fuel, which can be obtained by contacting designated authority or through specific online platforms.

- All motor fuel types being imported or diverted must be reported, including gasoline, ethanol, undyed and dyed diesel, aviation fuels, and any miscellaneous products, using specific product codes and tax rates.

- For diesel fuel dyed according to Canadian standards, report as undyed diesel products and ensure the appropriate taxes are paid, reflecting the nuanced requirements for fuel classifications.

- The form necessitates comprehensive information on the import or diversion, including company and contact details, date of entry into Michigan, document numbers, and precise quantities of fuels in gallons.

- Calculating taxes due requires applying the correct tax rate per gallon for each fuel type, with the rates provided for gasoline products, ethanol, undyed and dyed diesel, biodiesel and aviation fuels.

- If a late filing occurs, a penalty equal to 100% of the total tax due is imposed, along with interest calculated at 1% above the prime rate set biannually, emphasizing the importance of timely submissions.

- Authorization for the Treasury to discuss the return with a preparer is optional, providing flexibility in managing tax affairs while ensuring confidentiality and control over the information shared.

- Payments and completed forms must be directed to the Michigan Department of Treasury, Special Taxes Division, with checks made payable to "State of Michigan-Special Taxes" and the account number clearly indicated to ensure accurate processing.

Understanding each of these points before completing the Michigan 3778 form can significantly streamline the process, ensuring compliance with Michigan's tax requirements for motor fuel imports and diversions. This attention to detail safeguards businesses against penalties and fosters a transparent relationship with tax authorities.

Popular PDF Templates

Michigan Workers Independent Contractor Worksheet - Detailing the type of work performed allows for a clearer understanding of the contractor's role and responsibilities.

State of Michigan 2022 Tax Forms - The Michigan 151 form is a Power of Attorney Authorization document allowing you to appoint a representative for state tax, benefit, or debt matters.