2368 Michigan PDF Form

Understanding the intricacies of the Michigan Department of Treasury 2368 form is pivotal for homeowners seeking to take advantage of the Homeowner’s Principal Residence Exemption, a beneficial provision allowing for a reduction in local school operating taxes on their principal dwelling. Instituted under the authority of P.A. 105 of 2003, this affidavit is essential for homeowners to officially declare their property as their principal residence, thus making them eligible for the exemption. It’s crucial to note that the act of filing this form not only claims the exemption but also nullifies any prior exemptions claimed by the homeowner on other properties, ensuring that the exemption is exclusively applied to the current principal residence. The form requires detailed information about the property and its owners, including property tax identification numbers, ownership details, occupancy status, and certifications regarding the accuracy of the provided information. Homeowners are guided through a comprehensive process, from specifying the type of residence to potentially rescinding previous exemption claims should the property’s status as a principal residence change. The deadline for filing is clearly set for May 1st of the claim year, with instructions for submission to the local township or city assessor where the property is situated. By complying with these stipulations, homeowners can navigate the tax landscape more effectively, ensuring they rightfully benefit from available exemptions while adhering to state tax laws.

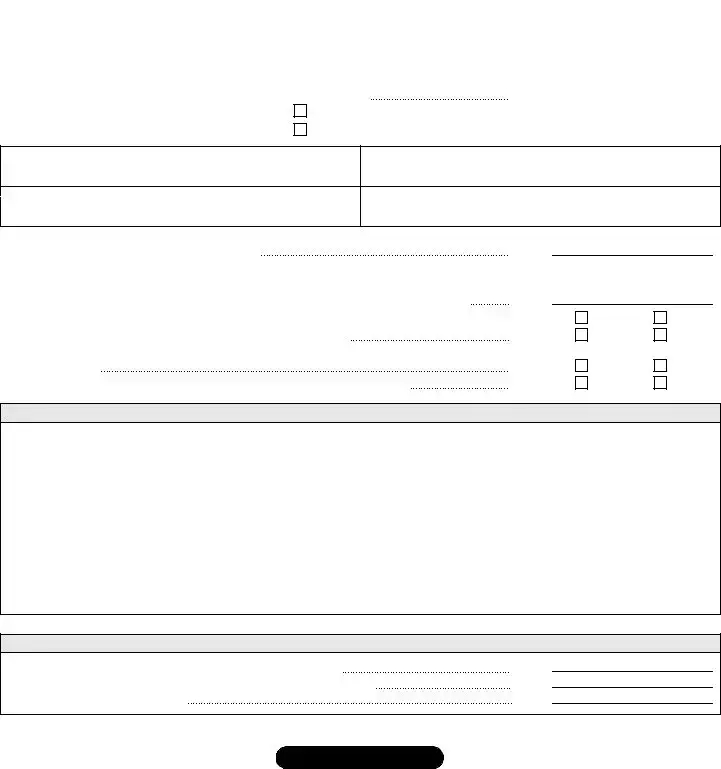

Preview - 2368 Michigan Form

Michigan Department of Treasury 2368 (Rev.

Homeowner's Principal Residence Exemption Affidavit

Issued under authority of P.A. 105 of 2003.

Completion of this affidavit constitutes a claim for a Homeowner’s Principal Residence Exemption when filed with the local assessor of the city or township where the property is located. Filing this affidavit invalidates any previous Homeowner’s Principal Residence Exemption the homeowner may have claimed. A Request to Rescind Homeowner’s Principal Residence Exemption, Form 2602 must be filed with the local assessor for any previous claims.

Print or type in blue or black ink. Use a separate form for each property number.

Property Information |

|

|

|

|

|

|

|

|

|

|

1. |

Property Tax Identification Number |

|

|

|

|

2. ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

||||

3. |

Street Address of Property |

4. Name of Township or City |

5. County |

|

|

|

||||

|

|

|

|

Township |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

6. Date the property in line 1, above, became your principal residence |

6. |

|

|

|

|

|||||

The property in line 1 above is my: |

|

|

6a. |

Principal residence |

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

6b. |

Residential vacant contiguous or adjacent lot |

|

|

|

||

7.Name of Owner (First, Middle, Last)

8.Owner's Social Security Number

9.Name of

10.

11. Property owner's daytime telephone number |

11. |

12.If this parcel has more than one home on it, or if you own and live in one unit of a

(your principal residence) occupies. Your exemption will be based on this percentage |

12. |

|

13. |

Have you claimed a principal residence exemption for another Michigan principal residence? |

13. |

14. |

If yes, have you rescinded that principal residence exemption? |

14. |

15. |

Do you or your spouse claim an exemption, credit or deduction on property located in |

|

|

another state? |

15. |

16. |

Have you or your spouse filed a tax return as a resident of another state? |

16. |

%

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

Certification

I certify under penalty of perjury the information contained on this document is true and correct to the best of my knowledge.

17. |

Owner's Signature |

Date |

17a. |

Date |

|

|

|

|

|

17b. Mailing Address, if Different than Property Address Above |

|

|

|

|

|

|

|

|

|

18. |

Closing Agent or Preparer's Name and Mailing Address |

|

|

|

|

|

|

|

|

Local Government Use Only

19. |

Was an exemption in place prior to this affidavit being filed? |

19. |

20. What is the first year this exemption will be posted to the tax rolls? |

20. |

|

21. |

Indicate property classification |

21. |

www.michigan.gov/treasury

Instructions for Form 2368,

Homeowner’s Principal Residence Exemption Affidavit

General Information

If you own and occupy your principal residence, it may be exempt from a portion of your local school operating taxes. To claim an exemption, complete this affidavit and file it with your township or city by May 1st of the year of the claim. Your local assessor will adjust your taxes on your next property tax bill. Note that this is an exemption from part of the taxes and does not affect your assessment.

Owning means you hold the legal title to the principal residence or that you are currently buying it on a notarized or recorded land contract. Renters should not file this form.

Occupying means this is your principal residence, the place you intend to return to whenever you go away. It is the address that appears on your driver's license or voter registration card. You may have only one principal residence at a time. Vacation homes and income property which you do not occupy as your principal residence, may not be claimed.

Rescinding Your Exemption. If you claim an exemption, then stop using it as a principal residence, you must notify your township or city assessor within 90 days of the change or you may be penalized. This can be done using the Form 2602, Request to Rescind Homeowner's PrincipAL Residence Exemption.

Interest and Penalty. If it is determined that you claimed property that is not your principal residence, you may be subject to the additional tax plus penalty and interest as determined under the Property Tax Act.

Lines not listed here are explained on the form.

Property Information

Line 1. Property is identified with a property tax identification number. This number will be found on your tax bill and on your property tax assessment notice. Enter this number in the space indicated. If you cannot find this number, call your township or city assessor. Submit a separate affi davit for each property being claimed.

Your property number is vital. Without it, your township or city cannot adjust your property taxes accurately.

Lines

Line 6. Your principal residence is the dwelling that you occupy as your permanent home and any vacant adjacent or contiguous properties that are classed residential. Indicate the date this property became your principal residence.

Lines

Note: The request for the Social Security number is authorized under section 42 USC 405 (c) (2) (C) (i). It is used by the Department of Treasury to verify tax exemption claims and to deter fraudulent filings. Any use of the number by closing agents or local units of government is illegal and subject to penalty.

Line 12.

If the parcel of property you are claiming has more than one home on it, you must determine the percentage that you own and occupy as your principal residence. A second residence on the same property (e.g., a mobile home or second house) is not part of your personal residence, even if it is not rented to another person. Your local assessor can tell you the assessed value of each residence to help you determine the percentage that is your personal residence.

If you rent part of your home to another person, you may have to prorate your exemption. If your home is a single- family dwelling and the renters enter through a common door or your living area to get to their rooms, you may claim a 100 percent exemption if less than 50 percent of your home is rented to others who use it as a residence. However, if part of the home was converted to an apartment with a separate entrance, you must calculate the percentage that is your principal residence, by dividing the floor area of your principal residence by the floor area of the entire building.

Lines

Certification

Sign and date the form. Enter your mailing address if it is different from the address at the top of the form.

Mailing Information

Mail your completed form to the township or city assessor in which the property is located. This address may be on your most recent tax bill or assessment notice. Do not send this form directly to the Department of Treasury.

If you have any questions, visit our Web site at www.michigan.gov/treasury or call

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | Issued under authority of P.A. 105 of 2003. |

| Form Purpose | Completion of this affidavit constitutes a claim for a Homeowner's Principal Residence Exemption when filed. |

| Local Filing Requirement | Must be filed with the local assessor of the city or township where the property is located. |

| Invalidation of Previous Claims | Filing this affidavit invalidates any previous Homeowner’s Principal Residence Exemption the homeowner may have claimed. |

| Requirement for Rescinding Exemption | A Request to Rescind Homeowner’s Principal Residence Exemption, Form 2602, must be filed for any previous claims. |

| Ink Requirement | Must be filled out in blue or black ink. |

| Separate Forms for Multiple Properties | Use a separate form for each property number. |

Guidelines on Utilizing 2368 Michigan

Filling out the 2368 Michigan form is essential for homeowners seeking a Principal Residence Exemption, which may provide relief from a portion of local school operating taxes. This process involves accurately providing property and personal information, then submitting the affidavit to the local assessor. The following steps guide you through filling out the form correctly to ensure timely processing and to avoid common mistakes that could delay or invalidate your claim.

- Find your Property Tax Identification Number: This number is crucial and can be found on your tax bill or property tax assessment notice. Enter it in the designated space on the form.

- Fill in Property Information: Enter the complete address of the property you are claiming, including ZIP code. Indicate whether the property is in a city or township. If located in a village, specify the township where the principal residence is located.

- Specify the Use of the Property: Indicate the date the property became your principal residence. Also, specify if the property includes a residential vacant contiguous or adjacent lot.

- Owner Information: Provide the name(s), Social Security Number(s), and daytime telephone number of the legal owner(s). Only include co-owners if they occupy the principal residence.

- Determine Exemption Percentage for Multiple-Unit or Multi-Purpose Properties: If your property falls into this category, you need to calculate and enter the portion of the property used as your principal residence.

- Disclosure of Other Exemptions: Answer questions regarding any other Michigan principal residence exemption claims, including whether any previous claims have been rescinded. Also disclose if you or your spouse claim any property tax exemption, credit, or deduction in another state, or have filed a tax return as a resident in another state.

- Sign and Date the Form: Both the owner and co-owner (if applicable) must sign and date the form. Ensure your mailing address is correct, especially if it differs from the property address.

- Contact Details for Closing Agent or Preparer: If a closing agent or another individual prepared this form, include their name and mailing address.

- Submit the Form: Mail the completed affidavit to the township or city assessor where the property is located. Use the address from your most recent tax bill or assessment notice. Do not send the form directly to the Department of Treasury.

After submitting the form, your local assessor will review the affidavit and apply the exemption to your next property tax bill, if eligible. Remember, claiming this exemption is an affirmation that the property is your principal residence. Misrepresentation can lead to penalties, including additional taxes, penalty, and interest charges. Keep a copy of the submitted form for your records and follow up with the local assessor's office if you do not receive confirmation of your exemption status within a reasonable time frame.

Crucial Points on This Form

What is the purpose of the Michigan Department of Treasury 2368 form?

The Michigan Department of Treasury 2368 form, also known as the Homeowner's Principal Residence Exemption Affidavit, is designed to allow homeowners to claim a tax exemption for their principal residence. This exemption applies to a portion of the local school operating taxes. By submitting this affidavit, homeowners assert that the property listed is their primary residence, where they intend to return to when away. It is critical to note that filing this affidavit invalidates any previous Homeowner's Principal Residence Exemption claims on other properties.

Who needs to complete the 2368 form?

Property owners who own and occupy their home as their principal residence need to complete the form. This includes individuals holding legal title or those currently purchasing the home under a notarized or recorded land contract. The property must be the homeowner's primary place of residence and cannot be a rental property or a vacation home that is not occupied as the primary residence. Co-owners who do not reside at the property should not be included in the filing.

How and when should the 2368 form be filed?

Homeowners should complete the 2368 form with accurate property and owner information, and then mail it to the local assessor's office of the city or township where the property is located. This form needs to be filed by May 1st of the year in which the homeowner wishes to claim the exemption. For precise mailing addresses, homeowners are advised to refer to their most recent tax bill or assessment notice. It is recommended to keep a copy of the filed form for personal records.

What are the consequences of not properly claiming or rescinding the exemption?

Failure to properly claim the Principal Residence Exemption can result in the homeowner paying higher taxes than necessary, as they miss out on the exemption benefits. On the other hand, if a homeowner previously claimed the exemption but their property is no longer their principal residence, they must rescind the exemption using Form 2602. Failure to notify the township or city assessor within 90 days of the change in principal residence status could result in penalties. Furthermore, if a homeowner improperly claims a property as their principal residence, they could face additional tax liability along with penalties and interest charges as determined under the Property Tax Act.

Common mistakes

Filling out the Michigan Department of Treasury 2368 form requires careful attention to detail, but mistakes can easily occur. One common error is the incorrect entry of the Property Tax Identification Number in line 1. This unique number is crucial for the accurate processing of the form. It identifies the specific property for which the homeowner is seeking a Principal Residence Exemption. Failure to provide the correct Property Tax Identification Number may result in the failure to receive the exemption, leading to unnecessary payment of school operating taxes that could have been exempt.

Another frequent oversight is neglecting to rescind previous Homeowner's Principal Residence Exemptions by not filing a Request to Rescind Homeowner’s Principal Residence Exemption, Form 2602, as indicated in the instructions. When homeowners move and claim a new principal residence, they must inform the local assessor of the change. This ensures that the exemption is only applied to the current principal residence. Overlooking this step could lead to legal complications or financial penalties for claiming exemptions on more than one property.

Filling out personal information sections—lines 7 through 11—without the necessary attention to detail is another mistake. Specifically, providing incorrect Social Security Numbers for the owner or co-owner can have significant implications. These numbers are used for verification of tax exemption claims and to prevent fraudulent filings. Incorrect Social Security Numbers can delay the processing of the form or even result in the denial of the exemption.

Errors in the determination and reporting of the percentage of the property used as the principal residence, as required in line 12 for multiple-unit or multi-purpose properties, often lead to inaccuracies in exemption calculations. Owners must accurately calculate the portion of the property that qualifies as their principal residence, especially in cases where the property includes rental units or additional structures. Incorrect calculations can either limit the exemption unduly or inflate it, both of which can lead to discrepancies with the tax authorities.

Finally, a common error is failing to answer all relevant questions in lines 13 through 16 regarding other principal residence exemptions claimed in Michigan, ownership of property in other states, and residency status for tax purposes. These questions are critical for verifying the eligibility of the homeowner for the exemption claimed on the form. Omitting this information or providing false answers can result in the refusal of the exemption and may lead to penalties.

Documents used along the form

When dealing with the intricacies of property exemptions in Michigan, particularly with the Homeowner's Principal Residence Exemption Affidavit (Form 2368), individuals often find themselves navigating a maze of related forms and documents. Each of these plays a crucial role in ensuring homeowners can successfully claim their exemptions or update their property's tax status. Below is a concise overview of other essential forms and documents often used alongside Form 2368.

- Form 2602 - Request to Rescind Homeowner's Principal Residence Exemption: This form is necessary for homeowners who previously claimed an exemption for their principal residence but now need to rescind it due to changes like moving out or selling the property.

- Form 4640 - Property Transfer Affidavit: Used when there's a transfer of ownership, this form must be filed with the local assessor to update the property records. It ensures the correct exemption status is applied to the property following the transfer.

- Form 3372 - Michigan Sales and Use Tax Certificate of Exemption: While not directly related to property taxes, this form is often required for homeowners who are making significant improvements to their residence and wish to claim an exemption from sales tax on materials.

- Form 2766 - L-4260 Property Tax Affidavit: This affidavit is necessary for claiming tax exemption on new construction on the property that is not yet occupied or used for its intended purpose.

- Form 556 - Michigan Homestead Property Tax Credit Claim: Homeowners may need to file this claim if they seek a tax credit for part of their property taxes on their primary residence.

- Deed or Land Contract: While not a form, the deed or land contract for the property is often required to establish ownership when filing for exemptions or updating property tax information.

Handling property taxes and exemptions can seem overwhelming, but familiarizing oneself with the proper forms and documents can streamline the process significantly. Regardless of your situation—whether you're filing the 2368 form for the first time, rescinding a previous exemption, or transferring property—it's essential to understand what documents are needed to ensure your property's tax status is accurate and beneficial to you.

Similar forms

The 2602 Michigan Request to Rescind Homeowner’s Principal Residence Exemption form is similar because it also deals with the homeowner's principal residence exemption, specifically the process to rescind that claim. This is necessary if a homeowner's eligibility changes.

New York State STAR Exemption Application resembles the 2368 form as it serves a similar purpose of providing homeowners with a tax exemption on their principal residence, although it applies specifically within New York State.

California Homeowner’s Exemption Declaration mirrors the 2368 form since it allows homeowners in California to claim an exemption that reduces their property tax liability, focusing on the homeowner's principal residence.

Florida Homestead Exemption Application shares similarities by offering tax benefits to Florida residents for their primary home, including protections against certain tax increases.

Texas Homestead Exemption Form is akin to the 2368 form in that it provides property tax relief and protections for the homeowner's primary residence within Texas.

Illinois Homeowner Exemption Application offers tax savings for Illinois homeowners' principal residences, reflecting the intent of Michigan's 2368 form to make housing more affordable for occupants.

Pennsylvania Homestead and Farmstead Exclusions is parallel to the 2368 form by providing school property tax relief for homeowners' primary residences, also aiming to make homeownership more attainable.

Ohio Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses offers a similar benefit, highlighting a reduction in property tax for the demographic's primary residence, akin to the objectives of the 2368 form.

Wisconsin Lottery and Gaming Credit Application, by offering a property tax credit for the homeowner’s primary residence based on lottery and gaming revenues, shares a purpose with the 2368 form—reducing the tax burden on principal residences.

New Jersey Homestead Benefit Program likewise provides property tax relief to homeowners for their main residence, employing a direct benefit approach that parallels the tax break focus of Michigan's 2368 form.

Dos and Don'ts

Filling out the Michigan Department of Treasury 2368 form, also known as the Homeowner's Principal Residence Exemption Affidavit, requires attention to detail and accuracy to ensure a successful claim. Below are key do's and don'ts to consider during the process:

Do:- Fill out the form using blue or black ink: This ensures the information is legible and conforms to the requirements.

- Use a separate form for each property number: If you're claiming exemptions for multiple properties, it’s crucial to fill out and submit a separate affidavit for each one.

- Include accurate property identification: The property tax identification number is essential for your claim to be processed correctly. Make sure it’s entered accurately.

- Indicate the correct date the property became your principal residence: This date is important for establishing when your exemption should begin.

- Sign and date the form: Your signature certifies that the information provided is true and correct to the best of your knowledge, making it a crucial step in the process.

- Mail the form to the correct local assessor: Ensure that the completed form is sent to the township or city assessor where the property is located, not to the Department of Treasury.

- Leave any required fields blank: Incomplete forms may delay or invalidate your exemption claim. Make sure all relevant sections are filled out.

- Use incorrect property information: Double-check the details against your property tax bill or assessment notice to avoid errors.

- Claim exemptions on ineligible properties: Exemptions are only for your principal residence. Vacation homes or income properties do not qualify.

- Forget to rescind previous exemptions: If you’ve claimed an exemption for another property, ensure you've filed the necessary rescission form.

- Ignore the deadline: Submit your form by May 1st of the year you’re claiming the exemption to ensure it’s applied to your next tax bill.

- Disregard the need for accuracy with Social Security Numbers: Incorrect or missing Social Security Numbers can lead to issues with your claim, so fill them out carefully.

Misconceptions

Understanding the Michigan Department of Treasury Form 2368, related to the Homeowner's Principal Residence Exemption, is crucial for homeowners. Some misconceptions can lead to confusion or improperly filed documents. Here, we aim to clarify these misunderstandings to ensure homeowners are well-informed.

Only for new homeowners: It's a common misconception that Form 2368 is only for those who have recently purchased a home. In reality, any homeowner who occupies the property as their principal residence and hasn't already claimed this exemption on another property is eligible to file.

Filing annually: Some believe that this form must be filed every year to maintain the exemption. However, once filed and approved, the exemption remains in place until there is a change in ownership or the homeowner's principal residence status changes.

Renters are eligible: There's a misunderstanding that renters can file this form if they consider the property their principal residence. The exemption, however, applies only to homeowners who hold the legal title or are buying the home under a land contract.

Available for multiple residences: A significant misconception is thinking that the exemption can be claimed for more than one residence. By law, a homeowner can claim this exemption for only one property—the one that serves as their principal residence.

Includes all property taxes: Another misunderstanding is that this exemption covers all property taxes. In reality, it specifically exempts a part of the school operating taxes and does not affect other property tax assessments or levies.

Social Security number is optional: The form requires the homeowner's Social Security number. Some believe this is optional, but it is mandatory for verification purposes and to prevent fraudulent claims.

Immediate effect on taxes: Some people expect that once they file Form 2368, their tax exemption will apply immediately. However, the local assessor will adjust the taxes on the next property tax bill.

Eligibility solely based on occupancy: While occupying the property is a requirement, ownership (holding legal title or buying on a recorded land contract) is also necessary. Some think that simply living in the property qualifies them for this exemption.

Exemption for vacant land: There's a misconception that vacant land adjacent to the principal residence automatically qualifies for the exemption. The adjacent or contiguous vacant property must also be residential and used as part of the principal residence.

Correcting these misconceptions helps homeowners accurately determine their eligibility and properly claim the Principal Residence Exemption. This, in turn, can lead to significant savings on property taxes and ensure compliance with Michigan law.

Key takeaways

Understanding how to properly fill out and use the Michigan Department of Treasury 2368, the Homeowner's Principal Residence Exemption Affidavit, is crucial for homeowners wishing to claim an exemption from part of their local school operating taxes. Here are key takeaways to guide you through this process:

- Eligibility Criteria: This affidavit is for homeowners who own and occupy their residence as their principal dwelling. If you are renting, this form is not for you.

- Filing Deadline: To take advantage of the exemption for a given year, file this affidavit with your city or township by May 1st.

- One Principal Residence Only: You can claim an exemption for only one principal residence at a time, which means vacation homes or income properties do not qualify.

- Information Required: You must provide specific property details, including the Property Tax Identification Number, address, and your personal information. This accuracy is vital for adjusting your property taxes correctly.

- Previous Claims: Filing this affidavit invalidates any previous homeowner's principal residence exemptions. If applicable, submit a Form 2602 to rescind any prior claims.

- Multiple-Unit and Multi-Purpose Properties: If your property includes more than your principal residence, such as a rented unit, you must determine the percentage of the entire property that your principal residence occupies. This percentage will affect your exemption.

- Penalties for False Claims: Claiming an exemption falsely can result in additional taxes, penalties, and interest. Ensure all information you provide is accurate and truthful.

- Mailing Instructions: Do not send your completed affidavit directly to the Department of Treasury. Instead, mail it to the local assessor's office in the city or township where the property is located.

Remember, accurately completing and timely filing Form 2368 can significantly affect your property taxes. For any questions or further clarification, visit the Michigan Department of Treasury's website or contact their office directly.

Popular PDF Templates

Michigan Amended Tax Return Instructions - Refunds, credits, or zero balance returns resulting from amendments made on the MI-1040X-12 must be mailed to the specified address for processing.

Eviction Filing Fee - A form for those in Michigan seeking to have their court filing fees waived due to financial hardship.

State of Michigan 2022 Tax Forms - Completing the Michigan 151 form grants specific powers to a chosen individual or organization regarding your financial dealings with the state.