Michigan 165 PDF Form

The Michigan 165 form, officially known as the 2021 Sales, Use, and Withholding Taxes Annual Return (Form 5081), plays a crucial role for businesses operating within Michigan. This detailed form, mandated by several Public Acts, facilitates the annual reporting and payment of sales, use, and withholding taxes. Designed to streamline the tax return process, it discourages the utilization for amending returns or substituting monthly/quarterly filings. Businesses must meticulously report their total gross sales, rentals of tangible property, telecommunications services, and calculate the taxable balance after accounting for allowable deductions, which range from resale exemptions to government exemptions, among others. Additionally, it outlines the process for reporting the use tax on items purchased for business or personal use, withholding tax details, and summarizing overall tax dues and payments. A notable feature is the signature section, underscoring the legal declaration of accuracy by the taxpayer or an authorized representative, and, if applicable, by the preparer. With a deadline firmly set for February 28, 2022, and the option to file electronically via Michigan Treasury Online, the form emphasizes timely compliance with state tax laws. Furthermore, instructions accompanying the form provide critical guidance on applicable exemptions, deductions, and interest or penalty calculations, ensuring taxpayers can fulfill their obligations with confidence.

Preview - Michigan 165 Form

Click Here to Use Michigan Treasury Online to File Electronically

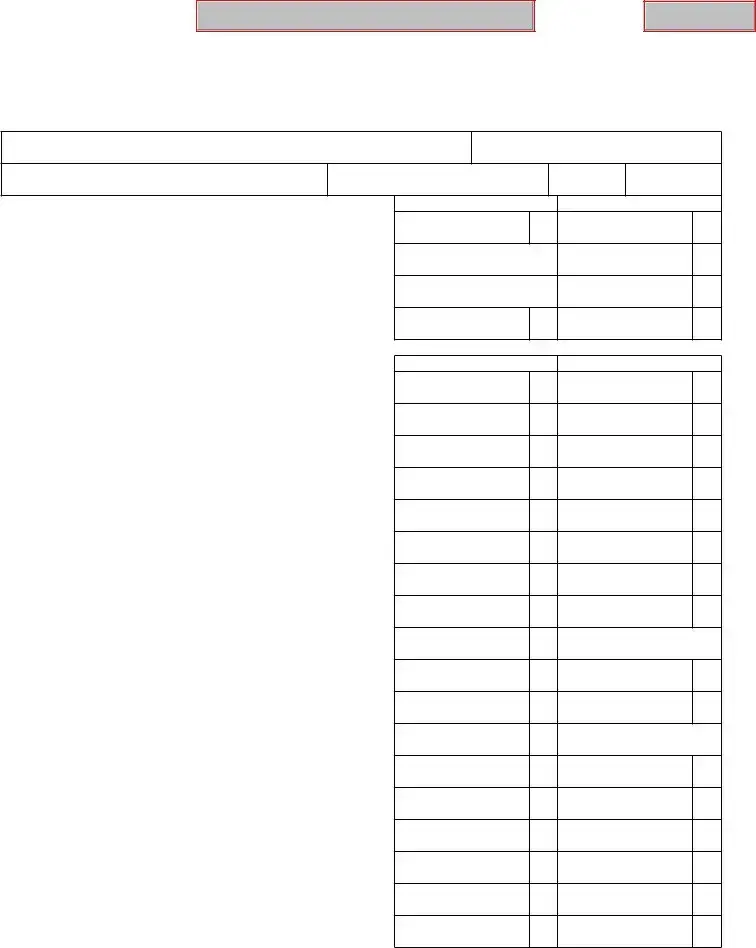

Michigan Department of Treasury

5081 (Rev.

2021 Sales, Use and Withholding Taxes Annual Return

Issued under authority of Public Acts 167 of 1933, 94 of 1937, and 281 of 1967, all as amended.

Reset Form

This form cannot be used as an amended return; see the 2021

Sales, Use and Withholding

Taxes Amended Annual Return (Form 5082).

File this return by February 28, 2022. |

Do not use this form to replace a monthly/quarterly return. |

Taxpayer’s Business Name

Business Account Number (FEIN or TR Number)

Street Address

City

State

ZIP Code

PART 1: SALES AND USE TAX

1.Total gross sales for tax year being reported...........................................

2.Rentals of tangible property and accommodations .................................

3.Telecommunications services..................................................................

4.Add lines 1, 2 and 3.................................................................................

A. Sales |

B. Use: Sales & Rentals |

1.

2. XXXXXXX

3. XXXXXXX

4.

5.ALLOWABLE DEDUCTIONS

|

a. Resale, sublease or subrent |

5a. |

|

b. Industrial processing exemption |

5b. |

|

c. Agricultural production exemption |

5c. |

|

d. Interstate commerce |

5d. |

|

e. Nontaxable services billed separately |

5e. |

|

f. Bad debts |

5f. |

|

g. Food for human/home consumption |

5g. |

|

h. Government exemption |

5h. |

|

i. Michigan motor fuel tax |

5i. |

|

j. Direct payment deduction |

5j. |

|

k. Other exemptions and/or deductions (see instructions) |

5k. |

|

l. Tax included in gross sales |

5l. |

|

m. Total allowable deductions. Add lines 5a - 5l |

5m. |

6. |

Taxable balance. Subtract line 5m from line 4 |

6. |

7. |

Gross tax due. Multiply line 6 by 6% (0.06) |

7. |

8. |

Tax collected in excess of line 7 |

8. |

9. |

Tax due before discount allowed. Add lines 7 and 8 |

9. |

10. |

Total discount allowed (see instructions) |

10. |

A. Sales Tax |

B. Use Tax |

XXXXXXX

XXXXXXX

+ 0000 2021 68 01 27 4 |

Continue on page 2. |

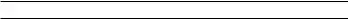

2021 Form 5081, Page 2 of 2 |

|

|

|

|

|

|||

Taxpayer’s Business Name |

|

Business Account Number |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Sales Tax |

|

B. Use Tax |

||

11. |

Total tax due. Subtract line 10 from line 9 |

|

11. |

|

|

|

|

|

12. |

.....................Tax payments and credits in current year (after discounts) |

12. |

|

|

|

|

|

|

PART 2: USE TAX ON ITEMS PURCHASED FOR BUSINESS OR PERSONAL USE |

|

|

|

|||||

|

|

|

||||||

13. |

Purchases for which no tax was paid or inventory purchased or withdrawn for business or personal use.... |

13. |

|

|

||||

14. |

.....................................................................Total use tax on purchases due. Multiply Line 13 by 6% (0.06) |

|

|

14. |

|

|

||

15. |

..........................................................................Use tax paid on purchases and withdrawals in current year |

|

|

15. |

|

|

||

PART 3: WITHHOLDING TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

16. |

Gross Michigan payroll, pension and other taxable compensation |

|

|

16. |

|

|

||

17. |

Total number of |

|

17. |

|

|

|

|

|

18. |

........................................................................Total Michigan income tax withheld per |

|

|

18. |

|

|

||

19. |

..............................................................Total Michigan income tax withholding paid during current tax year |

|

|

19. |

|

|

||

PART 4: SUMMARY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

20. |

Total sales, use and withholding tax due. Add lines 11A, 11B, 14 and 18 |

|

|

20. |

|

|

||

21. |

.....................................................Total sales, use and withholding tax paid. Add lines 12A, 12B, 15 and 19 |

|

|

21. |

|

|

||

22. |

...........................................If line 21 is greater than line 20, enter the difference here. If not, skip to line 25 |

|

|

|||||

23. |

............................................................................Amount of line 22 to be credited forward to a future period |

|

|

23. |

|

|

||

24. |

REFUND. Subtract line 23 from line 22 |

|

|

|

|

24. |

|

|

25. |

If line 21 is less than 20, enter balance due |

|

|

|

|

25. |

|

|

26. |

.................................................................................Penalty for late filing or late payment (see instructions) |

|

|

26. |

|

|

||

27. |

Interest for late payment (see instructions) |

|

|

|

|

27. |

|

|

28. |

TOTAL PAYMENT DUE. Add lines 25, 26 and 27 |

|

|

|

|

28. |

|

|

PART 5: SIGNATURE (All information below is required.)

Taxpayer Certification. I declare under penalty of perjury that the information in this |

Preparer Certification. I declare under penalty of perjury that this |

|||||

return and attachments is true and complete to the best of my knowledge. |

return is based on all information of which I have any knowledge. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s Signature |

|

|

|

By checking this box, I authorize Treasury to discuss my return with my preparer. |

|

|

||

|

|

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

|

|

Signature of Taxpayer or Official Representative (must be Owner, Officer, Member, |

Preparer’s Business Address |

|

||||

Manager, or Partner) |

|

|

|

|

||

|

|

|

|

|

|

|

Print Taxpayer or Official Representative’s Name |

|

Date |

|

|

||

|

|

|

|

|

|

|

Title |

Telephone |

Number |

Preparer’s Identification Number |

Preparer’s Telephone Number |

||

|

|

|

|

|

|

|

File and pay this return for free on Michigan Treasury Online at mto.treasury.michigan.gov.

Alternatively, make check payable to “State of Michigan.” Write the account number, “SUW Annual” and tax year on the check. Send the return and payment due to: Michigan Department of Treasury, P.O. Box 30401, Lansing, MI

+ 0000 2021 68 02 27 2

2021 Form 5081, Page 3

Instructions for 2021 Sales, Use and

Withholding Taxes Annual Return (Form 5081)

Form 5081 is available for submission electronically using Michigan Treasury Online (MTO) at mto.treasury.michigan.gov or by using approved tax preparation software. Most taxpayers will have the option to file the Annual EZ form, reducing the amount of fields needed to complete. Go to MTO to see if you qualify.

NOTE: The address field on this form is required to be completed but will not be used to replace an existing valid address for the purpose of correspondence or refunds. Update address and other registration information using MTO at mto.treasury.michigan.gov or mail a Notice of Change or Discontinuance (Form 163).

IMPORTANT: This is a return for sales tax, use tax and/ or withholding tax. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use tax or withholding tax, the taxpayer is certifying that no tax is owed for that tax type. Only enter figures for taxes the business is registered and/or liable for. If it is determined that tax is owed the taxpayer will be liable for the deficiency as well as penalty and interest.

PART 1: SALES AND USE TAX

Lines 1 through 3: For information about determining whether a person has nexus with Michigan, see Revenue Administrative Bulletins (RABs)

16.Please also visit www.michigan.gov/remotesellers for guidance, including FAQs.

Line 1A: SALES TAX - Total Gross Sales for the Tax

Year: This line should be used by sellers with nexus to report sales of tangible personal property where ownership transfers in Michigan. This includes sellers with nexus through physical presence or economic presence (remote sales).

Enter total sales, including cash, credit and installment transactions, of tangible personal property. Include any costs incurred before ownership of the property is transferred to the buyer, including installation, shipping, handling, and delivery charges. Dealers do not reduce sales reported here by any

Providers of nontaxable services (that do not involve the sale or lease of tangible personal property) should not report those sales.

Line 1B: USE TAX - Total Sales for the Tax Year: This line should be used by:

•Sellers with nexus to report sales of tangible personal property sourced to Michigan, for which ownership transfers outside Michigan, or

•Remote sellers without nexus who voluntarily collect Michigan tax.

Enter total sales, including cash, credit, and installment transactions, of tangible personal property.

Line 2B: USE TAX - Rentals of Tangible Personal Property and Accommodations.

•Lessors of tangible personal property: Lessors that have made a valid election under MCL 205.95(4) and MAC R 205.132(1) should report receipts from rentals of that tangible personal property under the election.

•Persons providing accommodations: This includes but is not limited to total hotel, motel, and vacation home rentals, and assessments imposed under the Convention and Tourism Act, the Convention Facility Development Act, the Regional Tourism Marketing Act, and the Community Convention or Tourism Marketing Act.

Line 3B: USE TAX - Telecommunications Services. Enter gross income from telecommunications services.

Line

Line 5a: Resale, Sublease or Subrent. Enter resale, sublease or subrent exemption claims.

Line 5b: Industrial Processing Exemption. The sale or lease of tangible personal property ultimately used in industrial processing by an industrial processor is exempt. Industrial processing is the activity of converting or conditioning tangible personal property by changing its form, composition, quality, combination, or character. In general, all of the following must be met:

•Property must be used in producing a product for ultimate sale at retail,

•Property must be sold or leased to an industrial processor, including a person that performs industrial processing on behalf of another industrial processor or performs industrial processing on property that will be incorporated into a product for ultimate sale at retail, and

•Activity starts when property begins moving from raw materials storage to begin industrial processing and ends when finished goods first come to rest in finished goods inventory.

If property is used for both an exempt and a taxable purpose, the property is only exempt to the extent that it is used for an exempt purpose. In such cases, the exemption is limited to the percentage of exempt use to total use determined by a reasonable formula or method approved (but not required to be

Line 5c: Agricultural Production Exemption. Property must be directly or indirectly used in agricultural production. Generally, the following

(i) Tangible personal property sold or leased to a person

2021 Form 5081, Page 4

engaged in a business enterprise that uses or consumes the property for either:

•Tilling, planting, draining, caring for, maintaining, or harvesting things of the soil, or

•Breeding, raising, or caring for livestock, poultry, or horticultural products.

(ii)To the extent that the property is affixed to and made a structural part of real estate for others and used for an exempt purpose in (i), tangible personal property sold to a contractor that is one of the following:

•Agricultural land tile

•Subsurface irrigation pipe

•Portable grain bins

•Grain drying equipment and its fuel or energy source However, the following sales from (i) or (ii) are not exempt:

•Food, fuel, clothing, or similar property for personal living or human consumption, or

•Property permanently affixed to and becoming a structural part of real estate unless it is agricultural land tile, subsurface irrigation pipe, a portable grain bin, or grain drying equipment. Certain property that can be disassembled and reassembled may be exempt.

Some specific types of exempt property and exempt uses of property are clarified in the statute. If property is used for both an exempt and a taxable purpose, the property is only exempt to the extent that it is used for an exempt purpose. In such cases, the exemption is limited to the percentage of exempt use to total use determined by a reasonable formula or method approved (but not required to be

Line 5d: Interstate Commerce. Enter sales made in interstate commerce. To claim such a deduction, the property must be delivered by the business to the

Line 5e: Nontaxable Services Billed Separately. Enter charges for nontaxable services billed separately, such as repair or maintenance, if these charges were included in gross receipts on line 1. Costs, such as delivery or installation charges, that are incurred before the completion of the transfer of ownership of taxable property are included in the tax base and may not be subtracted.

Line 5f: Bad Debts. Bad debts may be eligible for a deduction if the following criteria are met:

•The debts are charged off as uncollectible on business books and records at the time the debts become worthless

•The debts are deducted on the return for the period during which the bad debts are written off as uncollectible

•The debts are or would be eligible to be deducted for federal income tax purposes.

A bad debt deduction may be claimed by a

Line 5g: Food for Human/Home Consumption. Enter the total of retail sales of

Line 5h: Government Exemption. Direct sales to the United States government or the state of Michigan or its political subdivisions are exempt.

Line 5i: Michigan Motor Fuel Tax. Motor fuel retailers may deduct the Michigan motor fuel taxes that were included in gross sales on line 1 and paid to the State or the distributor.

Line 5j: Direct Payment Deduction. Enter sales made to purchasers that claimed direct pay exemption from sales and use taxes. With the exemption claim, the purchaser must include the following statement: “Authorized to pay use tax on purchases of tangible personal property directly to the State of Michigan under Account Number [listing either the Federal Employer Identification Number or the Michigan Treasury Registration Number]. If using Michigan Sales and Use Tax Certificate of Exemption (Form 3372), check the box in Section 3 for “Other” and include the above statement as the explanation. MCL 205.98.

Line 5k: Other Exemptions and/or Deductions. Identify exemptions or deductions not covered in items 5a through 5j on this line. Examples of exemptions or deductions are:

•Allowable

Taxes paid to Secretary of State are not reported here. Instead, they are reported on the Vehicle Dealer Supplemental Schedule (Form 5086,

•Credit for the core charge attributable to a recycling fee, deposit, or disposal fee for a motor vehicle or recreational vehicle part or battery if the recycling fee, deposit, or disposal fee is separately stated on the invoice, bill of sale, or similar document given to the purchaser.

•Direct sales, not for resale, to certain nonprofit agencies, churches, schools, hospitals, and homes for the care of children and the aged, to the extent the property is used to carry out the nonprofit purpose of the organization. For sales to certain nonprofit agencies, the exemption is limited based on the sales price of property used to raise funds or obtain resources. All sales must be paid for directly from the funds of the exempt organization to qualify.

•Assessments imposed under the Convention and Tourism Act, the Convention Facility Development Act, the

2021 Form 5081, Page 5

Regional Tourism Marketing Act, or the Community Convention or Tourism Marketing Act. Hotels and motels may deduct the assessments included in gross sales and rentals if use tax on the assessments was not charged to the customers.

•Credits allowed to customers for sales tax originally paid on merchandise voluntarily returned, provided the return is made within the time period for returns stated in the taxpayer’s refund policy or 180 days after the initial sale, whichever is earlier. Repossessions are not allowable deductions.

•Sales to contractors of materials which will become part of a finished structure for a qualified exempt nonprofit hospital, qualified exempt nonprofit housing entity or church sanctuary, or materials to be affixed to and made a structural part of real estate located in another state. The purchaser will provide a Michigan Sales and Use Tax Contractor Eligibility Statement (Form 3520). See RAB

•Vehicle sales to

•Qualified nonprofit organizations with aggregate sales in the calendar year of less than $25,000 may exempt the first $10,000 of sales for fundraising purposes. Separately, veterans organizations exempt under IRC 501(c)(19) may exempt sales for the purpose of raising funds for the benefit of an active duty service member or veteran, up to $25,000 per event.

Line 5l: Tax Included in Gross Sales. Complete this line only if you have tax included in your gross sales. Subtract line 5m from line 4, then divide by 17.6667 and enter the amount.

Line 8: If more tax was collected than the amount on line 7, enter the difference.

Line 10: Total Discount Allowed for Timely Payments.

•Annual filers: Enter $72 if the tax due on line 9 is $108 or more. If tax due is less than $108, calculate the discount by multiplying line 9 by 2/3 (0.6667).

•Accelerated/Monthly/Quarterly filers: Enter total discounts allowed for the year.

Line 12: Enter total payments plus credits from 2021 Fuel Supplier and Wholesaler Prepaid Sales Tax Schedule (Form 5083), 2021 Fuel Retailer Supplemental Schedule (Form 5085), and 2021 Vehicle Dealer Supplemental Schedule (Form 5086), if applicable, made for the current tax year.

Note: all prepaid sales tax schedules are

PART 2: USE TAX ON ITEMS PURCHASED FOR BUSINESS OR PERSONAL USE

Line 13: Unless a specific exemption applies enter purchases for which no sales or use tax was paid, including property withdrawn for business or personal use. See Michigan Use Tax Act, 1937 PA 94, for information on various exemptions. For questions contact Michigan Department of

Treasury at

PART 3: WITHHOLDING TAX

Line 17: Enter the number of your

Line 18: Enter the total Michigan income tax withheld for the return year.

Line 19: Enter the total Michigan income tax withholding previously paid for the return year. (Do not include penalty and interest.)

PART 4: SUMMARY

Line 24: Enter the amount of overpayment from line 22 to be refunded. Refunds will not be made in amounts of less than $1.

Line 25: If line 21 (tax paid) is less than line 20 (tax due), enter the additional tax due. Pay any amount greater than or equal to $1.

Line 28: Total Payment Due. Add lines 25, 26 and 27. Make check payable to “State of Michigan.” Write the account number, “SUW Annual” and the tax year on the check. Do not pay if the amount due is less than $1.

How to Compute Penalty and Interest

If the return is filed after February 28 and no tax is due, compute penalty at $10 per day up to a maximum of $400. If the return is filed with additional tax due, include penalty and interest with the payment. Penalty is 5% of the tax due and increases by an additional 5% per month or fraction thereof, after the second month, to a maximum of 25%. Interest is charged daily using the average prime rate, plus 1 percent.

Refer to www.michigan.gov/taxes for current interest rate information or help in calculating late payment fees.

PART 5: SIGNATURE

REMINDER: Taxpayers must sign and date returns. Preparers must provide a Preparer Taxpayer Identification Number (PTIN), FEIN or Social Security Number (SSN), as well as a business name, business address and phone number.

Annual Return Reporting

All taxpayers are encouraged to file the annual return electronically using Michigan Treasury Online (MTO). Visit mto.treasury.michigan.gov for more information. Taxpayers with 250 or more employees must file their withholding return electronically. Do not include wage statements with your mailed annual return.

1099 and Wage Statement Reporting

Due Date. State copies of wage statements are due to the Department of Treasury on or before January 31. Late filing is subject to penalty as provided by the Revenue Act. Pursuant to the Income Tax Act of 1967, Treasury is unable to grant an extension of this filing.

2021 Form 5081, Page 6

1099 Reporting: Forms with Withholding. Taxpayers who withheld Michigan income tax on a 1099 form (1099- MISC,

1099 Reporting: Forms without Withholding. Michigan participates in the combined federal/state 1099 filing program. Taxpayers who electronically filed 1099 forms using the IRS Filing Information Returns Electronically (FIRE) system should not send copies to Treasury. Taxpayers who did not electronically file 1099 forms through the IRS FIRE system should only send copies of the

Filing Options. All taxpayers are encouraged to file state copies of wage statements electronically using Michigan Treasury Online (MTO). On MTO, you can submit wage statements for a particular business you have connected to via Tax Services or you can utilize Guest Services to send a copy of the IRS EFW2 file for one or multiple businesses.

For all MTO upload options, you will receive a confirmation of your submission. Visit mto.treasury.michigan.gov for more information. Alternatively, taxpayers can mail wage statements to: Michigan Department of Treasury Lansing, MI 48930. Do not include a copy of the annual return with wage statement mailing.

Magnetic Media. Treasury offers Magnetic Media filing to all taxpayers reporting wage statements to Michigan. You can send Magnetic Media by mail or electronically through MTO. Taxpayers with 250 or more employees must use MTO to electronically submit wage statements. For more information, refer to Transmittal for Magnetic Media Reporting of

Tax Assistance

For assistance, call

Form Characteristics

| Fact | Detail |

|---|---|

| Form Name and Number | Michigan Department of Treasury 5081 (Rev. 04-20) |

| Type of Form | 2021 Sales, Use and Withholding Taxes Annual Return |

| Governing Laws | Public Acts 167 of 1933, 94 of 1937, and 281 of 1967, all as amended |

| Amendment Information | This form cannot be used as an amended return; see the 2021 Sales, Use and Withholding Taxes Amended Annual Return (Form 5082). |

| Filing Deadline | File this return by February 28, 2022 |

| Usage Restrictions | Do not use this form to replace a monthly/quarterly return |

| Electronic Filing Option | Form 5081 is available for submission electronically using Michigan Treasury Online (MTO) at mto.treasury.michigan.gov |

| Signature Requirements | Taxpayer Certification requires a declaration under penalty of perjury that the information is true and complete |

Guidelines on Utilizing Michigan 165

Filing out the Michigan 165 form, officially known as the 2021 Sales, Use and Withholding Taxes Annual Return (Form 5081), is a straightforward process that requires attention to detail. It's designed for businesses to report their sales, use, and withholding taxes for the previous year. After filling out this form, it’s due by February 28, 2022, to ensure compliance with state tax laws. To assist you through this process, here's a step-by-step guide to complete your form accurately.

- Navigate to the Michigan Department of Treasury website or access Michigan Treasury Online (MTO) to file electronically, which is encouraged for accuracy and convenience.

- Enter the Taxpayer’s Business Name and Business Account Number (FEIN or TR Number) at the top of the form.

- Provide the complete Street Address, City, State, and ZIP Code for the business.

- In PART 1: SALES AND USE TAX, input the Total gross sales for the tax year being reported on line 1.

- Fill in the amounts for Rentals of tangible property and accommodations, and Telecommunications services on lines 2 and 3, respectively.

- On line 4, Add lines 1, 2, and 3 to get the total for Sales and Use: Sales & Rentals.

- List ALLOWABLE DEDUCTIONS from a to l, including resale, agricultural production exemption, and government exemption among others, in the corresponding sections (5a-5l).

- Calculate and enter the Taxable balance on line 6 by subtracting line 5m from line 4.

- Compute the Gross tax due by multiplying line 6 by 6% (0.06) and record this on line 7.

- If you collected tax in excess, report this on line 8.

- Add lines 7 and 8 to get the Tax due before discount allowed and input this total on line 9.

- Calculate any Total discount allowed (if applicable) and note it on line 10.

- Proceed to PART 2 and PART 3 to report Use Tax on items purchased for business or personal use and Withholding Tax information, respectively.

- In PART 4: SUMMARY, tally up Total sales, use, and withholding tax due and payments made, then determine if there’s a balance due or a refund.

- Review the Penalty for late filing or late payment sections if they apply, and add these amounts to your total payment due.

- Ensure all required signatures and preparer information are completed in PART 5: SIGNATURE.

- File the return electronically via MTO for efficiency, or mail the completed form along with any payment due to the address listed on the form.

After submitting the Michigan 165 form, you’ve complied with the annual requirement for reporting sales, use, and withholding taxes. This process helps maintain your business’s good standing with the Michigan Department of Treasury. Remember, timely and accurate filing prevents potential penalties and interest on late payments. Should questions arise during the filing process, the Michigan Department of Treasury offers resources and assistance to support businesses through their website and helpline.

Crucial Points on This Form

What is the purpose of the Michigan 165 form?

The Michigan 165 form, officially known as Form 5081, serves as the Annual Return for Sales, Use, and Withholding Taxes. It is designed for businesses to report and remit their annual totals for these specific taxes to the Michigan Department of Treasury. This form consolidates the reporting for sales tax, use tax, and income tax withheld from employees' wages, all of which are crucial for businesses operating within Michigan.

What is the deadline for filing the Michigan 165 form?

Businesses are required to file the Michigan 165 form by February 28th following the tax year being reported. For instance, the form for the 2021 tax year should have been filed by February 28, 2022. It's important to adhere to this deadline to avoid potential penalties and interest for late filing.

Can I use the Michigan 165 form for amending a return?

No, the Michigan 165 form cannot be used to amend a previously filed return. If you need to make changes to a return you've already submitted, you'll need to use the Sales, Use, and Withholding Taxes Amended Annual Return (Form 5082) specifically designed for amendments.

Who is required to file the Michigan 165 form?

Any business that has collected sales tax, use tax, or withheld income tax from employees' wages in Michigan during the tax year must file the Michigan 165 form. This includes both traditional brick-and-mortar businesses and those engaging in e-commerce that meet certain nexus criteria established by Michigan law.

How can I file the Michigan 165 form?

The Michigan Department of Treasury encourages businesses to file Form 5081 electronically using the Michigan Treasury Online (MTO) system or approved tax preparation software. However, businesses also have the option to file a paper return by sending the completed form along with any payment due to the Michigan Department of Treasury's specified submission address.

What information is required to complete the Michigan 165 form?

To accurately complete the Michigan 165 form, businesses will need to provide the following information:

- Business name and address.

- Business account number (FEIN or TR Number).

- Total gross sales, rentals, and telecommunications services for the tax year.

- Allowable deductions such as sales for resale, agricultural production exemptions, and other specific deductions.

- Details on sales, use, and withholding tax owed and paid during the tax year.

This information helps the Department of Treasury assess the correct tax liability for each business.

Are there penalties for late filing or incorrect payment?

Yes, businesses that file their Michigan 165 form late or fail to pay the correct amount owed may incur penalties and interest. The penalty for late filing starts at $10 per day, up to a maximum of $400. If additional tax is due with the late return, the penalty is 5% of the tax due, increasing by an additional 5% per month or fraction thereof, after the second month, up to a maximum of 25%. Interest is also charged on late payments, calculated using the prime rate plus an additional 1%.

Common mistakes

One mistake that often occurs when completing the Michigan 165 form, specifically known as Form 5081, is the improper reporting of total gross sales for the tax year being reported in Part 1, line 1. It's crucial to include all sales, cash, credit, and installment transactions of tangible personal property in this line. Some individuals mistakenly exclude certain transactions or incorrectly deduct items that should be included in the total gross sales, such as shipping or delivery charges incurred before the ownership transfer of the property. Reporting accurate sales figures is vital for accurate tax calculation.

Another common error involves the deductions and exemptions section, specifically lines 5a through 5l, where individuals can claim allowable deductions such as resale, industrial processing exemption, or agricultural production exemption. Taxpayers often overlook the need for documentation to substantiate these deductions. As stated in the instructions, for every exemption or deduction claimed, there should be a corresponding business record or completed copy of the Michigan Sales and Use Tax Certificate of Exemption (Form 3372) obtained from the purchaser. Failing to properly document these deductions could result in disallowed claims and potential penalties.

Incorrectly calculating the taxable balance and gross tax due in lines 6 and 7 is a third mistake. This calculation involves subtracting the total allowable deductions from the gross sales and then applying the 6% tax rate to this taxable balance. Errors in arithmetic or misunderstanding which items are deductible can lead to reporting the wrong tax amount due. Particularly, the multiplication by the 6% tax rate is a step that should be checked for accuracy to avoid underpaying or overpaying the tax owned.

A fourth error involves the use tax section, particularly lines 13 and 14 in Part 2, where taxpayers report purchases for which no tax was paid and calculate the total use tax due. People often either underreport these purchases or fail to report them at all, either because they're unaware of the requirement or they misunderstand what qualifies. It's important to include all purchases of tangible property for business or personal use for which sales tax wasn't paid at the time of purchase, as these are subject to the use tax.

Lastly, an often overlooked mistake is the failure to properly complete the taxpayer certification at the end of Form 5081. This part requires the taxpayer or their official representative to sign and date the return, acknowledging the accuracy and completeness of the information provided under penalty of perjury. Missing signatures, incorrect representation titles, or undated forms can result in the return being considered incomplete, which may delay processing and potentially lead to penalties for filing an incomplete return.

Documents used along the form

When preparing and filing the Michigan Form 165 (Sales, Use and Withholding Taxes Annual Return), it is common for businesses and tax preparers to encounter a suite of supplementary forms and documents that support the primary submission. These documents play various roles in the accurate reporting and compliance of tax obligations. Understanding each of these documents is crucial for a comprehensive grasp of Michigan's tax reporting requirements.

- Form 5082 (Sales, Use and Withholding Taxes Amended Annual Return): This form is used for making amendments to previously filed annual return forms, such as the Form 165. It's necessary if a taxpayer needs to correct errors or update information after the original form has been submitted.

- Form 163 (Notice of Change or Discontinuance): Employed by taxpayers who need to report changes in their business information or indicate a discontinuance of business. This form ensures that the Michigan Department of Treasury has accurate and current details about the business.

- Michigan Sales and Use Tax Certificate of Exemption (Form 3372): This document is vital for businesses that make purchases exempt from sales tax. It serves as proof of eligibility for tax-exempt purchases and must be completed and kept on file by sellers to substantiate exempt transactions.

- Form 5086 (Vehicle Dealer Supplemental Schedule): Specifically designed for vehicle dealers, this e-file only form reports the detailed information on sales and use tax related to vehicle transactions. It complements the annual return by providing a breakdown of tax responsibilities arising from vehicle sales, trade-ins, and repossessions.

The meticulous collection and completion of these documents support the main filing of the Michigan Form 165 by providing essential details, corrections, and clarifications related to sales, use, and withholding taxes. Taxpayers should ensure they gather and accurately fill out these forms to maintain compliance with Michigan tax laws and to streamline their tax return process.

Similar forms

The Michigan 165 form is quite specific in its application and use, but there are other documents related to tax and financial reporting that share similarities in purpose and function. Here are six documents that are similar to the Michigan 165 form:

- IRS Form 940: This form is used for reporting annual Federal Unemployment Tax Act (FUTA) tax. Similar to the Michigan 165 form, Form 940 is also an annual return, but it focuses on unemployment taxes paid by employers at the federal level, showing how it also deals with tax obligations on a yearly basis.

- IRS Form 941: This form is employed for reporting quarterly federal taxes. It is used to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks, and to pay the employer's portion of Social Security or Medicare tax. Like the Michigan 165 form, it ties into payroll but does so on a quarterly basis, and it includes withholdings, which are part of the Michigan form as well.

- IRS Form 944: Designed for small employers to file and pay the annual amount of social security, Medicare, and withheld federal income taxes. The similarity here is the annual reporting structure for taxes that are related to employment, much like the withholding tax section of the Michigan 165 form.

- IRS Form W-2: This wage and tax statement is issued by employers to their employees and the IRS at the end of each tax year. It reports employee annual wages and the amount of taxes withheld from their paychecks. The connection to the Michigan 165 form comes from the requirement to report withholdings and wages, with the 165 form including data that could be compiled from multiple W-2 forms.

- IRS Form 1099: These forms are used to report various types of income other than wages, salaries, and tips (for which Form W-2 is used). The 1099 forms report income from self-employment earnings, interests and dividends, government payments, and more. The Michigan 165 form's requirement to report the total number of W-2 and 1099 forms reflects its role in consolidating financial reporting, similar to how individual 1099 forms account for specific sources of income.

- Form 5082: The 2021 Sales, Use, and Withholding Taxes Amended Annual Return. This form is specifically designed for amending previously submitted 165 forms, reflecting the unavoidable need for corrections and adjustments in tax reporting. It directly relates to the annual closure of tax liabilities, much like the original Michigan 165 form, but with a focus on rectifying any errors or updates post submission.

These documents each serve a unique purpose in the vast landscape of tax and financial reporting, yet they share commonalities with the Michigan 165 form in terms of periodic tax responsibility fulfillment, employer payroll reporting, and tax adjustments.

Dos and Don'ts

When it comes to tackling the Michigan 165 form, also known as the 2021 Sales, Use and Withholding Taxes Annual Return (Form 5081), it's crucial to approach the process with care. To ensure accuracy and compliance, here are six do's and don'ts to consider:

- Do verify all your business information, including your Business Account Number (FEIN or TR Number), street address, city, state, and ZIP Code. Accuracy in these details is critical for the Michigan Department of Treasury to process your form correctly.

- Do report total gross sales, rentals of tangible property and accommodations, and telecommunications services accurately in Part 1. Ensure all your figures are correct and reflect your sales accurately to avoid any discrepancies.

- Do take advantage of allowable deductions and exemptions. Carefully review lines 5a to 5l in the form to identify any exemptions or deductions you're eligible for, such as resale, industrial processing exemption, or agricultural production exemption.

- Don't use Form 5081 as an amended return. If you need to amend your annual return, you should refer to the Sales, Use and Withholding Taxes Amended Annual Return (Form 5082), as stated in the form's instructions.

- Don't neglect the signature part. The taxpayer or official representative must sign and date the form, certifying that the information provided is accurate and complete. An unsigned form can lead to processing delays or be returned.

- Don't wait until the last minute to submit your form. The due date for filing is February 28th, 2022. Late submissions may result in penalties and interest charges. Filing by the due date also allows you to take advantage of any allowable discounts for timely payments.

This guidance aims to simplify the completion and submission of the Michigan 165 form, ensuring compliance and accuracy in reporting your sales, use, and withholding taxes for the year 2021.

Misconceptions

When it comes to understanding the Michigan 165 form, commonly referred to based on its use for reporting Sales, Use, and Withholding Taxes, a plethora of misconceptions exist, leading to confusion and errors in filing. Shedding light on these can help in streamlining the filing process and ensuring compliance with Michigan tax laws. Here are ten common misconceptions and the truths behind them:

- Amendment Capabilities: A prevalent misconception is that the Michigan 165 form can be used for amended returns. However, this form explicitly cannot be used as an amended return; for amendments, one must reference Form 5082, specifically designed for such adjustments.

- Filing Deadline: The belief that the filing due date is flexible is incorrect. The form mandates submission by February 28, following the tax year in question, highlighting the importance of meeting specific deadlines to avoid penalties.

- Replacement for Monthly/Quarterly Returns: Contrary to some beliefs, the Michigan 165 form does not serve as a substitute for monthly or quarterly returns. This form is intended for annual reconciliation and reporting, not for interim filings.

- Electronic Filing Obligations: Many are under the impression that electronic filing is optional. While Michigan Treasury Online (MTO) offers convenient filing, certain taxpayers, especially those with 250 or more employees, are mandated to file their withholding returns electronically, emphasizing the shift towards digital compliance.

- Exemption Claims: Misunderstandings abound regarding exemptions, especially sales for agricultural production or industrial processing. These exemptions are clearly outlined and allowable under specific conditions to ensure only qualified transactions benefit from such deductions.

- Use Tax Reporting: It's wrongly assumed by some that all out-of-state purchases are exempt from use tax. The reality is purchases for business or personal use, where no sales tax was paid at the time of purchase, must be reported, subjecting them to use tax on the Michigan 165 form.

- Discount Calculations: The misconception that all filers receive a standard discount is incorrect. Discounts on tax dues are available under certain conditions and are calculated based on the tax due and timely filing, demonstrating the state's incentive for early compliance.

- Gross Sales Reporting: There’s a misconception that businesses do not need to report nontaxable sales. Actuality dictates that all sales, including nontaxable ones, should be reported, followed by the application of appropriate deductions and exemptions to arrive at the taxable balance.

- Withholding Tax Overstatement: Some believe that overestimated withholding taxes cannot be adjusted. Overpayments can indeed be corrected and either refunded or credited towards future tax liabilities, ensuring fairness in taxation.

- Penalty and Interest for Late Payment: A common belief suggests penalties are negotiable or waivable. Statutory penalties and interest are calculated based on prime rates plus additional percentages for late payments, underscoring the importance of adhering to deadlines.

Dispelling these misconceptions about the Michigan 165 form fosters better understanding and compliance, reducing errors and penalties for Michigan's taxpayers. It's beneficial for businesses and tax professionals alike to familiarize themselves with the specifics of this form to ensure accurate and timely filing.

Key takeaways

Filing the Michigan 165 form, known formally as the 2021 Sales, Use and Withholding Taxes Annual Return, is a critical process for businesses operating within Michigan. This form consolidates the reporting of sales, use, and withholding taxes for a given year. Here are key takeaways to guide you through accurately filling out and utilizing this form:

- Electronic Filing is Encouraged: The Michigan Department of Treasury strongly recommends filing this form electronically through Michigan Treasury Online (MTO). This platform not only streamlines the process but may also expedite any refunds due to the business.

- Deadlines are Critical: The form must be submitted by February 28 of the following year. Adhering to this deadline is crucial to avoid penalties and interest charges that accrue from late submissions.

- Specific Use: It's important to understand that the 165 form is not to be used for amending returns. If you need to correct previously submitted information, you should refer to the Sales, Use and Withholding Taxes Amended Annual Return (Form 5082).

- Not for Monthly/Quarterly Returns: This form serves as an annual recap and cannot replace monthly or quarterly sales, use, and withholding tax returns. Keep regular filings separate from this annual summary.

- Detailed Reporting Required: The form necessitates detailed reporting of gross sales, taxable sales, allowable deductions, and tax calculations across sales, use, and withholding tax categories. Each section must be carefully completed to ensure compliance and accuracy.

- Penalties for Late Filing: If filed after the deadline without owing tax, a penalty of $10 per day, up to $400, can be charged. Late filings with tax due will incur a 5% penalty of the tax due, increasing by an additional 5% per month after the second month, up to a maximum of 25%, plus daily interest.

- Eligibility for Electronic EZ Form: Some taxpayers may have the option to file an Annual EZ form, which simplifies the process by reducing the number of fields that need to be completed. Check the MTO website to see if you qualify for this simplified filing option.

In conclusion, careful and punctual submission of the Michigan 165 form is vital for businesses to remain in good standing with the Michigan Department of Treasury. Leveraging the MTO system can make this process more efficient and help ensure that your business complies with Michigan tax laws.

Popular PDF Templates

Michigan Business Tax Filing Requirements - Guides on calculating refundable credits from Form 4574 and subsequent tax refund or credit forward actions.

Michigan C 8000H - The form culminates in an apportionment percentage that combines property, payroll, and sales factors to guide tax base and capital acquisition deduction allocations.