Michigan 1353 PDF Form

The Michigan Department of Treasury requires various forms from businesses, and the Michigan 1353 form is particularly crucial for determining a business's tax obligations within the state. Issued under the authority of Public Act 228 of 1975, the 1353 (Rev. 11-19) Nexus Questionnaire is designed to gather comprehensive information about a company's activities that could establish a tax nexus in Michigan. By completing the form, businesses disclose their physical and economic presence in the state, which includes details about property ownership or lease, the existence of employees or agents within the state, sales activities, and more. The questionnaire takes a thorough approach, asking for the legal name of the business, Federal Employer Identification Number (FEIN), and descriptions of business activities under specific Michigan Compiled Laws (MCL). It differentiates between physical presence—such as owning or leasing property and having employees or representatives in the state—and economic presence, like exceeding certain sales thresholds. The form also inquires into the nature of the company's business activity, categorizing them into sales of tangible or intangible property, performance of services, and other specific activities that could influence tax liability. The detailed information required ensures the Michigan Department of Treasury can accurately assess whether a business has established a sufficient connection to the state, warranting tax collection under Michigan law.

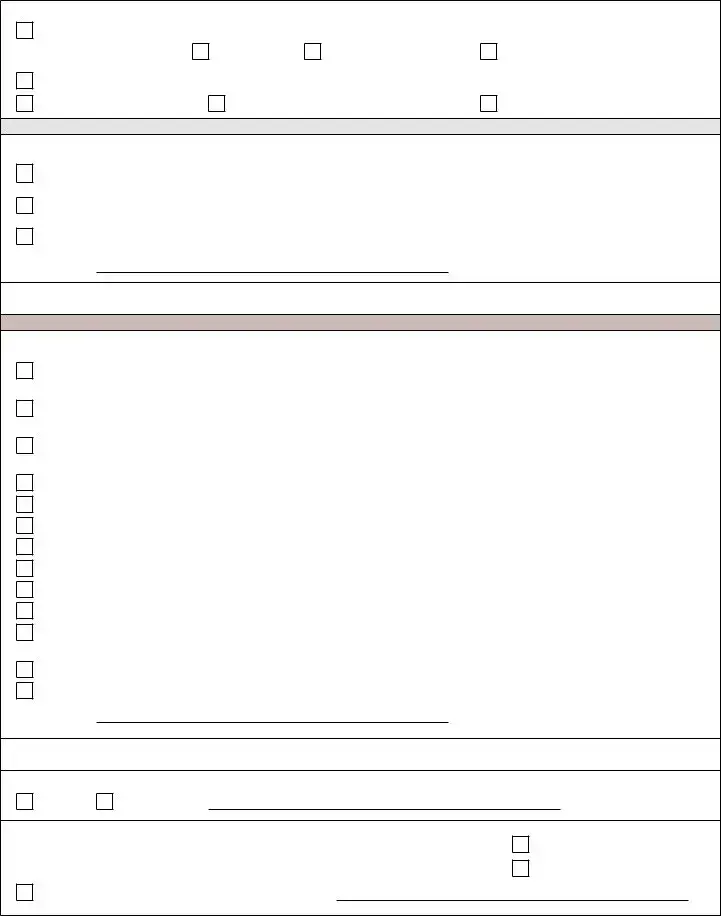

Preview - Michigan 1353 Form

Michigan Department of Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issued under authority of Public Act 228 of 1975. |

||||||||||||

1353 (Rev. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Michigan Department of Treasury Nexus Questionnaire |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal Name of Business or Individual (hereafter referred to as Company) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Employer Identification Number (FEIN), SSN or TR Number |

|

|

DBA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Street Address |

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1. If your company received a Letter of Inquiry Concerning Michigan Taxes enter reference number: |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2. Briefly describe your company’s business activity defined under MCL 206.603(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3. Describe how your company sells its product(s) and/or service(s) in the State of Michigan |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical Presence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Check all that apply. Refer to Table 1 and 2 on Page 3 for specific examples of business activity. |

|

|

|

|

|

||||||||||||||||||||||

4. |

|

Employees, agents, representatives, independent contractors, subcontractors, brokers, or other affiliated persons (both Michigan |

|

||||||||||||||||||||||||

|

|

residents and nonresidents) conduct business activity at any time within Michigan on your behalf. |

|

|

|

|

|

||||||||||||||||||||

Indicate the number of days when someone has conducted business activities within Michigan on your behalf: |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

List the last four completed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

tax year(s) (mm/dd/yyyy) |

|

Yr ( |

) |

|

|

Yr ( |

) |

|

Yr ( |

) |

|

Yr ( |

) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Check (X) the number of days |

|

|

1 day |

|

|

|

|

1 day |

|

|

|

1 day |

|

|

|

1 day |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

during the tax year |

|

|

2 or more days |

|

|

|

|

2 or more days |

|

|

|

2 or more days |

|

|

|

2 or more days |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Describe nature of activity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

5. |

|

Property within Michigan. The company owns, rents, leases, maintains, or has the right to use tangible personal property, real property, or |

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

|

|

an office or other establishment permanently or temporarily physically located in Michigan. |

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Enter period(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

6. |

|

Affiliates within Michigan. The company entered into an agreement, directly or indirectly, with 1 or more residents under which the |

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

|

|

resident, for a commission or other consideration, directly or indirectly, referred potential purchasers, whether by a link on an internet |

|

||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

|

|

website, |

|

|

|

|

|

||||||||||||||||||||

|

Enter period(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

a. |

|

The cumulative gross receipts from sales of tangible personal property to Michigan purchasers who were referred to the company |

|

||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||

|

|

|

by Michigan residents (through an agreement with the company) exceeded $10,000 in a |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

Enter period(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

b. |

|

The total cumulative gross receipts from sales of tangible personal property to Michigan purchasers exceeded $50,000 in a |

|

||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

period. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Enter period(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Economic Presence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Check all that apply. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

7. |

|

Michigan |

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

|

|

separate transactions. (Refer to RAB |

|

||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

|

Enter calendar year(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

8. Your company or the Unitary Business Group (UBG): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

a. |

|

Actively solicits sales in Michigan through the use of mail, telephone, or |

|

||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

which sales transactions occur. (Refer to RAB |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

Enter calendar year(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

b. |

|

Has gross receipts of $350,000 or more per year sourced to Michigan. (Refer to RAB |

|

||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||

|

|

|

Enter calendar year(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

9. |

|

The company has an ownership or beneficial interest in a |

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

|

|

which has nexus with this state. (Refer to RAB |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Enter the calendar year(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOP  If any of lines 4 through 9 are checked or the company is an Insurance Company with written premiums on property or risk located or residing in Michigan, continue completing this form. For all others, sign and mail to address on last page.

If any of lines 4 through 9 are checked or the company is an Insurance Company with written premiums on property or risk located or residing in Michigan, continue completing this form. For all others, sign and mail to address on last page.

1353, Page 2

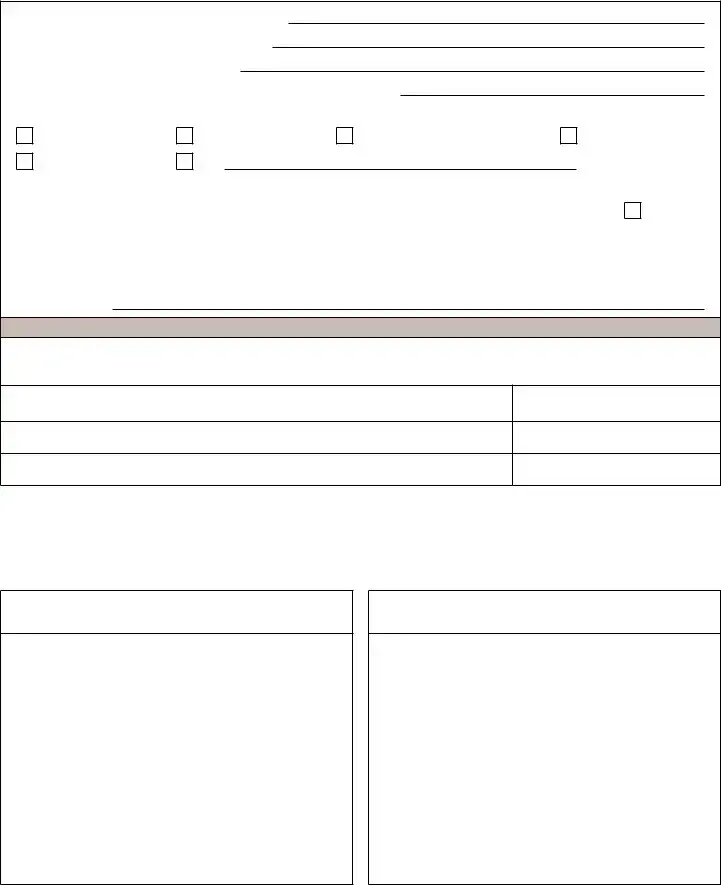

10.Check all that apply to your business activity:

Sale of property. |

|

|

Indicate type of property: |

Real |

Tangible Personal |

Rental Property (whether property is real, personal, tangible or intangible)

Intangible

Performance of Services

Financial Institution (Refer to MCL 206.651)

Insurance Company (Refer to MCL 206.607)

Protected Activities (PL

11.Indicate which activities below (if any) the Company’s employees, agents, representatives, independent contractors, brokers or other affiliated persons (both Michigan residents and nonresidents) conducted within Michigan for the last four completed tax years.

Solicit sales to purchasers in this state whether sales are wholesale, retail, or otherwise. (Solicitation means any speech or conduct that explicitly or implicitly invites an order, and ancillary activities that neither explicitly or implicitly invites an order.)

Maintain samples that are not sold or provided for other consideration, attend trade shows where no sales are made/orders taken, provide highly

technical presentations to solicit a sale (not after a sale has been made)

Deliver goods using vehicles owned, leased, used or maintained by the company

Enter period(s):

Additional comments:

Unprotected Activities (PL

12.Indicate which activities below (if any) the Company’s employees, agents, representatives, independent contractors, brokers or other affiliated persons (both Michigan residents and nonresidents) conducted within Michigan for the last four completed tax years.

Provide any services within Michigan, including but not limited to, consulting services, entertainment services, rental services, professional services, or transportation services provided as a transportation company (transport through, into, or from Michigan)

Maintain, occupy, own, lease or use an office, distribution facility, warehouse, or similar place of business in Michigan to facilitate the sale or

delivery of tangible personal property or maintain a market in Michigan

Provide customers with any kind of technical assistance or service including, engineering assistance, design service, quality control, product inspections, or similar services beyond the purpose of soliciting a sale

Sale of intangible property within Michigan

Assemble, install, or supervise installation at or after shipment or delivery

Make repairs or provide maintenance or service to property sold or to be sold to Michigan customers

Conduct training courses, seminars, or similar events for

Solicit, negotiate, or enter into franchising, licensing or similar agreements

Attend and/or participate at a trade show at which sales are solicited or made

Maintain a sample or display room in excess of 14 days or carry samples for sale, exchange or distribution in any manner for consideration or

other value

Consign stock of goods or other tangible personal property to any person in Michigan for sale

Pick up damaged goods using vehicles owned, leased, used, or maintained by the company

Enter period(s):

Additional Comments:

13. Do the Company’s employees approve or accept purchase orders or perform credit checks or authorize credit, while physically present in Michigan?

No

Yes, enter period(s):

14. The company has filed the following Michigan taxes: |

|

|

||

|

|

None |

|

Sales Tax |

|

|

|

||

|

|

Corporate Income Tax |

|

Use Tax on Sales/Rentals |

|

|

|

||

Individual or Composite Individual Income Tax, under SSN/FEIN:

Payroll Withholding

Use Tax on Purchases

1353, Page 3

15.What is the company’s State of Incorporation/Formation?

16.What is the company’s State of Domicile/Residence?

17.When was the company incorporated/formed?

18.When did the company’s business begin (if different than incorporation/formed)?

19.Organization Type (check one)

Individual

Limited Liability Company

Other:

Partnership

20. |

Federal Tax Return Type (check one) |

|

|

|

|

|

|

|

|||||

|

|

|

1040, Schedule C or E |

|

1120S, |

|

1065, Partnership |

|

1120, Corporation |

||||

|

|

|

|

|

|

||||||||

|

|

|

Form |

|

Other Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

None, related entity files. Check Return Type of related entity above and list FEIN: |

|

|

|

|

||||||

|

|

|

|

|

|

||||||||

21. |

If your company is a member of a UBG, enter the Designated Member FEIN. (Refer to RAB |

||||||||||||

Designated Member.) |

|

|

|

|

|

|

|

|

|

|

|||

1041, Fiduciary

Certification

I declare, under penalty of perjury, that the information provided in this questionnaire and any attachments is, to the best of my knowledge, true,

correct and complete (If prepared by a person other than an officer, partner or owner of the business, this declaration is based on all information of

which you have knowledge).

Preparer’s Signature

Date

Print or Type Name and Title

Telephone Number

Mailing Address (if different than address on Page 1)

Email Address

Mail To:

For U.S. Mail (Including Certified/Registered)

Michigan Department of Treasury

Discovery and Tax Enforcement Division

PO Box 30140

Lansing MI 48909

Table 1

Business Activities Which Create Nexus

•Inspect dealer inventories, review customer displays and shelving or replace stale product

•Provide transportation services or provide shipping information and/or coordinate deliveries

•Conduct seminars

•Perform managerial or research activities, or lease employment or personnel services

•Meet with customers to determine user satisfaction, or maintain display room or sample

•Pick up or replace damaged, defective or returned property, or repossess property

•Sell additional service contracts

•Perform computer data processing

•Provide private investigation, protection, patrol, watchman or armored car services

•Perform other types of services than those listed

•Secure deposits for sale

For Courier Delivery Service

Michigan Department of Treasury

Discovery and Tax Enforcement Division

7285 Parsons Drive

Dimondale MI 48821

Table 2

Real and Tangible Personal Property Held in Michigan

Which Create Nexus

•Repair shop, parts department or warehouse

•Office equipment or fixtures of any kind

•Employment office or purchasing office

•Mobile office, meeting place for directors, or

•Retail outlet

•Motor store(s) (trucks with driver sales person)

•Motor vehicles of any kind

•Telephone answering service

•Stock of goods (including consignment)

•Tools and dies at suppliers

•Real property or fixtures to real property of any kind

For a more complete explanation of Michigan’s Sales, Use, and Corporate Income Tax nexus standards, refer to Treasury’s Web site: www.michigan.gov/taxes.

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | Issued under the authority of Public Act 228 of 1975. |

| Form Purpose | The purpose of Form 1353 is to serve as a Nexus Questionnaire for businesses or individuals regarding Michigan taxes. |

| Content Sections | Includes sections on business activity, physical presence, economic presence, sales solicitation, and reportable Michigan taxes. |

| Specific Inclusions | Details requirements for reporting property within Michigan, affiliate agreements, and sales exceeding certain thresholds. |

| Useful References | References include several Revenue Administrative Bulletins (RABs) for detailed definitions and standards regarding nexus with Michigan. |

Guidelines on Utilizing Michigan 1353

Filling out the Michigan 1353 form is a critical step for businesses to ensure compliance with Michigan tax laws. This form is designed to assess a company's tax obligations based on its physical and economic presence within the state. Accurate completion and timely submission can significantly impact a company's operations in Michigan. The steps outlined below will guide you through the process of filling out this form correctly.

- Start by entering the Legal Name of Business or Individual at the top of the form.

- Input your Federal Employer Identification Number (FEIN), SSN, or TR Number in the designated field.

- Fill in your business’s DBA (Doing Business As) name if applicable.

- Provide your business’s Street Address, City, State, and ZIP Code.

- If you received a Letter of Inquiry Concerning Michigan Taxes, enter the reference number in question 1.

- Briefly describe your company’s business activity as defined under MCL 206.603(2) in question 2.

- In question 3, describe how your company sells its products and/or services in the State of Michigan.

- For question 4, check all that apply regarding Physical Presence and provide details as requested about the nature of activities and the number of days someone conducted business activities within Michigan on your behalf.

- Questions 5 to 9 cover different scenarios regarding property, affiliates within Michigan, and your company’s economic presence. Check all that apply and provide necessary details, including periods and calendar years.

- Under question 10, check all that apply to your business activity and specify the type of property if you select "Sale of property".

- Questions 11 and 12 require information on the Company’s activities within Michigan. Select all activities that apply and provide the periods for each.

- Answer whether the Company’s employees approve or accept purchase orders or perform credit checks while in Michigan for question 13.

- In question 14, indicate the Michigan taxes your company has filed.

- Provide your company’s State of Incorporation/Formation, State of Domicile/Residence, incorporation/formation date, and the date business began in questions 15 to 18.

- Select your Organization Type and Federal Tax Return Type in questions 19 and 20.

- If applicable, enter the Designated Member FEIN for a Unitary Business Group (UBG) in question 21.

- Complete the certification section with the preparer’s signature, date, and contact details. Print or type the name and title of the individual filling out the form.

- Mail the completed form to the address provided on the last page for U.S. Mail or Courier Delivery Service as per your preference.

Following these detailed steps will ensure your Michigan 1353 form is accurately completed, reflecting your business activities within the state. Proper documentation and adherence to state guidelines are crucial for maintaining your compliance and avoiding any potential legal issues.

Crucial Points on This Form

What is the Michigan 1353 Form?

The Michigan 1353 Form is a document used by the Michigan Department of Treasury to gather information to determine a business's or individual's tax obligations in the state. This inquiry is based on their activities and presence in Michigan. The information collected includes details about the company's physical presence, sales, property, affiliates, and economic presence within the state.

Who needs to complete the Michigan 1353 Form?

This form should be completed by businesses or individuals who have received a Letter of Inquiry from the Michigan Department of Treasury concerning state taxes. It's also relevant for companies engaging in activities that could establish a tax nexus with Michigan.

What is considered a 'nexus' for Michigan taxes?

A 'nexus' refers to the type of connection between a business and a state that requires the business to file and pay taxes in that state. This can include having a physical presence, exceeding certain sales thresholds, or other business activities outlined by Michigan laws and regulations.

What type of information do I need to provide in the form?

You will need to detail your company’s activities, such as physical presence, property owned or leased, affiliations with Michigan residents, sales thresholds, and types of business activities conducted within the state. Specific dates and periods of activity, as well as financial thresholds met, are also required.

How do I determine if my business activities create a nexus in Michigan?

Refer to the guidelines provided in Tables 1 and 2 of the Michigan 1353 Form for specific examples of business activities that create nexus. These include actions like inspecting dealer inventories, providing services, conducting seminars, and maintaining an office or other types of physical presence.

What happens if I do determine that my business has a nexus in Michigan?

If your business activities establish a nexus in Michigan, you are required to complete the Michigan 1353 Form in its entirety. Following this, you may need to register for relevant state taxes and fulfill any obligations such as filing returns and making tax payments.

Where do I send the completed Michigan 1353 Form?

The completed form should be mailed to the Michigan Department of Treasury at the address provided on the last page of the form. There are addresses available for both U.S. Mail and courier delivery services.

What if I'm unsure about how to answer a question on the form?

If you're uncertain about how to respond to a query on the Michigan 1353 Form, it's recommended that you consult with a tax professional or directly contact the Michigan Department of Treasury for clarification.

Are there deadlines for submitting the Michigan 1353 Form?

While the form itself does not specify a submission deadline, it should be returned promptly upon receipt of a Letter of Inquiry from the Michigan Department of Treasury to avoid potential penalties or interest on unpaid taxes.

Can more than one type of business activity apply to my company?

Yes, multiple types of business activities can apply to your company, and you should check all that apply on the Michigan 1353 Form. This includes everything from selling physical or intangible property, performing services, and any unprotected activities as defined by the state.

Common mistakes

One common mistake made when filling out the Michigan 1353 form is inaccurately reporting the business activity under question 2. Often, businesses either provide too much detail, leading to confusion about the core activities, or too little, which does not give the Department of Treasury enough information to accurately assess the nexus. A clear, concise description that directly aligns with MCL 206.603(2) criteria is necessary for accurate processing.

Another mistake is failing to correctly check the applicable boxes in the Physical Presence section, specifically questions 4 through 6. This misunderstanding or oversight can occur when businesses are not fully aware of what constitutes a physical presence within Michigan. For example, companies sometimes overlook the presence of independent contractors or fail to realize that maintaining a warehouse or stock of goods in the state constitutes a physical presence that needs to be disclosed.

The Economic Presence section, questions 7 and 8, is another area where errors frequently occur. Businesses often misreport or misunderstand the thresholds for economic presence, such as the $100,000 in sales or 200 separate transactions condition. This misunderstanding can result in incorrectly indicated economic ties to Michigan, leading to incorrect nexus determinations and potential compliance issues.

Incorrect or incomplete entries in the sections regarding a company’s affiliation with a Unitary Business Group (UBG) or its involvement with protected and unprotected activities under questions 10 through 12 also lead to mistakes on the form. Businesses sometimes fail to recognize their relationships with other entities or the nature of their activities within Michigan that could affect their tax obligations. This lack of recognition can inadvertently mislead or provide incomplete information to the Department of Treasury, affecting the accuracy of tax assessments and obligations.

Documents used along the form

When dealing with legal or tax issues in Michigan, especially when utilizing the Michigan 1353 Nexus Questionnaire form, it's important to understand that several other forms and documents commonly complement this process. Knowing which documents you might need can streamline your interactions with the Michigan Department of Treasury and ensure that your business operations are compliant with state laws and regulations. Below are five documents often used alongside the Michigan 1353 form. Each serves a unique purpose, contributing to a thorough and accurate representation of your business's nexus within the state.

- Michigan Sales Tax License Application (Form 518): This application is necessary for businesses intending to sell or lease tangible personal property that is subject to sales tax. If your business activities in Michigan include sales, completing this form will help you comply with sales tax regulations.

- Michigan Corporate Income Tax Return (Form 4891): If your business operates as a corporation and has established nexus in Michigan, this return is crucial. It details the income tax obligations of your corporation to the state based on the income generated within Michigan.

- Michigan Individual Income Tax Return (MI-1040): For businesses operating as sole proprietorships or pass-through entities like S-Corporations and partnerships, where business income passes through to individual tax returns, this form is essential. Business owners must report their share of the business income on their personal tax returns.

- Uniform Sales & Use Tax Exemption/Resale Certificate - Multijurisdiction (Form 3372): This form is used by businesses to claim exemption from sales and use tax on purchases of tangible personal property that will be resold or used in the production of goods for sale. It's critical for businesses with multi-state operations or sales.

- Change of Address or Responsible Party — Business (Form 8822-B): It's important to keep your business's contact information up to date with the Michigan Department of Treasury. If your business has recently undergone a change in address or responsible party, submitting this form ensures that all communication regarding your tax obligations reaches the right place.

Understanding and preparing these documents in the context of your business's operations in Michigan can significantly affect your compliance and financial well-being. It's not just about filling out the forms but also understanding how they interconnect and reflect the nature and extent of your business activities within the state. Keeping accurate records and staying informed about the requirements can make navigating Michigan's tax laws much smoother.

Similar forms

The California Form 568 - This form is used by the California Department of Tax and Fee Administration for Limited Liability Companies (LLCs) to report income and determine their franchise tax obligations. Similarly to the Michigan 1353 form, it requires detailed information about the company's activities within the state to assess tax nexus and obligations based on physical presence and economic activities.

The New York ST-809 - This form is required for vendors to report and pay sales taxes to the New York Department of Taxation and Finance. Like the Michigan 1353 form, the ST-809 assesses a company's activities in the state, particularly sales activities, to determine if the business meets the threshold for sales tax nexus.

The Texas Franchise Tax Report - This extensive report, required by the Texas Comptroller of Public Accounts, evaluates whether a company's operations in Texas meet the criteria establishing a franchise tax liability. The similarity to the Michigan 1353 form lies in its evaluation of a company's physical and economic presence in the state, determining tax obligations based on a variety of operational metrics.

The Florida DR-1 - Florida’s Department of Revenue requires this registration form for businesses to collect sales tax. It parallels the Michigan 1353 form by requiring businesses to disclose information about their activities within the state, thus determining their nexus for sales and use tax purposes based on both physical and economic presence.

The Illinois Business Registration Application (REG-1) - Similar to Michigan's form, the Illinois Department of Revenue’s REG-1 form is required for businesses to register for various tax purposes, including sales tax. The form requires information about a business's activities within Illinois to determine the extent of its tax obligations, focusing on the presence of the business and the nature of its operations, similar to the criteria used in the Michigan 1353 form.

Dos and Don'ts

When filling out the Michigan 1353 form, there are specific steps you should follow to ensure that the process is completed accurately and efficiently. It's crucial to pay attention to these dos and don'ts to avoid common mistakes that could potentially delay the processing of your form or lead to inaccuracies in your business's tax obligations to the State of Michigan. Here's a guide to help you navigate the process:

Do:- Read the instructions carefully before you begin filling out the form. Understanding each section fully is key to providing accurate information.

- Use the correct legal name of your business and the Federal Employer Identification Number (FEIN), Social Security Number (SSN), or TR Number as requested in the form to ensure consistency in your business's tax records.

- Provide detailed descriptions of your company’s business activities and the nature of your presence in Michigan, as this information is crucial for determining your tax responsibilities.

- Check all that apply in sections regarding physical and economic presence to accurately represent your business activities in the state.

- Review your responses thoroughly before submitting to ensure all information is complete and accurate.

- Sign and date the form, as this certifies that the information provided is true to the best of your knowledge and belief.

- Skip sections that apply to your business. If a section is relevant to your business activities in Michigan, make sure you provide the necessary information.

- Ignore the specific examples provided in Tables 1 and 2 on Page 3 of the form. These examples can help you determine what constitutes business activity that creates nexus with the state.

- Provide vague or incomplete descriptions of your business activities. Specificity is important for a correct assessment of your nexus status.

- Forget to list the periods relevant to each applicable section. Dates are crucial for determining tax liabilities for specific tax years.

- Overlook the certification at the end of the form. Filling out this section incorrectly or not at all could result in your form being returned or not processed.

- Mail the form to the wrong address. Ensure you send it to the address provided on the form to avoid delays in processing.

By following these guidelines, you can navigate the completion of the Michigan 1353 form with confidence, knowing you've taken the correct steps to fulfill your business's tax obligations in the state.

Misconceptions

Misunderstandings often cloud the true requirements and implications of completing the Michigan 1353 form, known as the Nexus Questionnaire. Addressing these misconceptions directly can provide clarity and ease for businesses navigating their tax responsibilities in Michigan.

- Misconception 1: The form is only for large corporations.

Many believe that the Michigan 1353 form is tailored exclusively for large entities. However, this form applies to any business or individual operating within Michigan, regardless of size, that engages in activities creating a "nexus" or connection that may subject them to Michigan taxes.

- Misconception 2: Online businesses are exempt.

There's a common myth that businesses operating solely online without a physical presence in Michigan do not need to complete this form. The truth is that economic presence, such as a certain level of sales or transactions within Michigan, can also establish nexus, making the form relevant for online sellers too.

- Misconception 3: Submitting the form automatically leads to higher taxes.

Submitting the Michigan 1353 form doesn't necessarily mean your tax bill will increase. The form helps the Department of Treasury determine if your business activities create a tax nexus in Michigan. Depending on the findings, some businesses may not see any change in their tax obligations.

- Misconception 4: Only businesses with employees in Michigan need to fill it out.

While having employees in Michigan is one factor that can create a nexus, other activities can too. Merely renting property, storing inventory, or making sales in Michigan can be sufficient, regardless of whether you have employees in the state.

- Misconception 5: It's a one-time requirement.

The Nexus Questionnaire might need to be completed more than once. If your business operations or structure change, or if the state tax laws are updated, it may be necessary to submit updated information to accurately assess your nexus status.

- Misconception 6: All parts of the form apply to every business.

Not every section of the Michigan 1353 form will be relevant to every business. It's designed to cover a broad range of situations, and only the parts that apply to your specific business activities need to be completed based on your nexus with Michigan.

- Misconception 7: The form is only about sales tax.

Some think this questionnaire is exclusively concerned with sales tax. In reality, it covers various taxes, including corporate income tax and use tax. It's a comprehensive tool for understanding a business's overall tax nexus in Michigan, beyond just sales tax.

Understanding these misconceptions about the Michigan 1353 form helps clarify its purpose and importance. It's not just about tracking business size or tax collection but ensuring businesses are tax-compliant according to their specific interactions with the State of Michigan.

Key takeaways

Filling out the Michigan 1353 form is a critical step for businesses to ensure compliance with the state's tax obligations. This document, issued by the Michigan Department of Treasury, is designed to determine a company's nexus, or connection, with Michigan that would subject it to state taxes. Here are eight key takeaways about completing and using this form:

- It is essential for any business operating in Michigan, or having transactions or a physical presence in the state, to fill out the Michigan 1353 form to assess their tax obligations accurately.

- The form requires comprehensive information about the business, including legal name, Federal Employer Identification Number (FEIN), Social Security Number (SSN), or Treasury (TR) Number, and detailed contact information.

- Businesses need to provide a detailed description of their activities in Michigan, indicating whether they have a physical presence in the state through employees, agents, real property, or personal property.

- Companies must disclose any affiliations with Michigan residents that refer potential purchasers to the company, which could constitute a nexus and thereby tax obligations within the state.

- Economic presence is also a critical factor; businesses must indicate if their sales or transactions in Michigan exceed certain thresholds, which would require them to contribute state taxes.

- The form covers a range of business activities, including the sale of property, performance of services, and any protected activities under Public Law 86-272, which might limit the state's ability to impose an income tax.

- Unprotected activities, which could create a tax nexus, include providing services, maintaining an office or place of business in Michigan, or engaging in activities that facilitate sales or deliveries in the state.

- Finally, the form requires information about the company's tax filings, state of incorporation, business type, and the federal tax return type, which helps the Michigan Department of Treasury assess the company's full tax responsibilities.

In summary, the Michigan 1353 form plays a crucial role in determining a business's tax obligations in the state. By providing detailed information about their operations, businesses can ensure compliance with Michigan's tax laws, avoiding penalties and fostering a transparent relationship with the state's tax authorities.

Popular PDF Templates

Michigan Pc 584 - By filling out the PC 584 form, an individual signals their desire to receive notifications about probate hearings, ensuring they stay informed about the case progress.

Michigan Lottery Address - Commissions offered to retailers include a percentage of sales and bonuses, as outlined by the Lottery, incentivizing active participation.