Mi 163 PDF Form

When business landscapes transform, whether through growth, redirection, or conclusion, the Michigan Department of Treasury provides a structured method for reporting these changes via the Mi 163 form. This form acts as an essential tool for businesses in Michigan that have undergone modifications, including discontinuation or adjustments to their operational details. It requisitely captures different aspects of business modifications such as changes in business name or address, sales or closure of the business, updates in tax types, and much more, all compiled in an organized manner. The form's structured layout simplifies the process, allowing for thorough communication between businesses and the government ensuring all pertinent details are up-to-date. Completing and submitting this form, available for electronic completion or via mail, ensures compliance with state requirements, helping to avert potential legal or financial complications. It is a reminder too, especially for businesses drawing to a close, to fulfill obligations like filing final returns. The Mi 163 form thus stands as a vital component in the ecosystem of business management within Michigan, acting as a bridge between business changes and regulatory acknowledgment.

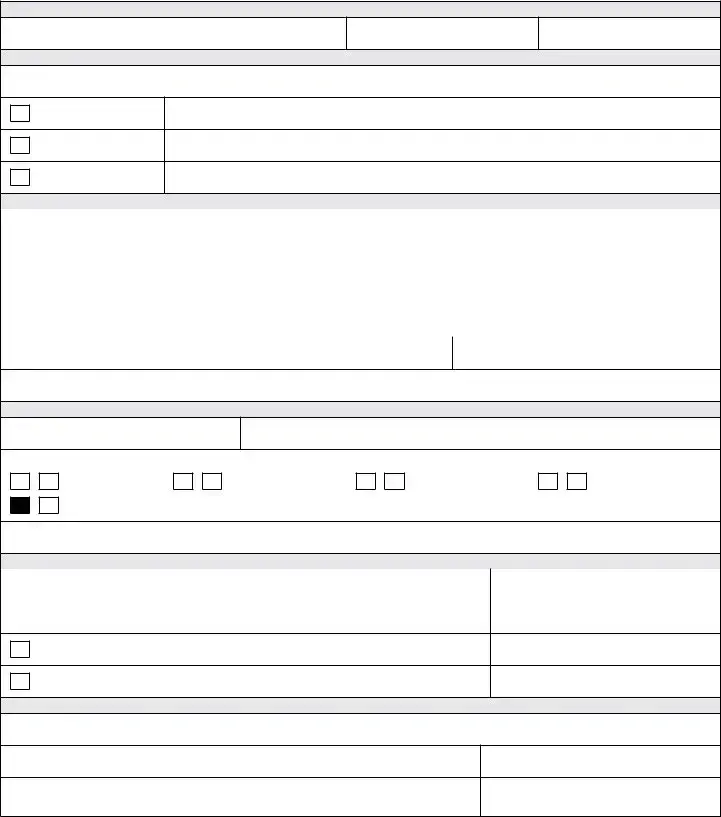

Preview - Mi 163 Form

Michigan Department of Treasury 163 (Rev.

Notice of Change or Discontinuance

Use this form only if you discontinued or made changes to your business. Complete all sections that apply. Changes provided on this form may also be completed electronically at mto.treasury.michigan.gov. If using this form, sign and mail to: Michigan Department of Treasury, Registration Section, PO Box 30778, Lansing MI 48909.

PART 1: BUSINESS INFORMATION

Business Name (required)

Account Number (FEIN or TR No.) required Business Phone Number

PART 2: BUSINESS NAME/ADDRESS CHANGES

Check all boxes that apply below. If reporting a discontinued business, check “Change Legal Address” below, complete the “New Legal Address” field,

and complete Part 3 as applicable.

New Business Name

Change Business Name

New Legal Address (If a discontinued business, enter contact address for all

Change Legal Address

New Mailing Address

Change Mailing Address

PART 3: BUSINESS SALE OR CLOSURE

Effective Date of Discontinuance |

REMINDER: If discontinuing a business, the business owner is obligated to timely file all final returns for the year. If |

||

|

|

|

discontinuing a business on behalf of a deceased taxpayer, a copy of the death certificate is required with this form. |

|

|

Close Entire Business |

With the exception of IFTA, Motor Fuel, and Tobacco Tax, checking this box registers a discontinuance of all Michigan |

|

|

||

|

|

taxes related to this business. Complete the “Effective Date of Discontinuance” field at left. Do not complete Part 4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sell Part of Business |

Effective Date of Partial Business Sale (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sell Entire Business |

Effective Date of Entire Business Sale (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

Buyer Name

Buyer FEIN (if known)

Buyer Address (if known)

PART 4: ADDING OR DELETING A TAX TYPE

Effective Date of Change (mm/dd/yyyy)

Complete this section if the business is to remain open and only specific taxes need to be added or deleted from the business registration.

ADD DEL |

ADD DEL |

ADD DEL |

ADD DEL |

Sales Tax

Corporate Income Tax

Michigan Business Tax

Use Tax

Payroll/Pension Withholding Tax — To add this tax, complete an “Application for Registration” (Form 518).

To add/delete Tobacco Products Tax licenses, call

PART 5: OTHER BUSINESS CHANGES OR INFORMATION — Check all that apply.

|

|

Seasonal Open Date |

Seasonal Close Date |

|||

|

|

Change status to a seasonal business. Enter month numerically (for example, 08 for August). |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAICS Code |

|

|

||

|

|

Add or update NAICS code. Go online to https://www.census.gov/eos/www/naics/ for codes. |

|

|

||

|

|

|

|

|

|

|

Number of Business Locations

Change the number of business locations in Michigan. Enter updated number at right.

Change or correct Federal Employer Identification Number. Enter correct FEIN at right. |

Correct FEIN |

|

NOTE: IRS written verification is required to change account numbers; include verification with this document.

PART 6: CERTIFICATION — ALL FIELDS BELOW MUST BE COMPLETED

I declare under penalty of perjury that the information on this form and attachments is true and complete to the best of my knowledge. I understand that by signing this form, I am certifying that I am authorized to make these changes on behalf of the business.

Taxpayer Name (required)

Taxpayer Title (required)

Taxpayer Signature (required)

Date (mm/dd/yyyy)

•Attach to this form additional information and any relevant documentation explaining other changes (e.g. mergers and name changes) to your business. If this business was changed to a different ownership (LLC, Limited Partnership, Sole Proprietor, Corporation, or

Partnership) you must complete a new Registration for Michigan Taxes (Form 518), available at www.michigan.gov/taxes.

•To add or remove Owners, Officers, Partners or Representatives for the business, go to mto.treasury.michigan.gov.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | Used for notifying the Michigan Department of Treasury about changes or discontinuance of a business. |

| Electronic Submission Option | Changes can also be made online at mto.treasury.michigan.gov. |

| Mandatory Information | Business Name and Account Number (FEIN or TR No.) are required fields. |

| Business Address/Name Changes | Allows for updating new business name, legal, and mailing addresses. |

| Business Sale or Closure | Provides options to indicate the sale or closure of the whole business or part of it, including effective dates. |

| Tax Type Adjustments | Section detailed for adding or deleting specific tax types associated with the business registration. |

| Governing Law | Guided by Michigan state laws for business registration and discontinuance processes. |

Guidelines on Utilizing Mi 163

Filling out the Michigan Department of Treasury 163 form is a necessary step when there are changes to be made regarding a business, such as discontinuance, changes in business name, address, or ownership, as well as updates to tax type information. It's a straightforward process, intended to keep the state informed and your business in compliance with local regulations. Once completed, this document ensures that your business records with the Michigan Department of Treasury are up to date, which is crucial for maintaining proper tax filings and organizational records. Here, we break down the process into manageable steps to guide you through filling out the form accurately.

- Part 1: Business Information: Enter the full business name as currently registered. Provide the Account Number, which could be the Federal Employer Identification Number (FEIN) or Treasury Registration (TR) Number, and the business phone number.

- Part 2: Business Name/Address Changes: Check the appropriate boxes that apply to your situation (e.g., New Business Name, New Legal Address). Fill in the fields with the new information as applicable.

- Part 3: Business Sale or Closure: Indicate if the business has been sold or closed. Specify the effective date of discontinuance, partial sale, or complete sale. If the business was sold, provide the buyer’s name, FEIN (if known), and address (if known).

- Part 4: Adding or Deleting a Tax Type: If adjusting the types of taxes your business is registered for, complete this section by checking off "ADD" or "DEL" next to the appropriate tax types. Some changes may require contacting specific departments or completing additional forms as noted.

- Part 5: Other Business Changes or Information: Check any boxes that apply for other changes, like changing to a seasonal business operation, updating the NAICS code, adjusting the number of business locations, or correcting the FEIN. Provide the necessary details for each change.

- Part 6: Certification: The taxpayer must declare that the information provided is accurate. Include the name and title of the taxpayer, sign the form, and date it to validate the information provided.

- Finally, attach any additional documentation that supports or explains the changes reported on this form, such as IRS verification for a FEIN change or documentation related to a sale of the business.

After completing the form and attaching any relevant documentation, mail it to the Michigan Department of Treasury at the address provided on the form. This action not only updates your business’s records with the state but also ensures compliance with Michigan’s tax and regulatory requirements. Keeping this information current is essential for a smooth operation and avoiding potential legal or financial issues down the line.

Crucial Points on This Form

What is the purpose of the MI-163 form?

The MI-163 form, also known as the Notice of Change or Discontinuance, is a critical document for businesses in Michigan. It serves as an official notification to the Michigan Department of Treasury about significant changes to a business. This could include discontinuing operations, changing the business name or address, transferring ownership, adjusting tax types, or updating seasonal business information. Completing this form ensures that the state's records accurately reflect the current status and details of the business, which is essential for compliance and communication purposes.

How to file the MI-163 form?

Filing the MI-163 form can be done electronically or by mail. For electronic submissions, businesses can go to the Michigan Treasury Online (MTO) website at mto.treasury.michigan.gov and follow the prompts for updating business information. If choosing to mail the form, it should be completed in full, signed, and sent to the Michigan Department of Treasury, Registration Section, PO Box 30778, Lansing, MI 48909. Remember to include any relevant documentation or additional information if your business has undergone complex changes such as mergers or ownership shifts.

When should the MI-163 form be submitted?

The MI-163 form should be submitted promptly after any changes occur within your business. Whether it's a discontinuance of the business, a change in business name or address, a sale, or an adjustment in tax types, timely submission is crucial. For discontinuing businesses, it's particularly important to file all final tax returns for the year of discontinuance without delay. Failing to provide timely notification can result in outdated records, miscommunication, and potential penalties.

What information must be included in the MI-163 form?

Completing the MI-163 form requires various pieces of information, depending on the nature of the change. Key details include:

- Business name and account number (FEIN or TR No.)

- Contact information

- Details of name or address changes

- Effective date and specific details on business sale or closure

- Changes in tax types being added or deleted

- Updates to seasonal business operations, NAICS code, number of Michigan locations, or correction of FEIN

Make sure all sections that apply to your situation are completed accurately to provide a clear record of the changes.

Are there any special considerations for discontinuing a business or selling it?

Yes, discontinuing or selling a business brings about additional responsibilities. If you're discontinuing your business, ensure all final tax returns are filed for the relevant tax year. In the case of a sale, you'll need to provide the effective date of the sale and the buyer's information. It's also essential to check specific boxes in Part 3 of the form to indicate whether the entire business is being closed or only a portion is being sold. Providing accurate and timely information helps facilitate a smooth transition and ensures compliance with Michigan tax laws.

Common mistakes

Filling out the Michigan Department of Treasury 163 form, known as the Notice of Change or Discontinuance, requires meticulous attention to detail. One common mistake is not completing all the required fields in PART 1: BUSINESS INFORMATION. This section is crucial as it provides the fundamental details about the business. Neglecting to fill in the business phone number or account number can result in the form being processed incorrectly or not at all.

Another error occurs in PART 2: BUSINESS NAME/ADDRESS CHANGES. Specifically, businesses often overlook the necessity of checking the appropriate boxes to indicate the type of change (e.g., new business name, change in business name, new legal/mailing address). Failing to provide clear instructions about the change sought can lead to incorrect updates to business records, complicating future correspondence with the Michigan Department of Treasury.

Incorrectly handling PART 3: BUSINESS SALE OR CLOSURE is another frequent mistake. Business owners sometimes forget to indicate the effective date of discontinuance or sale, leading to confusion about when the change took place. In scenarios involving a discontinuance due to the death of a taxpayer, forgetting to attach a copy of the death certificate can further delay the process.

In PART 4: ADDING OR DELETING A TAX TYPE, a common misstep is not properly indicating which taxes are to be added or deleted from the business registration. This oversight can cause the business to remain liable for taxes it no longer needs to pay or not registered for taxes it is legally obliged to collect and remit, potentially leading to legal complications and fines.

Another area prone to errors is PART 5: OTHER BUSINESS CHANGES OR INFORMATION. Businesses occasionally miss the opportunity to update their NAICS code or the number of business locations, which are important for accurate tax categorization and assessments. Moreover, failing to correct or update the Federal Employer Identification Number (FEIN) with the necessary IRS written verification can result in significant administrative headaches.

The certification section, PART 6, is also a critical part of the form where mistakes can occur. Signatures are sometimes omitted by the authorized individual, rendering the form incomplete and delaying the update process. Ensuring that the taxpayer's name, title, and signature are correctly entered and dated is crucial for the form's validity. Remember, this section is a declaration of the truthfulness and completeness of the information provided, and overlooking this final step can invalidate the entire submission.

Documents used along the form

When businesses undergo changes such as discontinuation, sale, or adjustments in their operational or legal structure, the Michigan Department of Treasury's Form MI-163, Notice of Change or Discontinuance, plays a crucial role. However, this form often accompanies several other documents to ensure a comprehensive update of the business's status with the state. Below are some of the commonly associated forms and documents, each serving a specific need in the process of reflecting a business's current situation accurately.

- Form 518 – Application for Registration: Businesses looking to add Payroll/Pension Withholding Tax to their registration or to register a new or changed business with the Michigan Department of Treasury must complete this form. It's essential for businesses that are restructuring or expanding their tax obligations.

- Death Certificate: In cases where a business discontinuation occurs due to the death of the owner, a copy of the death certificate is required. This document signifies the reason behind the discontinuation and facilitates the necessary transitions in ownership or closure procedures.

- IRS Verification for FEIN Change: When a business changes its Federal Employer Identification Number (FEIN), IRS written verification is needed alongside the MI-163 form. It is crucial for updating tax records and ensuring that all future correspondences and obligations are accurately tracked.

- Business Sale Agreement: If a business is sold, either partially or entirely, the agreement or contract detailing the sale's terms, conditions, and the parties involved must be provided. This document outlines the transaction's specifics, enabling proper recording and transition of tax obligations to the new owner(s).

- Seasonal Business Documentation: For businesses changing their status to or from seasonal operations, documents specifying the open and close dates, as well as any changes to operations that affect their tax liabilities, are necessary. This ensures accurate tax collection and compliance with state laws regarding seasonal businesses.

Together, these forms and documents complement the MI-163 form, enabling businesses to inform the Michigan Department of Treasury about significant changes comprehensively. Ensuring that all relevant paperwork is accurately completed and submitted is imperative for compliance, avoiding penalties, and maintaining a clear record with the state's tax authorities.

Similar forms

The Michigan Department of Treasury 163 form, designed for reporting changes or discontinuance of a business, bears similarities to a variety of other documents needed for business transitions and updates. These documents, essential for maintaining accurate records and legal compliance, include:

- Business Registration Forms: Similar to the MI 163 form, these forms are used when starting a business. They often require detailed business information, much like the Business Information section of the MI 163 form.

- Change of Address Forms: These forms, used by individuals and businesses to report a change of address, resemble the section of the MI 163 form dedicated to updating a business’s legal and mailing addresses.

- Business Closure Forms: These documents, necessary for officially closing a business, are akin to the Business Sale or Closure segment of the MI 163 form, as both require information regarding the cessation of business operations.

- Tax Status Update Forms: These are used when there are changes in the business that affect its tax obligations, mirroring the part of the MI 163 form where specific taxes can be added or deleted, depending on the business’s current requirements.

- NAICS Code Update Requests: Just like the section in the MI 163 form that allows for the addition or updating of a business’s NAICS code, these requests are crucial for ensuring that a business is categorized correctly under the North American Industry Classification System.

- Seasonal Operation Notices: Similar to the MI 163’s provision for changing a business's status to a seasonal operation, these notices inform governmental agencies about the specific operating seasons of a business.

- Ownership or Representative Update Documents: Much like the indirect reference in the MI 163 form to update business registration for changes in ownership or representation, these documents are necessary when there is a change in the owners, officers, partners, or representatives of a business.

Each document, including the MI 163 form, plays a pivotal role in the life cycle of a business, ensuring that it remains compliant with state laws and regulations. Proper filing of these documents reflects the current standing and operational status of the business, maintaining transparency with regulatory entities.

Dos and Don'ts

When dealing with the Michigan Department of Treasury Form 163, accurately submitting the necessary information regarding changes or discontinuance of your business is crucial. Here are some guidelines to help you complete this form correctly and efficiently:

Do:

Review the entire form before beginning to ensure you understand all the requirements.

Complete all sections that apply to your specific situation, whether it involves a change in business details or discontinuance.

Use the electronic submission option at mto.treasury.michigan.gov for a more streamlined process, if possible.

Provide accurate and current business information, including the new legal and mailing addresses if they have changed.

Indicate the effective date of discontinuance or sale of the business clearly, to avoid any confusion.

Sign and date the form, as it's mandatory for processing. Without your signature, the form may be returned, causing delays.

Attach any required documentation, such as a death certificate if discontinuing a business on behalf of a deceased taxpayer or IRS verification for FEIN changes.

Double-check that all information provided is correct and complete to the best of your knowledge.

Ensure that you are authorized to make the changes on behalf of the business. Unauthorized changes could lead to legal complications.

Mail the completed form to the provided address of the Michigan Department of Treasury promptly to avoid any delays in processing.

Don't:

Leave any applicable sections incomplete. Failing to provide all necessary information can lead to processing delays or the form being returned.

Overlook the importance of providing the new business name or address, if applicable, which is crucial for accurate records.

Forget to sign and date the form, as this is a common mistake that could invalidate your submission.

Ignore the need for attaching required documents, such as death certificates or IRS verification for changes to FEIN.

Submit the form without double-checking all entries for accuracy. Mistakes can lead to further complications and delay the processing time.

Assume you don't need to notify the Michigan Department of Treasury if you're only making minor changes. All changes should be reported.

Use outdated forms or information. Always ensure you have the latest version of Form 163 and the most current information.

Underestimate the importance of updating all changes, no matter how small they may seem. Even minor updates can have significant legal implications.

Presume the changes take effect immediately upon submission. Processing times can vary, and official records may not reflect changes instantly.

Disregard the option to complete changes electronically, which can be a faster and more secure method.

Misconceptions

When dealing with the Michigan Department of Treasury's MI-163 form, Notice of Change or Discontinuance, there are several misconceptions that can complicate the filing process. It's important to clear these up to ensure smooth and compliant business operations.

Misconception 1: The Form is Only for Closing Businesses. Many assume the MI-163 form is solely for those looking to close their business. However, it must also be used for any changes, such as updates to business name, address, or ownership structure.

Misconception 2: Electronic Filing Isn't an Option. Contrary to what some believe, changes reported on this form can also be completed online through the Michigan Treasury Online (MTO) portal, providing a quicker and more efficient filing option.

Misconception 3: All Tax Types Cease Upon Business Discontinuance. Marking your business as discontinued does not automatically end all Michigan tax responsibilities. Specific taxes such as IFTA, Motor Fuel, and Tobacco Tax require separate discontinuation processes.

Misconception 4: Immediate Processing of Changes. Submitting the form doesn't mean changes are effective immediately. Processing times may vary, affecting when changes are officially recognized by the Michigan Department of Treasury.

Misconception 5: A Copy of the Death Certificate is Always Required. A death certificate is necessary only if discontinuing a business on behalf of a deceased taxpayer. For standard business changes or discontinuances, this document is not required.

Misconception 6: Part 4 is for Closed Businesses. This section is actually for businesses that remain operational but need to add or delete specific tax types from their Michigan business registration, not businesses that are closing.

Misconception 7: IRS Verification Isn’t Needed for FEIN Changes. If correcting a Federal Employer Identification Number (FEIN), IRS written verification is required. This ensures accuracy and compliance with both state and federal records.

Understanding these nuances ensures that your filings are accurate and compliant, avoiding potential penalties and facilitating a smoother operation of your business affairs in Michigan.

Key takeaways

When engaging with the Michigan Department of Treasury regarding changes in your business operations, the MI 163 form plays a crucial role. Here are five key takeaways to understand when filling out and using this form:

- The MI 163 form is designed exclusively for businesses that have either discontinued operations or undergone significant changes. It is pivotal to complete all relevant sections to ensure the state has the most current information.

- Businesses can opt to submit changes electronically, a convenience that streamlines the process and may expedite the state's update of your business records. Electing to use the electronic submission portal at mto.treasury.michigan.gov can save time and reduce paperwork.

- For those discontinuing their business, it's important to provide an effective date of discontinuance and ensure that all final tax returns for the business are filed in a timely manner. This is crucial for meeting state requirements and avoiding potential penalties.

- If a business sale occurs — whether partial or complete — details about the buyer, such as their name and, if known, their Federal Employer Identification Number (FEIN) and address must be included. This clear transfer of information assists in the smooth transition of tax liabilities and records.

- Any changes to tax types associated with the business require specific details, including the effective date of such changes. Whether adding or deleting tax types from the business registration, this section must accurately reflect current tax obligations or exemptions.

In addition to these specifics, businesses contemplating a change to their structure (for example, transitioning to a different ownership model or altering the entity type) are required to file a new Registration for Michigan Taxes (Form 518). Moreover, updates or corrections to the business's Federal Employer Identification Number require IRS written verification. Including this verification with the MI 163 form submission is essential for making any adjustments to account numbers.

Lastly, completing the certification section is mandatory. By signing, the individual affirms under penalty of perjury that the information provided is accurate and truthful. This certification also confirms the individual's authorization to make declarations on behalf of the business, highlighting the form's role in ensuring both accountability and transparency in business changes reported to the Michigan Department of Treasury.

Popular PDF Templates

Board of Law Examiners - Form F 6 is crucial for Michigan businesses needing reliable workers’ compensation insurance from the state’s Placement Facility.

Michigan Workers Independent Contractor Worksheet - A comprehensive approach to better define and understand the nature of independent contracting in Michigan.

How to Fill Out Hipaa Form - Acts as a legal permission slip for healthcare providers to release records without violating HIPAA.