Michigan 2796 PDF Form

Dealing with real estate transactions can often be complex and taxing, both figuratively and literally. In Michigan, a valuable tool for some sellers is the Michigan Department of Treasury 2796 form, officially known as the Application for State Real Estate Transfer Tax (SRETT) Refund. This form, derived from the authority of Public Act 330 of 1993, serves as a beacon of hope for sellers who have paid the SRETT but later discover their sale qualifies for exemption under certain conditions outlined in MCL 207.526. The intricate details of this form allow for a refund request to be filed within a notably specific timeframe of four years and 15 days from the date of sale or transfer, mandating the submission of documentation to support the claim. Sellers must carefully fill out their identification, claim an exemption, and provide the necessary proof alongside the deed and other relevant tax documents, with the goal of alleviating the financial burden of the SRETT paid during their property transaction. The form facilitates a variety of exemptions, including but not limited to transfers made under specific family relations, certain trusts, or reorganization of entities without changing beneficial ownership, showcasing the state's recognition of various occasions where the transfer tax could be deemed unnecessary or unfair. All of this culminates into a pivotal resource for eligible sellers aiming to navigate the maze of real estate transactions with the potential for financial relief.

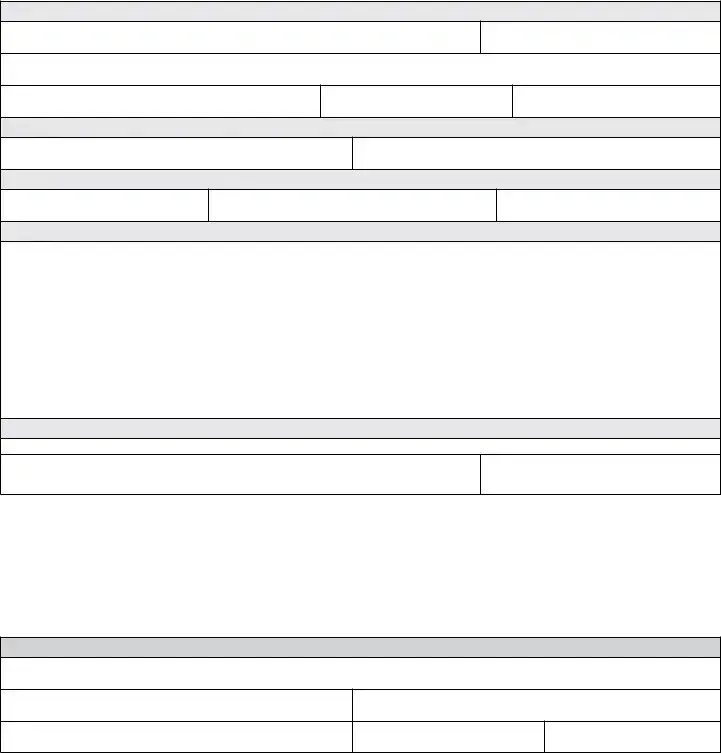

Preview - Michigan 2796 Form

Michigan Department of Treasury 2796 (Rev.

Application for State Real Estate Transfer Tax (SRETT) Refund

Issued under authority of Public Act 330 of 1993.

When a Seller of property pays the SRETT to a County Treasurer, and later determines that the sale (transfer) of the property qualiies

for exemption under MCL 207.526 (see Page 2), the Seller(s) may request a refund of the SRETT paid to a County Treasurer from the

Michigan Department of Treasury by iling this form and submitting documentary evidence to support the refund request. This form must be iled within four years and 15 days from the date of sale or transfer of the property.

Type or print in blue or black ink.

PART 1: IDENTIFICATION

Name(s) of ALL Seller(s) - (refund check will be made payable to ALL seller(s) as listed on the recorded deed)

Social Security or Federal ID Number(s) of ALL Seller(s)

Address where refund check is to be mailed

City and State

ZIP Code

Telephone Number

PART 2: BASIS FOR EXEMPTION: (see Page 2 for list of exemptions)

State Exemption Being Claimed Under PA 330 of 1993, as Amended

Amount of SRETT Refund Requested

PART 3: RECORDED DEED

Date of Transfer of Property (MM/DD/YYYY)

Tax Parcel/Sidwell ID Number

Taxing Entity (City, Township, Village)

PART 4: REQUIRED DOCUMENTATION

Attach a copy of the recorded deed, copies of tax statements or other appropriate documentation to support your refund request.

Please note that to qualify for a refund of the SRETT under “u”, (1) the SEV of the property in the year of sale must be equal to or less than the SEV in the year of purchase; (2) the property must qualify for 100% Principal Residence Exemption and, (3) the sales price of

the property cannot exceed the true cash value of the property in the year of sale. (For additional information, please refer to Attorney

General Opinion No. 7214, available at www.michigan.gov/ag). If claiming exemption under “u”, please submit ALL of the following:

1.Proof of date of purchase/SEV in year of purchase

2.Proof of date of sale/SEV in year of sale

3.Proof that property qualiied for the Principal Residence Exemption

4.Proof of SRETT paid to Register of Deeds (copy of recorded deed containing Real Estate Transfer Tax stamp, oficial receipt from county treasurer, or form

5.Proof of sales price of property

PART 5: SELLER’S CERTIFICATION

I declare under penalty of perjury that the information on this form and attachments is true and complete to the best of my knowledge.

Signature(s) of ALL Seller(s)

Date

Questions may be directed to Treasury’s Technical Services Section at

Michigan Relay Service by calling

MAILING INSTRUCTIONS: Mail this application and copies of supporting documentation to:

Michigan Department of Treasury

Technical Services Section

P.O. Box 30698

Lansing, MI

TREASURY USE ONLY

Reviewed by

Treasury Approval Signature

Printed Name

Title

Date

Amount Approved for Refund

2796, Page 2 |

Exemptions to State Real Estate Transfer Tax (SRETT) |

|

Under Section 6 of PA 330 of 1993, as amended, you may claim an exemption from the SRETT for one of the reasons listed below. Enter the section number for the exemption you are claiming in Part 2 of form 2796.

(a)A written instrument in which the value of the consideration for the property is less than $100.00.

(b)A written instrument evidencing a contract or transfer that is not to be performed wholly within this state only to the extent the written instrument includes land lying outside of this state.

(c)A written instrument that this state is prohibited from taxing under the United States constitution or federal statutes.

(d)A written instrument given as security or an assignment or discharge of the security interest.

(e)A written instrument evidencing a lease, including an oil and gas lease, or a transfer of a leasehold interest.

(f)A written instrument evidencing an interest that is assessable as personal property.

(g)A written instrument evidencing the transfer of a right and interest for underground gas storage purposes.

(h)Any of the following written instruments:

(i)A written instrument in which the grantor is the United States, this state, a political subdivision or municipality of this state, or an oficer of the United States or of this state, or a political subdivision or municipality of this state, acting in his or her oficial capacity.

(ii)A written instrument given in foreclosure or in lieu of foreclosure of a loan made, guaranteed, or insured by the United States, this state, a political subdivision or municipality of this state, or an oficer of the United States or of this state, or a political subdivision or municipality of this state, acting in his or her oficial capacity.

(iii)A written instrument given to the United States, this state, or 1 of their oficers acting in an oficial capacity as grantee, pursuant to the terms or guarantee or insurance of a loan guaranteed or insured by the grantee.

(i)A conveyance from a husband or wife or husband and wife creating or disjoining a tenancy by the entireties in the grantors or the grantor and his or her spouse.

(j)A conveyance from an individual to that individual’s child, stepchild, or adopted child.

(k)A conveyance from an individual to that individual’s grandchild,

(l)A judgment or order of a court of record making or ordering a transfer, unless a speciic monetary consideration is speciied or ordered by the court for the transfer.

(m)A written instrument used to straighten boundary lines if no monetary consideration is given.

(n)A written instrument to conirm title already vested in a grantee, including a quitclaim deed to correct a law in title.

(o)A land contract in which the legal title does not pass to the grantee until the total consideration speciied in the contract has been paid.

(p)A conveyance that meets 1 of the following:

(i)A transfer between any corporation and its stockholders or creditors, between any limited liability company and its members or creditors, between any partnership and its partners or creditors, or between a trust and its beneiciaries or creditors when the transfer

is to effectuate a dissolution of the corporation, limited liability company, partnership, or trust and it is necessary to transfer the title of real property from the entity to the stockholders, members, partners, beneiciaries, or creditors.

(ii)A transfer between any limited liability company and its members if the ownership interests in the limited liability company are held by the same persons and in the same proportion as in the limited liability company prior to the transfer.

(iii)A transfer between any partnership and its partners if the ownership interests in the partnership are held by the same persons and in the same proportion as in the partnership prior to the transfer.

(iv)A transfer of a controlling interest in an entity with an interest in real property if the transfer of the real property would qualify for exemption if the transfer had been accomplished by deed to the real property between the persons that were parties to the transfer of the controlling interest.

(v)A transfer in connection with the reorganization of an entity and the beneicial ownership is not changed.

(q)A written instrument evidencing the transfer of mineral rights and interests.

(r)A written instrument creating a joint tenancy between 2 or more persons if at least 1 of the persons already owns the property.

(s)A transfer made pursuant to a bona ide sales agreement made before the date the tax is imposed under sections 3 and 4, if the sales agreement cannot be withdrawn or altered, or contains a ixed price not subject to change or modiication.

(t)A written instrument evidencing a contract or transfer of property to a person suficiently related to the transferor to be considered a single employer with the transferor under section 414(b) or (c) of the internal revenue code of 1986, 26 USC 414.

(u)A written instrument conveying an interest in property for which an exemption is claimed under section 7cc of the general property tax act,

1893 PA 206, MCL 211.7cc, if the state equalized valuation of that property is equal to or lesser than the state equalized valuation on the date of purchase or on the date of acquisition by the seller or transferor for that same interest in property. If after an exemption is claimed under this subsection, the sale or transfer of property is found by the treasurer to be at a value other than the true cash value, then a penalty equal to

20% of the tax shall be assessed in addition to the tax due under this act to the seller or transferor.

(v)A written instrument transferring an interest in property pursuant to a foreclosure of a mortgage including a written instrument given in lieu of foreclosure of a mortgage. This exemption does not apply to a subsequent transfer of the foreclosed property by the entity that foreclosed on the mortgage.

(w)A written instrument conveying an interest from a religious society in property exempt from the collection of taxes under section 7s of the general property tax act, 1893 PA 206, MCL 211.7s, to a religious society if that property continues to be exempt from the collection of taxes under section 7s of the general property tax act, 1893 PA 206, MCL 211.7s.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Number | 2796 |

| Revision Date | August 2012 |

| Purpose | Application for State Real Estate Transfer Tax (SRETT) Refund |

| Issuing Authority | Michigan Department of Treasury |

| Governing Law | Public Act 330 of 1993 |

| Eligibility for Refund | Seller(s) may request a refund if the sale qualifies for exemption under MCL 207.526 |

| Deadline for Filing | Within four years and 15 days from the date of the sale or transfer |

| Required Documentation | Recorded deed, copies of tax statements, or other supportive documents |

| Contact Information | Treasury’s Technical Services Section at 517-636-4230 |

| Mailing Instructions | Mail to Michigan Department of Treasury Technical Services Section P.O. Box 30698 Lansing, MI 48909-8198 |

Guidelines on Utilizing Michigan 2796

Filling out the Michigan Department of Treasury 2796 Form is a critical step for those seeking a refund of the State Real Estate Transfer Tax (SRETT) paid in a transaction that qualifies for an exemption. Michigan's Public Act 330 of 1993 provides for such exemptions under specific conditions. The form, commonly referred to as Form 2796, facilitates the process of claiming this refund. For the successful submission, applicants should provide accurate identification details, specify the basis for exemption, include the recorded deed date, and attach all required supporting documentation. Following the step-by-step instructions below will help ensure the form is correctly filled out and submitted.

- Start by typing or printing in blue or black ink to ensure legibility.

- Under PART 1: IDENTIFICATION, enter the names of all sellers as they appear on the recorded deed. This is crucial because the refund check will be issued to these names.

- Provide the Social Security or Federal ID Number(s) for all listed sellers.

- Fill in the mailing address, including city, state, and ZIP code, where the refund check should be sent.

- Include a telephone number for possible contact regarding the application.

- Move to PART 2: BASIS FOR EXEMPTION. Here, specify the state exemption being claimed under PA 330 of 1993, as amended. Consult Page 2 of the form for a list of exemptions and enter the appropriate section number related to your claim.

- Enter the amount of SRETT refund requested.

- In PART 3: RECORDED DEED, indicate the date of the property transfer, the tax parcel/Sidwell ID number, and the taxing entity (city, township, village).

- For PART 4: REQUIRED DOCUMENTATION, attach a copy of the recorded deed, alongside copies of tax statements or other relevant documents that support your refund request. If claiming exemption under "u", ensure to include proof of date of purchase and sale, SEV in the year of purchase and sale, qualification for Principal Residence Exemption, proof of SRETT paid, and evidence of the property’s sales price.

- Proceed to PART 5: SELLER'S CERTIFICATION. All sellers listed must sign, declaring that the information provided is true and complete to the best of their knowledge. Include the date next to each signature.

- Lastly, review the MAILING INSTRUCTIONS section to ensure the application and all copies of supporting documentation are sent to the correct address: Michigan Department of Treasury, Technical Services Section, P.O. Box 30698, Lansing, MI 48909-8198.

Once submitted, it generally takes 4 to 6 weeks for the form to be processed. During this time, it's important to stay patient and be prepared for any follow-up inquiries from the Treasury’s Technical Services Section. Successfully navigating these steps will bring individuals closer to receiving their SRETT refund.

Crucial Points on This Form

What is the Michigan Department of Treasury 2796 form?

The Michigan Department of Treasury 2796 form, also known as the Application for State Real Estate Transfer Tax (SRETT) Refund, is a document utilized by sellers of property who have paid the SRETT to a County Treasurer and later determine that their property sale or transfer qualifies for an exemption under MCL 207.526. This form allows sellers to request a refund of the SRETT.

When should the 2796 form be filed?

The 2796 form must be filed within four years and 15 days from the date of sale or transfer of the property. It is important for sellers to adhere to this timeframe to ensure their eligibility for a refund of the SRETT paid.

What documentation is required to support a refund request?

To support a refund request, sellers need to attach several pieces of documentation to the 2796 form, including:

- A copy of the recorded deed.

- Copies of tax statements or other appropriate documentation.

- If claiming exemption under “u”, the seller must provide proof of the date of purchase/SEV in year of purchase, the date of sale/SEV in year of sale, proof that the property qualified for the Principal Residence Exemption, proof of SRETT paid, and proof of sales price of property.

What are some common exemptions that allow for a SRETT refund?

The Michigan Department of Treasury recognizes several exemptions under PA 330 of 1993, as amended, that may qualify a seller for a SRETT refund, including but not limited to:

- Transfers of property where the value of the consideration is less than $100.

- Transfers of property to or from governmental units or in foreclosure or in lieu of foreclosure.

- Transfers that create or disjoin a tenancy by the entireties between spouses.

- Conveyances from an individual to that individual's child or grandchild.

- Transfers undertaken to effectuate a dissolution of an entity and transfer the title of real property from the entity to its principles without changing the beneficial ownership.

How long does the process take for a SRETT refund to be issued?

Once the application and all required documentation are submitted, the Michigan Department of Treasury advises applicants to allow 4 to 6 weeks for the processing of their SRETT refund request. This timeframe may vary based on the complexity of the request and the completeness of the application submitted.

Where should the 2796 form and accompanying documentation be mailed?

All applications for a SRETT refund, including the 2796 form and required supporting documentation, should be mailed to:

Michigan Department of Treasury

Technical Services Section

P.O. Box 30698

Lansing, MI 48909-8198

Common mistakes

Filling out the Michigan Department of Treasury 2796 form, essential for requesting a State Real Estate Transfer Tax (SRETT) refund, often involves intricate details that are sometimes overlooked. One common mistake is the incorrect identification of seller(s). Applicants must ensure that the name(s) of all seller(s) exactly match those on the recorded deed. This also extends to their Social Security or Federal ID Number(s), which must be accurate to avoid processing delays. Failure in this basic yet crucial step could lead to a significant hold-up in receiving the refund.

Another area frequently mishandled is the basis for exemption section. It is requisite to accurately state the exemption being claimed under PA 330 of 1993, as amended. This involves picking the correct exemption code that applies to the seller’s situation from the list provided on page 2 of the form. When applicants fail to correctly identify or enter the wrong code for the exemption, it may result in the denial of the application for a tax refund. Understanding each exemption category and its requirements is central to correctly filling out this part of the form.

The deed date and property identification, including the Tax Parcel/Sidwell ID Number, also prove to be stumbling blocks. Specifying the date of transfer accurately is essential, as this date is critical for meeting the eligibility criteria — applications must be filed within four years and 15 days from this date. Moreover, properly identifying the property by its Tax Parcel/Sidwell ID Number ensures that the refund is applied correctly. Incorrect or incomplete information in this section can lead to unnecessary confusion and a potential rejection of the refund request.

Required documentation often poses challenges, as well. Applicants sometimes forget to attach all necessary documents to support their refund request. For exemptions under section "u", for example, it's crucial to include proof of the date of purchase and sale, evidence of the property’s Principal Residence Exemption status, a copy of the recorded deed showing the SRETT paid, and proof of the property’s sales price. Missing any of these documents can weaken the application, risking the refund’s denial.

Mistakes in seller certification frequently occur when sellers do not sign the application or when the signing date is omitted. This section affirms the truthfulness and completeness of the information provided, under penalty of perjury. If this part is left incomplete or unsigned, the application’s validity is compromised, leading to delays or outright disqualification of the refund request.

Lastly, errors happen during the mailing process. Applications and supporting documentation must be sent to the correct address provided by the Michigan Department of Treasury. Neglecting to include all required documents in the mailing or sending the package to an incorrect address can significantly delay the processing time. Therefore, double-checking the mailing address and ensuring that all necessary documents are enclosed before sending off the application is vital for a smooth refund process.

Documents used along the form

When dealing with real estate transactions in Michigan, specifically regarding the application for a State Real Estate Transfer Tax (SRETT) Refund as outlined in the Michigan Department of Treasury 2796 form, a range of other documents may need to be gathered and submitted to ensure the process is completed efficiently and accurately. These forms and documents are crucial for validating the seller's claim for a tax refund, evidencing the property's eligibility under specific exemptions, and fulfilling legal and procedural requirements.

- L-4258 Real Estate Transfer Tax Valuation Affidavit: This affidavit is vital for confirming the value of the property at the time of its transfer. It plays a crucial role, especially when seeking exemptions based on property valuation.

- Copy of the recorded deed: Including a copy of the deed that was recorded at the time of sale is necessary to prove the transfer of property occurred. This serves as an official record of the transaction.

- Proof of Principal Residence Exemption (PRE): If claiming an exemption based under section "u," documentation showing the property was qualified for 100% PRE at the time of sale is required.

- Tax statements or billings: Recent tax documents for the property can help establish the State Equalized Value (SEV) and corroborate the property's tax status.

- Proof of SRETT payment: Sellers need to submit evidence of the SRETT payment, which could include an official receipt from the county treasurer, to qualify for a refund.

- Proof of sale price: Documents evidencing the property's sale price verify that it does not exceed the true cash value, which is a condition for some exemptions under the SRETT rules.

- Attorney General Opinion No. 7214: Although not a form, this document may be necessary for understanding specific legal interpretations of the SRETT exemptions, especially for complex cases.

Collectively, these documents support a refund application by detailing the transaction, the property's value, exemption qualifications, and the rightful claim to a SRETT refund. For a smooth and successful refund process, ensuring the completeness and accuracy of these accompanying documents is as crucial as the application form itself. Presenting a well-documented case not only aids in the swift processing of the refund but also mitigates the likelihood of disputes or rejections by providing clear evidence of eligibility under the outlined exemptions.

Similar forms

The application process for a State Real Estate Transfer Tax (SRETT) refund, as found in the Michigan 2796 form, is similar to filing an Income Tax Refund Request because both require individuals to present comprehensive documentation and evidence to support their claims for a refund from the state treasury.

Filing an Application for Homestead Property Tax Credit shares similarities with the Michigan 2796 form since both involve claiming exemptions based on the specific use or value of property, necessitating proof of eligibility.

The Request for Property Tax Exemption mirrors the Michigan 2796 process in that property owners must submit specific criteria and documentation to qualify for a tax exemption, including detailed evidence about the property and its use or ownership.

Submitting a Claim for Principal Residence Exemption (PRE) is akin to the Michigan 2796 form because both require validation that the property in question meets certain conditions outlined by state law, focusing on the property's use as a principal residence.

The process of Requesting a Refund for Overpaid Property Taxes entails providing thorough documentation of the overpayment, similar to how the 2796 form demands detailed evidence to support a claim for refund of paid SRETT.

Filing a Deed Transfer with the County Register of Deeds shares similarities with part of the Michigan 2796's requirements. Both involve dealing with property transfer documentation, though for different purposes—one for the official recording of property transfer and the other for obtaining a tax refund based on that transfer.

The submission of documentation for an Affidavit of Affixture for Manufactured Housing bears a resemblance to the requirements of the Michigan 2796 form where specific documents are necessary to establish the nature of the property and its qualification for certain tax treatment.

The process of applying for a Veterans Property Tax Exemption is similar to the 2796 form in its approach of requiring veterans to provide proof of eligibility and documentation regarding their property to qualify for a tax exemption.

Dos and Don'ts

When filling out the Michigan 2796 form for a State Real Estate Transfer Tax (SRETT) refund, it's imperative to approach the task meticulously to ensure a smooth process. Below are lists of things you should and shouldn't do to aid in this endeavor.

Things You Should Do:- Use blue or black ink: This ensures your application is legible and meets the form's requirements.

- Attach all required documentation: These documents can include the recorded deed, tax statements, and other proofs like the Principal Residence Exemption or the SEV at the time of purchase and sale.

- Accurately identify the exemption being claimed: Clearly specify under which section of PA 330 of 1993, as amended, your exemption falls. Understanding the exemptions listed on Page 2 is crucial.

- Include all seller(s)' names exactly as they appear on the recorded deed: This ensures that the refund check will be correctly issued.

- Provide comprehensive and accurate identification information: Complete every section that requests details about the seller(s), including Social Security or Federal ID numbers, to avoid any delays or misunderstandings.

- Forget to sign the certification section: The form requires the signature(s) of all seller(s), certifying under penalty of perjury that the information provided is accurate and complete.

- Omit contact information: Failing to provide a current address and telephone number can lead to delays in processing or receiving your refund.

- Assume your application will be processed immediately: The Michigan Department of Treasury advises allowing 4 – 6 weeks for processing. Patience is key.

- Include original documents: Only copies of supporting documentation should be mailed with your application, as original documents may not be returned.

- Wait too long to file: The application must be filed within four years and 15 days from the date of the sale or transfer of the property to qualify for a refund.

Adhering to these guidelines can help facilitate a smoother processing of your Michigan 2796 form and avoid common pitfalls that delay or prevent refund issuance. Always double-check your application for completeness and accuracy before submitting it.

Misconceptions

There are several misconceptions about the Michigan Department of Treasury 2796 form, commonly known as the Application for State Real Estate Transfer Tax (SRETT) Refund. This document is essential for individuals who believe they are entitled to a refund for the SRETT they paid. By clarifying these misconceptions, taxpayers can better navigate the process of claiming their refunds.

Misconception 1: The 2796 form can be filed at any time after the property sale.

Many believe there is no strict deadline for filing the 2796 form. However, the truth is that the application must be submitted within four years and 15 days from the date of the property sale or transfer. This strict deadline emphasizes the importance of timely action by sellers who wish to claim a refund.

Misconception 2: Any sale or transfer of property qualifies for a SRETT refund.

Not all property sales or transfers are eligible for a SRETT refund. Eligibility for a refund is contingent upon meeting specific criteria outlined under MCL 207.526, which includes a list of exemptions such as transfers for minimal consideration, certain familial transfers, and transactions not subject to tax under federal law. Understanding the basis for exemption is critical for applicants.

Misconception 3: The refund process is automatic upon filing the 2796 form.

Some sellers may mistakenly think that submitting Form 2796 guarantees a refund. In reality, the Michigan Department of Treasury reviews each submission thoroughly, requiring the seller to provide ample documentary evidence supporting the claim for a refund. Only upon satisfactory review of the documentation and form does the Treasury approve the refund.

Misconception 4: The form is complicated and requires legal assistance to complete.

Another common belief is that completing the 2796 form is complex and necessitates hiring a legal professional. While understanding tax forms can be daunting, the 2796 form is designed to be straightforward. By carefully reading the instructions and perhaps seeking clarification from the Treasury's Technical Services Section if needed, most sellers can complete and file the form without professional help.

Clarifying these misconceptions is essential for ensuring that eligible sellers are aware of their entitlements and understand the correct process for claiming a SRETT refund. It empowers taxpayers to take appropriate action within the specified timeframe and according to the Department of Treasury's requirements.

Key takeaways

Filling out and submitting the Michigan 2796 form is essential for property sellers in Michigan who believe their property transaction qualifies for a State Real Estate Transfer Tax (SRETT) refund. Understanding the key aspects of this form can simplify the process and ensure compliance with state law. Here are six key takeaways:

- The Michigan Department of Treasury requires the 2796 form for anyone seeking a refund of the SRETT under specific qualifications outlined by Public Act 330 of 1993. This act provides various exemptions and conditions under which a seller can claim a refund.

- Applicants must file this form within a strict timeframe—four years and 15 days from the date of the sale or transfer of the property—to be eligible for a refund.

- To complete the form accurately, sellers must provide detailed information about the sale, including the date of transfer, tax parcel ID, the taxing entity, and the basis for the exemption claim, which is critical for the Department of Treasury to process the refund request.

- Documentation is key. Sellers must attach appropriate documentation to support their refund request, such as a copy of the recorded deed, tax statements, proof of SRETT paid, and other relevant evidence that validates the exemption claim.

- Specific criteria for exemption "u", as outlined, require comprehensive proof, including documentation of the property's State Equalized Value (SEV) at the time of purchase and sale, proof the property qualified for 100% Principal Residence Exemption, evidence of the SRETT paid, and the sales price of the property. Each piece of evidence plays a vital role in establishing eligibility for the SRETT refund.

- Seller’s certification is a declaration under penalty of perjury that the information provided on the form and in the attachments is accurate and complete. This certification underscores the seriousness of the application and the legal obligation to provide truthful and complete information.

To successfully navigate the SRETT refund process with the Michigan 2796 form, sellers should meticulously gather and submit all required information and documentation within the prescribed timeframe. Understanding and adhering to these guidelines can significantly enhance the chances of receiving a refund.

Popular PDF Templates

What Does Live Scan Check - It reaffirms the commitment of various agencies to uphold security standards while processing sensitive personal information.

Mi-1040 Form 2023 - Stipulates the handling of payments, detailing how they are to be received, the impact of insufficient funds, and the order in which funds are applied towards the loan.

Mi-1040 Form 2023 - Utilizing official resources and seeking guidance when needed can greatly enhance the accuracy of submissions for form 4652.