Mi 1040X 12 PDF Form

The MI-1040X-12 form is a crucial document for residents and tax filers within the state of Michigan who need to amend previously filed income tax returns. Issued by the Michigan Department of Treasury, this form allows individuals to make necessary corrections to income, deductions, exemptions, and credits that were either incorrectly reported or overlooked in the original submission. It's pertinent for the years 2012 and 2013 due to legislative authority under Public Act 281 of 1967, which underscores the state's ongoing commitment to ensuring taxpayers can rectify their filings with accuracy and ease. Errors or changes in personal information, income brackets, nonrefundable and refundable credits, or filing status from single to married, or vice versa, are just some of the adjustments that can be addressed using this form. Additionally, explanations for changes in dependency and detailed instructions for calculating adjustments to taxable income and tax owed or refunds due are provided to guide filers through the amendment process. Taxpayers are reminded of the importance of attaching all supporting documentation and schedules to avoid delays in processing. The form, alongside comprehensive instructions, underscores Michigan's efforts to streamline tax rectification processes, ensuring individuals have the means to comply with state tax laws while securing their financial responsibilities accurately.

Preview - Mi 1040X 12 Form

Michigan Department of Treasury (Rev.

MICHIGAN Amended Income Tax Return

Issued under authority of Public Act 281 of 1967. Type or print in blue or black ink.

NOTE: If you are amending for tax year 2011 or prior, you must use Form

1.ENTER TAX YEAR you are amending (YYYY)

2. Filer’s First Name |

M.I. |

Last Name |

3. |

Filer’s Social Security No. (Example: |

|||||

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

If a Joint Return, Spouse’s First Name |

M.I. |

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

4. |

Spouse’s Social Security No. (Example: |

|||||

Home Address (Number, Street, or P.O. Box) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City or Town |

|

|

State |

|

|

ZIP Code |

|||

|

|

|

|

|

|

|

|

|

|

FILING STATUS

5.On Original Return

6.On This Return

Single |

Married - |

Married - |

||||||

Filing Jointly Filing Separately * |

||||||||

|

|

|||||||

|

|

|

|

..................... |

|

|

* If married, iling separately, enter Spouse’s full name: |

|

|

................ |

|

|

|

||||

................

.....................

.....................

INCOME, ADDITIONS AND DEDUCTIONS |

|

A. On Original Return |

B. Net Change |

C. Correct Amount |

|||

7. |

Adjusted gross income. Explain changes on line 39 |

7. |

|

|

|

|

|

8. |

Additions to adjusted gross income |

8. |

|

|

|

|

|

9. |

Total income. Add lines 7 and 8 |

9. |

|

|

|

|

|

10. |

Subtractions from adjusted gross income |

10. |

|

|

|

|

|

11. |

Balance. Subtract line 10 from line 9 |

11. |

|

|

|

|

|

12. |

Multiply number of exemptions by applicable amount (see instructions)... |

12. |

|

|

|

|

|

13. |

Taxable income. Subtract line 12 from line 11 |

13. |

|

|

|

|

|

14. |

Tax. Multiply line 13 by tax rate (see instructions) |

14. |

|

|

|

|

|

NONREFUNDABLE CREDITS |

|

|

|

|

|

|

|

15. |

Credit for Income Tax Imposed by Government Units Outside Michigan |

15. |

|

|

|

|

|

16. |

Historic Preservation Tax Credit (nonrefundable, attach Form 3581).. |

16. |

|

|

|

|

|

17. |

Small Business Investment Tax Credit (attach applicable certiicate) |

17. |

|

|

|

|

|

18. |

Total nonrefundable credits. Add lines 15 through 17 |

18. |

|

|

|

|

|

19. |

Subtract line 18 from line 14. If line 18 is more than line 14, enter “0” |

19. |

|

|

|

|

|

20. |

Voluntary Contributions (see instructions) |

20. |

|

|

|

|

|

21. |

Use tax due (see instructions) |

21. |

|

|

|

|

|

22. |

Add lines 19, 20 and 21 |

22. |

|

|

|

|

|

REFUNDABLE CREDITS AND PAYMENTS |

|

|

|

|

|

|

|

23. |

Property Tax Credit (attach |

23. |

|

|

|

|

|

24. |

Farmland Preservation Credit (attach |

24. |

|

|

|

|

|

25. |

Michigan Earned Income Tax Credit (attach copy of federal return) ... |

25. |

|

|

|

|

|

26. |

Historic Preservation Tax Credit (refundable, attach Form 3581) |

26. |

|

|

|

|

|

27. |

Michigan tax withheld (attach Schedule W) |

27. |

|

|

|

|

|

28. |

Estimated tax, extension payments and credit forward |

28. |

|

|

|

|

|

29. |

Amount paid with original return, plus additional tax paid after iling (do not include interest or penalty) ... |

29. |

|

00 |

|||

30. |

Total refundable credits and payments. Add lines 23 through 29 of column C |

|

30. |

|

00 |

||

REFUND OR BALANCE DUE

31. |

Overpayment, if any, on original return (see instructions) |

31. |

||||

32. |

Subtract line 31 from line 30 (if negative, see instructions.) |

32. |

||||

33. |

If line 22, column C, is greater than line 32, enter BALANCE DUE |

|

|

|||

|

Include interest |

|

and penalty |

|

.......(if applicable, see instructions) |

33. |

00

00

00

34. If line 22, column C, is less than line 32, enter REFUND to be received |

34. |

00

+ 0000 2013 10 01 27 2 |

Continue on page 2. This form cannot be |

processed if page 2 is not completed and attached. |

Filer’s Social Security No.

|

|

|

|

|

|

|

|

|

|

*Enter dates of Michigan residency for tax year being amended. |

|||||||||||

RESIDENCY STATUS |

Resident |

Nonresident |

Enter dates as |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

35. On Original Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

......................... |

|

............................. |

|

................... FROM |

|

|

|

|

TO |

||||||||||

36. On This Return ...............

.........................

.............................

................... FROM

TO

EXEMPTIONS

37. Complete only if changing the number of exemptions. Enter a number for all that apply in the appropriate box (see instructions).

Enter the number of exemptions claimed: |

On Your Original Return |

|

On This Return |

|||

a. |

Number of federal exemptions |

a. |

|

...................................... |

a. |

|

b. |

Deaf, blind or disabled * |

b. |

|

...................................... |

b. |

|

c. |

. ......................Number of qualiied disabled veterans |

c. |

|

...................................... |

c. |

|

*Applies to people who are hemiplegic, paraplegic, quadriplegic or classiied as totally and permanently disabled under Social Security guidelines.

38.List below all your dependents and answer all questions for each dependent

A |

B |

C |

D |

E |

F |

G |

H |

|

|

|

|

|

|

Did the |

Was this |

|

|

|

|

Did the dependent |

Did you provide |

dependent live |

dependent |

|

|

|

|

ile a federal return |

more than half the |

with you more |

claimed on |

|

|

|

|

and claim exemption |

dependent’s |

than 6 months |

your original |

Name |

Social Security Number |

Relationship |

Age |

for self? |

support? |

during the year? |

return? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPLANATION OF CHANGES

39.Explain change in number of dependents and changes to income, deductions and credits. Show computations in detail and attach applicable schedules and supporting documentation if necessary.

Taxpayer Certiication. I declare under penalty of perjury that the information in this |

Preparer Certiication. I declare under penalty of perjury that |

|||

return and attachments is true and complete to the best of my knowledge. |

|

this return is based on all information of which I have any knowledge. |

||

|

|

|

||

Filer’s Signature |

Date |

Preparer’s PTIN, FEIN or SSN |

||

|

|

|

|

|

|

|

|

|

Preparer’s Business Name (print or type) |

|

|

|

||

Spouse’s Signature |

Date |

|

||

|

|

|

|

|

|

|

|

|

Preparer’s Business Address (print or type) |

|

|

|

|

|

|

|

By checking this box, I authorize Treasury to discuss my return with my |

|

|

|

|

|

||

|

|

preparer. |

|

|

|

|

|

|

|

|

|

|

|

|

Refund, credit, or zero returns. Mail your return to: Michigan Department of Treasury, Lansing, MI 48956

Pay amount on line 33. Mail your check and return to: Michigan Department of Treasury, Lansing, MI 48929

Make your check payable to “State of Michigan.” Print your Social Security number, the tax year you are amending and

on the front of your check. If paying on behalf of another taxpayer, write the taxpayer’s name and Social Security number on the check. Do not staple your check to the return. Keep a copy of your return and all supporting schedules for six years from the date iled or the due date,

whichever is later.

+ 0000 2013 10 02 27 0

Instructions for Form

Amended Michigan Income Tax Return

General Instructions

Use this form to correct income tax returns, credit claims and

schedules for tax year 2012 or 2013. If you are amending for tax year 2011 or prior, you must use form

To Amend Credit Claims

If amending any of the following credit claims, ile Form

MI‑1040X‑12 and attach the document indicated:

•Michigan Historic Preservation Tax Credit (Attach a corrected Form 3581.)

•Small Business Investment Tax Credit (Attach a Michigan

Strategic Fund certiicate.)

If you are amending the following credits and have no

adjustments to Form

corrected credit form and do not ile Form

•Farmland Preservation Tax Credit Claim

(Attach a corrected

•Michigan Homestead Property Tax Credit Claim

•Michigan Homestead Property Tax Credit Claim for Veterans and Blind People

Important note for Michigan Home Heating Credit Claim

the top. An amended claim requesting an additional refund will

not be accepted after September 30 following the year of the

claim.

To Amend Schedules

To avoid processing delays, if the change on your income tax return is the result of a change to a schedule, attach a copy of the corrected schedule to Form

schedules as well as Michigan schedules.

Income and Deductions

If you have questions about what income is taxable or what is deductible, see the instructions for Form

amending. If you need forms or assistance, visit our Web site at

www.michigan.gov/taxes.

When to File

File Form

Interest and Penalty

If your amended return results in tax due, include interest with

your payment. Interest is 1 percent above the prime rate which is adjusted on July 1 and January 1. For information on interest

rates, visit our Web site at www.michigan.gov/taxes. Penalty, if applicable, is 10 percent of the tax due (minimum $10).

Rounding Dollar Amounts

Round down all amounts less than 50 cents. Round up all amounts of 50 through 99 cents. Do not enter cents.

Lines not listed are explained on the form.

Line 1: Enter the tax year you are amending (calendar year or iscal year). Your return cannot be processed without this

information

Lines 7 through 28: Enter an explanation of changes to these lines on line 39. See special instructions for amending use tax on line 21. Attach copies of corrected or new schedules.

Column A: Enter the amounts shown on your original return or as adjusted due to an examination of your original return.

Column C: Report the corrected totals after taking into account

the amounts of the increases or decreases shown in column B.

If there are no changes, enter the amount reported in column A.

Line 7: If you are correcting Adjusted Gross Income (AGI) due to the amount of wages or other employee compensation, attach

Schedule W. If you are correcting AGI based on an amended federal return, provide a copy of the amended federal return and supporting schedules.

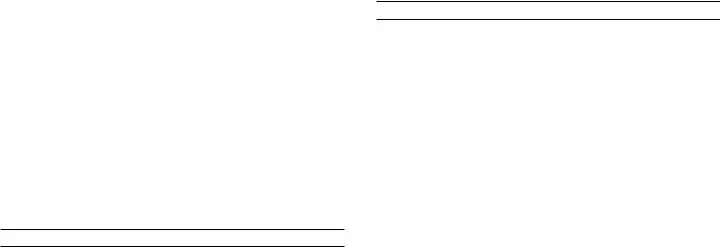

Line 12: Enter the exemption allowance based on the number of exemptions claimed on line 37.

|

Michigan |

Special |

Disabled |

Year |

Personal |

||

Exemption |

Exemptions |

Veteran |

|

2012 |

$ 3,763 |

$ 2,400 |

$ 300 |

2013 |

$ 3,950 |

$ 2,500 |

$ 300 |

Filers who can be claimed as a dependent on someone else’s return follow special rules. Refer to the instructions for tax year

being amended.

Line 14: Your taxable income must be multiplied by the tax rate

in effect for the year you are amending.

Year |

Tax Rate |

2012 |

4.33% |

2013 |

4.25% |

Lines 15 through 17: Enter changes in your nonrefundable

credits. See instructions for the tax year being amended to determine the amount of your credit. Attach a copy of Form 3581

if you are amending or claiming a new Historic Preservation Tax Credit.

Line 20: Amended amounts for voluntary contribution funds or programs will not be accepted.

Line 21: Amended use tax amounts will not be accepted on the

MI‑1040X‑12. To amend your use tax, write a letter to Michigan

Department of Treasury, Business Tax Division, P.O. Box 30427, Lansing, MI 48909.

Lines 23 through 26: Enter changes in your property tax

credit, farmland preservation credit, earned income tax credit, and/or historic preservation tax credit. Attach the appropriate amended claim documentation: Forms

Line 27: Enter the amended tax withheld by your employer. Attach a corrected Schedule W and provide an explanation to support your claim, including the circumstances that

created the corrected Schedule W if it was corrected.

If you are claiming a repayment credit for tax paid on income reported in a previous year, add the amount of the credit to the Michigan tax withheld. Write the words “Claim of Right/ Repayments” next to line 27. Attach a schedule showing the computation of the credit, proof of the repayment, and pages 1 and 2 of your U.S. Form 1040 and Schedule A if applicable.

Line 28: Enter total Michigan estimated tax payments, amounts credited forward from 2011 or 2012, and any payment made with

a request for extension.

Line 29: Enter the amount paid with your original return, and any additional tax paid after you iled your original return. Do not

include interest or penalty payments.

Line 31: Enter the amount of refund you received from your original return. If you received more than one refund from the original return, include the total amount of refunds on this line, also include the amount to be credited to next year. Do not

include interest received on your refunds.

Lines 32 and 33: If line 32 is negative, treat it as a positive amount and add it to the amount on line 22, column C. Enter the

result on line 33. This is the amount you owe. Include interest with your payment. (See “Interest and Penalty” on page 3.) Make your check payable to “State of Michigan” and write

your Social Security number, “2012” or “2013” and the words

Line 34, REFUND: If line 32 is greater than line 22, column C, subtract line 22, column C, from line 32 and enter this amount as your refund.

Exemptions

Line 37: Enter the number of federal exemptions and Michigan special exemptions claimed on your original return and claimed

on this return.

Review the instruction booklet for tax year being amended if you need deinitions or more information.

Complete lines 37 through 39 if you are changing the number of exemptions or exemption allowance you originally claimed. On line 37, enter the number of exemptions you claimed on your original return and the number of exemptions you are claiming

on this amended return.

Deaf, Blind or Disabled: You qualify for the deaf exemption if the primary way you receive messages is through a sense other than hearing, for example: lip reading or sign language. You qualify for the blind or disabled exemption if you are blind, hemiplegic, paraplegic, quadriplegic or totally and permanently disabled. Blind means your better eye permanently has 20/200 vision or less with corrective lenses, or your peripheral ield of vision is 20 degrees or less. Totally and permanently disabled means disabled as deined under Social Security Guidelines 42 USC 416. Individuals 66 or older may not claim an exemption as totally and permanently disabled.

Qualified Disabled Veteran: A taxpayer may claim an exemption in addition to the taxpayer’s other exemptions if

(a)the taxpayer or spouse is a qualiied disabled veteran, or

(b)a dependent of the taxpayer is a qualiied disabled veteran. To be eligible for the additional exemption an individual must be a veteran of the active military, naval, marine, coast guard, or air service who received an honorable or general discharge

and has a disability incurred or aggravated in the line of duty as described in 38 USC 101(16). This additional exemption may

not be claimed on more than one tax return. See the instructions for line 12, page 3.

Line 39: Enter the line reference from page 1 for each line where a change is reported and give a detailed explanation of the reasons for the change. If an explanation is not provided, the processing of your return will be delayed.

When You Are Finished

Refund, Credit or Zero Return. Mail your return to:

Michigan Department of Treasury

Lansing, MI 48956

Pay amount on line 33. Mail your check and return to:

Michigan Department of Treasury

Lansing, MI 48929

Do not staple multiple prior year returns together. However, you can mail multiple prior year returns in the same envelope.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The MI-1040X-12 form is used for amending previously filed Michigan state income tax returns for the tax years 2012 or 2013. It corrects inaccuracies in income, tax credits, or deductions. |

| Authority | Issued under the authority of Public Act 281 of 1967, which governs the process and requirements for amending filed state income tax returns in Michigan. |

| Filing Requirement | Required to be filed only after the original tax return has been processed, and within four years of the due date of the original return to claim a refund. |

| Submission Details | For refunds, credits, or zero returns, mail to: Michigan Department of Treasury, Lansing, MI 48956. If tax is owed, mail payment and return to: Michigan Department of Treasury, Lansing, MI 48929. Payments should be made to "State of Michigan" with specific identification details. |

Guidelines on Utilizing Mi 1040X 12

For individuals needing to amend a previously filed Michigan state income tax return, completing the MI-1040X-12 form accurately is crucial. It's designed to adjust any information originally reported on your Michigan income tax return. Whether correcting income, deductions, or credits, it's important to carefully compile and report all pertinent changes to ensure your tax obligations are accurately met. Here are the steps to guide you through the process of filling out the MI-1040X-12 form.

- Write the tax year you're amending in the space provided at the top of the form.

- Enter your first name, middle initial, and last name in the fields provided. If filing a joint return, also include your spouse's first name, middle initial, and last name.

- Provide your Social Security Number in the designated area. If a joint return, include your spouse's Social Security Number as well.

- Fill in your home address, city or town, state, and ZIP code in the relevant fields.

- For your filing status, check the box on the original return and on this return to indicate your filing status.

- Correct any information or numbers for adjusted gross income, additions to adjusted gross income, total income, subtractions, exemptions, and calculate your taxable income accordingly, using sections A, B, and C.

- Update any nonrefundable credits, voluntary contributions, and use tax due as applicable.

- Amend refundable credits and refund or balance due sections based on the new figures.

- If necessary, update your residency status and exemptions for the tax year being amended on the second page of the form.

- Explain all changes in detail in the "Explanation of Changes" section. Include computations and attach any required supporting documentation or corrected schedules.

- Sign and date the form. If you had a preparer, ensure they also sign and include their PTIN, FEIN, or SSN along with their business name and address.

- Review the "Where to File" section on the form to determine the correct mailing address based on whether you are receiving a refund, credit, zero return, or if you owe an additional balance. Be sure to include the proper postage.

After submitting the MI-1040X-12 form, it's advisable to keep a copy of the amended form and all supporting documents for your records. The Michigan Department of Treasury will process your amended return, which may result in an adjusted refund amount or balance due. Handling taxes with diligence ensures your financial obligations are met accurately, potentially avoiding future complications.

Crucial Points on This Form

What is the MI-1040X-12 form used for?

The MI-1040X-12 form is used to amend previously filed Michigan income tax returns for the 2012 or 2013 tax years. If taxpayers need to correct income, deductions, or credits on their state returns, this form serves that purpose.

When should the MI-1040X-12 form be filed?

File the MI-1040X-12 only after the original return has been processed. If you're claiming a refund, the amended return must be filed within four years from the original due date. For example, for a 2012 return originally due on April 15, 2013, the MI-1040X-12 should be postmarked by April 17, 2017, to claim a refund.

How is income and deductions reported on the MI-1040X-12?

When reporting changes to income and deductions on the MI-1040X-12:

- Column A should reflect amounts from the original or adjusted return.

- Column B is for the net change: increases or decreases in income or deductions.

- Column C should show the corrected amounts after adjustments.

What should I do if I need to correct a credit claim?

To correct a credit claim like the Michigan Historic Preservation Tax Credit, attach the corrected Form 3581 with the MI-1040X-12. For certain credits, such as the Farmland Preservation Tax Credit, you may just need to submit the corrected MI-1040CR-5 with a new MI-1040 labeled "Amended" on top, without needing to file an MI-1040X-12.

How do I calculate the interest and penalty if I owe additional tax?

If the amended return results in tax due, calculate interest at 1 percent above the prime rate, adjusted semi-annually. The penalty is 10 percent of the tax due with a minimum of $10. Attach your calculation and payment for the correct amount owed to ensure accurate processing.

Can I amend my return to claim a refund after the original due date?

Yes, you can amend a return to claim a refund, but it must be done within four years of the original due date. Ensure that you provide a detailed explanation of the reason for the refund and attach all necessary documentation to support your claim.

What documents are needed to amend exemptions or dependents on the MI-1040X-12?

When changing the number of exemptions or dependents, complete lines 37-39 on the form and:

- Provide the number of exemptions claimed on the original and amended returns.

- Attach documents or schedules supporting the change, such as proof of a new dependent.

- For changes due to disability status, blind, deaf, or qualified disabled veteran exemptions, include documentation verifying the condition or status.

Common mistakes

When filling out the Michigan Amended Income Tax Return (MI-1040X-12), there are common mistakes that people often make. These mistakes can cause delays in processing and affect the accuracy of the tax return. Here's a friendly guide to help avoid these errors:

Firstly, a frequent mistake is not clearly entering the tax year being amended. This simple oversight can significantly delay processing. Ensuring the correct tax year is entered in the designated field at the top of the form is crucial.

Another common error involves the filer’s Social Security Number and, if applicable, their spouse's. These numbers must be accurately provided as they are essential for the Michigan Department of Treasury to identify the taxpayer's records.

Incorrectly updating filing status changes between the original and amended returns also leads to complications. It’s important to review the filing status on the original return and carefully select the correct status on the amended return if there have been any changes.

When it comes to income, additions, and deductions, failing to explain the net changes thoroughly is a mistake to avoid. Taxpayers should carefully detail the reason for each modification on line 39, ensuring all computations are shown and necessary documentation attached.

Another oversight involves exemptions. If there are changes to the number of exemptions being claimed, it is essential to accurately complete the exemptions section and provide a full explanation alongside any supporting documents.

Many forget to attach a corrected Schedule W if there are adjustments to income or tax withholding. This oversight can result in inaccurate tax calculations and potential delays in processing the amended return.

One of the more technical errors includes incorrectly calculating the taxable income, tax, or credits. Utilizing the correct tax rate for the year being amended and accurately applying any credits or deductions ensures the amendment is precise.

Failure to sign the amended return is another simple yet common mistake. Both the taxpayer and their spouse, if filing jointly, need to sign and date the form to validate it. An unsigned return will not be processed.

Last but certainly not least, some taxpayers mistakenly delay sending their amended return because they are unsure if it’s necessary. If there have been any errors or changes that affect tax calculations, it’s always best to file an amended return. Ensuring it is sent to the correct address based on whether there is a payment to be made or a refund expected is also vital.

By paying attention to these details, taxpayers can successfully amend their returns while minimizing errors and delays.

Documents used along the form

When filing an amended Michigan income tax return using form MI-1040X-12, individuals may often need additional forms and documents to complete their submission. These forms and documents support the changes made on the amended return, ensuring accuracy and compliance with tax regulations.

- MI-1040CR: This form, known as the Michigan Homestead Property Tax Credit Claim, is used by taxpayers seeking a credit for property taxes paid on their homestead. If adjustments to property tax credits are part of the amendment, including an updated MI-1040CR is necessary.

- MI-1040CR-2: Similar to the MI-1040CR, this form is designed for veterans and blind individuals claiming a homestead property tax credit. Adjustments to tax credits for these groups require inclusion of an updated MI-1040CR-2.

- MI-1040CR-5: This form is for claiming the Farmland Preservation Tax Credit. If your amended return involves changes to credits received under this program, attaching a new or corrected MI-1040CR-5 is needed.

- Form 3581: For those claiming Michigan Historic Preservation Tax Credits, whether nonrefundable or refundable, adjustments to these credits necessitate the inclusion of Form 3581 with the amended return.

- Schedule W: This document provides details on Michigan tax withheld, required when there are corrections to the amount of state tax withheld as reported on your original return. A corrected Schedule W supports any changes made to withheld tax amounts.

Together with the MI-1040X-12, these forms ensure taxpayers can accurately report adjustments to income, tax credits, or deductions initially claimed on their Michigan income tax return. It's important to review each document thoroughly, ensuring all information is correct and complete before submission. This preparation helps in avoiding delays in processing and ensures the amended return reflects the taxpayer's correct tax liability or refund entitlement for the year being amended.

Similar forms

The IRS Form 1040X is the federal counterpart to Michigan's MI-1040X-12, specifically designed for taxpayers needing to amend their federal income tax returns. Similar to the MI-1040X-12, it provides a structured format for reporting original amounts, the changes being made, and the corrected figures. This ensures that taxpayers can clearly communicate updates to their income, deductions, tax credits, and payments to the IRS.

Form 540X, Amended Individual Income Tax Return for California, shares its purpose with the MI-1040X-12, being the designated form for residents to amend their state income tax return. Like the MI-1040X-12, Form 540X requires filers to detail changes to income, deductions, tax liabilities, and credits, and provides spaces for explaining the reasons for such amendments, helping ensure accuracy and compliance.

The New York Form IT-201-X, Amended Resident Income Tax Return, serves the same purpose for New York State residents, allowing them to amend previous returns. Similar to Michigan’s form, it requires detailed explanations of income adjustments, deductions, and credit modifications, reflecting the necessary transparency and accuracy in state tax adjustments.

Form IL-1040-X, Amended Individual Income Tax Return for the state of Illinois, is used by Illinois taxpayers aiming to correct previously filed state income tax returns. It parallels the MI-1040X-12 in its structure, enabling taxpayers to outline modifications to income, tax credits, deductions, and payments or refunds due, ensuring adjustments are clearly communicated and processed efficiently.

Form PA-40X, Amended PA Personal Income Tax Schedule, allows Pennsylvania residents to correct or amend previous state income tax returns, akin to Michigan’s MI-1040X-12. Both forms facilitate adjustments to income, tax calculations, credits, and deductions with sections designated for detailed explanations of each change, ensuring the state tax authorities have accurate, updated information.

Dos and Don'ts

When preparing to amend your Michigan income tax return using the MI-1040X-12 form, paying attention to detail is critical. To ensure you complete the form correctly and optimize your submitted amendment, here are some essential do's and don'ts:

- Do use blue or black ink when filling out the form to ensure readability.

- Don't use the MI-1040X-12 form if you are amending for tax years before 2011. Use Form MI-1040X for those years instead.

- Do ensure you've filled in the correct tax year you are amending at the very start of the form to avoid any processing delays.

- Don't guess or estimate figures; ensure all numbers reflect the accurate changes, whether it's an increase or decrease from the original submission.

- Do attach all necessary documentation, such as corrected schedules or supporting documents, to substantiate the amendments you're making.

- Don't leave any necessary fields blank. If a section requires your input, especially changes in income, deductions, or credits, fill it out completely.

- Do provide a detailed explanation for the changes you are reporting, including computations, on line 39. This clarity can help process your amendment more swiftly.

- Don't include cents in your monetary amounts. Round down amounts less than 50 cents and round up amounts from 50 to 99 cents.

- Do sign the form at the end. An unsigned form is invalid and will lead to unnecessary processing delays.

Filling out the MI-1040X-12 form carefully and accurately can expedite the amendment process and ensure you pay or receive the correct amount associated with your Michigan income tax return. Always double-check your work for completeness and accuracy before submission.

Misconceptions

There are several misconceptions about the Michigan Amended Income Tax Return MI-1040X-12 form that can lead to confusion. Understanding these misconceptions is crucial for accurately completing and submitting the form. Here are ten common misunderstandings and the truth behind them:

- Misconception: The MI-1040X-12 form can be used for any tax year. Truth: This specific form is designed for amending returns for tax years 2012 and 2013 only. For other years, a different version of the form must be used.

- Misconception: You can file the MI-1040X-12 electronically. Truth: As of the latest information, the MI-1040X-12 must be printed and mailed to the Michigan Department of Treasury. Electronic filing is not an option for amended returns.

- Misconception: Corrections to your refund amount can be directly entered on the form. Truth: The form requires details on the original figures, the net change, and the corrected amounts, leading to the recalculated refund or balance due.

- Misconception: The MI-1040X-12 form is only for correcting mistakes in income reported. Truth: The form is used to correct not just income, but also any part of the tax return including deductions, tax credits, and exemptions.

- Misconception: You need to submit a new form for each mistake on your original return. Truth: You can correct multiple errors on your original tax return using a single MI-1040X-12 form.

- Misconception: You can amend your return at any time using MI-1040X-12. Truth: Amended returns must be filed within four years of the due date of the original return.

- Misconception: If you owe money as a result of the amendment, you can wait for the Michigan Department of Treasury to bill you. Truth: If the amendment results in additional tax owed, you should include the payment with your MI-1040X-12 submission to avoid interest and penalties.

- Misconception: Supporting documentation is not necessary when filing the MI-1040X-12. Truth: Supporting documents and schedules are often required to validate the amendments made on the form.

- Misconception: Filing the MI-1040X-12 automatically extends the due date for your taxes. Truth: Filing an amended return does not grant an extension on paying taxes due. Taxes owed are due by the original filing deadline.

- Misconception: You must amend your federal return if you amend your Michigan return. Truth: While changes to your federal return often necessitate changes to your state return, amending your state return does not always require you to amend your federal return.

Understanding and clarifying these misconceptions ensure the correct use of the MI-1040X-12 form. Always refer to the latest guidelines from the Michigan Department of Treasury when preparing to amend your Michigan tax returns.

Key takeaways

Filling out and using the Michigan Amended Income Tax Return form MI-1040X-12 requires attention to detail and an understanding of your original tax filing. Below are key takeaways to guide you through the process:

- Know the correct form for the tax year: Use MI-1040X-12 for amending returns for the tax year 2012 or 2013. For prior years, a different form is required.

- Tax year specification is crucial: Clearly enter the tax year you're amending on the form, as processing cannot occur without this information.

- Accuracy in recounting original details: Column A requires the amounts from your original return or as adjusted by any previous amendments.

- Explain your changes: Line 39 is your spot to detail the reason for each amendment, including changes in income, deductions, and credits. Attach supporting documentation as needed.

- Amendments to credits: If you're adjusting credits like the Historic Preservation Tax Credit or the Small Business Investment Tax Credit, attach the necessary certificates or forms.

- Amending use tax: Changes to use tax should not be made on this form. Instead, write a letter to the Michigan Department of Treasury.

- Refund, credit, and balance due: Understand how to calculate your refund or balance due, taking into account overpayments and amendments to the credits and payments section.

- Dealing with exemptions: If changing the number of exemptions, fill out the relevant sections and understand the criteria for special exemptions.

- Mailing instructions vary based on payment: Send your completed return to different addresses depending on whether you owe a balance or are expecting a refund, credit, or have a zero return. Separate checks are required for each return when mailing multiple returns for different years.

By following these takeaways, taxpayers can navigate the amendment process with a clearer understanding, ensuring their MI-1040X-12 form is completed accurately and efficiently.

Popular PDF Templates

Death Certificate Records - Clarifies the role of tobacco use in the deceased’s death if it was a contributing factor.

Michigan Real Estate Forms - Applicants must provide their identification details, including names and social security numbers, for processing.

How Much Is a Vehicle Registration Renewal - Outlines a section for trade-in vehicle details, streamlining the process for those utilizing a vehicle trade-in toward the purchase.