Michigan 1028 PDF Form

Navigating through the complexities of state tax compliance can be a daunting task for companies operating within Michigan, particularly for those in the railroad industry. The Michigan 1028 form, officially known as the Annual Property Report for State Assessed Railroads, serves as a crucial document under this purview. As mandated by the State Tax Commission under the auspices of Michigan Public Act 282 of 1905, as amended, this form is integral for state-assessed railroads to accurately report their property values for the year ended December 31, 2011. With strict deadlines based on the company's annual gross receipts—March 31 for those exceeding $1,000,000 and March 15 for those at or below this threshold—filing this form is not optional but mandatory. Penalties for failing to submit a complete report by the due date are severe, costing companies $500 per day. Moreover, the form demands detailed information spanning from company identification and contact information to complex financial data concerning rolling stock, real property, and operational income. The added requirement of notarization further underscores the form’s significance and the seriousness with which the information must be treated. Therefore, understanding and preparing the Michigan 1028 form necessitates a thorough grasp of its sections, deadlines, and the meticulous attention to detail needed to avoid costly penalties and ensure compliance.

Preview - Michigan 1028 Form

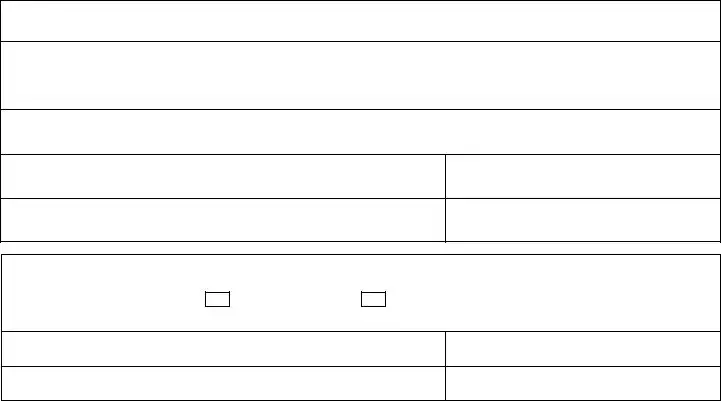

1028 (Rev.

State of Michigan

State Tax Commission

ANNUAL PROPERTY REPORT

For Year Ended December 31, 2011

State Assessed Railroads

This report is issued under Michigan Public Act 282 of 1905, as amended. Filing of this report is mandatory. There can be only one authorized contact person for each company. Companies with annual gross receipts greater than $1,000,000 are required to file this report on or before March 31. Companies with annual gross receipts equal to or less than $1,000,000 are required to file this report on or before March 15. A company failing to file a complete report by the applicable due date shall be subject to a fine of $500 per day.

Instructions for completion and filing options are available on pages

Company Name |

|

|

Federal Tax ID Number |

|

|

|

|

|

|

Company Address to which the tax bill should be sent |

City |

State |

ZIP Code |

|

|

|

|

|

|

Company Authorized Contact Person (to whom correspondence concerning this report should be addressed) |

Company Web site |

|

||

|

|

|

|

|

Contact Address |

|

City |

State |

ZIP Code |

|

|

|

|

|

Contact Telephone Number |

Contact Fax Number |

|

Contact |

|

|

|

|

|

|

Notary

Printed name of President, Secretary, Superintendent or Chief Officer under whose direction this report was prepared.

By my signature below, I certify that the information (including any attachments) in this report is complete and correct to the best of my knowledge and belief.

Signature ________________________________________________Title __________________________________Date _________________________

Subscribed and sworn to before me this ____________________________ day of _____________________________________, _______________.

Signature of Notary Public |

My Commission Expires |

Printed Name of Notary Public

Acting in the County of

Has your company experienced any name changes, acquisitions, or sales during the calendar year immediately preceding the statutory due date of this report.

YES

If yes, provide the following information:

NO

Description of Change (merger, acquisition, sale)

Date of Change

Under what name did the taxpayer file last year?

Name of Company Sold

1

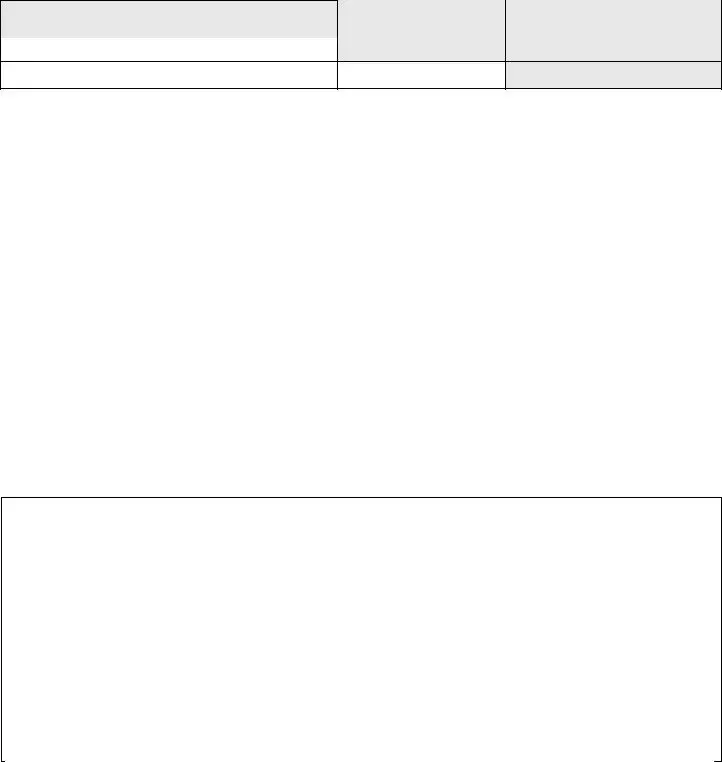

Schedule 1, Statement of Total Cost of Rolling Stock Owned or Leased by Year of Acquisition (Includes Locomotives, Freight Cars, Passenger Cars, Highway and Work Equipment)

|

|

|

|

|

|

|

|

TRUE |

|

|

|

|

|

|

|

|

CASH |

|

No. of |

COSTS |

|

|

|

REPORTABLE |

|

VALUE |

YEAR OF |

Units |

REPORTED |

LOSSES |

ADDITIONS |

|

COSTS |

|

(office |

ACQUISITION |

Reported |

PRIOR |

(office use |

(office use |

NO. OF |

CURRENT |

|

use |

|

Prior Year |

YEAR |

only) |

only) |

UNITS |

YEAR |

MULTIPLIER |

only) |

|

|

(office use) |

|

|

|

|

|

|

2011 |

|

|

|

|

|

|

0.8900 |

|

2010 |

|

|

|

|

|

|

0.7600 |

|

2009 |

|

|

|

|

|

|

0.6700 |

|

2008 |

|

|

|

|

|

|

0.6000 |

|

2007 |

|

|

|

|

|

|

0.5400 |

|

2006 |

|

|

|

|

|

|

0.4900 |

|

2005 |

|

|

|

|

|

|

0.4500 |

|

2004 |

|

|

|

|

|

|

0.4200 |

|

2003 |

|

|

|

|

|

|

0.3800 |

|

2002 |

|

|

|

|

|

|

0.3600 |

|

2001 |

|

|

|

|

|

|

0.3300 |

|

2000 |

|

|

|

|

|

|

0.3100 |

|

1999 |

|

|

|

|

|

|

0.2900 |

|

1998 |

|

|

|

|

|

|

0.2800 |

|

Prior |

|

|

|

|

|

|

0.2300 |

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 1 Total True Cash Value

Schedule 2, Investment in Road Property Used in Transportation Service with Additions and Retirements for the Year (Michigan Only)

Column A |

Column B |

Column C |

Column D |

Column E |

Column F |

Column G |

Column H |

Previous |

Original Cost |

Accumulated |

Expenditures for |

Depreciation |

Plant Balance |

Accumulated |

Net Book Value |

Year |

of |

Depreciation of |

Additions During |

of New Additions |

at Year End |

Depreciation |

= F - G |

Plant Balance |

Retirements |

Retirements at |

the Calendar |

During the |

= A - B + D |

at Year End |

|

from last |

Made During |

Beginning of |

Year |

Calendar Year |

|

|

|

Year’s |

Calendar |

Calendar Year |

|

|

|

|

|

Column F |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If your prior year plant ending balance is not equivalent to the amount in Column A that was carried forward from last year’s report, please indicate the revised amount and provide an explanation.

Revised Column A: _________

Explanation: |

_______ |

_ |

_ |

|

|

|

plus |

Construction in Progress (CIP) |

x .50 = Adjusted CIP |

||

|

_________ |

|

|

(incurred cost to date) |

equals |

||

_________

Schedule 2 True Cash Value

_________

Note: Inventory is exempt from assessment. Inventory does not include personal property under lease or principally intended for lease or rental (operating), rather than sale. Property allowed a cost recovery allowance or depreciation under the Internal Revenue Code is not inventory. Motor vehicles registered with the Michigan Secretary of State on Tax Day (December 31st) are exempt.

2

Schedule 3

A. Interest Paid on Debt From Railway Operations (National)

|

Last Four Year Results as Previously Reported |

|

|

Balance at Close of |

|

|

|

|

||||

|

|

|

Calendar Year |

|

|

Five Year Average |

|

|||||

|

|

|

(office use only) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

(December 31st) |

|

|||||

|

|

|

|

|

|

|

|

|

|

(office use only) |

|

|

|

year - 4 |

|

year - 3 |

year - 2 |

year - 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Total Net Operating from Railway Operations (National)

Last Four Year Results as Previously Reported

(office use only)

year - 4 |

year - 3 |

year - 2 |

year - 1 |

|

|

|

|

Balance at Close of

Calendar Year

(December 31st)

Five Year Average

(office use only)

Schedule 4, Statement of Allocation Factors

Note: "National" includes all North American Activity (U.S., Canada, and Mexico), "Michigan" only includes those items attributable to the State of Michigan.

|

Ar e y ou r op e r a t ion s e n t ir e ly w it h in t h e St a t e of M ich ig a n ? |

|

|

|||||||

|

Yes |

_ _ _ |

|

No |

_ _ _ |

|

|

|

|

|

|

I f Yes, y ou do not need t o pr ov ide t he follow ing in for m at ion . |

|

|

|||||||

|

I f No, please pr ov ide t he follow in g in for m at ion below ( Car Miles an d Rev en u es) . |

|

||||||||

|

Car Miles |

|

|

|

|

National |

Michigan |

|||

|

1. |

Freight Car Miles (Loaded and Empty) |

|

|

|

|||||

|

2. |

All Other Car Miles |

|

|

|

|

|

|

||

|

3. |

Total Car Miles (1+2) |

|

|

|

|

|

|

||

|

4. |

Percentage Attributable to Michigan |

|

|

|

|||||

|

Revenues (please enter full dollar amounts) |

National |

Michigan |

|||||||

|

1. |

Freight Revenue |

|

|

|

|

|

|

||

|

2. |

All Other Revenue from Operation |

|

|

|

|||||

|

3. |

Total Operating Revenue (1+2) |

|

|

|

|||||

|

4. |

Percentage Attributable to Michigan |

|

|

|

|||||

Schedule 5, Sales and Transfers of Car Marks

Did any sales or transfers of car marks occur during the calendar year immediately preceding the statutory due date of this report?

Yes |

____ |

No |

____ |

If Yes, describe any sales or transfers that occurred.

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

3

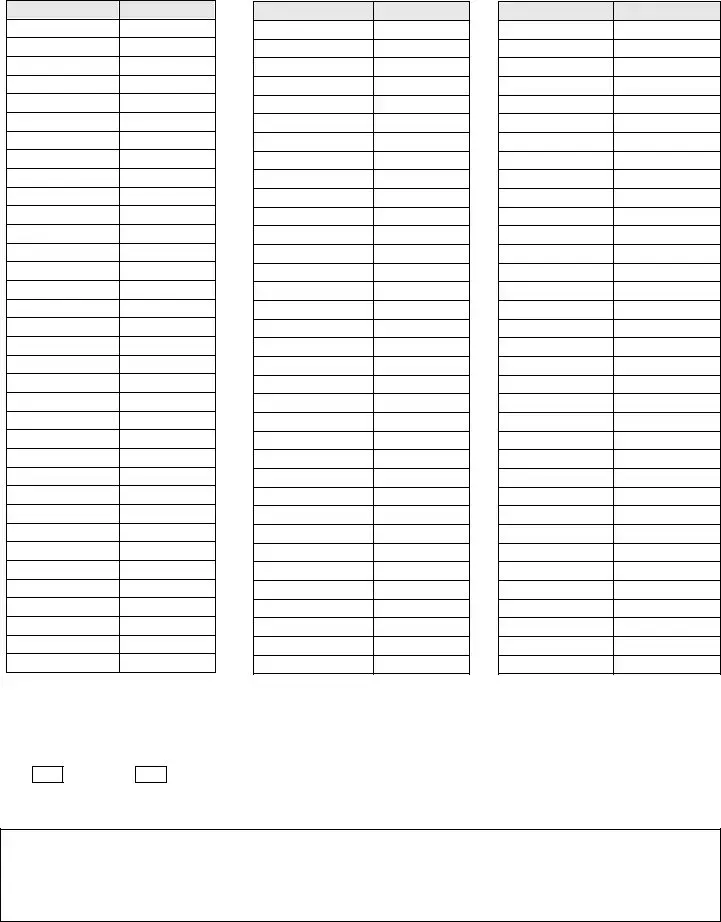

Schedule 6, Statement of Railcar Mileage Traveled Over Track Operated by your Company (itemize by Car Mark)

Car Mark

Mileage

Car Mark

Mileage

Car Mark

Mileage

Schedule 7, Real Property

Have there been any changes (additions or losses) to your Real Property in the calendar year immediately preceding the statutory filing date of this report?

Yes ____

No ____

If yes, please describe losses and/or additions in box below:

4

NOTE

All summary calculations will be completed AFTER the Assessment and Certification Division has reviewed and processed the information contained in this Annual Property Report. Once all processing is complete, you may view the summary calculations (worksheets) by requesting a personal identification number (PIN) and accessing your company's secure, online account. For additional information on how to request a PIN to access your account, please refer to the "How to file this report" section of the instructions.

Tentative values will be posted on or about May 15, and final values will be posted on or about June 15. Each state assessed company will receive a final tax bill by mail and any taxes due are payable on July 1.

5

2012

Application for Tax Credit for Maintenance and Improvement of Rights of Way

Section 13 of PA 282 of 1905, as amended allows credit for eligible expenses incurred in the State of Michigan by railroad companies for maintenance or improvement of rights of way, including those items, except depreciation, in the official

Eligibility Requirements

In order to be eligible for the tax credit for maintenance and improvement of rights of way under MCL 207.13(2), the railroad companies must fulfill the statutory requirements detailed in Section 13 of PA 282 of 1905 (MCL 207.13(3)). In addition to providing the requested summary information on this application for credit, each company must complete and file [3 copies of] the report described in Section 13 with the State Tax Commission that includes, but is not limited to, detailed information of the nature and location of expenses. A summary of the eligibility and reporting requirements are listed in the attached instructions on pages

Eligible and

Examples of Eligible and

Maximum Credit Available

The maintenance of way expense credits are not refundable or deferrable. Expenses in excess of a company's property tax liability are not eligible for credit against prior or subsequent years' liability.

***NOTE*** Filing of this credit application does not relieve the company of the statutory requirement of filing [3 copies] of the detailed expense report described in Section 13(3). You are still required to provide that to the State Tax Commission at the following address:

|

|

Mailing Address: |

For Overnight Package Delivery: |

Michigan Department of Treasury |

Michigan Department of Treasury |

Michigan State Tax Commission |

Michigan State Tax Commission |

P O Box 30471 |

Austin Building |

Lansing, MI |

430 W. Allegan Street |

|

Lansing, MI 48922 |

|

|

Company Name

Eligibilty

Has your company incurred eligible expenses, and submitted three (3) copies of the required expense report as described above?

Yes ___

No ___

If Yes, please enter total eligible expenses below.

If No, you are NOT ELIGIBLE for credit. DO NOT SUBMIT EXPENSES.

Total Eligible Expenses for Maintenance and Improvement of Rights of Way in Michigan which you have reported in the above described report.

$

___________________________

6

2012

Application for Tax Credit for Maintenance and Improvement

of Qualified Rolling Stock in Michigan

Section 13a of Public Act 282 of 1905, as amended, allows a credit for eligible expenses incurred in the State of Michigan by railroad and car companies for maintenance or improvement of eligible companies' qualified rolling stock.

Eligible Company is defined as:

Railroad companies, union station and depot companies, sleeping car companies, express companies, car loaning companies, stock car companies, refrigerator car companies, fast freight line companies, and all other companies owning, leasing, running, or operating any freight, stock, refrigerator, or any other cars not the exclusive property of a railroad company paying taxes upon its rolling stock under this act, over or upon the line or lines of any railroad in this state.

Eligible Expenses are expenses for repairs and maintenance that satisfy all of the following criteria:

1.Eligible expenses must have been incurred during the calendar year immediately preceding the statutory due date of this report.

2.Eligible expenses must have been incurred in the State of Michigan.

3.Eligible expenses must be made for the maintenance or improvement of rolling stock which are subject to taxation by the State under PA 282 of 1905 as amended.

Examples of Eligible and

Maximum Credit Available:

This credit is not refundable or deferrable. Expenses in excess of a company's property tax liability are not eligible for credit against prior or subsequent years' liability.

Company Name

Eligibility

Are you an "eligible company" which has incurred expenses that satisfy ALL of the requirements listed above?

Yes ___

No ___

If Yes, please enter total eligible expenses below.

If No, you are NOT ELIGIBLE for credit. DO NOT SUBMIT EXPENSES.

Total Eligible Expenses for Maintenance and Improvement of Qualified Rolling Stock in Michigan (include labor, material, overhead, and payments to others for work done).

$

7

Instructions for Completion of the Annual Report by State Assessed Railroads

Who must file this report? (MCL 207.6)

All railroad companies, union station and depot companies, and switching and terminal companies operating in the State of Michigan pursuant to Section 6 of PA 282 of 1905.

When is this report due? (MCL 207.6)

If your annual gross receipts exceed $1,000,000, this report is due by March 31st.

If your annual gross receipts do not exceed $1,000,000, this report is due by March 15th.

How to submit this report:

This report may be submitted electronically or mailed in paper format. If you wish to submit this form electronically, please visit the following web site at www.michigan.gov/stateassessedproperty or you may call (517)

If submitting this form by mail, please complete and sign the declaration on page one and send the entire completed form to:

Mailing Address: |

For Overnight Package Delivery: |

Michigan Department of Treasury |

Michigan Department of Treasury |

Michigan State Tax Commission |

Michigan State Tax Commission |

P O Box 30471 |

Austin Building |

Lansing, MI |

430 W. Allegan Street |

|

Lansing, MI 48922 |

What property is subject to taxation? (MCL 207.5)

The term "property having a situs in this state", includes all property, real and personal, of the persons, corporations, companies,

Schedule 1

List all rolling stock which is owned or leased by you. List the number of units reported as well as reportable current year costs. Property must be listed at its full original cost new, in the year that it was new. If the original/new acquisition cost of a railcar that was initially purchased by another company can be obtained, that information must be reported. If the original/new acquisition cost of a railcar that was initially purchased by another company cannot be obtained, then the original/new acquisition cost shall be equal to the subsequent price paid by the reporting company upon acquiring the used railcar. All betterments, including capital improvements, mandated betterments, capital upgrades, safety features, and mandated repairs should be reported in the year the expenditure is booked as a fixed asset.

The "Costs Reported Prior Year", "Losses", "Additions", and "True Cash Value" columns are for Assessment and Certification Division (ACD) use only. To view the values and calculations entered by the Assessment and Certification Division, please fill out form 4435 to obtain a Personal Identification Number (PIN) for access to the online reporting form available at www.michigan.gov/taxes (please see "How to submit this report" section above for specific website location). Tentative Values will be electronically posted on or about May 15th, and Final Values will be electronically posted on or about June 15th.

Schedule 2

This is to be submitted by all railroads and calls for summary data relating to investment for the company(s) properties in Michigan. Investment in account 732 (improvements on leased property) shall also be reported on Schedule 2. The "Previous Year Plant Balance" column is for Assessment and Certification Division office use only. List any retirements that have occurred during the calendar year immediately preceding the statutory due date of this report. List the accumulated depreciation for those retirements in the column designated.

8

List any expenditures for additions that occurred during the calendar year immediately preceding the statutory due date of this report. Exclude

In the Accumulated Depreciation column, list the accumulated depreciation for assets in place at year end.

List the balance of costs at calendar year end (December 31st). The "True Cash Value" column is for Assessment and Certification division office use only.

List the current year construction in progress. Report all costs that have been incurred including overheads, installation costs incurred, sales tax and freight. Reporting of costs should be separated by project. Property which is placed in service on or before December 31st is considered placed in service that year and should be entirely reported on the line which represents the year that it was considered placed in service. Similarly, the cost of all assets must be reported as acquired in the year that they were placed in service, rather than the year of purchase, if those years differ. The adjusted construction in progress and the Schedule 2 True Cash Value will be calculated by the Assessment and Certification Division.

Schedule 3

A.Enter the Total Interest Paid to service debt to finance railway operations. Interest must be for short term and long term debt. The columns provide for the amounts from the last four years. The

B.Enter the Total Net Operating Income from Railway Operations. The columns provide for the amounts reported from the last four years.

Schedule 4

If your company's property (whether owned or leased) is used entirely within the State of Michigan, you are not required to provide allocation information. If your company's property (whether owned or leased) is used partly within and partly without the State of Michigan, provide the allocation information based on the system as a whole, and the portion attributable to Michigan. For further details on reporting specifications, consult the Uniform System of Accounts for Railroad Companies. (49 CFR 1201 et.seq.)

Schedule 5

Please check the appropriate box indicating whether any sales or transfers of car marks have occurred in the calendar year immediately preceding the statutory due date of this report. If you select yes, please describe any sales and transfers of car marks that occurred.

Schedule 6

Enter the total annual mileage traveled during the calendar year immediately preceding the statutory due date of this report, over track that you operate (whether owned or leased). Please provide the mileage by individual car mark.

Schedule 7

Indicate whether there have been any changes to your real property as compared to the prior year’s information and provide information about any changes in the reporting box.

Losses to Real Property

Losses mean the decrease in value which has not been reflected in the assessment unit’s immediately preceding year’s assessment roll. Losses include removal or destruction of real property, newly exempt property, or newly contaminated property.

Additions to Real Property

Additions mean an increase in value which has not been reflected on the assessment unit’s immediately preceding year’s assessment roll. Additions include omitted property, new or replacement construction, and increases in value due to new public services and/or contamination remediation.

9

Instructions for Tax Credit for Maintenance and Improvement of Right of Way

Sec. 13 of PA 282 of 1905, as amended, (more specifically MCL 207.13(2) and MCL 207.13a(5)(b)(ii)), allows credit against the tax imposed, for eligible expenses incurred in the State of Michigan by railroad companies for maintenance or improvement of rights of way, including those items, except depreciation, in the official

Additional Statutory Requirements for Eligibility (MCL 207.13(2) - (5))

In order to be eligible for the tax credit for maintenance and improvement of rights of way, the railroad companies must complete and file [3 COPIES OF] an annual report with the State Tax Commission that includes the following:

1.Detailed data of right of way work conducted in this state during the past calendar year separated by costs of labor and materials on each project and itemized in the following categories:

(a)Miles of track laid

(b)Tons of new ballast installed

(c)Number of ties installed

(d)Miles of track surfaced

(e)Signals installed

(f)Under drainage work done

2.The number of notices of violation from the railway inspectors by railroad section,

3.A detailed account of the location and nature of the work defined by railroad section or mile posts surrounding the work area plus the county, city, or township in which the work was performed,

4. Demonstration that the highest priority of expenditures for the maintenance and improvement of rights of way has been given to rail lines that handle hazardous materials, especially those that are located in urban or residential areas, and detailed data on the tonnages of hazardous materials handled in relation to tonnages of other traffic handled over the rail line for which a tax credit is being applied.

In addition, the company must grant to another railroad company, upon application by the latter, trackage rights over its line for trains, providing that the train operations do not interfere with the movement of Michigan freight using the same trackage, if operations can be accomplished safely in the opinion of the grantor and if trackage arrangements and train operations are approved by the interstate commerce commission.

***NOTE*** Filing of the credit application does not relieve you of the requirement of filing 3 copies of the above defined report with the State Tax Commission. You are still required to provide the above information in a separate report.

What expenses are eligible for credit against the tax levied? MCL 207.13(2)

Eligible Expenses:

1.Eligible expenses must have been incurred during the calendar year immediately preceding the statutory due date of this report.

2.Eligible expenses must have been incurred in the State of Michigan.

3.Examples of Eligible Capital Expenses for Road and Equipment include, but are not limited to items from the following categories:

(1) |

Engineering exp. directly related to R & E Property |

(23) |

Wharves and Docks |

(3) |

Other |

(24) |

Coal and Ore Wharves |

(4) |

Grading |

(25) |

TOFC/COFC Terminals |

(5) |

Tunnels and Subways |

(26) |

Communication Systems |

(6) |

Bridges, trestles, and culverts |

(27) |

Signals and Interlockers |

(7) |

Elevated Structures |

(37) |

Roadway Machines |

(8, 9, 10, 11) Ties, Rails and other Track Material |

(38) |

Roadway small tools |

|

(12) Track Laying and Surfacing |

(39) |

Public Improvements - Construction |

|

(13) Fences, Snowsheds, and Signs |

(43) |

Other Expenses - Road |

|

(17) Roadway Buildings (portion housing MOW equipment and engineering)

10

Form Characteristics

| Fact Number | Detail |

|---|---|

| 1 | The Michigan 1028 Form is governed by Michigan Public Act 282 of 1905, as amended. |

| 2 | Its purpose is for the annual reporting of property by state-assessed railroads. |

| 3 | Filing this report is mandatory for companies involved. |

| 4 | Companies with annual gross receipts over $1,000,000 must file the report by March 31; those with $1,000,000 or less must file by March 15. |

| 5 | A fine of $500 per day is imposed on companies failing to file a complete report by the due date. |

| 6 | Instructions for completion and filing options are detailed on pages 9-12 of the report. |

| 7 | The form requires information on company details, authorized contact person, changes in the company structure, and various schedules including details on rolling stock, investment in road property, and more. |

Guidelines on Utilizing Michigan 1028

Filling out the Michigan 1028 form is a crucial part of ensuring that your company is compliant with state tax regulations. This form is specifically for state-assessed railroads and must be submitted annually to provide a comprehensive report on property values, among other financial details. It's imperative to complete this form accurately and submit it by the deadline to avoid potential fines. Here's a detailed walkthrough of the steps needed to fill out the form correctly.

- At the top of the form, write down the year for which you're filing the report right next to "For Year Ended December 31," ensuring the year matches your reporting period.

- Next, fill in your company’s legal name where it says "Company Name."

- Enter the Federal Tax ID Number of your company in the designated space.

- Under "Company Address to which the tax bill should be sent," provide the full mailing address, including City, State, and ZIP Code.

- Identify the Company Authorized Contact Person – the individual who handles inquiries about this report. Include their full name and position.

- For communication purposes, supply the contact details including the Web site, Contact Address, City, State, ZIP Code, Telephone Number, Fax Number, and E-mail Address.

- Fill in the printed name of the President, Secretary, Superintendent, or Chief Officer under whose direction the report was prepared, alongside their signature, title, and the date of signing at the bottom of the first page.

- The Notary Public will then need to sign, date, and print their name and commission details in the designated area below the officer’s signature.

- Answer the yes/no question regarding any company name changes, acquisitions, or sales during the last calendar year. If yes, provide a detailed description in the space provided.

- Proceed to Schedule 1, "Statement of Total Cost of Rolling Stock Owned or Leased by Year of Acquisition," and fill in the required information for each year of acquisition as listed.

- In Schedule 2, "Investment in Road Property Used in Transportation Service," input the Previous Year Original Cost, Accumulated Depreciation, and other requested financial details in the corresponding columns.

- Under Schedule 3, report the Interest Paid on Debt From Railway Operations and Total Net Operating from Railway Operations, including the last four-year results and five-year average.

- If applicable, fill in Schedule 4, the Statement of Allocation Factors, providing details on Car Miles and Revenues for both National and Michigan operations.

- For Schedule 5, indicate if any sales or transfers of car marks occurred and provide descriptions if necessary.

- In Schedule 6, list each railcar's mileage traveled over track operated by your company, itemized by Car Mark.

- Complete Schedule 7 by noting any changes to your Real Property in the reporting calendar year, describing losses and/or additions.

Once you've followed these steps and thoroughly checked your information for accuracy, your form is ready to be submitted before the due dates indicated: March 31 for companies with annual gross receipts greater than $1,000,000 and March 15 for those with receipts equal to or less than this amount. After submission, you'll want to stay attentive for any correspondence from the State Tax Commission regarding the processing of your report and be prepared to comply with any additional requests or clarifications they might have.

Crucial Points on This Form

What is the Michigan 1028 form?

The Michigan 1028 form, also known as the Annual Property Report, is a state-required document for railroads operating in Michigan. It is a detailed report governed by Public Act 282 of 1905, as amended, aimed at assessing railroads for tax purposes. This form collects information on a railroad company's property, including rolling stock, real estate, and other assets, for the year ended December 31. It also reports on financial aspects such as income from operations and interest paid on debt.

Who needs to file the Michigan 1028 form, and when is it due?

All railroads operating in Michigan with annual gross receipts over $1,000,000 must file this form by March 31 of each year. Railroads with annual gross receipts of $1,000,000 or less have a filing deadline of March 15. It's mandatory for these companies to submit a completed report by the specified due date to avoid substantial penalties.

What are the penalties for late filing of the Michigan 1028 form?

Companies that fail to submit a complete Michigan 1028 form by the applicable due date are penalized with a fine of $500 per day. This strict penalty emphasizes the importance of timely and accurate filing to ensure compliance and avoid unnecessary financial burdens.

How can a company file the Michigan 1028 form?

Details for completing and filing the Michigan 1028 form are provided in the last section of the report, pages 9-12. Companies can access instructions for electronic submission or paper filing, depending on their preference. It's essential to follow these guidelines closely to ensure the report is filed correctly and to streamline the submission process.

What information is required on the Michigan 1028 form?

The Michigan 1028 form requires detailed information about the railroads' property and financial status, which includes:

- Company identification and contact details, including the federal tax ID number and the authorized contact person's information.

- A statement of total cost of rolling stock organized by the year of acquisition.

- Investments in road property used in transportation service, reflecting additions and retirements during the year.

- Financial data such as interest paid on debt from railway operations and total net income from operations.

- Information on operational aspects like car mileage, sales or transfers of car marks, and changes to real property.

Accurate and complete reporting in each of these areas is critical for compliance and accurate tax assessment.

Common mistakes

Filling out the Michigan 1028 form can be daunting and mistakes can easily occur, impacting the accuracy and acceptability of the report. One common error is the misinterpretation of deadlines. Companies with gross receipts over $1,000,000 need to submit the form by March 31, while those with lesser receipts have a deadline of March 15. This misunderstanding can lead to missed deadlines and result in hefty fines.

Another mistake lies in the designation of the authorized contact person. The form specifies that only one individual can be listed as the contact person. Errors occur when companies list multiple contacts or fail to update this information when the designated person changes. This can lead to miscommunication and misplaced documents, as correspondence is directed to the wrong individual.

A significant number of errors stem from inaccurately reported financial information. For instance, the statement of total cost of rolling stock and the investment in road property used in transportation service must reflect true costs and values. Miscalculating or misunderstanding what amounts to report under each category can lead to discrepancies, potentially affecting assessed values and ultimately, tax liabilities.

Failure to report changes such as company name changes, mergers, or acquisitions can also result in inaccuracies. This information is crucial for maintaining up-to-date records, and omissions or errors can cause confusion and delays in processing the form. Ensuring that all changes are clearly and correctly reported is imperative.

Incorrectly calculating the true cash value in schedules 1 and 2 is another common mistake. These schedules require precise details about costs, depreciation, and net book values. Misinterpretation of the instructions or failure to accurately calculate these values can significantly affect the accuracy of the report.

Not properly detailing sales and transfers of car marks as required in schedule 5 is another oversight. This section requires specific details about transactions, and neglecting to provide comprehensive and accurate descriptions can lead to incomplete reporting. This information is vital for the State Tax Commission to accurately assess taxable property.

Lastly, updates on real property changes are often inadequately reported. Additions or losses to real property must be clearly described to ensure the property is correctly assessed. Overlooking or underestimating these updates can lead to incorrect tax assessments and potential penalties for the company.

Documents used along the form

In preparing and finalizing the Michigan 1028 form, which is an annual property report primarily for state-assessed railroads, multiple other documents and forms often come into play. These not only supplement the 1028 form but also ensure a comprehensive and compliant report submission to the State Tax Commission. Below is a description of up to 8 such documents often associated with the Michigan 1028 form.

- Audit reports: Audit reports provide third-party verification of a company's financial statements and operations. These documents can support the financial information provided in the 1028 form, especially regarding revenue and expenses.

- Inventory lists: Detailed inventories of all assets, including rolling stock and other property, help in accurately completing the Schedule 1 and 2 parts of the 1028 form that focus on the true cash value and investment in property used in transportation service.

- Debt service documentation: Documents detailing interest and principal payments on debt due to railway operations help complete Schedule 3A effectively, providing a clear picture of the financial obligations of the company.

- Operating income statements: These statements are necessary to fill out Schedule 3B, offering insights into the net operating income from railway operations, which is crucial for tax assessment purposes.

- Interstate commerce commission filings: For railroads operating beyond Michigan, filings with the Interstate Commerce Commission may provide necessary data for Schedule 4, particularly in delineating between Michigan and national operations.

- Sale and transfer records: Documentation of any sales or transfers of car marks, as mentioned in Schedule 5, including contract details, can provide the clarity needed for accurate reporting.

- Real property records: For Schedule 7, records of any additions or losses to real property in the reporting year are instrumental. They ensure the report reflects current assets and their valuation.

- Previous year's 1028 forms: Copies of 1028 forms filed in preceding years serve as reference points. They can help in ensuring consistency and tracking changes in assets, income, and other relevant metrics over time.

These documents collectively ensure the accuracy and completeness of the information required in the Michigan 1028 form. By meticulously compiling and reviewing each piece of documentation, companies can navigate the complex requirements laid out by the State Tax Commission, thus minimizing the risk of errors or omissions in their annual property reports.

Similar forms

The Michigan 1028 form, known as the Annual Property Report for State Assessed Railroads, is a specialized document that railroads must complete. It bears similarities to other regulatory filings across various sectors. These documents typically require detailed reporting and adherence to strict deadlines to ensure compliance with state and federal regulations. Below are six documents that share elements in common with the Michigan 1028 form:

- Form 990 (Return of Organization Exempt from Income Tax): Similar to the 1028 form, Form 990 is required by the IRS for tax-exempt organizations. Both documents demand comprehensive financial and operational disclosures, from revenues and expenses to governance and compliance with applicable laws. The emphasis on accountability and public disclosure links these forms closely in purpose and design.

- UC-018 (State Unemployment Insurance Quarterly Wage Report): This report is mandated for employers to declare wages paid to employees, mirroring the 1028's requirement for companies to report property values and changes. The focus on timely, accurate records for financial assessment by state authorities makes the UC-018 akin to the Michigan 1028 in essence and function.

- Form 5500 (Annual Return/Report of Employee Benefit Plan): Required by the Department of Labor, the IRS, and the Pension Benefit Guaranty Corporation, Form 5500 shares the 1028 form's complexity and the need for detailed financial reporting. Both forms scrutinize the economic aspects of their respective subjects to ensure compliance with federal standards.

- Form D (Notice of Exempt Offering of Securities): Like the Michigan 1028, Form D is a disclosure document, this time for companies raising capital through securities that are exempt from SEC registration. Both documents serve regulatory compliance purposes, ensuring that entities adhere to laws designed to protect stakeholders' interests.

- Form 1042 (Annual Withholding Tax Return for U.S. Source Income of Foreign Persons): Form 1042 requires detailed reporting on taxes withheld from non-U.S. residents, akin to the detailed reporting on property values and transactions required by the Michigan 1028 form. Their shared feature is the function of stringent reporting obligations to governmental authorities.

- Facility Pollution Permit Applications: While not a single form, applications for pollution permits across states demand detailed reporting on emissions, akin to the asset reporting on the 1028 form. Both types of documents are critical for regulatory compliance, with a focus on the environmental impact and property valuation, respectively.

These documents, each serving distinct regulatory needs, align with the Michigan 1028 form in their shared goal of ensuring entities operate within the confines of the law, promoting transparency, and safeguarding public and governmental interests through detailed reporting.

Dos and Don'ts

Do read the entire form and accompanying instructions carefully before starting to fill it out to ensure you understand all requirements.

Don't rush through filling out the form to avoid making mistakes that could result in penalties or fines.

Do ensure your company's authorized contact person information is accurate and current to facilitate smooth communication.

Don't forget to report any name changes, acquisitions, or sales during the calendar year immediately preceding the statutory due date of the report to maintain record accuracy.

Do use the detailed instructions on pages 9-12 for guidance on how to complete and file the report correctly.

Don't ignore the filing deadlines - March 31 for companies with annual gross receipts greater than $1,000,000 and March 15 for those equal to or less than this amount.

Do ensure that the financial information provided, including but not limited to the Statement of Total Cost of Rolling Stock and Investment in Road Property, is complete and correct to avoid penalties.

Don't overlook the importance of having the report notarized as required to attest to the veracity of the information provided.

Do request a personal identification number (PIN) for online account access after submission, to track the status of your report and view summary calculations when they become available.

Misconceptions

Misconceptions about the Michigan 1028 form, specifically designed for state-assessed railroads, often stem from a misunderstanding of its requirements and implications. By clarifying these areas, companies can more accurately comply with reporting requirements and avoid potential penalties.

- Misconception 1: The 1028 form is optional for small railroads.

Contrary to some beliefs, the Michigan 1028 form is mandatory for all state-assessed railroads, regardless of their size. Companies with annual gross receipts over $1,000,000 must file the report by March 31, while those with receipts of $1,000,000 or less have a deadline of March 15. This distinction underscores the state's expectation of compliance from all railroads operating within its jurisdiction. - Misconception 2: Late filing is inconsequential.

Some companies might underestimate the consequences of not filing the 1028 form on time, assuming that the state might overlook a delayed submission. However, the law is clear that a company failing to file a complete report by the due date is subject to a fine of $500 per day. This significant penalty emphasizes the importance of timely compliance with the reporting requirements. - Misconception 3: Updates on company changes are optional.

A common misconception is that reporting changes such as mergers, acquisitions, or sales within the company during the preceding calendar year is discretionary. In reality, the 1028 form specifically asks whether the company has experienced any name changes, acquisitions, or sales, requiring details about such changes if they have occurred. This ensures that the state tax commission has up-to-date information on the companies it assesses. - Misconception 4: All assets are subject to assessment.

Finally, there is a misunderstanding that all assets owned by the company are assessable for state tax purposes. The 1028 form clarifies that inventory is exempt from assessment, along with motor vehicles registered with the Michigan Secretary of State on Tax Day, and computer software purchased separately and commonly sold as such. Understanding these exemptions can help companies accurately report taxable property and avoid misreporting.

By addressing these misconceptions, companies can improve their compliance with Michigan's tax reporting requirements, ensure accurate filings, and avoid unnecessary fines. Moreover, a clear understanding of the 1028 form and its stipulations can facilitate a smoother interaction with state tax authorities, ultimately benefiting both the companies and the state.

Key takeaways

Understanding the proper completion and submission of the Michigan 1028 form is crucial for state-assessed railroads. These key takeaways highlight the most important aspects of the process to ensure compliance and avoid potential fines.

- The Michigan 1028 form is mandated under Michigan Public Act 282 of 1905, as amended. This underscores the importance of the document in the annual reporting requirements for state-assessed railroads.

- Filing deadlines vary based on a company's annual gross receipts. Companies with annual gross receipts over $1,000,000 must file the report by March 31, while those with $1,000,000 or less have until March 15. This tiered deadline system necessitates that firms accurately track their financial performance to determine the correct filing date.

- A penalty of $500 per day is enforced for not filing a complete report by the due date. It emphatically underscores the need for timeliness and completeness in complying with the reporting requirements.

- Changes such as name changes, acquisitions, or sales during the calendar year immediately preceding the statutory due date of the report must be disclosed. This requirement ensures the State Tax Commission has up-to-date information on the entity responsible for the rail assets being reported.

Ensuring accurate and timely filing of the Michigan 1028 form is essential for all state-assessed railroads operating within Michigan. It not only fulfills a legal obligation but also helps in the efficient management of the state's railroad property tax system.

Popular PDF Templates

State of Michigan Job Openings - Includes anticipatory guidance for applicants regarding the potential impacts and considerations of withdrawing land from the program.

Tax Clearance Certificate Michigan - Enables businesses to detail their dissolution plans or continued operations for the Michigan Department of Treasury’s review.

5080 Form 2024 - Prompts the need for accurate and complete entries in PART 1 and PART 2, dedicated to sales/use tax and business/personal use tax respectively.