Michigan 3683 PDF Form

The Michigan 3683 form presents a pivotal link between businesses and the Michigan Department of Treasury, facilitating a crucial avenue for handling withholding tax matters. Crafted under the authority of the Revenue Act, P.A. 122 of 1941, as amended, the availability of this form is a voluntary choice for businesses seeking to designate a payroll service provider or an individual to represent them. From establishing a power of attorney to embracing the nuances of Corporate Officer Liability (COL) Certificate requirements, this document lays down a structured path for businesses to ensure compliance with state tax regulations. It specifies the critical information needed, such as taxpayer and payroll service provider details, alongside the account number or Federal Employer ID No. (FEIN), and remains in effect until explicitly revoked in writing by the business. The involvement of an authorized representative from the business to sign and certify the power of attorney underscores the gravity and formality of the authorization process. In addition, the form alerts signatories about the personal liability implications for officers, members, managers, or partners in cases where there is a failure to file returns or pay taxes. Thus, the Michigan 3683 form embodies a comprehensive tool for businesses, facilitating a smoother interaction with state tax obligations while underscoring the responsibilities and potential liabilities of corporate officers.

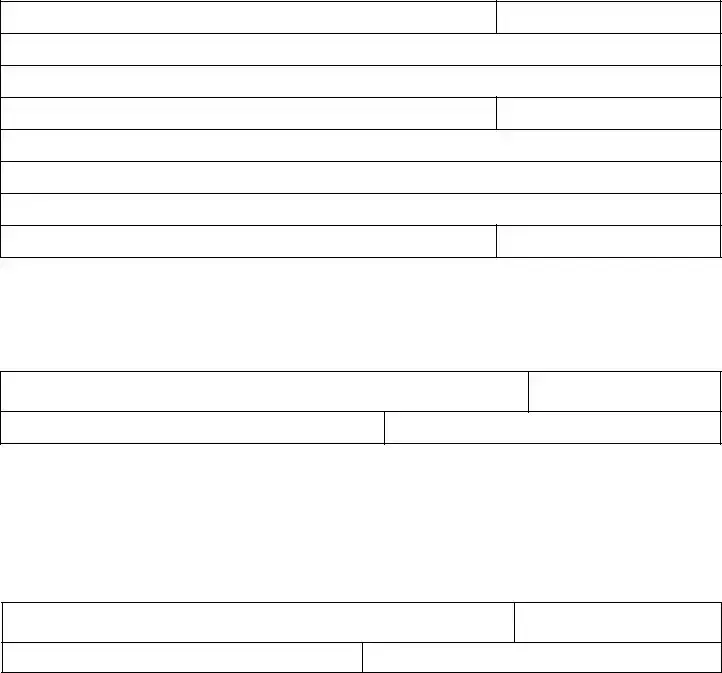

Preview - Michigan 3683 Form

Michigan Department of Treasury |

36 |

3683 (Rev. |

Payroll Service Provider Combined Power of Attorney Authorization and Corporate Officer Liability (COL) Certificate for Businesses

Issued under authority of the Revenue Act, P.A. 122 of 1941, as amended. Filing is voluntary.

Complete this form if you wish to appoint someone to represent your business to the State of Michigan for withholding tax matters.

Taxpayer Name

Address (Street or RR#)

City, State, ZIP Code

Contact Person

Payroll Service Name

Address (Street or RR#)

City, State, ZIP Code

Contact Person

Account No./Federal Employer ID No. (FEIN)

Telephone Number

Telephone Number

Effective _________________________ (mo/day/yr), the

represent my business and receive information in reference to all Treasury income tax withholding matters until I notify the Michigan Department of Treasury in writing that this Power of Attorney is revoked.

Taxpayer's Power of Attorney Authorization

Must be signed by an authorized representative of the business. I certify that I have the authority to execute this Power of Attorney.

Signature

Date

Type or Print Name

Title

Please be aware of officer, member or partner liability as provided in Michigan Compiled Laws 205.27a(5):

"If a corporation, limited liability company, limited liability partnership, partnership, or limited partnership liable for taxes administered under this act fails for any reason to file the required returns or pay the tax due, any of its officers, members, managers, or partners who the department determines, based on either an audit or an investigation, have control or supervision of, or responsibility for, making the returns or payments is personally liable for the failure......."

CERTIFICATION

Corporations, partnerships, LLP's or LLC's must complete this section before this form can be processed. This officer, member or partner certification must be resubmitted when there is a change in the individual responsible for filing and/or paying Michigan taxes.

Signature of Corporate Officer, Partner, or Member responsible for reporting and/or paying Michigan taxes

Date

Type or Print

Title

If you have any questions, please contact the Michigan Department of Treasury at (517)

Form Characteristics

| Fact Number | Description |

|---|---|

| 1 | The form is designated as Michigan Department of Treasury Form 3683. |

| 2 | It is a combined document that includes both Power of Attorney Authorization and Corporate Officer Liability (COL) Certificate for Businesses. |

| 3 | Issuance is under the authority of the Revenue Act, P.A. 122 of 1941, as amended. |

| 4 | Completing this form is voluntary and is intended for businesses wishing to appoint a representative for Michigan withholding tax matters. |

| 5 | The form requires information about the taxpayer and the payroll service provider, including addresses, contact persons, and telephone numbers. |

| 6 | An authorized representative of the business must sign the taxpayer's Power of Attorney Authorization to execute this Power of Attorney. |

| 7 | Michigan Compiled Laws 205.27a(5) provides for officer, member, or partner liability if necessary returns are not filed or taxes due are not paid. |

| 8 | For processing, corporations, partnerships, LLP's, or LLC's must complete the certification section certifying an officer, member, or partner responsible for tax matters. |

| 9 | Contact information for the Michigan Department of Treasury is provided for questions, including a telephone number, fax number, and mailing address. |

Guidelines on Utilizing Michigan 3683

Filling out the Michigan 3683 form is a critical step for businesses that wish to authorize a payroll service provider or individual to handle their withholding tax matters with the State of Michigan. It is an authorization which allows the appointed entity or individual to represent the business in inquiries and matters related to the state's income tax withholding. The form also includes a section that addresses corporate officer liability, making it clear that certain individuals within the company may be held personally responsible for failure to comply with tax filing and payment obligations. Here’s how to properly complete the Michigan 3683 form:

- Begin with the Taxpayer Name. This should be the official name of your business.

- Enter the business Address in the space provided. Include the street address or rural route number.

- Fill in the City, State, and ZIP Code of your business.

- Provide the name of the Contact Person. This is someone who the Department of Treasury can reach out to with questions about your form.

- Next, move to the Payroll Service Name. If you are appointing a payroll service provider, write their business name here.

- Enter the Address of the payroll service provider, including the street or rural route number.

- Include the payroll service's City, State, and ZIP Code.

- Fill in the Contact Person for the payroll service provider. This should be a person the state can contact for informations regarding payroll matters.

- Input your business Account No./Federal Employer ID No. (FEIN).

- Add the Telephone Number for both the taxpayer and the payroll service provider.

- Specify the Effective Date when the payroll service provider is authorized to begin representation. Use the format (month/day/year).

- Complete the Taxpayer's Power of Attorney Authorization section by having an authorized representative of the business sign and date the form. Also, type or print the name and title of the signatory.

- Understand and complete the CERTIFICATION section if applicable. This requires a signature from a corporate officer, partner, or member responsible for reporting and/or paying Michigan taxes, along with their title. It must be resubmitted anytime there's a change in the individual responsible for tax duties.

Once the form is fully completed, review it to ensure all information is accurate and legible. This form can then be faxed to the provided number or mailed to the Michigan Department of Treasury at the address listed at the top of the form. It's important to keep a copy of the form for your records. For any questions or further clarification, contacting the Michigan Department of Treasury directly is recommended.

Crucial Points on This Form

What is the Michigan 3683 form?

The Michigan 3683 form is a document used by businesses to appoint a payroll service provider or an individual as their authorized representative for state withholding tax matters. This form allows the appointed entity to communicate with the Michigan Department of Treasury on behalf of the business regarding any issues or transactions related to income tax withholding. It combines Power of Attorney Authorization with Corporate Officer Liability (COL) Certificate for businesses.

Who needs to fill out this form?

Any business entity, such as a corporation, partnership, limited liability company (LLC), or limited liability partnership (LLP), that wishes to authorize a payroll service provider or an individual to represent them in matters of state withholding tax with the Michigan Department of Treasury should complete this form. This is particularly important for businesses that want to ensure compliance without handling these matters in-house.

What information is required to complete the form?

Completing the Michigan 3683 form requires the following information:

- Taxpayer Name and Address (including city, state, and ZIP code)

- Contact Person for the taxpayer

- Payroll Service Name and Address (including city, state, and ZIP code)

- Contact Person for the payroll service

- Account Number/Federal Employer ID No. (FEIN)

- Effective date of the authorization

- Signatures from an authorized representative of the business and the corporate officer, partner, or member responsible for reporting and/or paying Michigan taxes

Is filling out this form mandatory?

No, completing the Michigan 3683 form is voluntary. Businesses choose to fill out this form to officially authorize a representative for their withholding tax matters, ensuring proper communication and compliance with the Michigan Department of Treasury.

How is the form submitted?

The completed Michigan 3683 form can be submitted in two ways:

- By Fax: Send it to (517) 636-4520.

- By Mail: Send it to the Michigan Department of Treasury, P.O. Box 30778, Lansing, MI 48909-8278.

What does the Corporate Officer Liability (COL) Certificate entail?

The section of Corporate Officer Liability (COL) Certificate as part of the Michigan 3683 form indicates that if the business fails to file the required returns or pay due taxes, any of its officers, members, managers, or partners who have control or supervision of, or responsibility for, making these filings or payments may be held personally liable. This clause underlines the importance of compliance and the serious responsibility assigned to the authorized signatory.

What happens if there is a change in the individual responsible for tax matters?

Should there be any change in the individual within the business who is responsible for filing and/or paying Michigan taxes, the certification section of the form must be completed and resubmitted. This ensures that the Michigan Department of Treasury is always in communication with the correct person regarding the business’s tax matters.

Who can I contact for questions regarding the form?

If you have any questions about the Michigan 3683 form, you are encouraged to contact the Michigan Department of Treasury directly at (517) 636-4660. They can provide guidance and clarification on how to properly complete and submit the form.

Common mistakes

Filling out the Michigan 3683 form, which serves to appoint a payroll service provider as a representative for tax withholding matters, seems straightforward. However, small mistakes can lead to big headaches. Here are seven common errors people make when completing this form.

Firstly, a common mistake is not ensuring the taxpayer information is completely filled out. Each field, including the taxpayer name, address, and especially the Federal Employer ID Number (FEIN), needs to be accurately completed. This information is crucial for the Michigan Department of Treasury to identify the business correctly.

Another frequent error is not providing complete and correct information for the payroll service provider. Like taxpayer information, every detail about the payroll service, including its name, address, and contact information, must be clearly and correctly filled out to avoid any miscommunication or delay in processing.

Failures in the authorization section also occur regularly. This part of the form requires precise dates and clear authorization for the payroll provider to act on the business's behalf. Not providing a specific effective date can cause unnecessary delays or even result in the form being rejected.

Perhaps one of the most critical mistakes made is in the Power of Attorney Authorization section not being signed by an authorized representative of the business. This signature is a mandatory component of the form, validating that the person signing has the authority to grant this power of attorney. Without it, the authorization cannot be accepted.

In addition, there's often confusion around the Corporate Officer Liability (COL) Certificate section. The importance of this part is frequently underestimated. It must be signed by an officer, partner, or member who is responsible for tax matters. Omitting this signature can lead to personal liability issues for tax failures, according to Michigan law.

Another oversight includes not updating the form when there are changes in the individual responsible for filing and/or paying Michigan taxes. As businesses evolve, so do their personnel. Failing to update this information can cause confusion and improperly assigned responsibilities.

Lastly, businesses sometimes neglect to contact the Michigan Department of Treasury with any questions they have about completing the form or understanding their responsibilities. Given that errors on this form can have legal and financial implications, taking advantage of the department's resources to ask questions or clarify doubts is a wise move.

In sum, while the 3683 form is a key document for businesses working with payroll service providers in Michigan, attention to detail and completeness are essential. Avoiding these common mistakes can ensure the process goes smoothly, safeguarding the business from potential legal and financial issues.

Documents used along the form

Handling business taxes in Michigan, especially when appointing a payroll service provider, involves several pieces of documentation beyond the Michigan 3683 form. This form itself is crucial for businesses looking to authorize someone else for withholding tax matters, but it's often just a part of the tax management puzzle. Let's dive into other forms and documents frequently used alongside the Michigan 3683 form, shedding light on their purposes to ensure smooth handling of tax-related responsibilities.

- Form 518: This is the Registration for Michigan Taxes form. It's essentially the first step for any new business in Michigan, allowing them to register for various taxes, including sales tax, use tax, and withholding tax.

- Form 160: Known as the Combined Return for Michigan Taxes, this form simplifies the filing process by allowing businesses to report and pay sales, use, and withholding taxes simultaneously.

- Form UIA 1028: Employer's Quarterly Wage/Tax Report, used by businesses to report wages paid and unemployment taxes due to the State of Michigan. It’s vital for maintaining compliance with unemployment insurance obligations.

- Form MI-W4: Michigan’s Withholding Exemption Certificate enables employees to determine the amount of Michigan income tax to be withheld from their paychecks.

- Articles of Incorporation/Organization: While not directly related to taxation, these documents are fundamental to identifying the business structure and ensuring that the entity is legally registered with the state.

- Corporate Resolution: This document identifies which members of the business have the authority to act on behalf of the corporation, such as appointing a payroll service provider via the Michigan 3683 form. It may be requested for verification.

- IRS Form 2848: Power of Attorney and Declaration of Representative. Although it's a federal form, businesses often use it alongside state forms when they need to authorize individuals to represent them before the IRS, highlighting its relevance in comprehensive tax management.

Every document plays a unique role in the broader picture of tax administration for Michigan businesses. Whether registering a new enterprise, handling ongoing tax obligations, or ensuring lawful representation in tax matters, understanding and preparing these documents is essential. It’s not just about fulfilling legal requirements, it's about fostering smooth operations and steering clear of penalties. If there’s ever uncertainty, consulting with a professional can provide clarity and direction, ensuring that your business remains in good standing while focusing on growth and success.

Similar forms

The IRS 2848, Power of Attorney and Declaration of Representative, is similar to Michigan's 3683 form in that both authorize someone to represent the taxpayer in matters before the state's Department of Treasury or the IRS, respectively. They allow the appointed individuals to receive confidential tax information and act on the taxpayer's behalf.

Form SS-4, Application for Employer Identification Number (EIN), shares similarities with the 3683 form as both involve federal employer identification numbers (FEIN) and are necessary for businesses to properly identify themselves for tax purposes.

The Michigan UIA 1028, Employer's Quarterly Wage/Tax Report, is related in the context of payroll and withholding tax matters. While UIA 1028 specifically deals with unemployment insurance taxes and wage reporting in Michigan, the 3683 form grants representatives the power to handle such withholding tax matters on behalf of the business.

The Business Entity Tax Return forms, such as the IRS 1120 for corporations, connect to the 3683 form through their focus on business tax responsibilities. The 3683’s section on Corporate Officer Liability (COL) Certificate highlights the personal liability of individuals in control of or responsible for business tax obligations.

State-specific Power of Attorney forms, like California's Form 3520, are counterparts to Michigan's 3683 in granting individuals the authority to represent a taxpayer or entity in tax matters with their respective state treasury or tax board.

Form 8821, Tax Information Authorization, is akin to the 3683 form by allowing the designated representative to access the taxpayer’s information, although not to represent them in tax matters, reflecting a narrower scope of authorization compared to the 3683 form.

The IRS 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, and its counterparts in state-level reporting requirements, such as Michigan's UIA reports, share the theme of tax and payroll reporting with the 3683 form. Both forms involve the identification and responsibilities of businesses in tax reporting and payment.

Certificate of Liability Insurance forms used by businesses to prove insurance coverage can be compared to the COL segment in the 3683 form, indicating a commitment to fulfilling certain responsibilities, although in different contexts (tax obligations vs. insurance requirements).

Dos and Don'ts

Filing out the Michigan 3683 form, a combined Power of Attorney Authorization and Corporate Officer Liability Certificate for businesses, requires careful attention to detail. Below are dos and don'ts to guide you through this process smoothly.

Do:- Read the form thoroughly before starting to fill it out. Understanding each section fully is crucial to providing accurate information.

- Confirm you have the authority to execute this Power of Attorney. This is essential to ensure the legality of the document.

- Provide accurate information for each section, including the taxpayer name, address, and contact information, to prevent any processing delays.

- Ensure the payroll service’s details are current and correct. Mistakes here can lead to communication errors.

- Clearly indicate the effective date of the authorization. This ensures that the document's validity period is well-defined.

- Double-check the account number/Federal Employer ID No. (FEIN) for accuracy to avoid misidentification.

- Sign and date the form in the designated areas to validate the Power of Attorney and Certification sections.

- Contact the Michigan Department of Treasury directly if you have any questions or need clarification on the form’s requirements.

- Leave any sections incomplete. Every field is important for the form’s processing.

- Rush through filling out the form without verifying the details. Take your time to ensure everything is correct.

- Forget to update the Certification section if there is a change in the individual responsible for filing and/or paying Michigan taxes for your entity. Keeping this information current is crucial.

- Assume the form is submitted correctly without confirmation. Follow up with the Michigan Department of Treasury if necessary.

By following these guidelines, you can ensure a smoother process in appointing a payroll service provider or updating the Corporate Officer Liability Certificate for your business with the Michigan Department of Treasury.

Misconceptions

Understanding the Michigan 3683 form can be a complex process, leading to widespread misconceptions about its use and requirements. Here’s a breakdown of common misunderstandings:

Misconception 1: The Michigan 3683 form is required for all businesses. In reality, filling out this form is voluntary and specifically geared towards businesses wishing to appoint a payroll service provider to handle their state tax withholding matters.

Misconception 2: Only corporations can use Form 3683. This form is not limited to corporations; it is also applicable to partnerships, limited liability companies (LLCs), and limited liability partnerships (LLPs) wanting to grant authority to a representative for tax withholding purposes.

Misconception 3: Form 3683 covers all types of taxes. The scope of this form is specifically focused on withholding tax for income. It does not cover other taxes a business may owe to the State of Michigan.

Misconception 4: Once filed, the form’s authorization is permanent. The authorization granted through the Michigan 3683 form remains in effect until the business notifies the Michigan Department of Treasury, in writing, that the power of attorney is revoked. Therefore, it is not a permanent arrangement.

Misconception 5: Any employee can sign the Form 3683. The form requires the signature of an authorized representative of the business. This means an individual with the authority to appoint someone to represent the business in tax withholding matters needs to sign it.

Misconception 6: Form 3683 grants power of attorney for all business matters. The power of attorney granted through Form 3683 is limited to income tax withholding matters. It does not grant broad financial or operational control over the business.

Misconception 7: The form eliminates personal liability for business taxes. Even with the submission of Form 3683, certain individuals within a corporation, LLC, LLP, or partnership could still be personally liable for unpaid taxes if it is determined that they had control or supervision over tax matters. Therefore, the form does not absolve individuals from responsibility or potential liability.

It's crucial for businesses to understand these nuances to ensure they comply properly with Michigan’s tax regulations and leverage the Form 3683 correctly for their needs.

Key takeaways

Filling out and using the Michigan 3683 form, a Power of Attorney Authorization and Corporate Officer Liability (COL) Certificate for Businesses, involves specific steps and considerations that are crucial for legal and tax representation in Michigan. Below are key takeaways to ensure accurate and compliant usage of this form:

- Voluntary Filing: Completing the Michigan 3683 form is voluntary but essential for businesses that wish to appoint a payroll service provider or an individual to represent them in matters related to Treasury income tax withholding. This representation includes the authority to receive information about the business's withholding tax matters.

- Authorization Duration: The authorization granted through the Michigan 3683 form remains effective until the business notifies the Michigan Department of Treasury in writing that it wishes to revoke the Power of Attorney. It is important to note the effective date carefully when filling out the form to ensure proper representation duration.

- Responsibility for Tax Matters: The form emphasizes the liability of corporate officers, partners, or members in case of failure to file required returns or pay taxes. Those with control, supervision, or responsibility for these tasks may be personally liable if the business fails to comply. Therefore, accurately completing and updating the certification section is of utmost importance.

- Updating the Form: If there is a change in the person responsible for tax matters in the corporation, partnership, LLP, or LLC, the Michigan 3683 form must be resubmitted with the new officer’s, partner's, or member's information. This ensures that the Michigan Department of Treasury can correctly identify and communicate with the individual in charge of tax-related responsibilities.

Businesses should take care to provide all requested information accurately and consult with legal or tax professionals if they have questions about filling out the form or about their tax obligations in general. Additionally, maintaining up-to-date records and promptly notifying the Michigan Department of Treasury about any changes in representation or responsibility is crucial for compliance and avoiding personal liability.

Popular PDF Templates

Veteran Benefits in Michigan - Outlined process for disabled veterans or their survivors in Michigan to claim exemption from property taxes, easing financial pressures.

State of Michigan Job Openings - Strives to balance economic development objectives with the preservation of farmland and open space in Michigan.

Electronic Certificate of Origin - The certificate necessary to authenticate a vehicle’s origin in the state of Michigan.