Michigan 2248 PDF Form

In the heart of Michigan's financial operations, the Michigan Department of Treasury Form 2248 steps in as a pivotal tool for taxpayers wishing to engage in Electronic Funds Transfer (EFT). Designed under the auspices of Public Act 122 of 1941, this form sets the stage for taxpayers to step into the digital age, enabling them to notify the state of their intent to submit payments electronically. The requirement to file this application unfolds as a mandatory step for those choosing EFT as their mode of payment, promising a streamlined, secure way to fulfill tax obligations directly from their bank accounts. Covering a wide array of tax types, from sales and use tax to corporate income and withholding taxes, Form 2248 is comprehensive, catering to a broad spectrum of Michigan's tax-paying community. It introduces an authorization segment for EFT debits, necessitating taxpayers' consent for the state and its contractor to make authorized withdrawals from their accounts. This method not only demands a signature of authorization but also calls for adherence to the rules and regulations of electronic transfers, underscoring the balance between accessibility and security. Incorporated within the form are sections for taxpayer identification, including names, addresses, and specific contact information, ensuring that filings are both personalized and traceable. Additionally, there's a crucial emphasis on the certification by officers or partners for corporations and partnerships, making it clear that financial accountability extends deeply into the fabric of organizational structure and governance.

Preview - Michigan 2248 Form

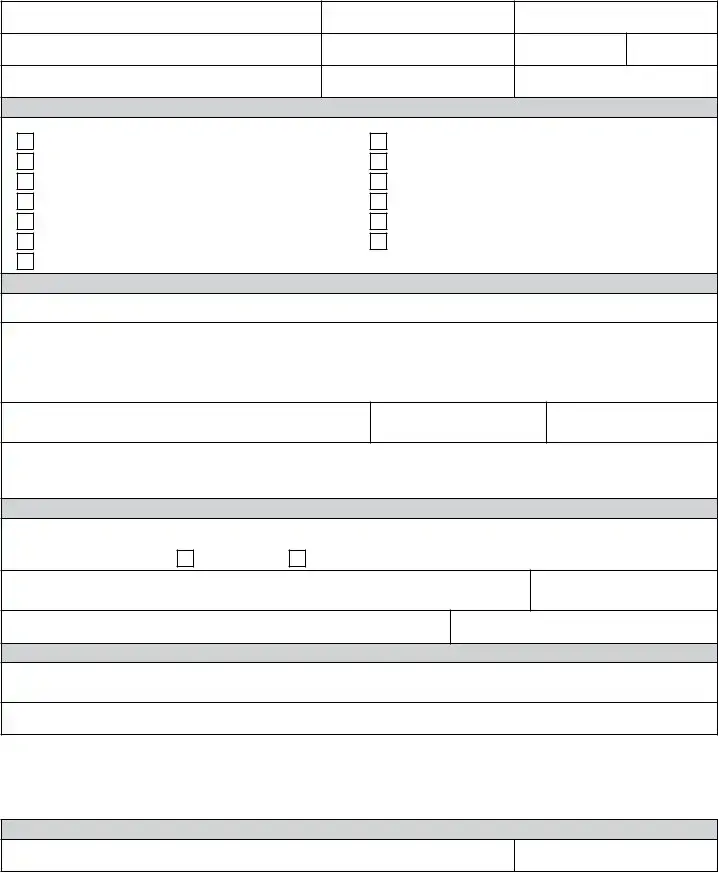

Michigan Department of Treasury

Form 2248 (Rev.

Electronic Funds Transfer (EFT) Debit Application

Issued under authority of Public Act 122 of 1941. Filing is mandatory if you wish to pay by EFT.

Use this form to notify us that you intend to file electronically. You may begin electronic filing after you receive our approval and

instructions from Treasury’s authorized contractor for remitting payments.

Taxpayer Name (Type or print clearly)

Taxpayer Identification Number

Address

City

State

ZIP Code

Contact Person

Contact Person Fax Number

Contact Person Telephone Number

INDICATE THE TYPE OF TAX(ES) YOU WILL BE PAYING BY EFT:

Tax Type and Tax Code

Withholding - Employer and Retirement (01100)

Sales Tax (04200)

Use Tax on Sales and Rentals (04400)

Use Tax on Purchases (04500)

Single Business Tax Annual (02671)

Michigan Business Tax Extensions (02355)

Michigan Business Tax Annual (02655)

Corporate Income Tax Annual (02670)

Corporate Income Tax Estimate (02170)

Corporate Income Tax Extensions (02370)

Flow Through Withholding Corporation Quarterly (02010)

Flow Through Withholding Individual Quarterly (02020)

Flow Through Withholding Annual (02675)

AUTHORIZATION FOR EFT DEBITS

If you are interested in making electronic payments of sales, use, withholding and/or Michigan business taxes using the EFT debit method, you must give written permission to access your bank account to withdraw the funds you authorize. Do this by signing below.

I authorize the State of Michigan and its authorized contractor to make variable withdrawals by electronic transfer from the designated financial institution and account. I understand that only the withdrawals I authorize will be made and that this process is protected by a password and a user code. I understand that I may cancel this authorization at any time by sending a written notice to the address noted below. I agree to comply with the National Automated Clearing House Association Rules and Regulations about electronic transfers as they exist on the date of my signature on this form or as subsequently adopted, amended, or repealed. Michigan law governs electronic funds transactions authorized by this agreement in all respects except as otherwise superseded by federal law. If multiple signers are required to authorize a withdrawal of funds, all must sign this form.

Signature of Responsible Officer

Title

Date

Please be aware of officer, member or partner liability as provided in Michigan Compiled Laws 205.27a(5): “If a corporation, limited liability company, limited liability partnership, partnership, or limited partnership liable for taxes administered under this act fails for any reason to file the required returns or pay the tax due, any of its officers, members, managers, or partners who the department determines, based on either an audit or an investigation,

have control or supervision of, or responsibility for, making the returns or payments is personally liable for the failure |

” |

CERTIFICATION

Corporations, partnerships, LLP’s or LLC’s must complete this section before this form can be processed. This officer, member or partner certification must be resubmitted when there is a change in the individual responsible for filing and/or paying Michigan taxes.

Please check the appropriate box:

New Application

Recertification - Change In Individual Responsible For Michigan Taxes

Signature of Corporate Officer, Partner or Member Responsible for Reporting and/or Paying Michigan Taxes

Date

Type or Print Name

SECURITY

Title

Please Select

The security question is required to complete the processing of your application. Please retain a copy of your answer. A correct response is required when contacting Treasury’s authorized contractor or completing certain updates to your account. You may change the security question and/or

response after successfully accessing your account.

What school did you attend for sixth grade?

All information requested above must be completed and accurate before your application is processed. Please allow 4 weeks for processing. If you have any questions, contact the Michigan Department of Treasury at (517)

Michigan Department of Treasury

Sales Use and Withholding Taxes

P.O. Box 30427

Lansing, MI 48909

TREASURY USE ONLY

Treasury Approval

Date

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Number and Title | Michigan Department of Treasury Form 2248, Electronic Funds Transfer (EFT) Debit Application |

| Revision Date | June 2012 (Rev. 06-12) |

| Authority | Issued under the authority of Public Act 122 of 1941. |

| Mandatory Filing | Filing this form is mandatory for taxpayers who wish to pay by EFT. |

| Purpose | Used to notify the Michigan Department of Treasury of the taxpayer's intent to file and pay taxes electronically. |

| Types of Taxes Covered | Includes withholding, sales tax, use tax, Michigan business tax, corporate income tax, and flow-through withholding taxes among others. |

| Authorization for EFT Debits | Taxpayers must give written permission for the State of Michigan and its authorized contractor to make electronic withdrawals from their bank account for tax payments. |

| Governing Law | Michigan law governs the EFT transactions, except as overridden by federal law. |

| Liability Clause | Michigan Compiled Laws 205.27a(5) details the liability of officers, members, partners, or managers for failure to file returns or pay taxes due. |

Guidelines on Utilizing Michigan 2248

When planning to use Electronic Funds Transfer (EFT) for paying taxes in Michigan, the official step involves submitting Form 2248 to the Michigan Department of Treasury. This form is your way of notifying the state that you intend to remit payments electronically and cannot be bypassed if you wish to use EFT for your taxes. It requires accurate and detailed information about your business and your consent for electronic withdrawals from your designated bank account. Following approval, you will receive detailed instructions from the Treasury's authorized contractor on how to proceed with your EFT payments. Here's how to properly fill out Form 2248:

- Type or print the Taxpayer Name clearly to ensure accurate identification.

- Fill in the E-Mail Address to facilitate easy communication.

- Provide the Taxpayer Identification Number, crucial for tax identification purposes.

- Enter the complete Address, including City, State, and ZIP Code for potential correspondence.

- Insert the Contact Person's name, Fax Number, and Telephone Number to designate a point of contact.

- Indicate the type(s) of tax(es) you will be paying by EFT by checking the appropriate boxes next to each tax type.

- In the AUTHORIZATION FOR EFT DEBITS section, read the agreement carefully. If agreeing, the responsible officer must sign at the bottom, indicating their authorization for the State of Michigan and its contractor to make electronic withdrawals.

- For corporations, partnerships, LLP's, or LLC's, complete the CERTIFICATION section. Check whether it's a New Application or Recertification and have the responsible corporate officer, partner, or member sign, indicating the individual responsible for reporting and/or paying Michigan taxes.

- Provide an answer to the security question at the bottom. This is required for the processing of your application and subsequent account verifications.

- Review all the information for accuracy and completeness. Any missing or incorrect information can delay the processing.

- Finally, you may fax or mail the completed form to the Michigan Department of Treasury using the provided contact information. Keep a copy for your records.

After submitting the form, expect a processing time of approximately four weeks. During this period, the Michigan Department of Treasury will review your application. Upon approval, you will receive further instructions from Treasury's authorized contractor on how to execute your EFT payments. Keep the communication lines open for any follow-ups or additional information requests from the department.

Crucial Points on This Form

What is the Michigan Form 2248?

Michigan Form 2248, also known as the Electronic Funds Transfer (EFT) Debit Application, is a document issued by the Michigan Department of Treasury. This form is used by taxpayers who wish to pay their taxes electronically. Filling out and submitting this form is mandatory if you prefer making tax payments via EFT. Once approved, taxpayers can start filing their taxes and remitting payments electronically as per the instructions provided by the Treasury’s authorized contractor.

Who must file the Form 2248?

Any taxpayer who wants to make electronic payments for sales, use, withholding, and/or Michigan business taxes must file Form 2248. This includes individuals, corporations, partnerships, LLPs, and LLCs that opt for the convenience of EFT debit transactions to settle their tax liabilities with the state.

What types of taxes can be paid using EFT as authorized by Form 2248?

You can pay various types of taxes through EFT upon completing Form 2248, including:

- Withholding - Employer and Retirement

- Sales Tax

- Use Tax on Sales and Rentals

- Use Tax on Purchases

- Single Business Tax Annual

- Michigan Business Tax Extensions and Annual

- Corporate Income Tax - Annual and Estimate

- Flow Through Withholding - Corporation Quarterly, Individual Quarterly, and Annual

What information do I need to provide on Form 2248?

When filling out Form 2248, you must provide the following information:

- Taxpayer's name and address

- E-mail address

- Taxpayer Identification Number

- Contact person’s details (name, telephone number, fax number)

- Type(s) of tax you will be paying by EFT

- Authorization for EFT debits, including financial institution and account information

How do I submit Form 2248?

You can submit Form 2248 to the Michigan Department of Treasury either by fax or mail. The fax number is (517) 636-4356, and the mailing address is:

Michigan Department of Treasury

Sales Use and Withholding Taxes

P.O. Box 30427

Lansing, MI 48909

Is it safe to provide my bank information on Form 2248?

Yes, providing your banking details on Form 2248 is secure. The form requires you to authorize state officials and their authorized contractor to make withdrawals from your account for the tax payments you have authorized. This process is regulated and safeguarded with passwords and user codes, ensuring the safety of your financial information.

What happens after I submit Form 2248?

After submitting Form 2248, please allow up to 4 weeks for processing. Upon approval, the Michigan Department of Treasury or its authorized contractor will provide you with the necessary instructions on how to proceed with your electronic payments for taxes.

Can I cancel my EFT authorization?

Yes, you can cancel your EFT authorization at any time. To do so, you must send a written notice to the Michigan Department of Treasury at the address indicated on Form 2248.

What should I do if there’s a change in the person responsible for paying Michigan taxes?

If there's a change in the individual responsible for overseeing tax filings and payments, you must complete the certification section of Form 2248, indicating it’s a recertification due to a change in the responsible individual, and submit it to the Michigan Department of Treasury.

What is the security question on Form 2248 for?

The security question on Form 2248 is a measure to enhance the security of your account. You will need to provide the answer to this question when contacting the Treasury’s authorized contractor or completing certain updates to your account. This extra layer of security helps ensure that only authorized individuals have access to your EFT information.

Common mistakes

Filling out the Michigan Form 2248, the Electronic Funds Transfer (EFT) Debit Application, requires attention to detail and a clear understanding of the instructions to avoid common mistakes. One of the most frequent errors is not providing a complete taxpayer identification number. This crucial detail is essential for processing the application accurately and securely.

Another area where errors often occur is in the selection of tax types. Applicants sometimes overlook or incorrectly indicate the type of tax(es) they will be paying by EFT. It's critical to select the appropriate tax codes that accurately represent your tax obligations to the Michigan Department of Treasury.

Many individuals also falter by not printing their information clearly. This form is processed manually, and unclear or illegible handwriting can lead to delays or incorrect processing of the application. Ensuring that all typed or printed information is clear and readable is paramount.

A significant mistake seen on these forms is the failure to properly authorize EFT debits. If the application requires multiple signatures for authorization of funds withdrawal, omitting any required signature can invalidate the entire process. Every individual required to sign must do so for the application to be processed.

Incorrect or incomplete contact information for the responsible officer, member, or partner is another common error. This information is essential for the Michigan Department of Treasury to communicate effectively regarding the EFT application and any related issues.

Applicants sometimes mistakenly leave the security question at the bottom of the form unanswered or provide a response that is too vague. This security measure is crucial for verifying the identity of the account holder when accessing account details or making inquiries.

A failure to select the correct box for a new application versus a recertification can lead to processing delays. This distinction is crucial for the Treasury to understand the context of the application, particularly if there has been a change in the individual responsible for Michigan taxes.

Some individuals forget to include their title or date when signing the form, which can question the legitimacy of the authorization. These details validate the individual’s authority to enroll in EFT debits on behalf of the entity.

Not updating officer, member, or partner certification following a change in responsibility within the entity is another oversight. The Michigan Department of Treasury requires current information to ensure accurate communication and responsibility for tax matters.

Finally, not retaining a copy of the completed Form 2248 for personal records is a mistake. Having this document readily available is essential for future reference, especially in situations requiring verification of the enrollment or addressing any discrepancies with the Treasury.

In conclusion, carefully reviewing and avoiding these common mistakes when completing the Michigan Form 2248 can streamline the process of enrolling in the state’s EFT system. The accuracy and completeness of this application are fundamental to ensuring efficient and secure electronic tax payments.

Documents used along the form

The process of managing taxes in Michigan, particularly when using the Michigan Department of Treasury Form 2248 for Electronic Funds Transfer (EFT) Debit Application, often involves handling other important documents. These documents are essential for various aspects of tax management and business operations. Here is a closer look at some of the additional forms and documents commonly used alongside Form 2248:

- Form 160: Combined Return for Michigan Taxes - This form is typically used by businesses to file and pay multiple taxes, including sales tax, use tax, and withholding tax. It simplifies the tax return process for businesses operating in multiple tax categories.

- Form 165: Annual Return for Sales, Use, and Withholding Taxes - Businesses utilize this form for annual reporting and remittance of sales, use, and withholding taxes. It is an essential document for end-of-year tax reconciliation.

- Form 5081: Sales, Use, and Withholding Taxes Annual Return - This recent form replaces Form 165 for reporting sales, use, and withholding taxes on an annual basis, streamlining the process further.

- Form 518: Registration for Michigan Taxes - Essential for businesses starting in Michigan, this form registers a business for various state taxes, laying the groundwork for tax compliance and EFT payments.

- Form 5278: Assessment and Property Tax Appeal Form - Used by businesses to appeal property tax assessments. This form is crucial for managing and potentially reducing property tax obligations.

- UIA 1028: Employer's Quarterly Wage/Tax Report - Employers submit this form quarterly to report wages paid, taxable wages, and unemployment insurance taxes. It’s vital for compliance with unemployment insurance regulations.

- Form 4574: Request for Informal Conference and Review - When disputing a tax decision made by the Michigan Department of Treasury, businesses can use this form to request an informal review of the decision.

- Form 4891: Corporate Income Tax Annual Return - This form is used by corporations operating in Michigan to file their annual corporate income tax return, an essential part of corporate tax compliance.

When filing Form 2248, it's important to be aware of these additional forms and documents that may be relevant to your business's tax responsibilities. Each document serves a specific purpose in the broader context of business operations and tax management. By staying informed and prepared, businesses can ensure compliance with Michigan tax laws and regulations, streamline their tax processes, and potentially mitigate tax-related challenges.

Similar forms

IRS Form 940: The IRS Form 940 is akin to the Michigan Form 2248 because both are used for tax-related purposes, specifically focusing on the reporting and payment of taxes electronically. Form 940 allows employers to report their annual Federal Unemployment Tax Act (FUTA) tax, mirroring the Michigan form's function for state taxes. Each requires detailed taxpayer identification and business information, facilitating the electronic transfer of funds to the respective tax authorities.

IRS Form 941: Similar to the Michigan 2248 form, IRS Form 941 is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. Additionally, it reports the employer's portion of Social Security or Medicare tax. The similarity lies in their mutual requirement for electronic reporting and payment, necessitating precise business and contact information for compliance and facilitating direct debits for tax payments.

Electronic Federal Tax Payment System (EFTPS) Enrollment Form: This form serves a similar purpose by enabling taxpayers to enroll in a system for paying all their federal taxes electronically, mirroring Michigan Form 2248's purpose for state taxes. Both forms require authorization to initiate electronic funds transfers (EFT) from a specified bank account for tax payments, emphasizing security measures and compliance with national electronic transfer rules.

California e-file Return Authorization for Individuals - Form 8453-OL: Although this form pertains to individual income tax returns in California, it shares a common goal with Michigan Form 2248: facilitating electronic tax transactions. Both documents require the taxpayer's consent for electronic processing, emphasizing the security of the information provided and enabling a streamlined, electronic filing process.

Florida Application for Pollutants Tax Electronic Funds Transfer Program: This form is for businesses in Florida that need to pay pollutants tax via electronic funds transfer, analogous to the Michigan 2248 form’s purpose for various state taxes. They both mandate businesses to provide detailed account information, grant authorization for direct debits, and ensure compliance with specific regulations governing electronic payments, thereby streamlining the tax payment process.

Dos and Don'ts

Filling out Michigan's Form 2248, the Electronic Funds Transfer (EFT) Debit Application, is a crucial step for taxpayers wishing to pay their taxes electronically. Properly completing this application ensures a seamless transition to electronic payments. Here are five essential dos and don'ts to guide you through the process:

Do:- Read the instructions carefully before you start to fill out the form. This understanding will help you avoid common mistakes.

- Type or print clearly in ink to ensure all information is legible and can be processed accurately by the Treasury Department.

- Verify your taxpayer identification number and contact information to avoid any issues with your EFT setup.

- Sign the authorization for EFT debits section to indicate your agreement and understanding of how the debits will work.

- Keep a copy of the completed form for your records. This can be helpful if there are any questions or disputes in the future.

- Leave any sections blank. If a section does not apply, write 'N/A' to indicate this. Incomplete forms may lead to processing delays.

- Ignore the security section. Your response to the security question is crucial for verifying your identity in future communications or transactions.

- Use pencil or erasable ink when filling out the form. This can lead to information being smudged or erased, potentially causing errors in your application.

- Forget to indicate the type(s) of tax you will be paying by EFT. This information helps the Treasury Department process your application correctly.

- Submit the form without all required signatures. If your business requires multiple signatories for withdrawals, ensure everyone has signed the form to avoid rejection.

By following these straightforward dos and don'ts, you can fill out Michigan Form 2248 with confidence, ensuring a smooth transition to electronically paying your taxes.

Misconceptions

Understanding the intricacies of tax forms can sometimes be confusing. Among these, the Michigan Department of Treasury Form 2248, related to Electronic Funds Transfer (EFT) Debit Application, carries its own set of misconceptions. It's crucial to clarify these misunderstandings to ensure compliance and ease the process for those it concerns.

- Form 2248 is optional for businesses.

This is incorrect. If a business wishes to pay their taxes via EFT, filing Form 2248 is mandatory as per Public Act 122 of 1941. It is the official notification to the Michigan Department of Treasury about the taxpayer’s intention to file electronically.

- Form 2248 can authorize any type of bank withdrawal.

Actually, the form is designed specifically to grant the State of Michigan and its authorized contractors permission to make withdrawals for tax payments authorized by the taxpayer. It does not permit other types of withdrawals from the taxpayer's account.

- Approval for EFT is granted immediately upon submission.

In reality, processing the application can take up to 4 weeks. Approval and instructions for starting electronic payments are provided after this period by Treasury’s authorized contractor.

- Once submitted, authorization cannot be canceled.

This is a misconception. Taxpayers can cancel the authorization for EFT debits at any time. This requires sending a written notice to the address listed on the form, indicating the taxpayer's desire to halt electronic fund transfers.

- A single signature is enough for multi-signature accounts.

For accounts that require multiple signatures to authorize withdrawals, all relevant individuals must sign Form 2248. This ensures that all parties with financial responsibility agree to the EFT debits.

- Security questions are optional.

On the contrary, answering a security question is a mandatory step when processing your application. It's essential for verifying your identity when contacting Treasury’s authorized contractor or when making certain updates to your account.

- The form serves multiple tax types.

While this is true, a common misconception is that it's a general-purpose form for all tax transactions. Form 2248 specifically authorizes EFT debits for sales, use, withholding, and Michigan business taxes. Taxpayers must carefully indicate the type(s) of tax they intend to pay using EFT, from the options provided on the form.

It's important for businesses and individuals to understand these nuances to ensure correct form submission and compliance with Michigan's tax laws. Misunderstandings can lead to delays or issues in tax payments, underscoring the importance of accurately completing and submitting Form 2248.

Key takeaways

Filling out the Michigan Department of Treasury Form 2248 is essential for businesses and individuals who wish to utilize Electronic Funds Transfer (EFT) for tax payments. Below are key takeaways to guide the process:

- Form 2248 is issued under the authority of Public Act 122 of 1941, making EFT filings mandatory for taxpayers who choose this payment method.

- The form serves as a notification to the Michigan Department of Treasury of the taxpayer's intent to file and remit payments electronically.

- Approval from the Michigan Department of Treasury and instructions from Treasury’s authorized contractor are required before starting EFT.

- Applicants must provide detailed information, including Taxpayer Name, Identification Number, Contact Information, and the Type(s) of Taxes to be paid via EFT.

- Selecting the tax type and code accurately is crucial, as it indicates the specific taxes the taxpayer intends to pay electronically.

- Written authorization is necessary to permit the State of Michigan and its authorized contractor to initiate withdrawals from the designated bank account.

- The process is protected by a password and user code, ensuring that only authorized withdrawals are made.

- Authorization can be canceled at any time with written notice, providing flexibility and control to the taxpayer.

- For corporations, partnerships, LLPs, or LLCs, a section certifies an officer, member, or partner responsible for tax filings and payments, which must be completed and updated with any changes.

- A security question is required for completing the application process, aiding in future account access and modifications.

- Compliance with National Automated Clearing House Association Rules and Regulations, as well as Michigan law, is agreed upon through signature, emphasizing the legal framework governing EFT transactions.

- Processing the application takes approximately 4 weeks, after which electronic filing can commence upon receiving Treasury approval.

Proper completion and submission of Form 2248 facilitate smooth and secure electronic tax payments, aligning with both state and federal regulatory standards.

Popular PDF Templates

Mi-1040 Form 2023 - The form provides instructions for businesses that were not required to register with the Michigan Department of Treasury.

Michigan 3891 - Contributes to the overall fiscal health of businesses by ensuring that overpayments are refunded in due course.

Mi-1040 Form 2023 - Incorporates critical regulatory references, such as adherence to the Real Estate Settlement Procedures Act (RESPA) for managing escrow accounts.